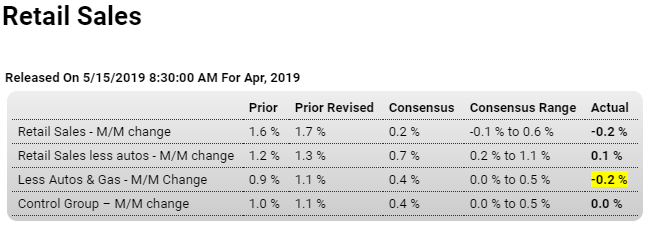

Weak and weaker than expected:

Highlights

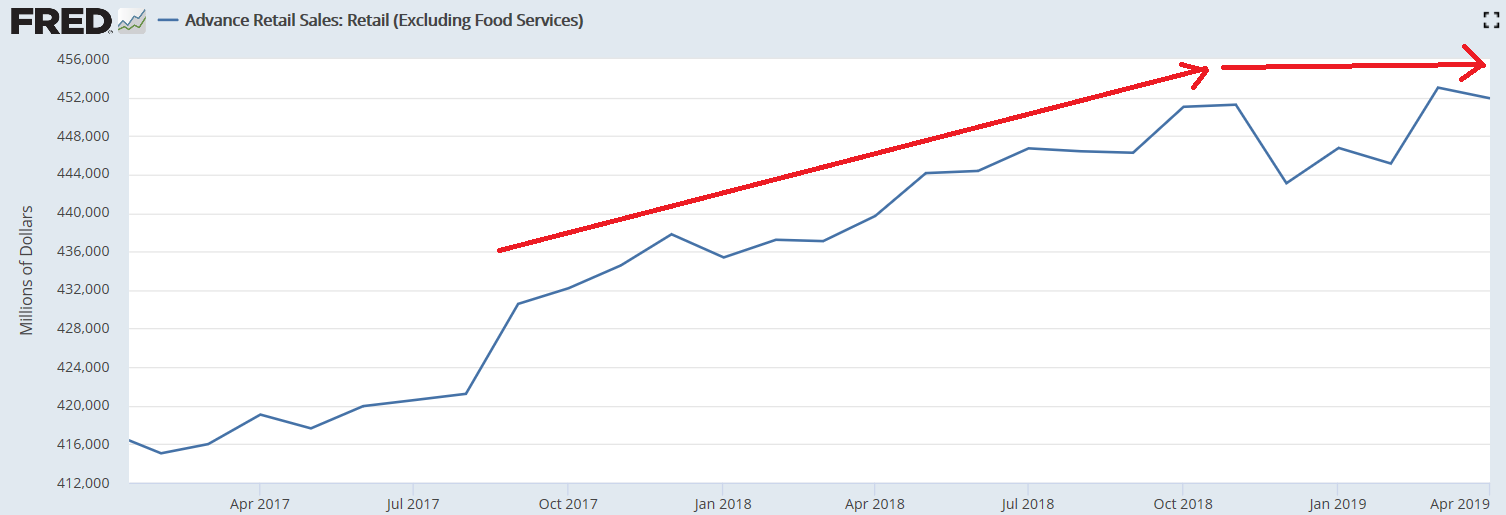

The second quarter gets off to a stumbling start pulled down by a 0.2 percent headline decline in an April retail sales report where the core details show unexpected weakness. Excluding autos, in which sales were already expected to fall sharply, April sales managed only a 0.1 percent gain to fall underneath Econoday’s consensus range. Excluding autos and also gasoline sales, which were already expected to rise sharply, sales fell 0.2 percent in April to also fall below the consensus range. Just making the consensus range is a no change result for the control group, a component used in the calculation of GDP and pointing squarely to early second-quarter deceleration in consumer spending which had already decelerated sharply in the first quarter.

A 1.1 percent decline in auto sales (signaled by the prior release of unit sales at manufacturers) is no surprise and neither is a 1.8 percent jump at gasoline stations, signaled here by the price of gas. The big surprise is a 1.3 percent drop at electronics & appliance stores that follows a 4.3 percent tumble in March. Weakness here hints at lower prices for consumer electronics and also lower spending on home improvements. Furniture sales also hint at trouble for residential investment, coming in unchanged following March’s 3.1 percent decline, as do sales of building materials which fell 1.9 percent in April following, however, a 1.2 percent rise in March.

The best news in the report comes from its weakest sub-component, department stores where April sales jumped 0.7 percent. This was enough, however, to give only a small 0.2 percent lift to the overall general merchandise component. Another positive is restaurants where sales rose 0.2 percent on top of a great monthly surge of 5.7 percent in March.

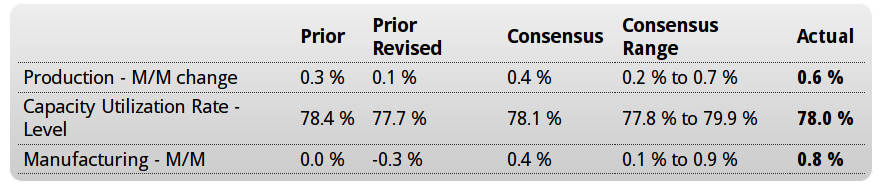

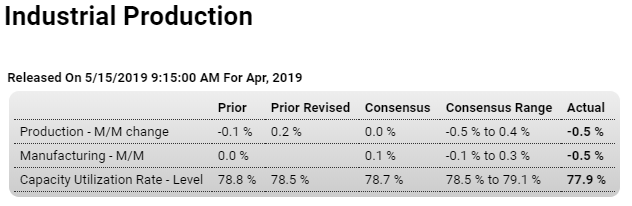

Another negative surprise:

Highlights

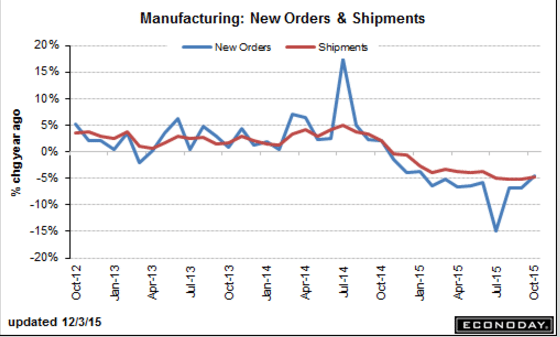

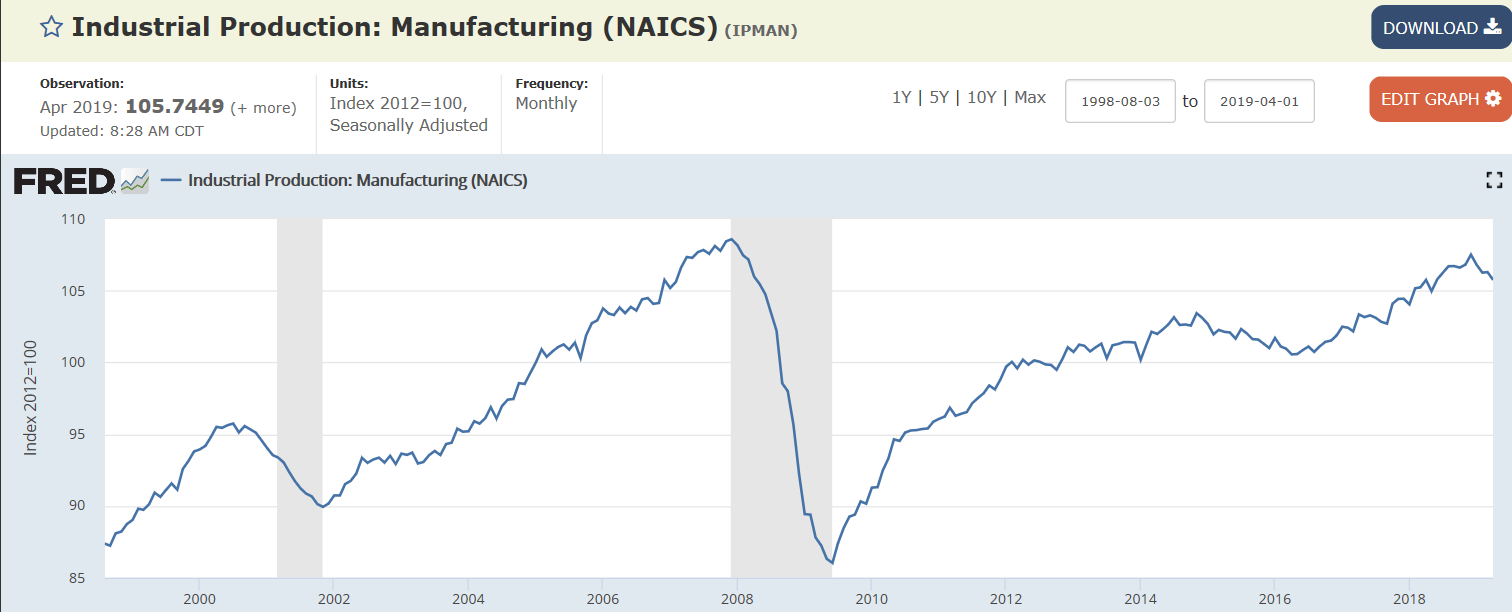

Like retail sales earlier this morning, the headline 0.5 percent decline for April industrial production is not masking strength underneath. Also falling 0.5 percent was production at manufacturers which is even more unexpected than the headline decline.

Motor vehicles and parts, where consumer sales have been mostly soft this year, fell 2.6 percent in April for a second monthly decline and year-over-year contraction of 4.4 percent. Business equipment fell 2.1 percent in the month for yearly growth of only 0.1 percent which doesn’t point to acceleration for business investment. Consumer goods also fell, down 1.2 percent in the month with construction supplies up only 0.1 percent that follows March’s 1.7 percent dip in readings that don’t point to strength for construction in general. Selected hi tech is a positive for April, up 0.6 percent with annual growth here at 3.2 percent.

Also positive is a 1.6 percent jump in mining volumes which rose 1.6 percent in April that follows, however, three straight months of declines. Output at utilities fell 3.5 percent in April with the yearly rate of minus 4.7 percent also pointing to general industrial weakness.

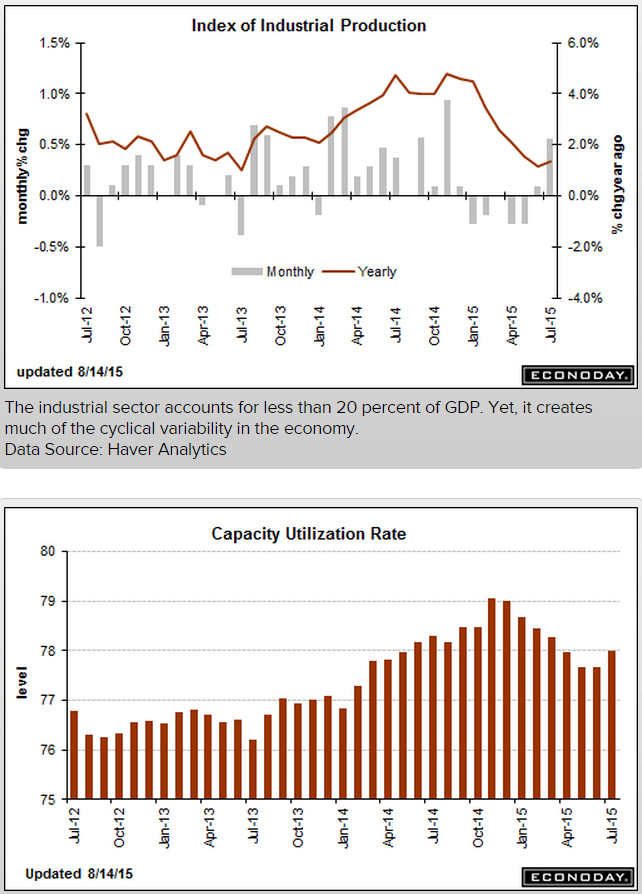

However tight the US labor market may be, capacity does not appear to be tight in the industrial sector as capacity utilization fell 6 tenths in April to a much lower-than-expected 77.9 percent. Utilization in the manufacturing sector is down 5 tenths to 75.7 percent.

This report doesn’t breakdown production of goods aimed for the domestic market and those for the foreign market but it will nevertheless offer a baseline for the overall effects of increased US-China tariffs. Going into those tariffs, the manufacturing sector, which first began to slow late last year, appeared to be flat at best.

Rolling over:

Corporate Japan logs first profit dip in 3 years as China slows

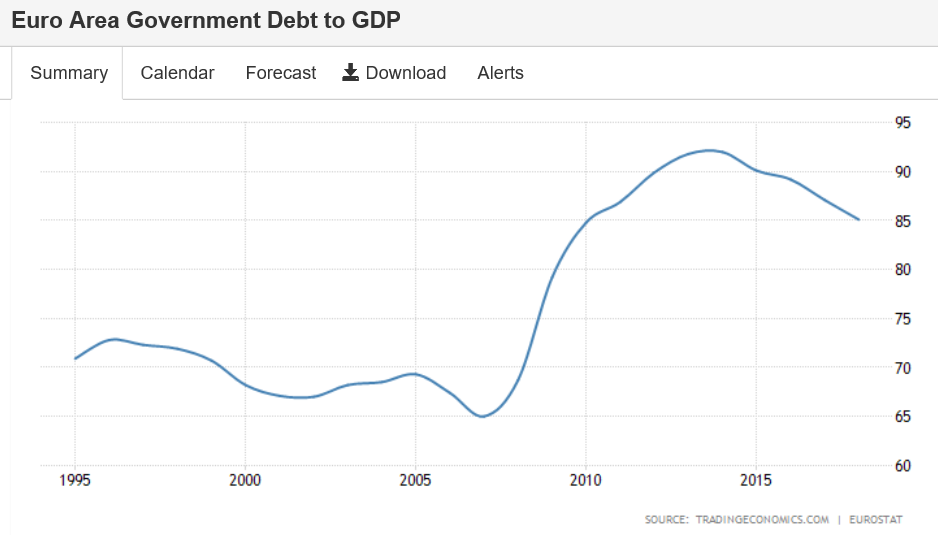

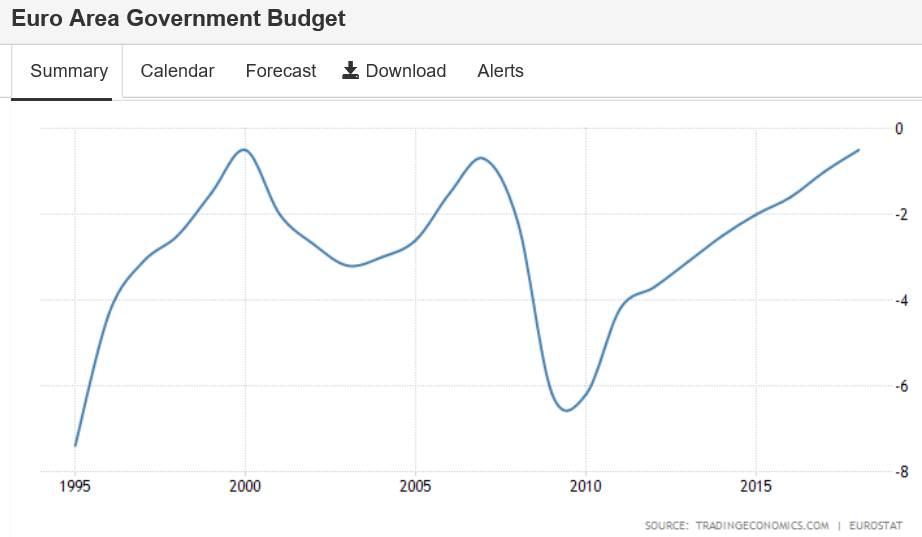

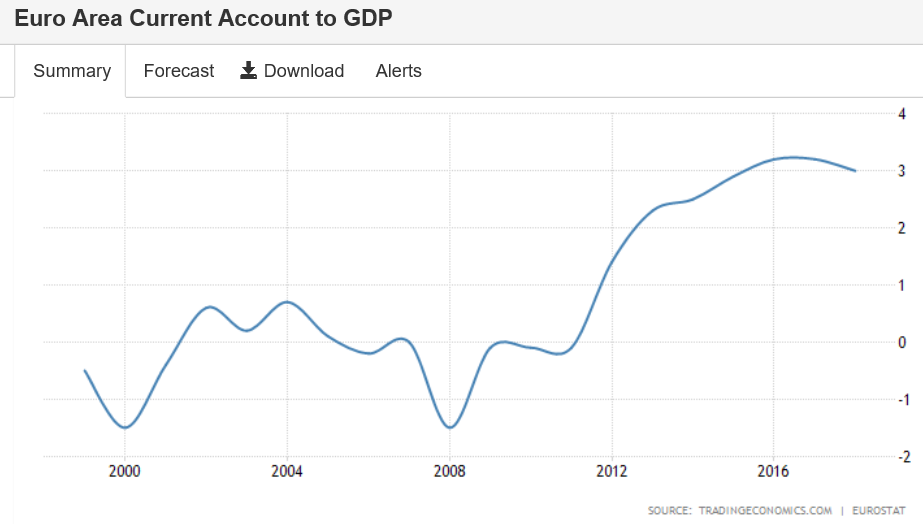

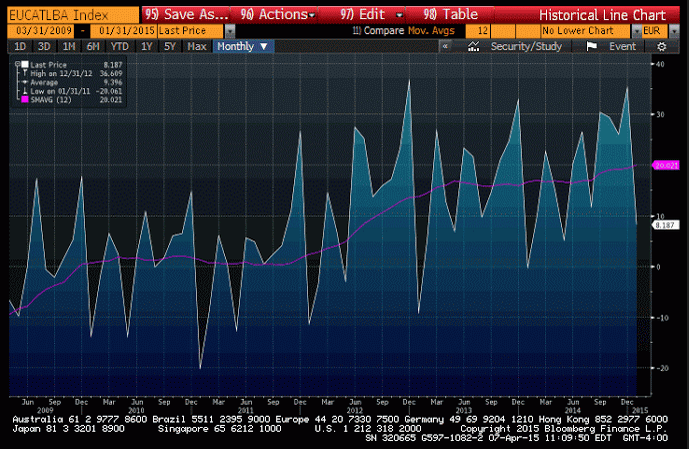

Fiscal has tightened in the euro area, and now with the global trade collapse prospects are looking grim:

Euro Area recorded a Government Budget deficit equal to 0.50 percent of the country’s Gross Domestic Product in 2018. Government Budget in the Euro Area averaged -2.84 percent of GDP from 1995 until 2018, reaching an all time high of -0.50 percent of GDP in 2000 and a record low of -7.40 percent of GDP in 1995.