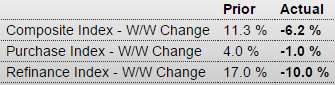

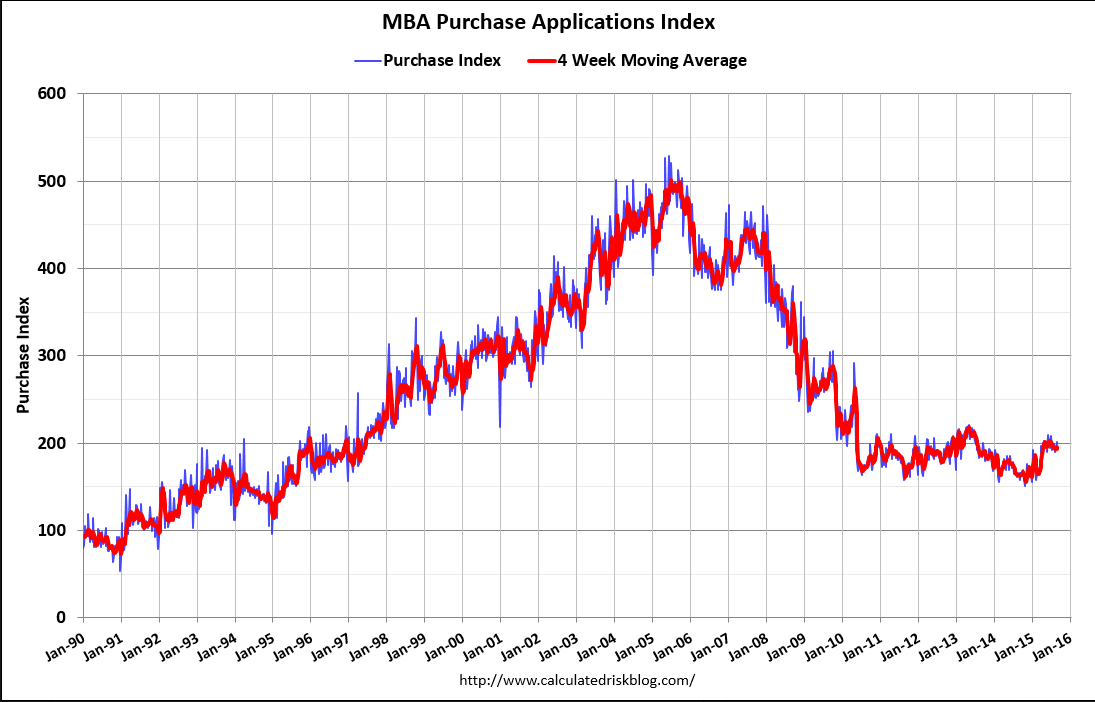

Purchase apps came in 41% higher than a year ago, but have been going nowhere for several months and now look to be drifting lower, as in any case they remain at seriously depressed levels:

MBA Mortgage Applications

Highlights

After jumping 17.0 percent in the prior week on a rate-related surge in refinancing applications, the refinance index fell back 10 percent in the September 4 week. The purchase index continues to show much less volatility, down 1.0 percent in the week. Rates were little changed in the week with the average 30-year mortgage for conforming loans ($417,000 or less) up 2 basis points to 4.10 percent.

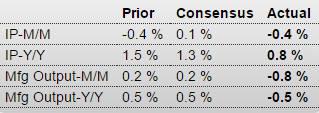

Blow up of the last few years. Note the recent decline:

Great Britain : Industrial Production

Highlights

The UK goods producing sector significantly underperformed expectations in July. Overall industrial production fell 0.4 percent on the month, matching its June decline, while the key manufacturing sector contracted a hefty 0.8 percent, easily eclipsing a 0.2 percent rise last time.

The monthly fall in manufacturing output reflected decreases in seven of the thirteen reporting subsectors. Within this, the steepest drop was posted by basic metals and metals products (5.7 percent), mainly due to weakness in weapons production which can be very volatile and this alone accounted for half of the overall decline. The second largest negative impact came from transportation equipment which subtracted 0.3 percentage points from monthly growth. However, outside of these categories performances were rather better and in particular there was a solid 5.8 percent gain in pharmaceuticals, in part courtesy of surprisingly buoyant export demand.

Total industrial production found some support from a 0.4 percent monthly increase in the volatile mining and quarrying subsector together with rises in electricity, gas, steam and air conditioning (1.3 percent) as well as in water and waste management (0.5 percent).

The latest data leave overall goods production in July 0.6 percent below its second quarter average and, on the same basis, manufacturing output down some 0.9 percent. The August manufacturing PMI (51.5) was less than bullish and while last month probably saw kind of a rebound, it looks as if industrial production will not provide much of a boost to real GDP growth this quarter. Whether the Fed tightens or not this month, there is still little pressure on the BoE MPC to hike any time soon.

What little growth we do get only tightens the noose further as govt’s net contribution to aggregate demand is further reduced. For 2014 the US economy was supported by oil related capital expenditures that ended when prices collapsed late last year, and so far year I’ve seen nothing stepping up to replace it, apart from increases in unsold inventories and accounting for the new health care premiums as an increase in personal consumption. With the federal deficit now below that of the euro area the rest of the US economy is likely heading in that direction as well:

CBO: Fiscal 2015 Federal Deficit through August more than 10% below Last Year

More good news … the budget deficit in fiscal 2015 will probably decline more than 10% compared to fiscal 2014.

From the Congressional Budget Office (CBO) today: Monthly Budget Review for August 2015The federal government’s budget deficit amounted to $528 billion for the first 11 months of fiscal year 2015, the Congressional Budget Office estimates. That deficit was $61 billion smaller than the one recorded during the same period last year. Revenues and outlays were both higher than last year’s amounts, by 8 percent and 5 percent, respectively. Adjusted for shifts in the timing of certain payments (which otherwise would have fallen on a weekend), the deficit for the 11-month period decreased by $42 billion.

In its most recent budget projections, CBO estimated that the deficit for fiscal year 2015 (which will end on September 30, 2015) would total $426 billion, about $59 billion less than the shortfall in fiscal year 2014. …

The Treasury will run a surplus in September, and it appears the deficit for fiscal 2015 (ends in September) will be below 2.4% of GDP.The Treasury will run a surplus in September, and it appears the deficit for fiscal 2015 (ends in September) will be below 2.4% of GDP.