It doesn’t get any more ominous than this.

This would insure an orderly default of the entire currency union.

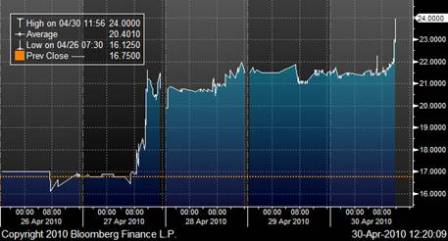

Which is already in progress.

Germany is concerned that the Greek situation resulted in larger deficits for the other members, and wants something in place so defaults don’t result in this type of fiscal expansion for the rescuers.

If they are in fact looking seriously at this new proposal for a default friendly institutional structure its all coming to an end in a deflationary debt implosion, accelerated by their desire for the pro cyclical fiscal policy of smaller national government deficits.

The next event should be the bank runs that force a shut down of the payments system.

It’s a human tragedy that doesn’t have to happen. I’ve proposed two obvious and constructive fixes that are not even being considered. It’s almost like ‘they’ want this to happen, but I now have no idea who ‘they’ are or what ‘their’ motives are.

As always, feel free to distribute.

Merkel’s Coalition Steps Up Calls for EU ‘Orderly Insolvencies’

By Tony Czuczka

May 4 (Bloomberg) — German Chancellor Angela Merkel’s coalition stepped up calls for allowing the “orderly” default of euro-region member states to avoid any repeat of the Greek fiscal crisis.

The parliamentary leaders of the three coalition parties agreed in Berlin today to put a resolution to parliament alongside the bill on Greek aid calling for the European Union to revise rules for the euro to put pressure on countries that run deficits.

Merkel said in an interview with ARD television late yesterday that it’s time to learn lessons from the Greek bailout and raised the option of “an orderly insolvency” as a way to make sure creditors participate in any future rescue.

“We want to move from crisis management to crisis prevention,” Birgit Homburger, the parliamentary head of Merkel’s Free Democratic coalition partner, told reporters in Berlin after the coalition leaders meeting. “We have to do everything we can to ensure we never get into such a situation again.”

Volker Kauder, the floor leader of Merkel’s Christian Democrats, said that the European Commission, the EU’s executive body, must be able to better examine the finances of member states to avert any rerun of what happened in Greece.

“We quite urgently need something for the members of European Monetary Union that we also didn’t have during the banking crisis two years ago,” Finance Minister Wolfgang Schaeuble told reporters yesterday. “Namely the possibility of a restructuring procedure in the event of looming insolvency that helps prevent systemic contagion risks.”