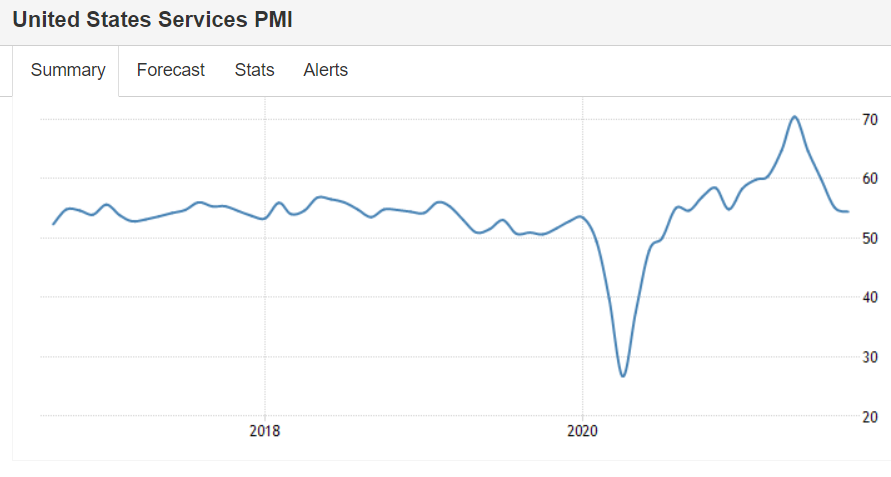

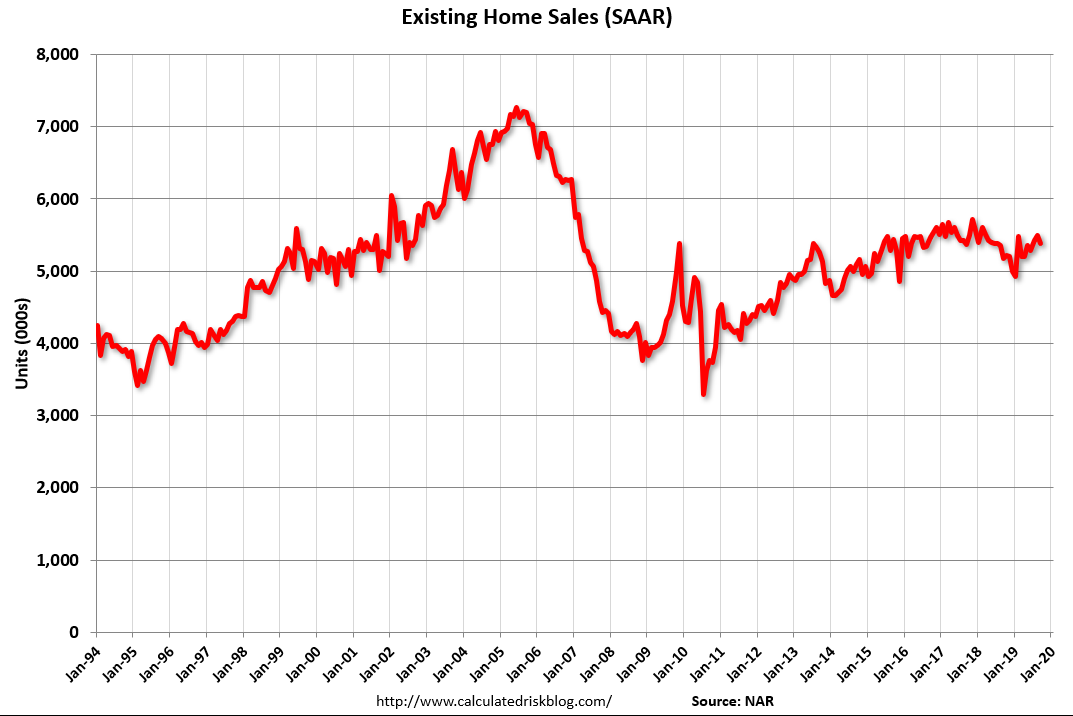

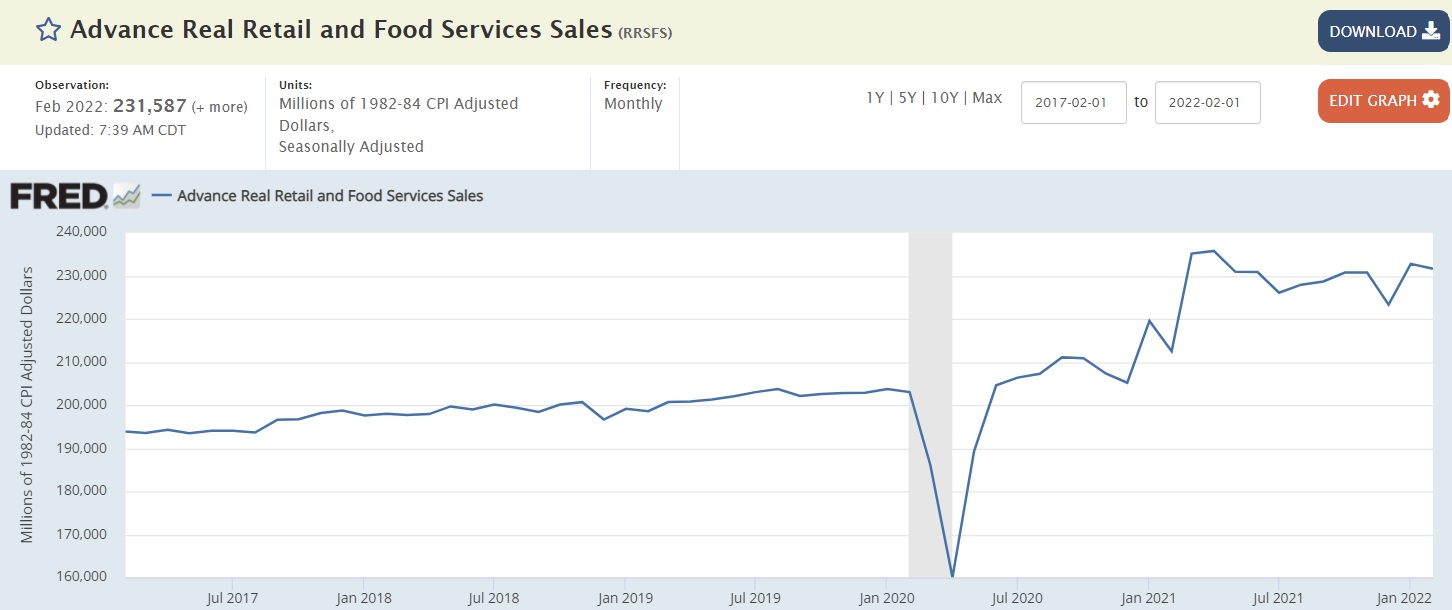

Gone flat post covid, adjusted for inflation:

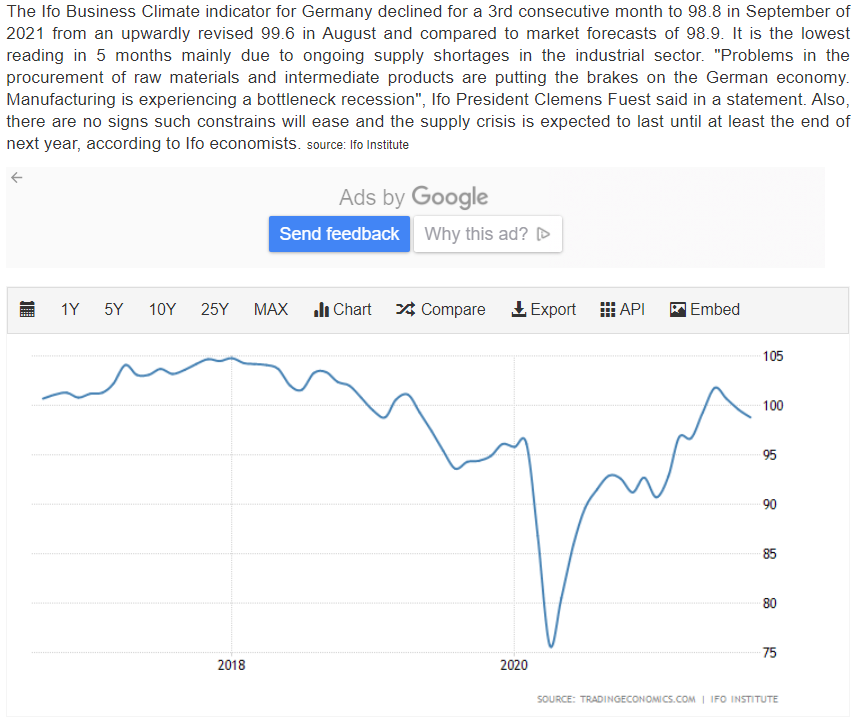

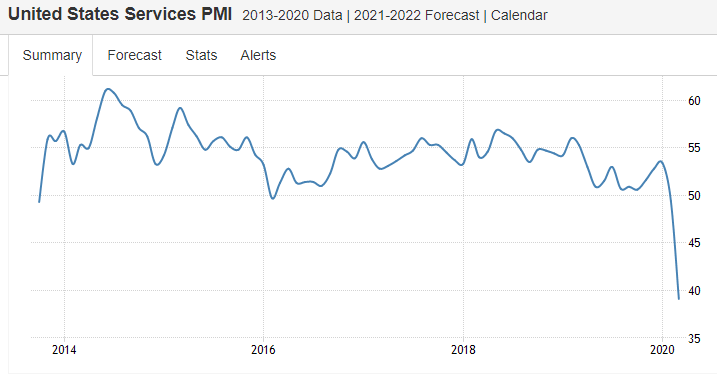

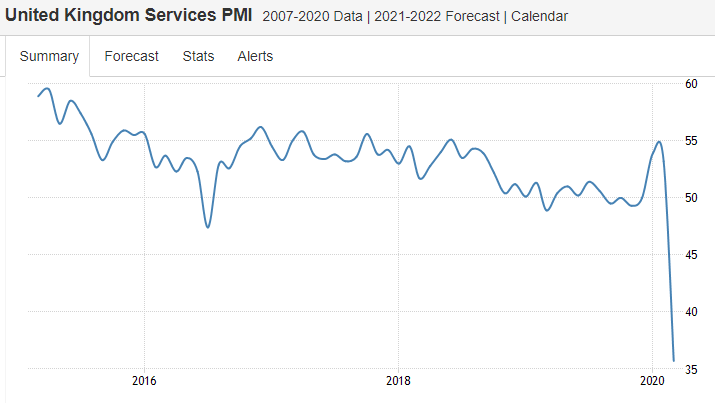

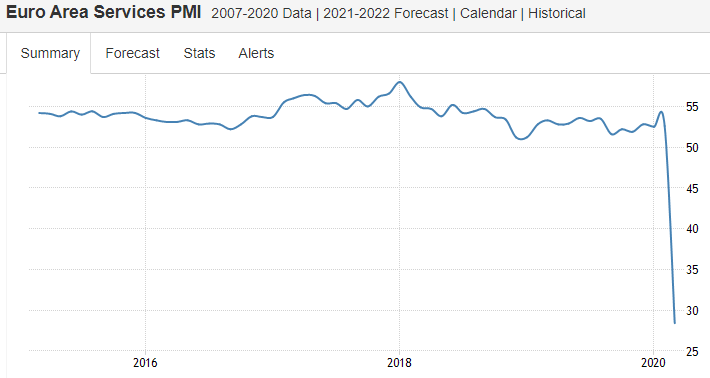

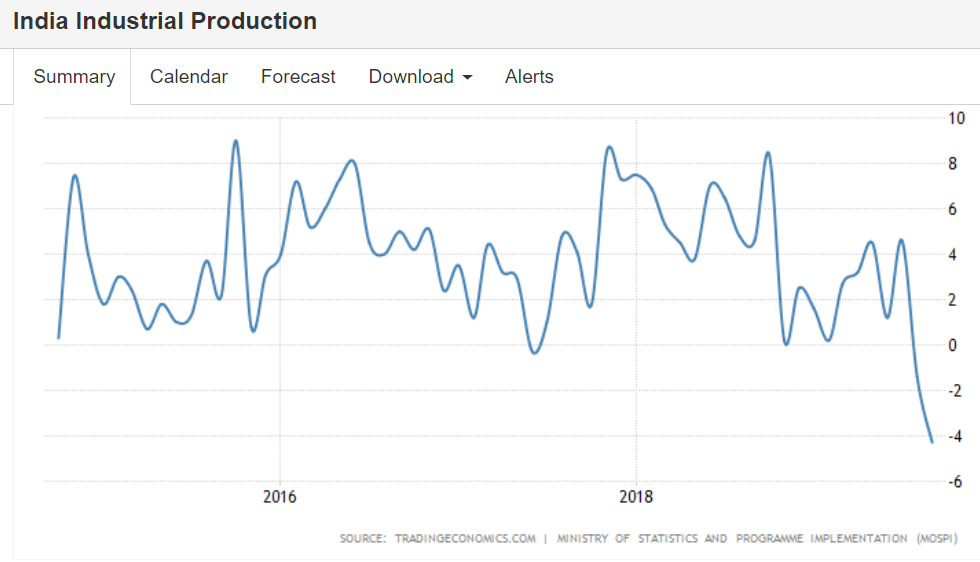

The post covid slump continues, and now there are war disruptions:

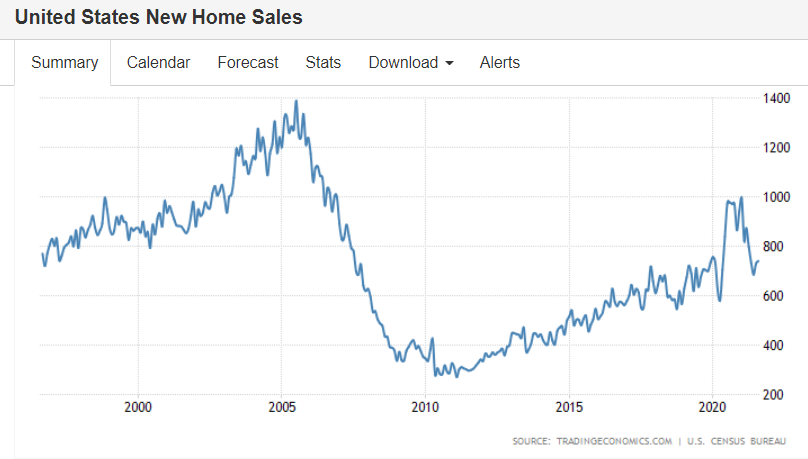

US Consumer Sentiment Lowest since 2011

The University of Michigan consumer sentiment for the US fell to 59.7 in March of 2022 from 62.8 in February, below market forecasts of 61.4, preliminary estimates showed. It is the lowest reading since November of 2011, as inflation expectations rose sharply due to a surge in fuel prices exacerbated by the Russian invasion of Ukraine. The current economic conditions index fell to 67.8 from 68.2 while the expectations gauge sank to 54.4 from 59.4. The year-ahead expected inflation rate (5.4%) rose to its highest level since 1981, and expected gas prices posted their largest monthly upward surge in decades. Personal finances were expected to worsen in the year ahead by the largest proportion since the surveys started in the mid-1940 pointing out that the high inflation rate is impacting incomes.