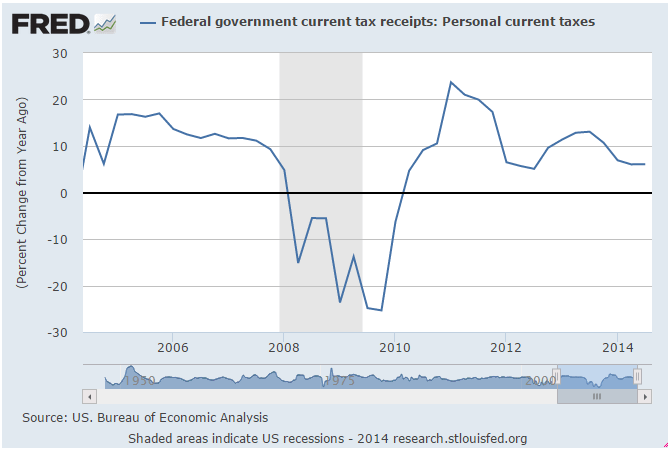

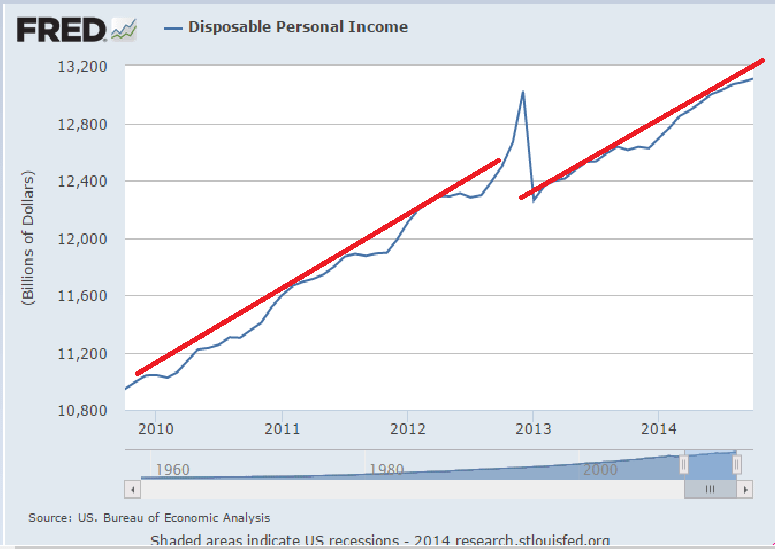

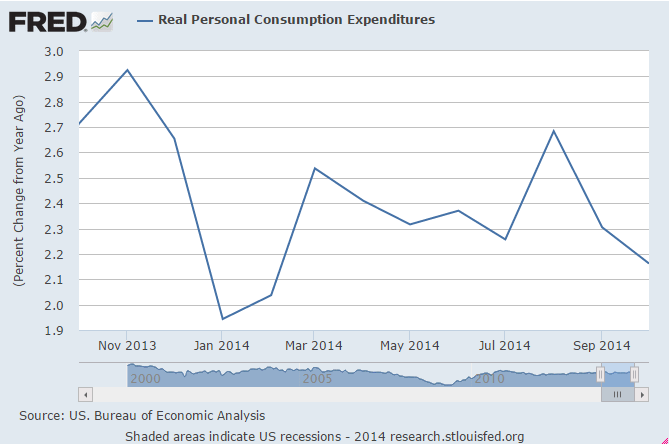

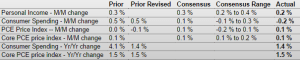

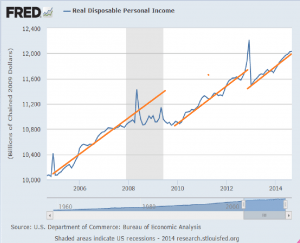

Personal Income growth remains anemic, particularly when the distribution of income gains is factored in. The gain in consumer spending was all durable goods, which has already reversed as per today’s earlier release.

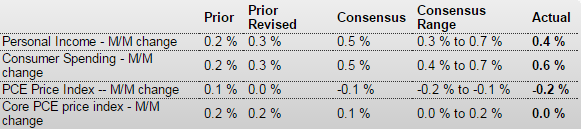

Personal Income and Outlays

Highlights

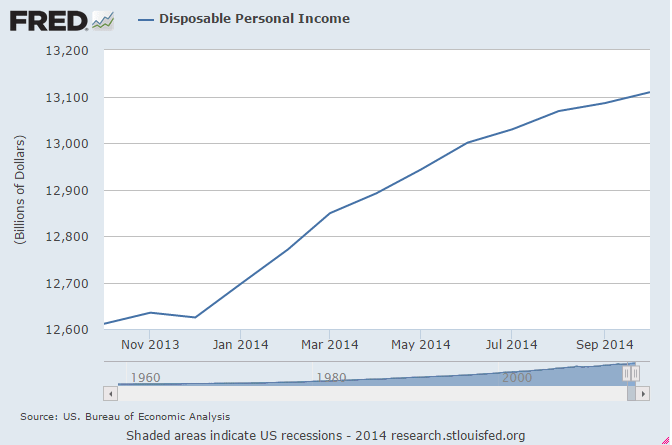

The consumer sector continues to improve with gains in income and spending but inflation remains weak. Personal income advanced 0.4 percent in November after growing 0.3 percent in October. The wages & salaries component increased 0.5 percent, following a gain of 0.3 percent the month before.

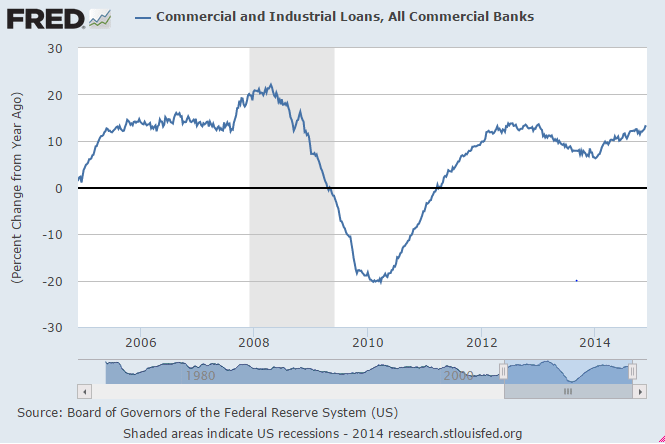

Personal spending grew 0.6 percent, following 0.3 percent in October.

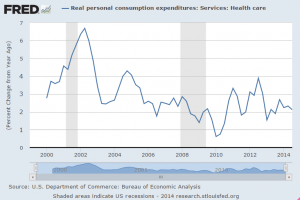

Strength was in durables which jumped 1.6 percent, following a rise of 0.3 percent in October. Nondurables were unchanged in November after decreasing 0.3 percent the prior month. Services improved 0.6 percent after rising 0.4 percent in October.

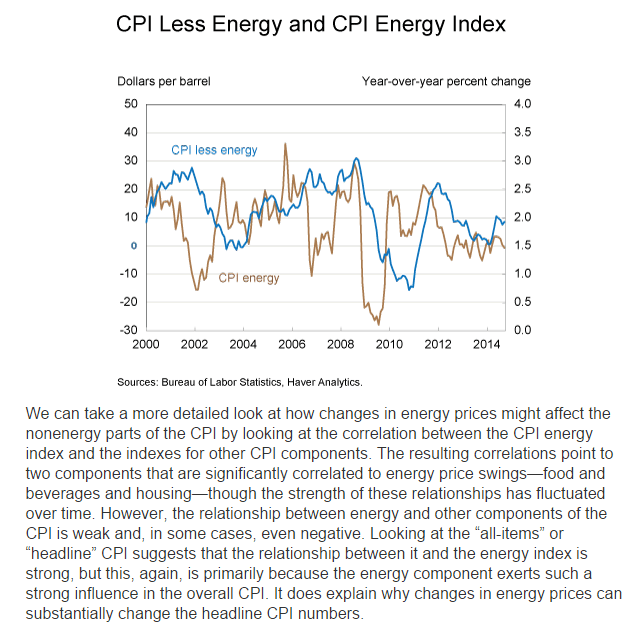

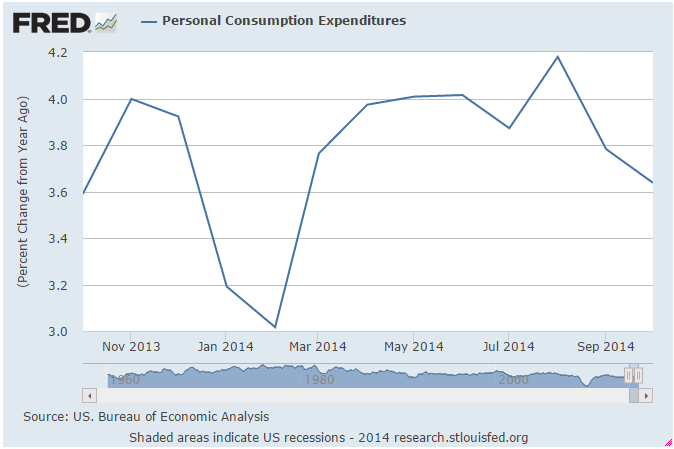

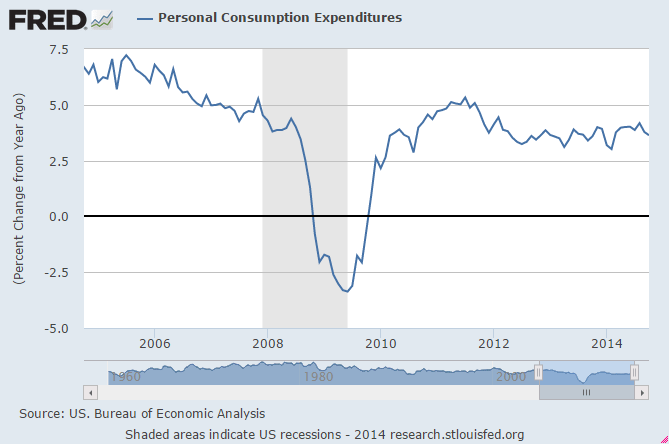

PCE inflation continues to be weak-largely due to lower energy costs. Headline inflation posted at a minus 0.2 percent on a monthly basis, following no change in October. Core PCE inflation was flat in November, following a 0.2 percent rise in October.

On a year-ago basis, headline PCE inflation eased to 1.2 percent in November from 1.4 percent the prior month. Year-ago core inflation came in at 1.4 percent in November compared to 1.5 percent in October. Both series remain below the Fed goal of 2 percent year-ago inflation.

Overall, the consumer sector is slowly improving even though inflation is below the Fed’s goal. In fact, lower gasoline prices are improving discretionary income and boosting spending elsewhere.

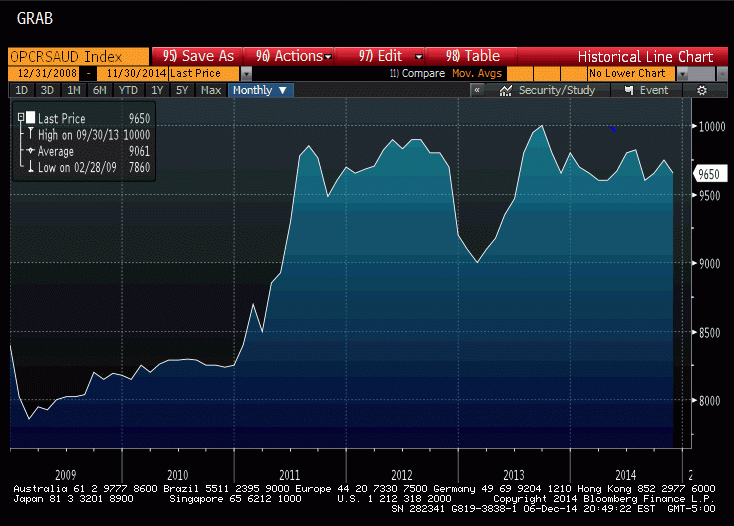

FHFA prices for home sales were up as the number of cheaper distressed sales declined.

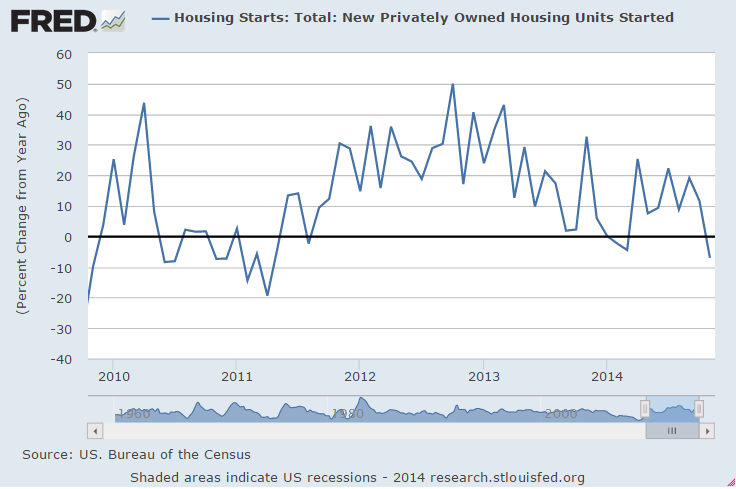

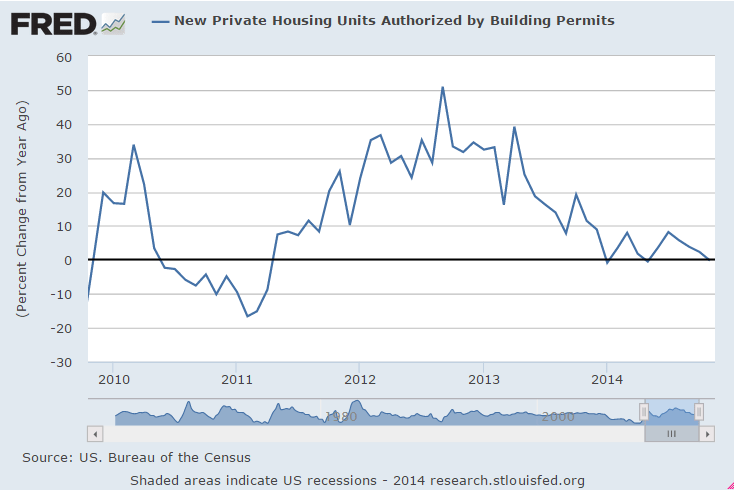

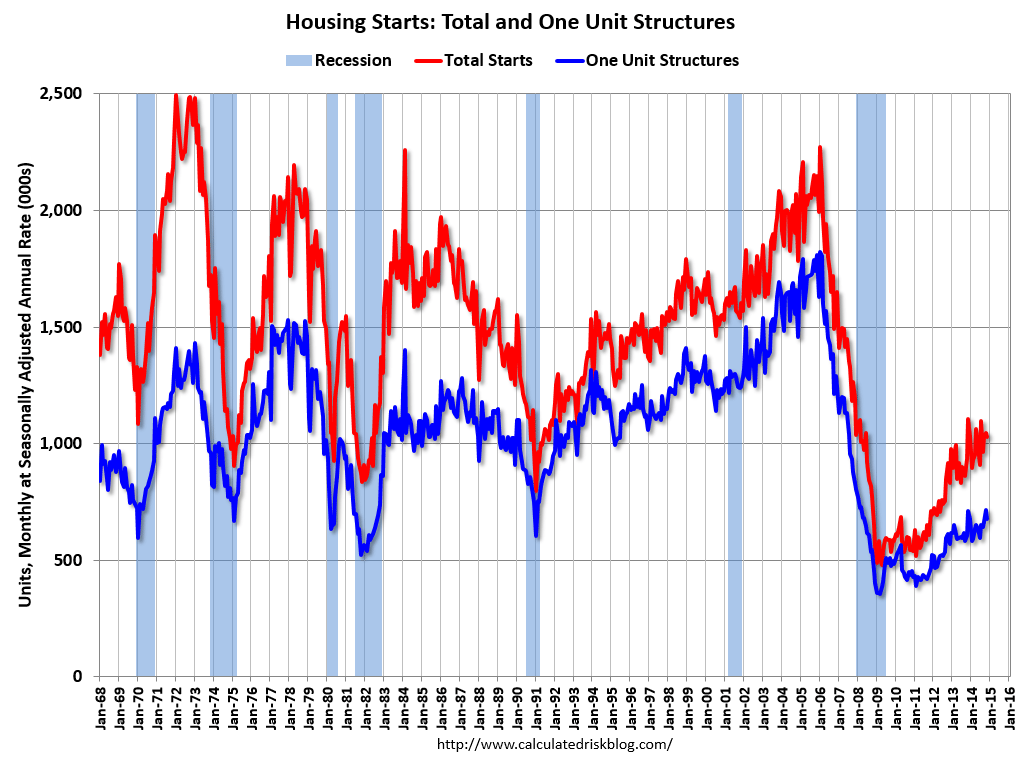

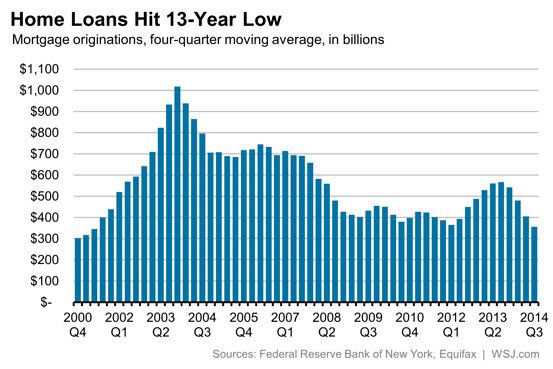

Still looking like the cycle has peaked.

Yet another reversal from a blip up in Q3, and new home sales are a contributor to GDP, so this should cause more downward revisions to Q4 GDP

New Home Sales

Highlights

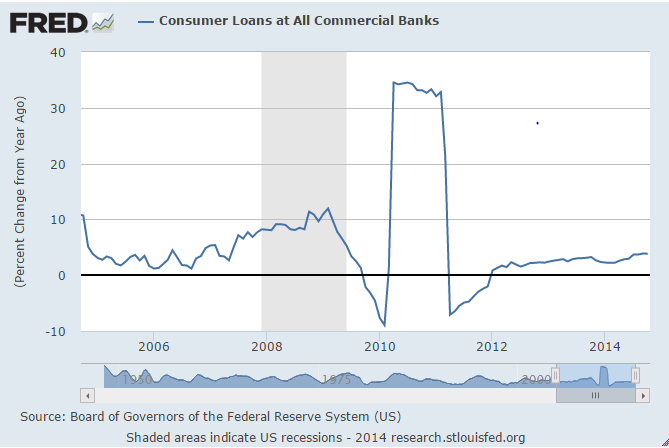

Like yesterday’s existing home sales report, today’s report on new home sales came in below low-end expectations, down 1.6 percent in November to an annual sales rate of 438,000 vs expectations for 460,000 and Econoday’s low-end estimate for 440,000.

Also like yesterday’s existing home sales report, price data show weakness with the median price down 3.2 percent in the month to $280,000. Year-on-year, the median price is up only 1.4 percent which, in what at least doesn’t point to an imbalance, is largely in line with year-on-year sales which are down 1.6 percent.

Supply data are stable with 213,000 new homes on the market vs 210,000 in October. Supply relative to sales is up slightly, to 5.8 months from 5.7 and 5.5 months in the prior two months. Regional sales data show declines in 3 of 4 regions including the South, which is larger than all other regions combined in this report, and a gain in the West.

Housing had been showing some life going into the fourth quarter but the readings on November have been a surprising disappointment and won’t be good reading for the nation’s builders.

Richmond Fed Manufacturing Index

Highlights

Activity has picked up this month in the Richmond’s Fed manufacturing district, to 7 from 4 in November. New orders show relative strength, at 4 vs November’s 1, but are still on the soft side. Order backlogs, however, show outright contraction for a second month, at minus 5 vs minus 2 in November.

Shipments show relative strength to November, at 5 vs 1, but, like new orders, are still on the soft side. A definitive sign of strength, however, comes from employment which is up 3 points to a very solid 13 in a reading that points to underlying confidence among the region’s manufacturers. Price data are soft in line with declining fuel costs.

Early readings on December’s manufacturing activity are mixed with today’s report and last week’s report from Kansas City pointing to slight acceleration for December but the reports from the New York and Philly Feds, along with the PMI national flash report, pointing to softness. Reports on November have also proven mixed with last week’s industrial production report showing outstanding strength in contrast to this.