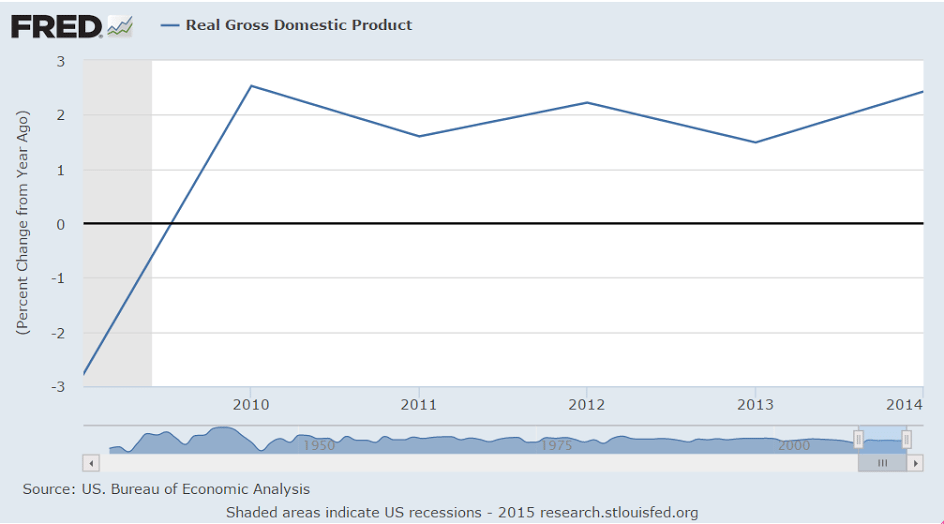

It all started when the FICA tax cuts and a few of the Bush tax reductions were allowed to expire at the end of 2012, followed by the sequesters a few months later 2013. That resulted in 2013 GDP growth of a bit less than 2% or so that might have been closer to 4% without the tax hikes and spending cuts.

Going into 2014 GDP I suggested growth might be closer to 0 than to the 3.5% being forecast. It again printed about in the middle averaging a bit over 2% (with some ups and downs…), and then towards the end of 2014 the price of oil collapsed and it was discovered there had been $hundreds of billions of planned capital expenditures that would be cut, domestically and globally, after which I again suggested GDP growth for the year- this time 2015- would now be near 0, and in fact could well be negative. Additionally, it was revealed the extent to which it was the large and growing oil capex expenditures up to that time that had been supporting at least 1% GDP growth up to that point. And so far GDP growth for 2015 has been less than 2014, even after 2014’s recent downward revisions, and along with slowing GDP has come slowing corporate revenues and earnings growth. All subject to further revisions, of course, which lately have been downward revisions.

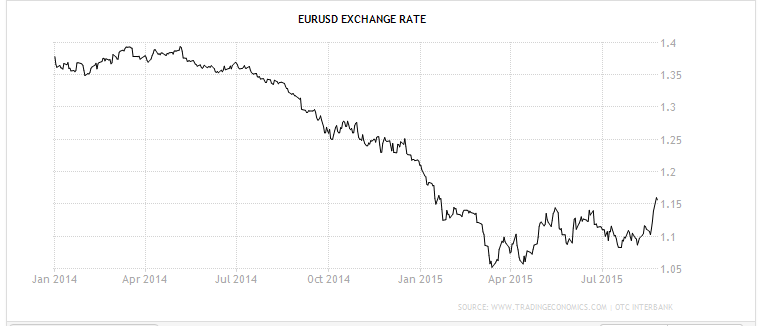

Meanwhile, in the first half of 2014 the euro began falling against the $ as well as other currencies. The fall coincided with the ECB threatening and then following through with negative rates and QE, much to the consternation of global portfolio managers, including Central Bankers, pension funds and hedge funds, who collectively proceeded to lighten up on their euro allocations. And along the way, issues surrounding Greece further frightened the portfolio managers into further selling of euro assets. This relentless selling pressure drove the euro down, particularly vs the US dollar. Specifically, a euro based portfolio manager might, for example, sell his euro securities, and then sell the euros to buy dollars, and then use the dollars to buy US stocks. Or a CB might manage its reserves such that the % of euro assets declined vs dollar assets. And a hedge fund might simply buy the $US index, which is about half dollar/euro and a way to sell euro and other currencies vs the dollar. All of this, along with several other ways to skin the same cat, constituted euro selling that drove the dollar up and the euro down, and at the same time produced buyers of US stocks.

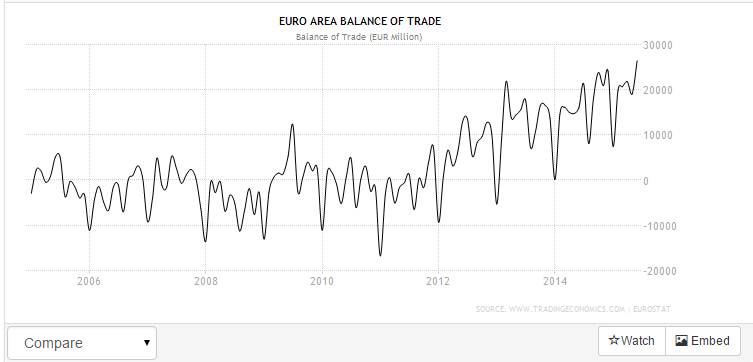

Fundamentally, however, the opposite was happening. The euro area had a (small) trade surplus, which was removing euro from global markets, but not as fast as the sellers were selling, and the euro went ever lower. But as it did this it made the euro area that much more ‘competitive’ (euro area goods and services were that much less expensive in dollar terms) which resulted in an ever larger trade surplus, with the latest release showing a record trade surplus of about 24 billion euro per month. And at the same time, the increased euro exports helped support the economy and generated forecasts for improved future growth, all of which supported euro stocks.

It now appears the curves (finally) crossed, with the euro area trade surplus now exceeding the euro portfolio selling which seems to have run its course, which caused the euro to bottom and start to appreciate. This started generating adverse marks to market for those short euro and long US stocks, for example, who subsequently began reversing their positions by buying euro and selling US stocks. And the strong euro also threatens euro area exports and therefore output, employment, and GDP forecasts, causing euro stocks to sell off as well.

So far I’ve left out what turned out to be the catalyst for this reversal- China. When China moved to allow the yuan to trade lower against the dollar, it was deemed a credible threat to both euro and US exports, and world demand in general, which set off the latest wave of selling.

So what’s next?

More selling of US stocks and buying euro to reverse those positions. Hedge funds might move quickly, but, for example, pension funds often do their reallocating at quarterly and annual meetings, so it could all take quite a bit of time.

Additionally, buying of euro will drive the euro up, as there is no ‘excess supply’ being generated. Quite the reverse, in fact, as the trade surplus works to make euro that much harder to get. That means the euro will appreciate until the trade surplus reverses (whether there is any causation or not…), which should prove highly problematic for the euro economy and euro stocks. The other side of this coin is the weaker dollar that should lend some support to the US stock market, though a collapsing euro area economy with it’s associate debt issues and political conflicts might do more harm than the weak dollar does good, not to mention the weakening domestic demand in the post oil capex world with no relief in sight from other sectors.

Lastly, the stock market has been maybe the best leading indicator, and probably because of it’s direct effect on perceptions of wealth and its influence on spending and investing decisions. And the Fed doesn’t target stocks,

but it doesn’t ignore them either, as it too recognizes the influence it can have on output and employment, especially on the downside.

Of course all of this can be reversed for the better with a simple fiscal expansion, as the underlying problem remains- the Federal deficit is too small in the absence of sufficient private sector deficit spending needed to offset desires to not spend income. (Yes, it’s always an unspent income story…)

But politics, at least for now, renders that sure fire remedy entirely out of the question.