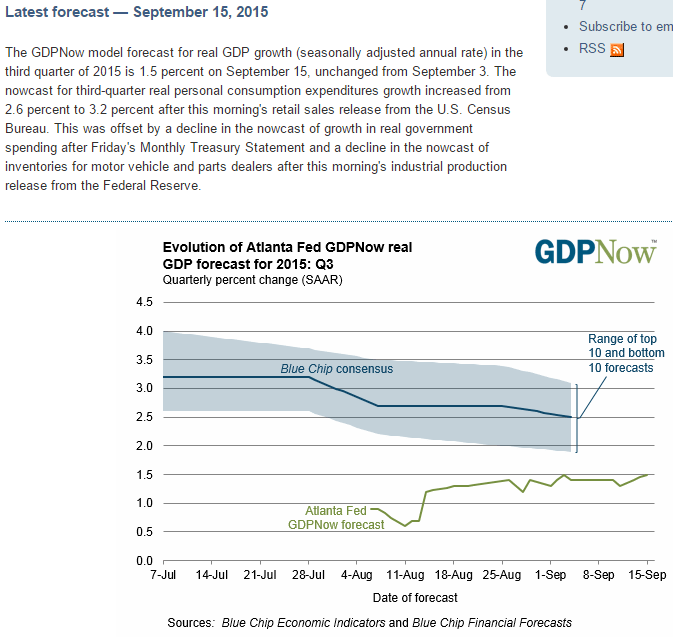

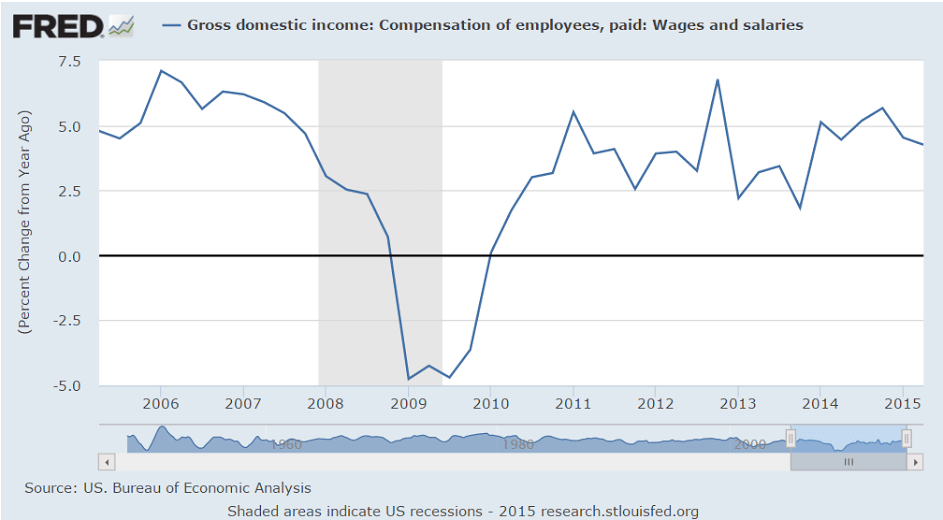

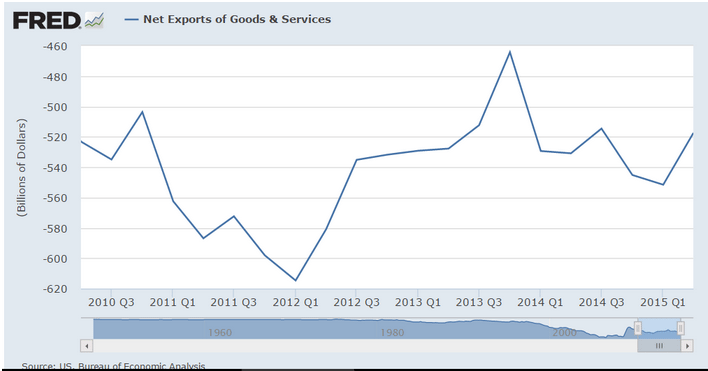

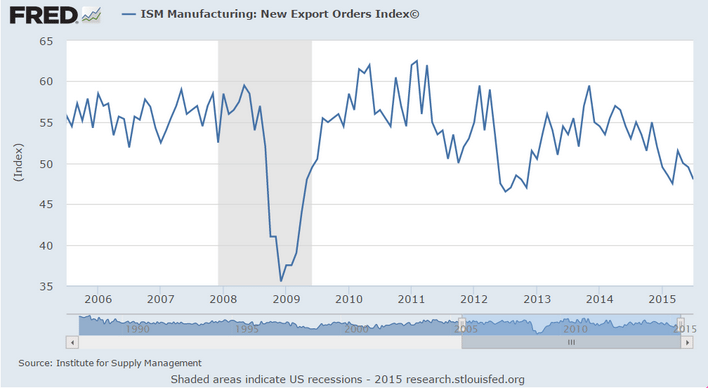

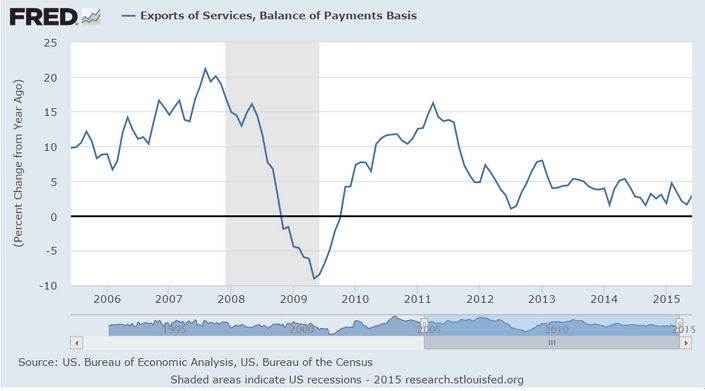

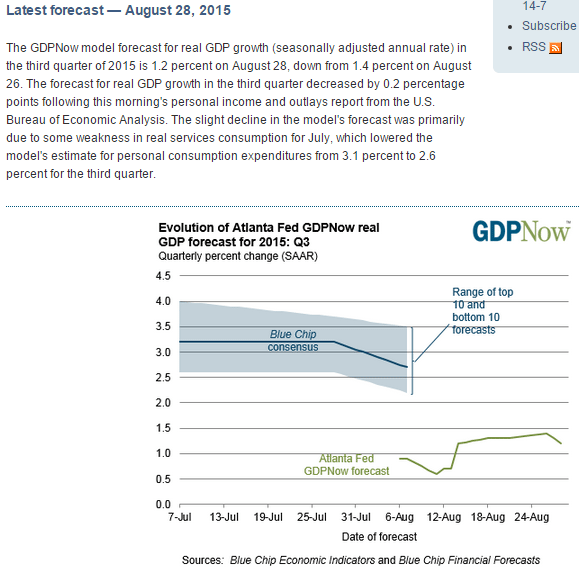

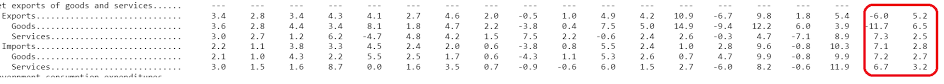

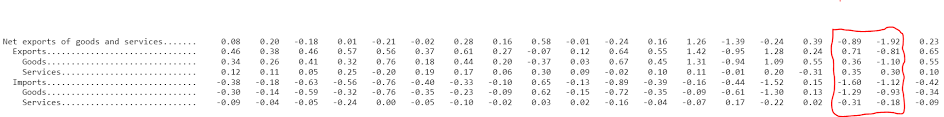

Higher than expected, still a bit lower year over year, and supported by heavy unsold inventory building that’s exceeding the growth of new orders, as well as an increase in net exports which is counter to all the survey information and other hard data as well. Net export reports tend to be volatile, with relatively large zigs followed by large zags. And note reported GDI- gross domestic income (the flip side of GDP)- was up only .6 as discussed below. And a few comments below on health care premium expense:

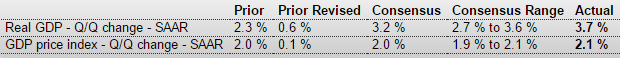

United States : GDP

Highlights

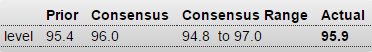

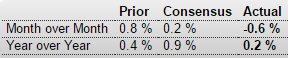

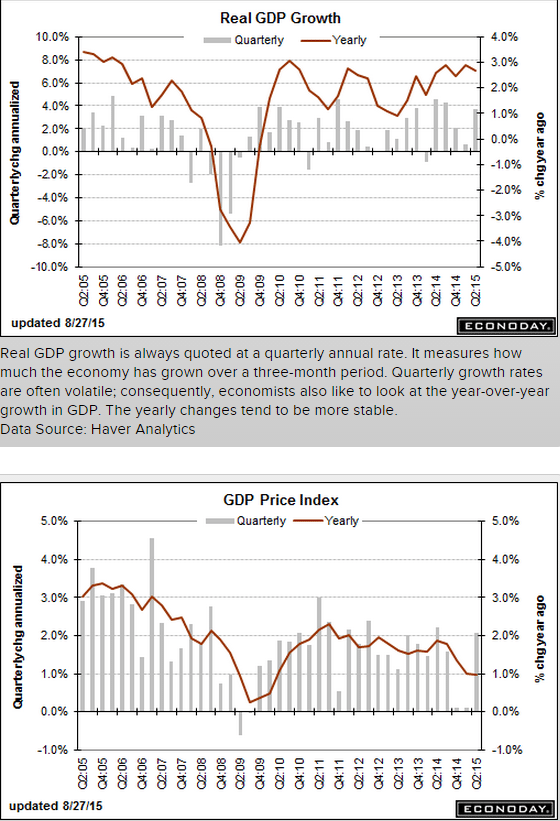

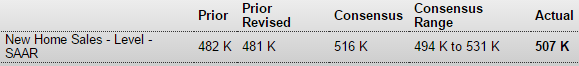

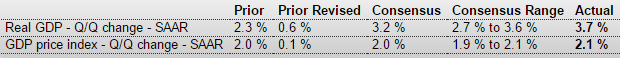

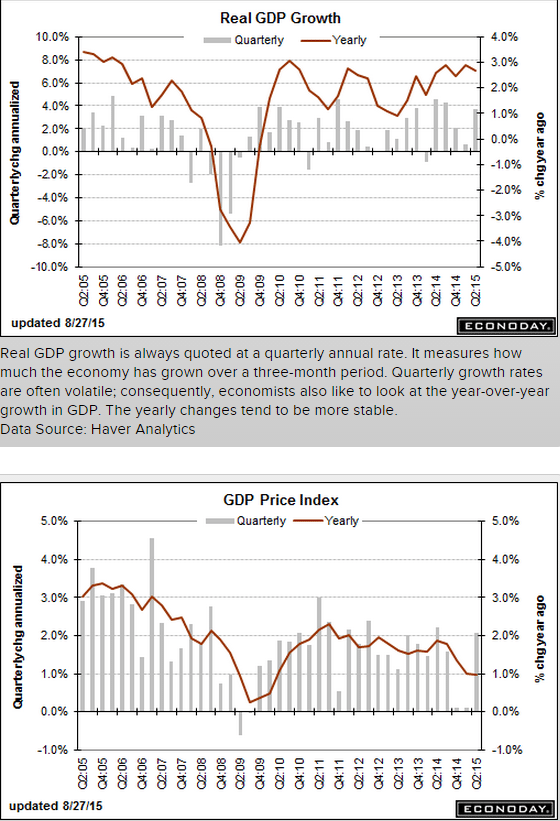

The second-quarter did show a big bounce after all, up at a revised annualized growth rate of 3.7 percent which is 5 tenths over the Econoday consensus and just ahead of the high estimate. The initial estimate for second-quarter GDP was 2.3 percent. This report points to better-than-expected momentum going into the current quarter.

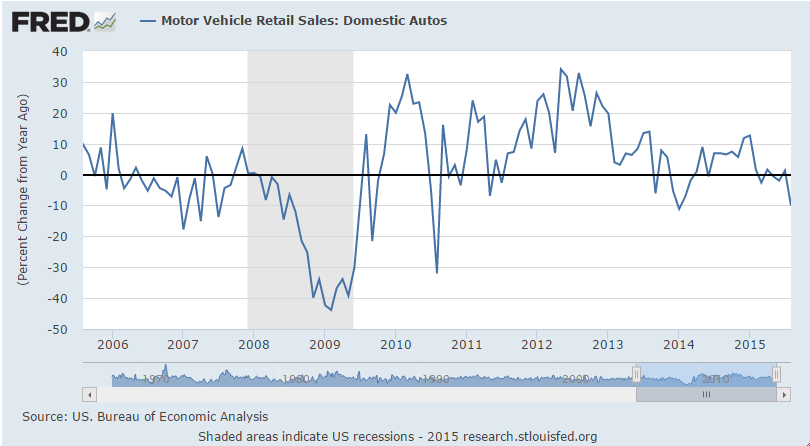

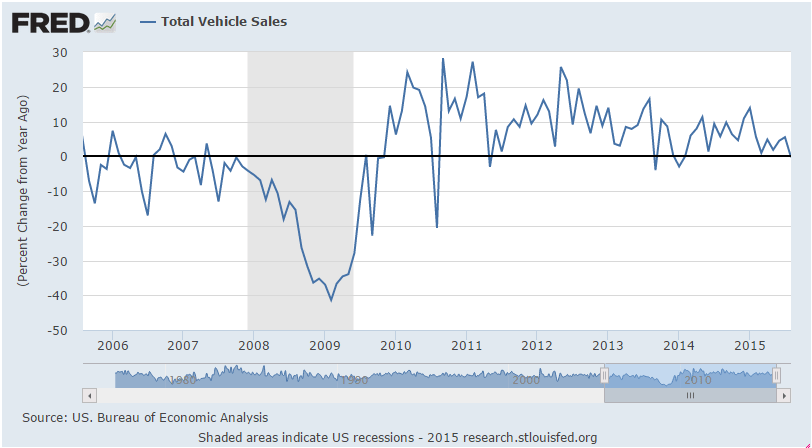

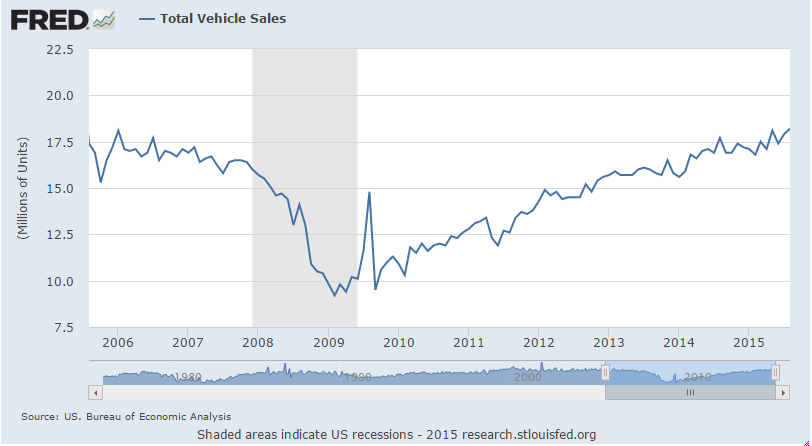

Consumer demand was strong with personal consumption expenditures at a 3.1 percent rate led by an 8.2 percent rate for durables, a gain that was tied to vehicle spending. Residential investment was very strong, at plus 7.8 percent, as was nonresidential fixed investment which, boosted by an upward revision to structures, came in at plus 3.2 percent. Inventories contributed to second-quarter growth as did improvement in net exports. Final demand proved very solid, at plus 3.5 percent. The GDP price index, unlike many other price readings, is showing some pressure, at 2.1 percent and just above the Fed’s general policy goal.

The economy’s acceleration is now much more respectable from the first quarter when growth, at only 0.6 percent, was depressed by heavy weather and special factors. Splitting the difference, first-half growth came in a bit over 2 percent which, as it turns out, is right in line with the similar performance of 2014 when first-quarter growth, again depressed by severe weather, fell 2.1 percent followed by a 4.6 percent surge in the second quarter. Growth in the third quarter last year was 4.3 percent which would be a very good performance for this third quarter.

The impact of today’s report on Fed policy for September’s FOMC is likely to be minimal. Focus at the upcoming meeting will be on the state of the global financial markets and, very importantly, the strength of next week’s employment report for August.

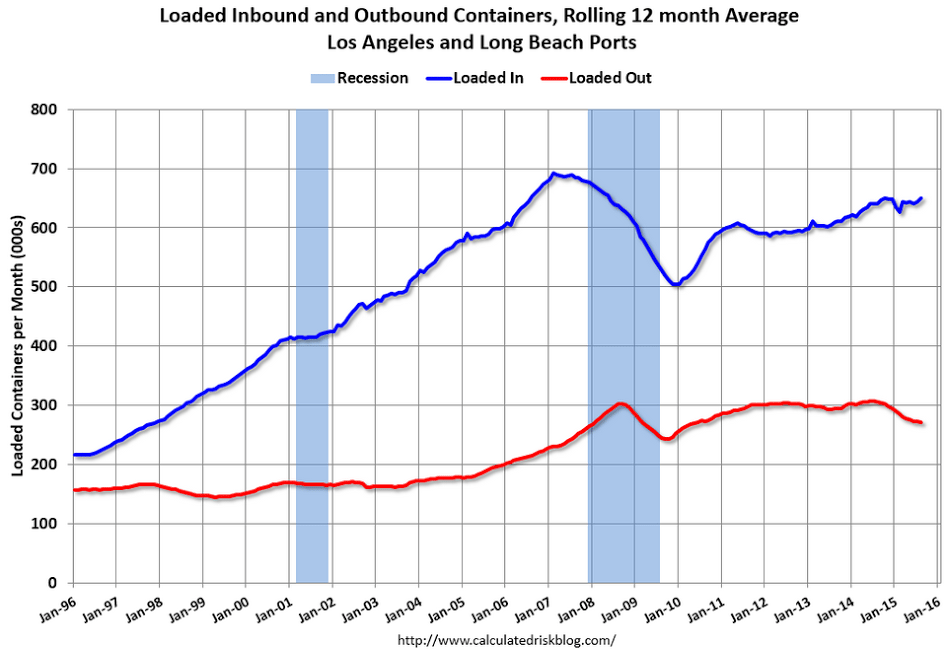

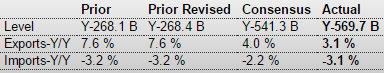

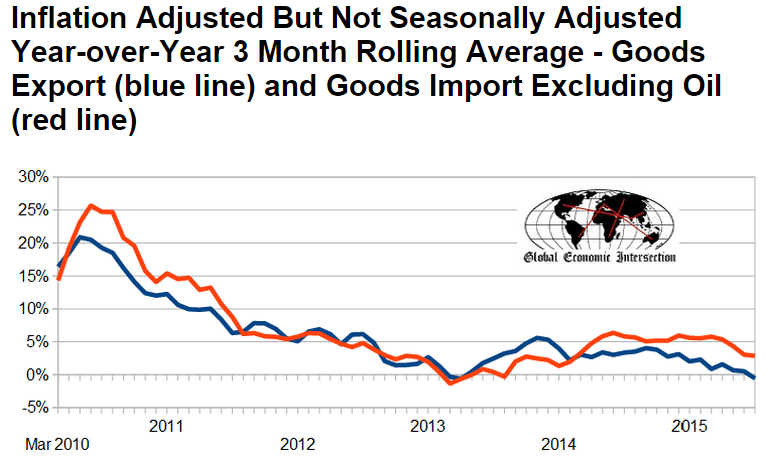

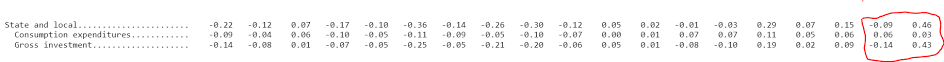

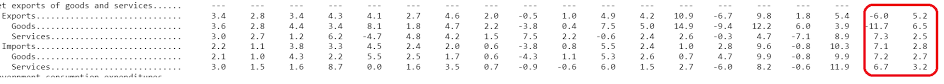

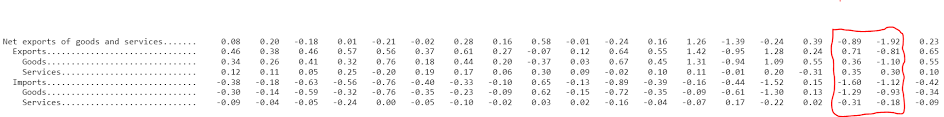

Note the volatility of exports and imports, particularly for the last two quarters:

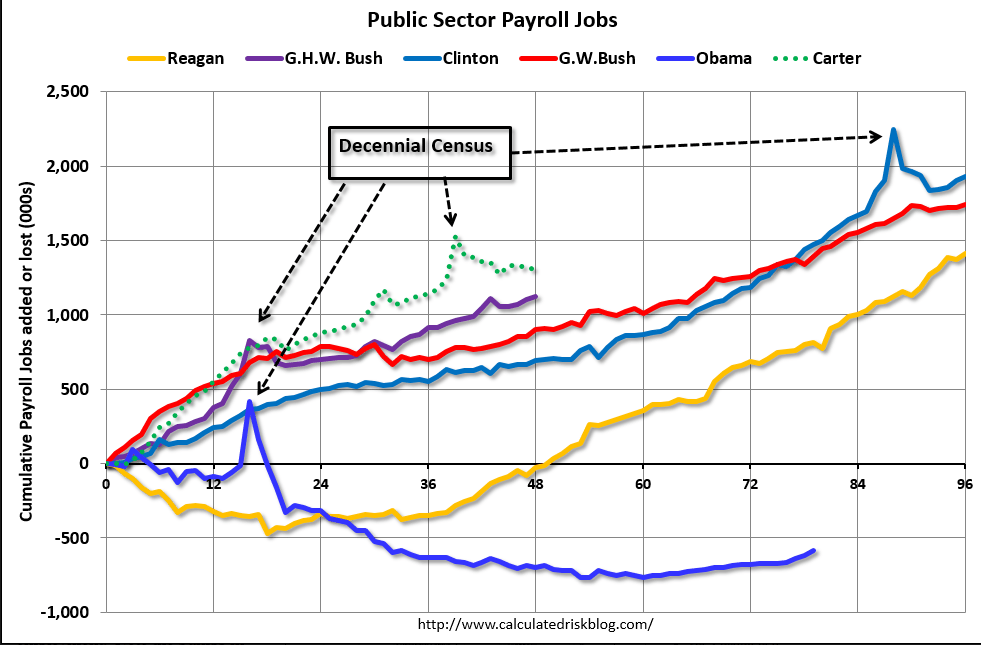

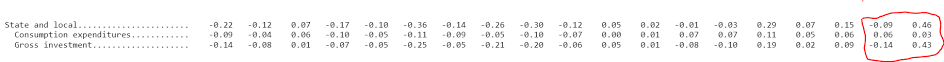

The state and local increase looks suspect as well:

The upward revisions to second-quarter growth also reflected the accumulation of $121.1 billion worth of inventories, up from the previous estimate of $110 billion. That meant inventories contributed 0.22 percentage point to GDP instead of subtracting 0.08 percentage point as reported last month.

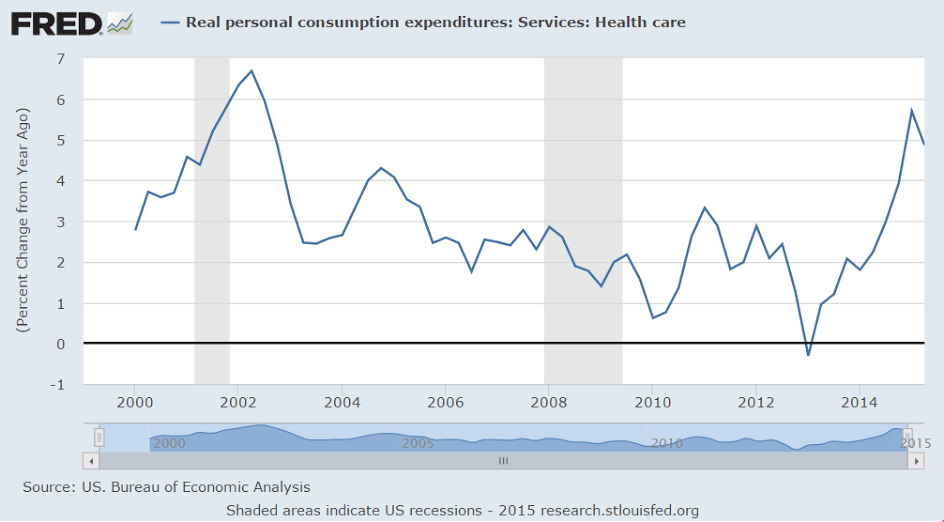

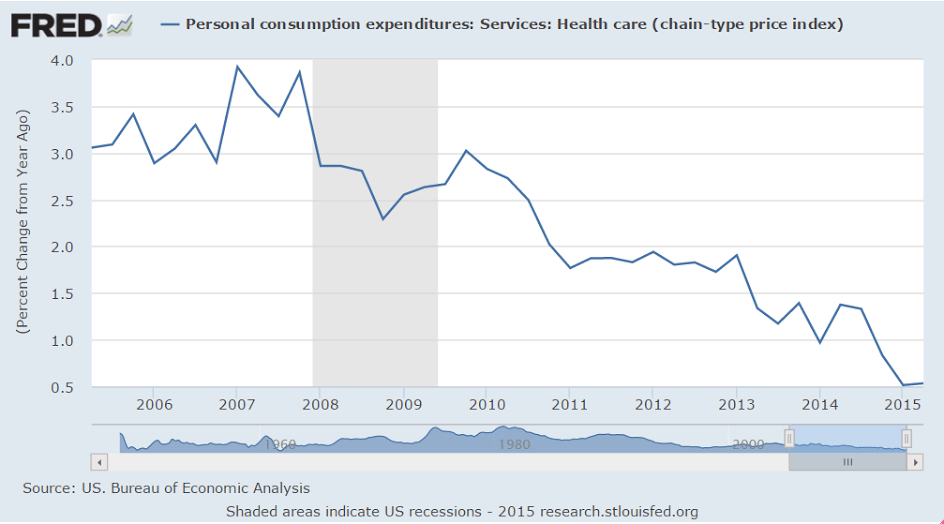

Apparently health care premiums are counted as personal consumption expenditures, and with the ACA there’s a one time increase in progress as more people get funded to pay premiums. This is adding some support to GDP growth until it levels off.

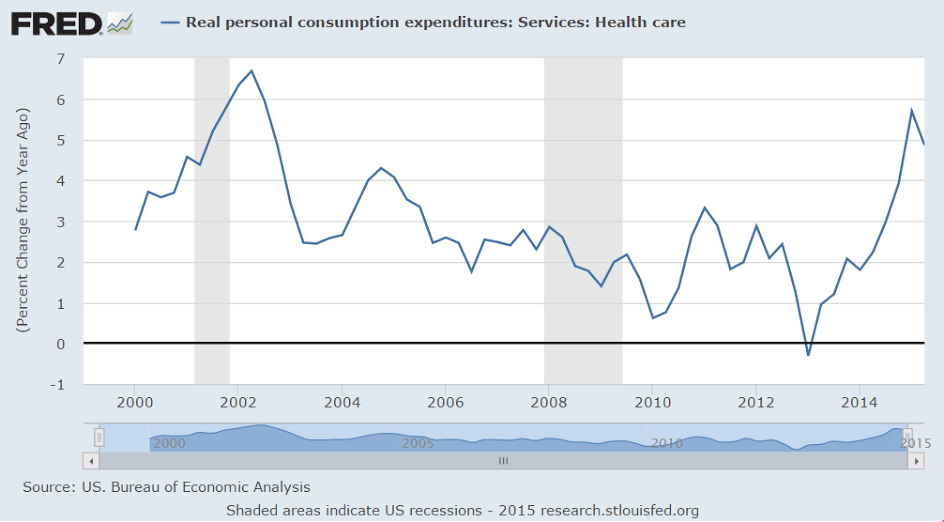

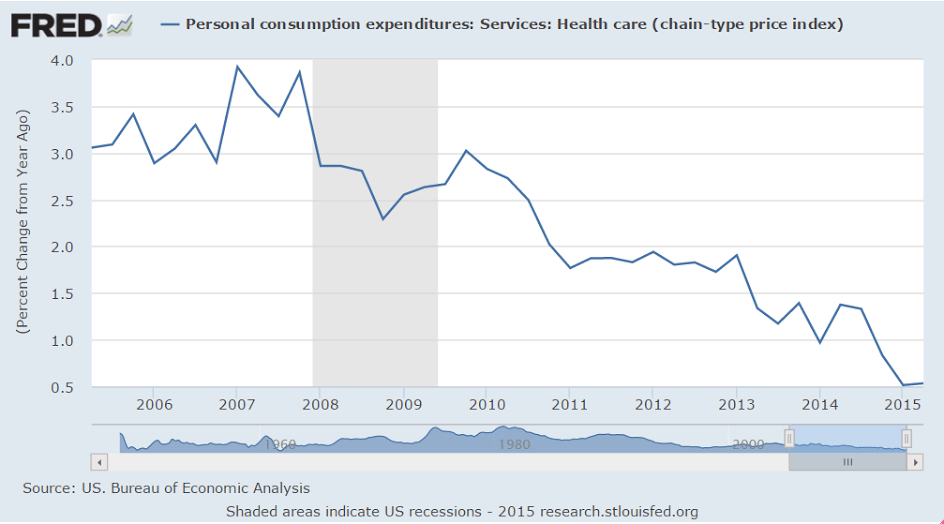

This has not necessarily increased actual health care services received or costs:

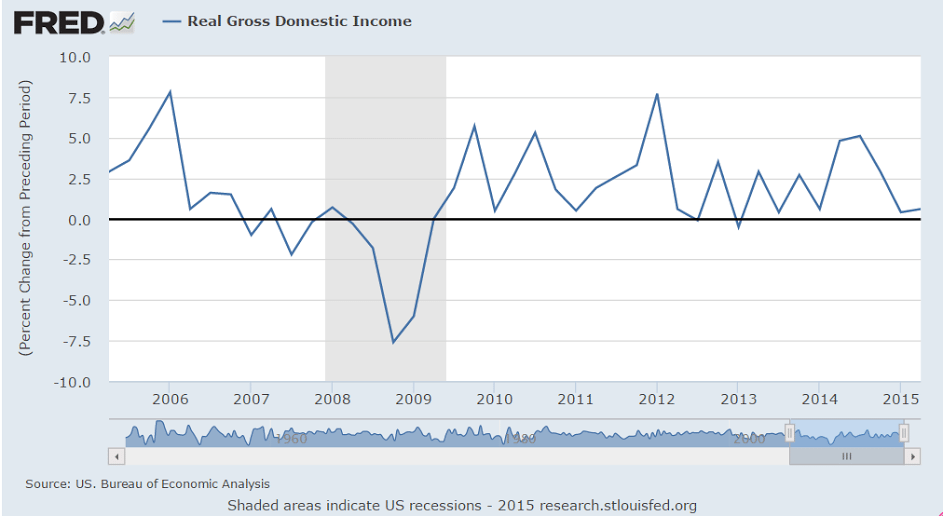

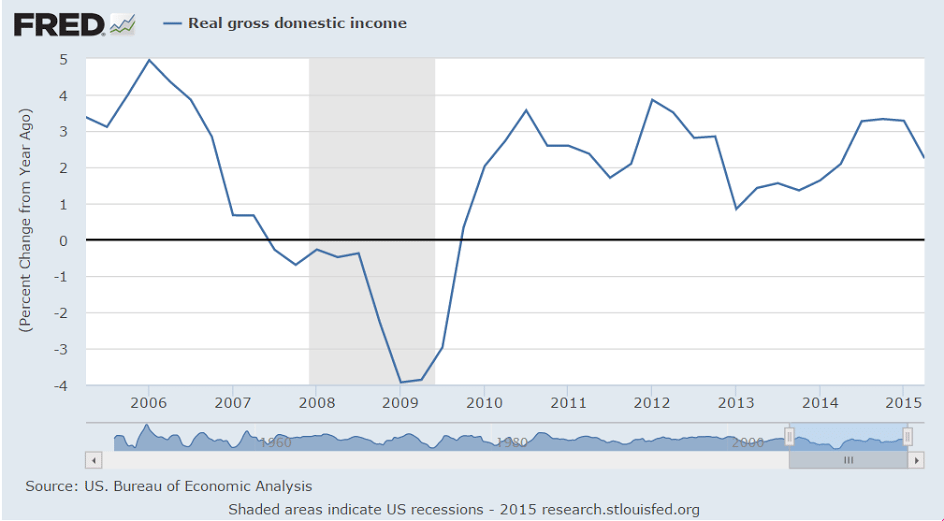

Gross domestic income was also released. While GDP measures total sales, GDI measures total income received from those sales. So while those numbers are necessarily identical, in practice they tend to differ initially as they are calculated independently and entail numerous estimates, and converge over time as hard numbers become available.

This is from the US Bureau of Economic Analysis:

Real gross domestic income (GDI) — the value of the costs incurred and the incomes earned in the production of goods and services in the nation’s economy — increased 0.6 percent in the second quarter, compared with an increase of 0.4 percent (revised) in the first. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 2.1 percent in the second quarter, compared with an increase of 0.5 percent in the first quarter.

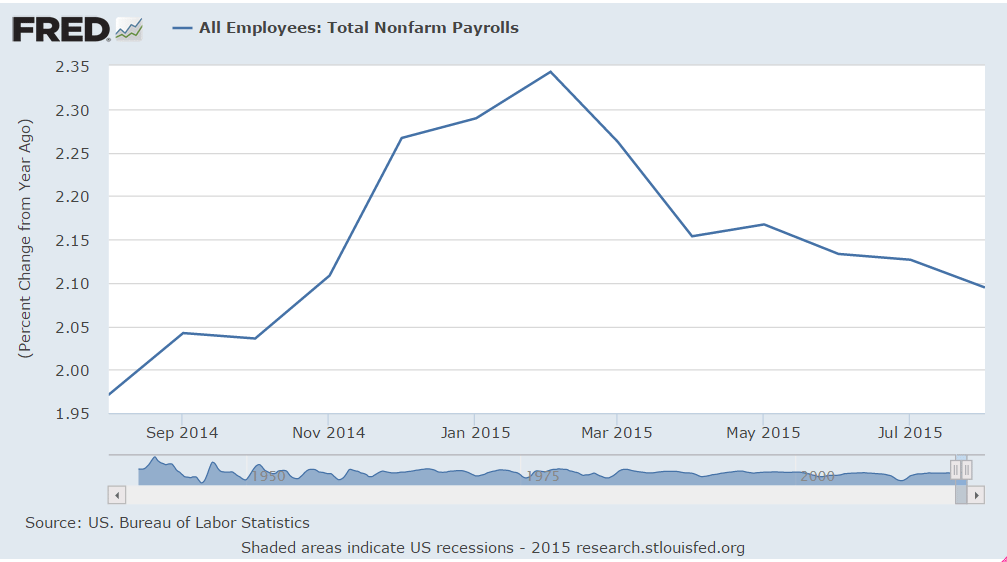

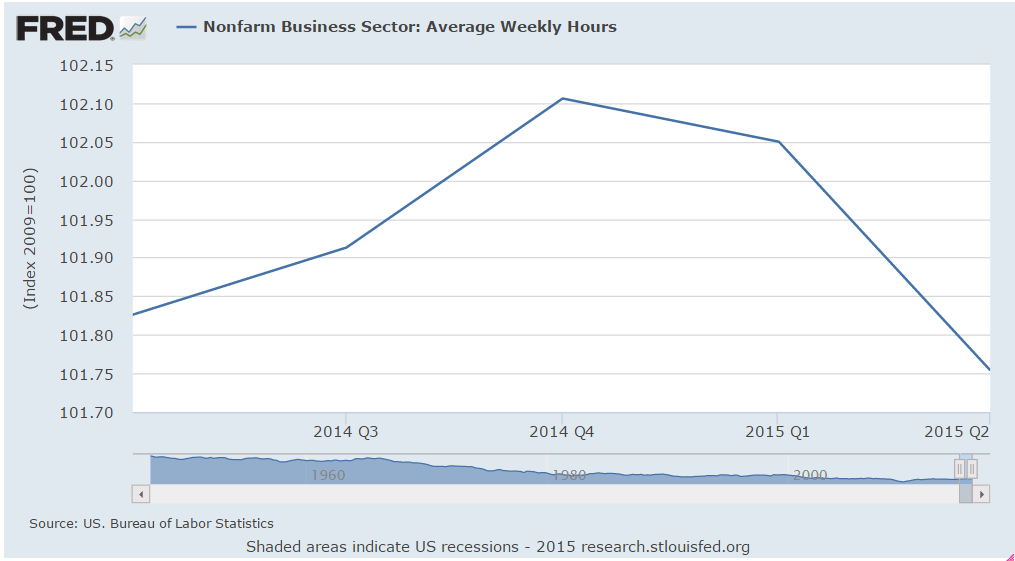

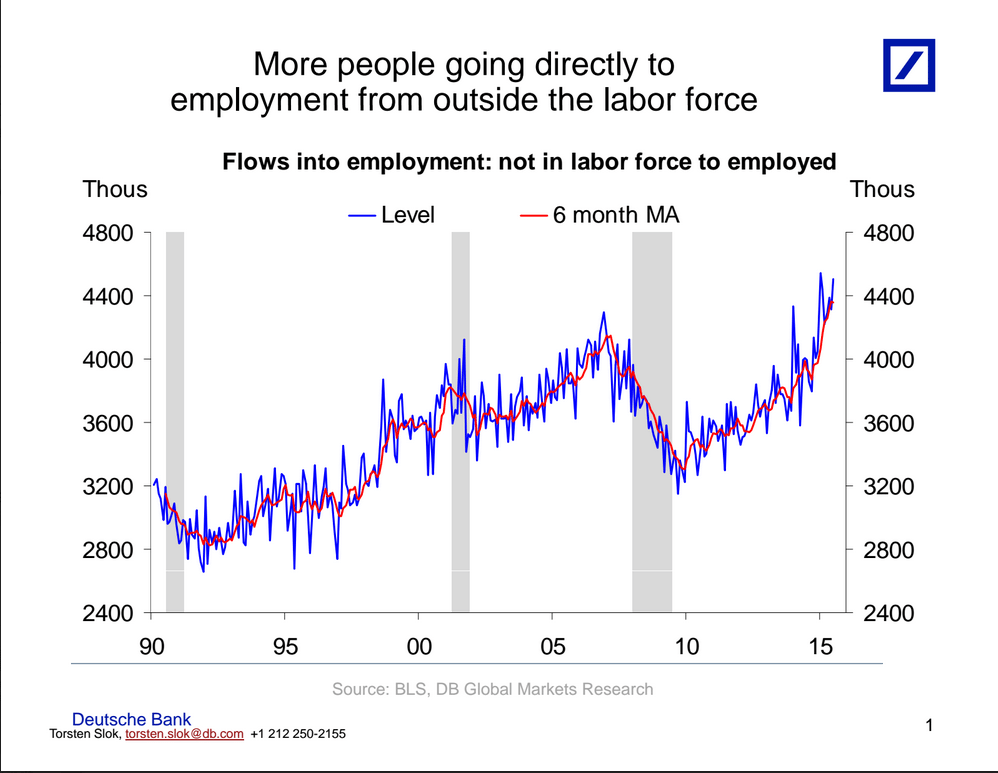

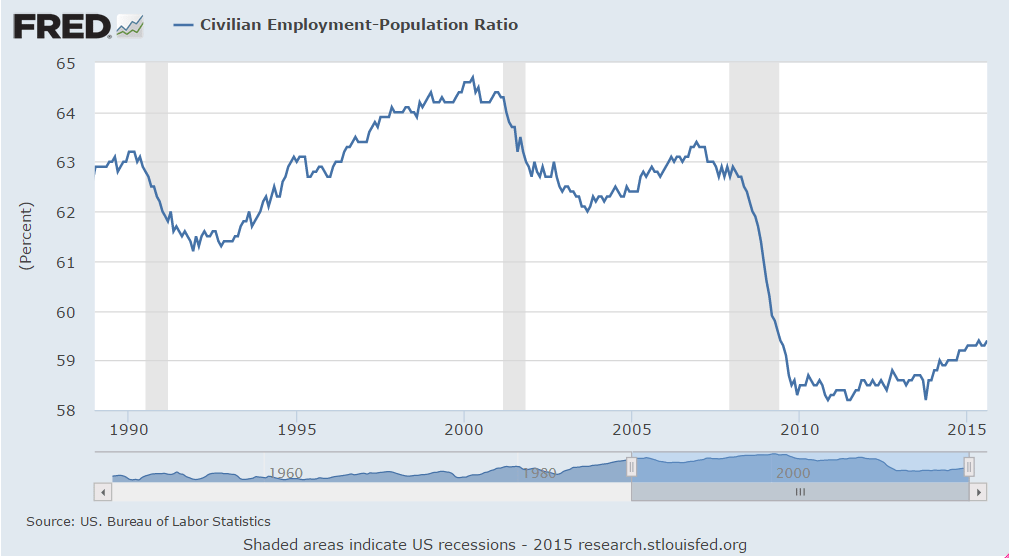

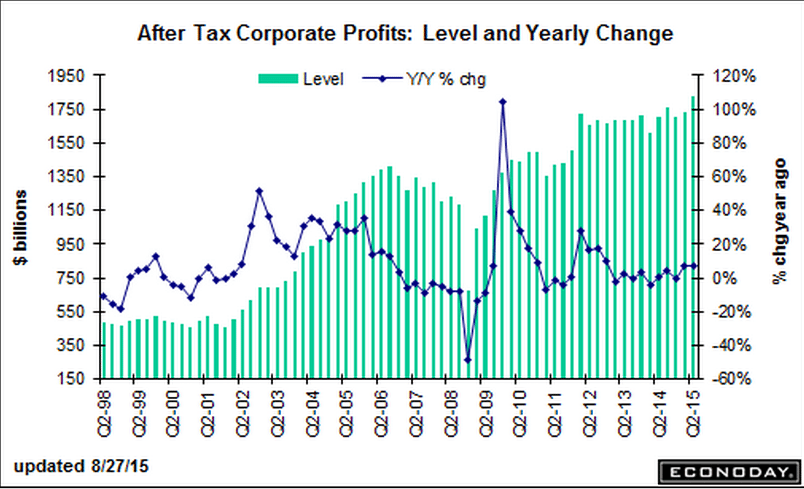

No acceleration here:

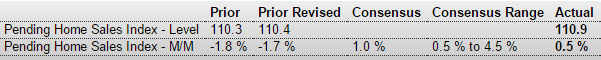

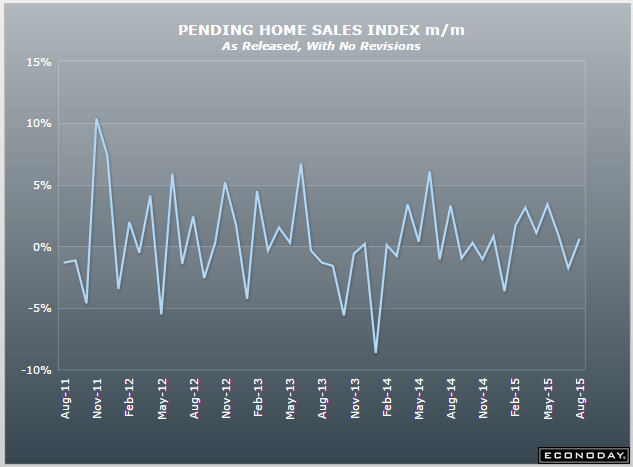

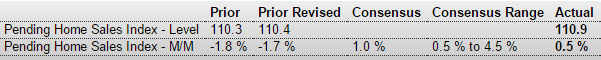

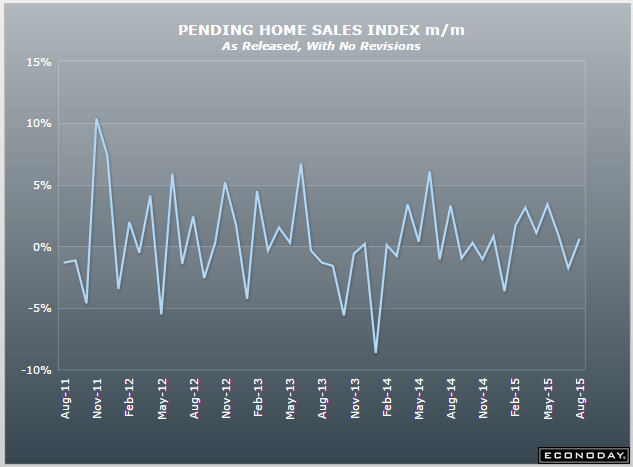

United States : Pending Home Sales Index

Highlights

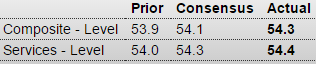

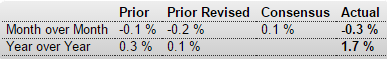

Pending home sales came in at the low end of expectations, up however a still respectable 0.5 percent. Regional data show a strong 4.0 percent gain for the Northeast, which however is the smallest region for existing home sales, and a 1.4 percent dip for the West. Sales were unchanged in the Midwest and rose 0.6 percent in the South which is the largest region. This report is positive but far from exceptional, pointing to no more than moderate growth ahead for existing home sales.

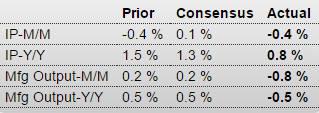

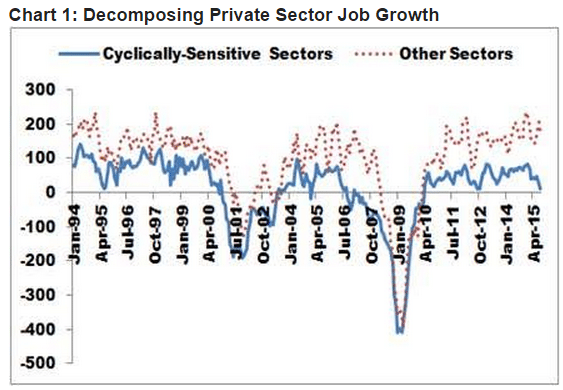

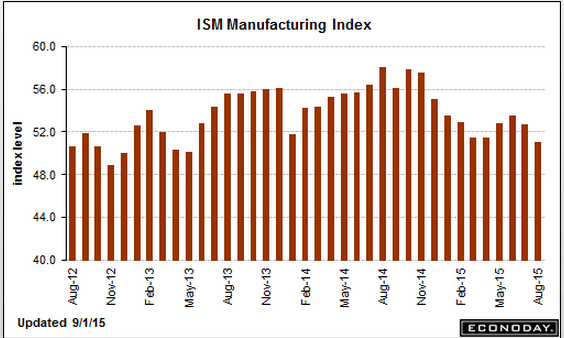

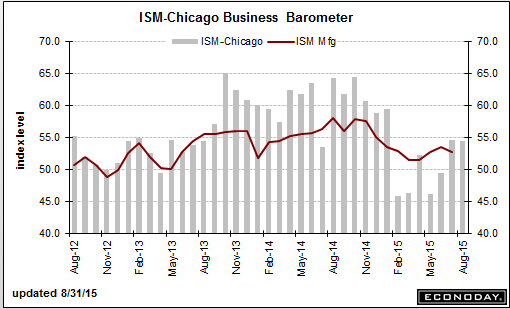

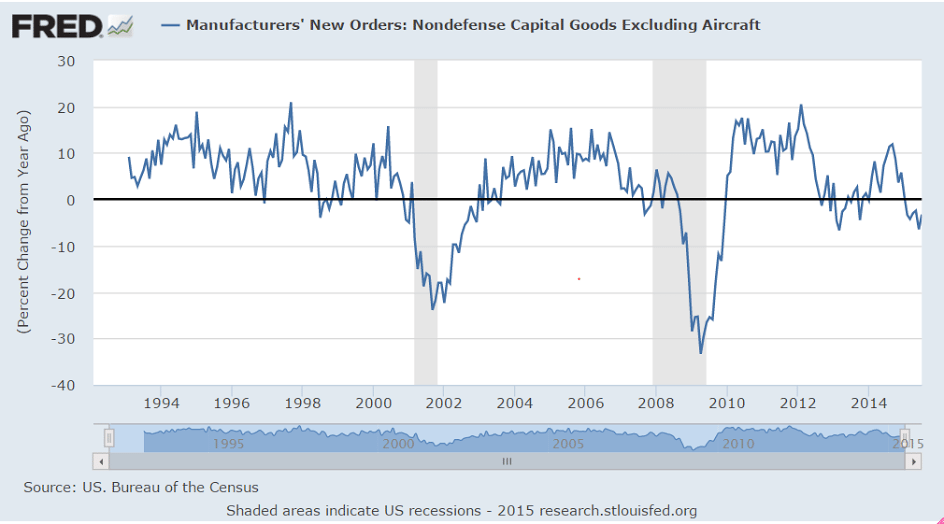

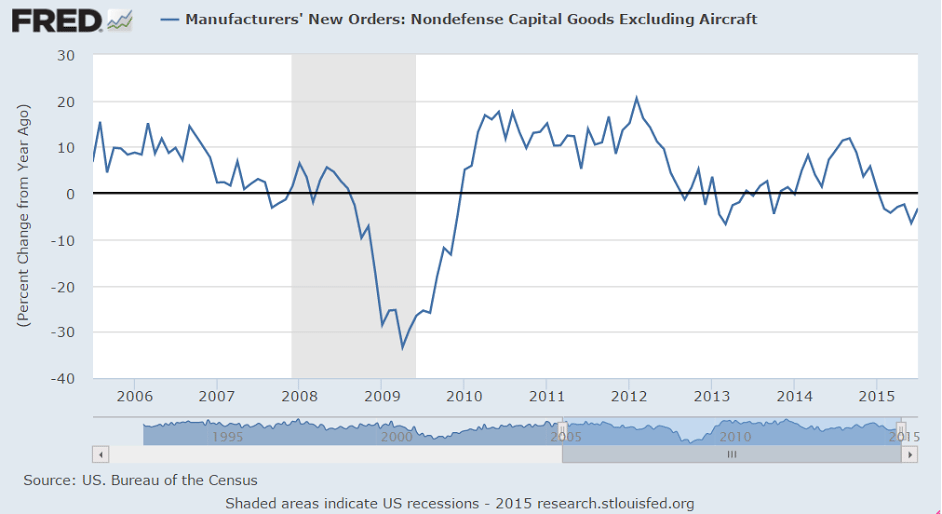

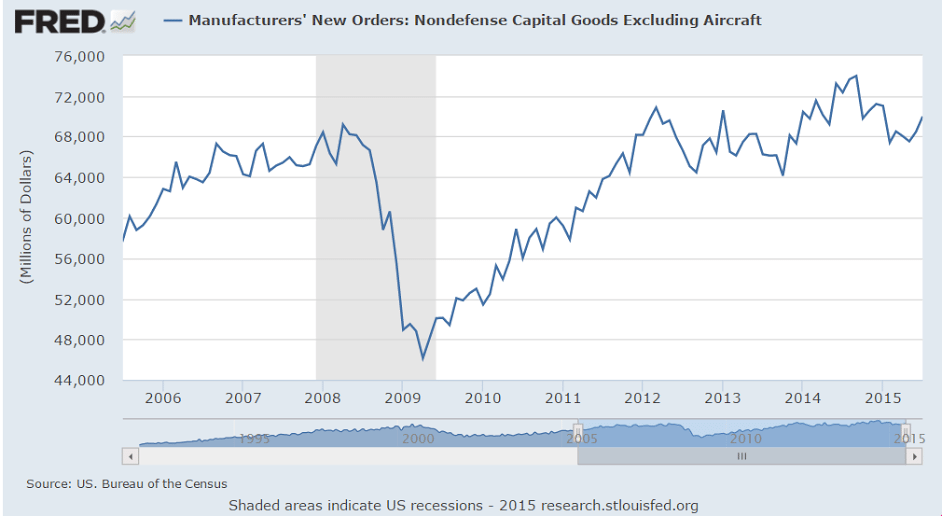

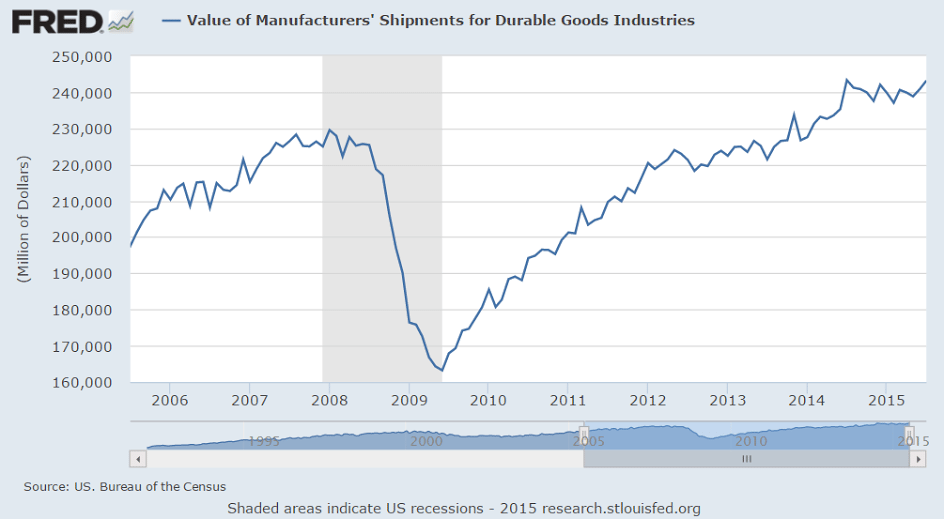

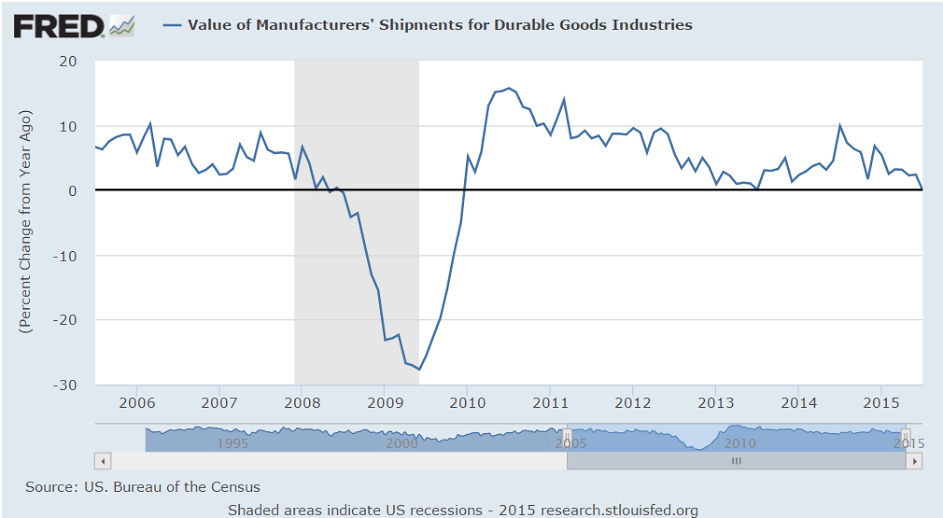

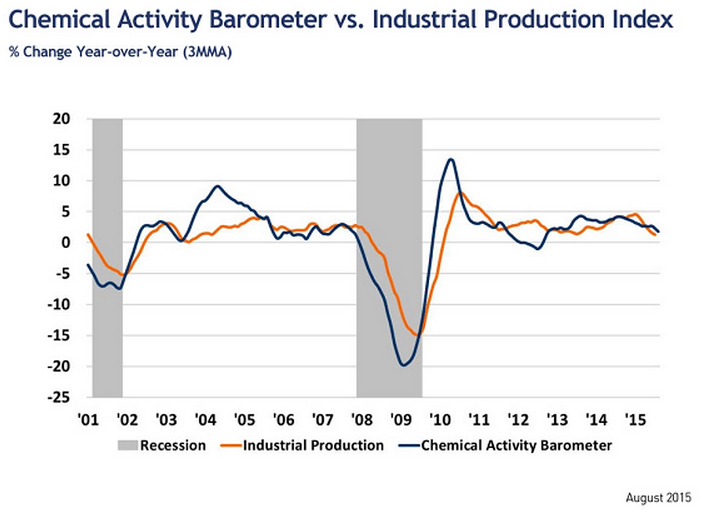

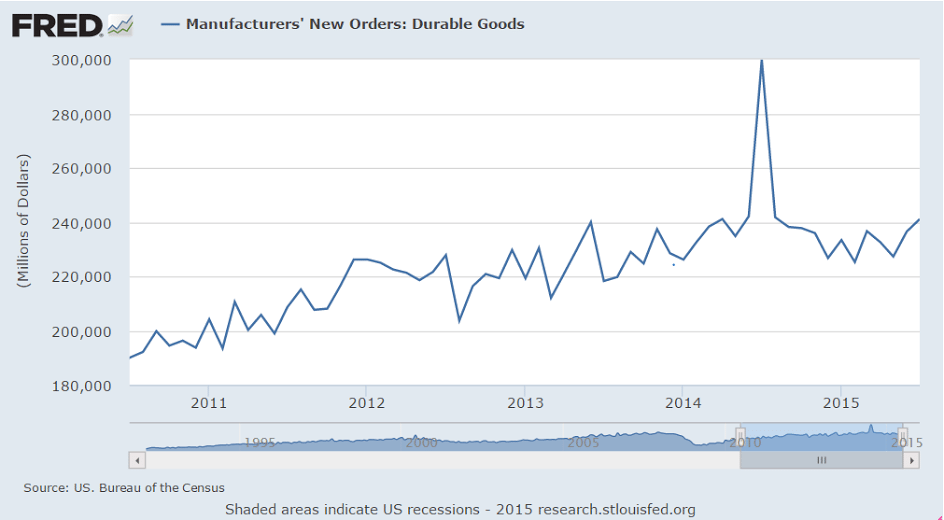

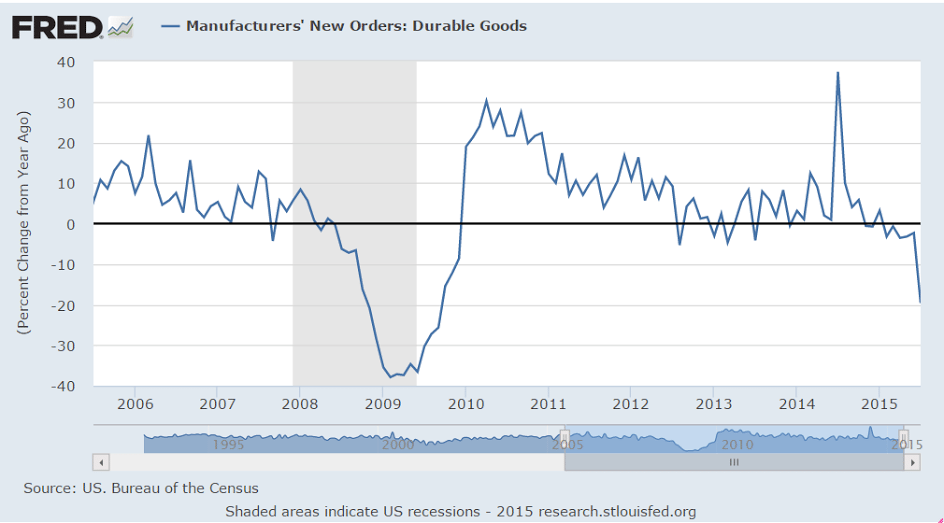

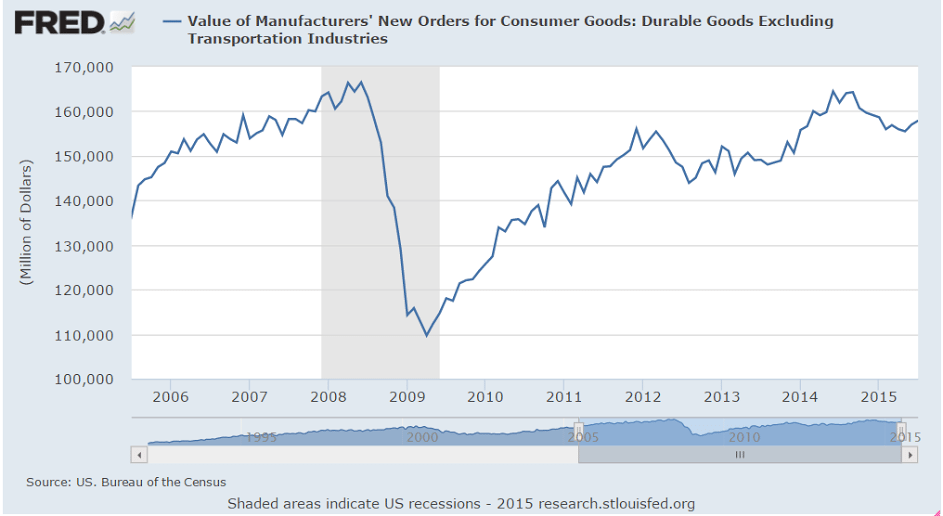

The bad news in manufacturing continues:

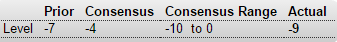

United States : Kansas City Fed Manufacturing Index

Highlights

Factory activity in the Kansas City Fed’s region remains in deep contraction, at minus 9 in August vs minus 7 in July and deeper than the Econoday consensus for minus 4. New orders are also at minus 9 with backlog orders at minus 21. These are deeply depressed readings that point to a long run of weak activity in the months ahead. Production is already far into the negative column at minus 16 with hiring at minus 10. Price readings in the August report are in contraction.

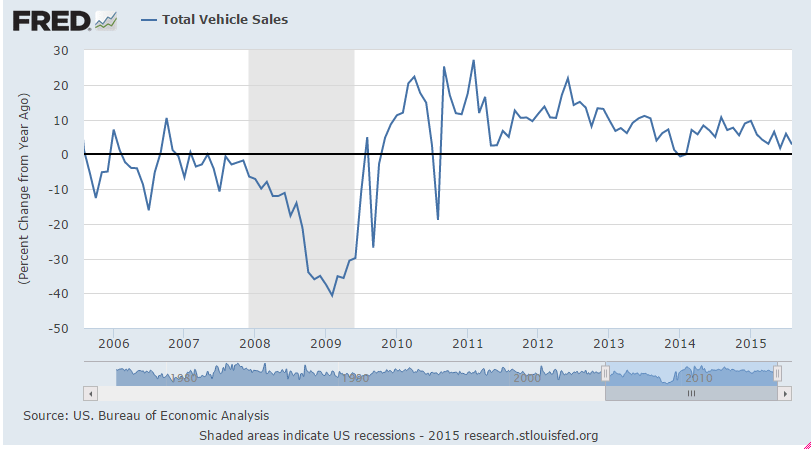

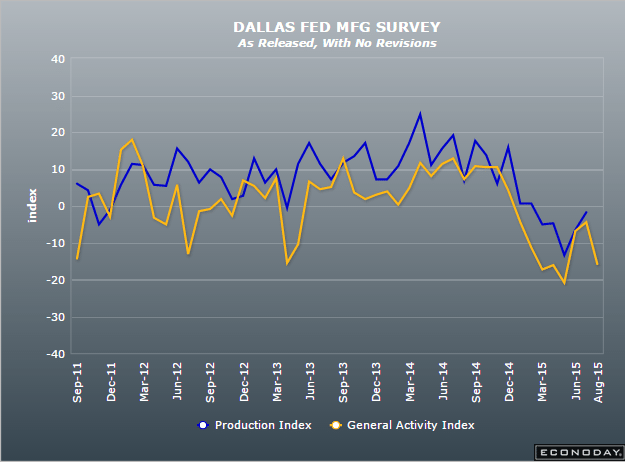

This report speaks to significant distress for the region which is getting hit by the oil-led fall in commodity prices. Taken together, regional reports have been mixed to soft so far this month, pointing to slowing for a factory sector that got a bit boost from the auto sector in June and July. The Dallas Fed report, which like this one has been badly depressed, will be posted on Monday.

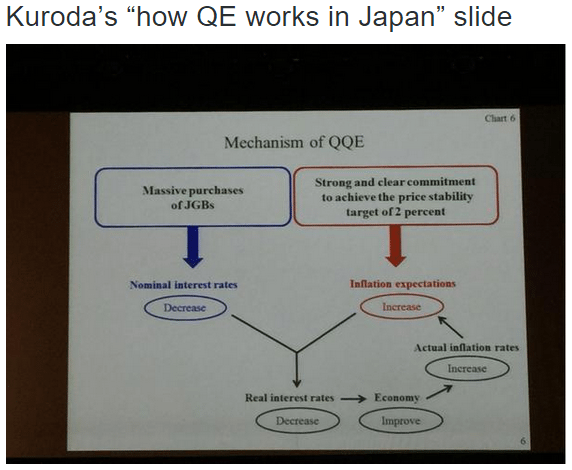

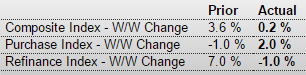

This is amateur hour.

After 20 years of this stuff, they still just need more time…