From the first day:

(EDITED)

BERNANKE:

Well, mortgage rates are down some from before this whole thing began.

But we have a problem, which is that the spreads between, say, treasury rates and lending rates are widening, and our policy is essentially, in some cases, just offsetting the widening of the spreads, which are associated with various kinds of illiquidity or credit issues.

So in that particular area, you’re right that it’s been more difficult to lower long-term mortgage rates through Fed action.

Seems he isn’t aware the tools he has to peg the entire term structure of rates as desired.

G. MILLER (?):

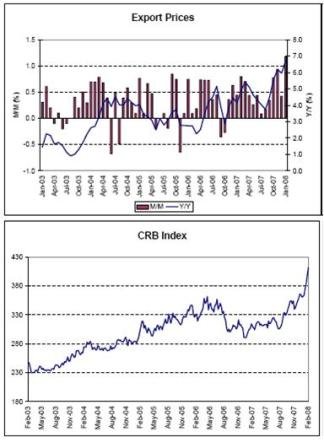

On January 17th, you presented your near-term economic outlook to the House Budget Committee. In that outlook, you indicated the future market suggests (inaudible) prices will decelerate over the coming year. However, since then, oil prices have reached record highs in nominal terms.

Questioning the Fed’s ability to forecast oil prices and the use of futures markets for forecasting.

If oil continues to remain at its current levels, thereby adding further pressure on the overall inflation, it may be more difficult for the Fed to cut interest rates. And if that were the case, what option do you have, beyond cutting interest rates, are you considering to help spur the economic growth?

BERNANKE:

Oil prices don’t have to come down to reduce inflation pressure. They just have to flatten out. And if they —

I would suggest that even if they flattened out, it will be years before all the cost push aspects of the current price filters through.

G. MILLER (?):

But if they don’t flatten out?

BERNANKE:

Well, if they continue to rise at this pace, it’s going to be a — create a very difficult problem for our economy. Because, on the one hand, it’s going to generate more inflation, as you described. But it’s also going to, you know, create more weakness because it’s going to be like a tax that’s extracting income from American consumers.

BERNANKE:

Well, we don’t know what oil prices are going to do. It depends a lot on global conditions, on demand around the world. It also depends on suppliers, many of which are politically unstable or politically unstable regions or have other factors that affect their willingness and ability to supply oil. So, there’s a lot of uncertainty about it.

But our analysis, combined with what we can learn from the futures market, suggests that we should certainly have much more moderate behavior this year than we have. But, again, there’s a lot of uncertainty around that estimate.

Still using futures markets for forecasting.

And he is also forecasting growth to pick up in Q3 and Q4 and inflation to moderate. Seems contradictory?

BERNANKE:

Our easing is intended to, in some sense, you know, respond to this tightening in credit conditions, and I believe we’ve succeeded in doing that, but there certainly is some offset that comes from widening spreads, and this is what’s happening in the mortgage market.

Has to be frustrating – they cut rates to hopefully cut rates to domestic borrowers, but those rates don’t go down, only the $ goes down and imported prices rise further.

FRANK:

The gentleman from Texas, Mr. Neugebauer?

RANDY NEUGEBAUER, U.S. REPRESENTATIVE (R-TX):

Thank you.

Mr. Chairman, I want to turn my attention a little bit.

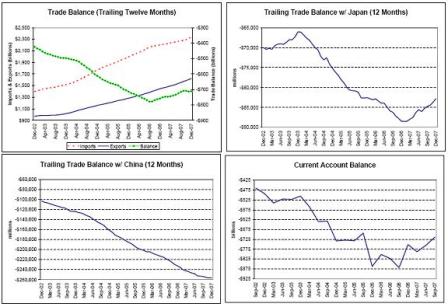

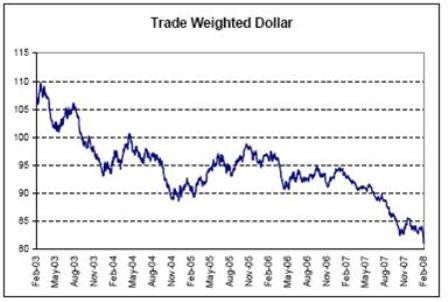

You mentioned in your testimony a little bit about the dollar and the fact that it has increased our exports — because American goods are more competitive. But at the same time, it’s created — it swings the other way and the fact that it raises price — it has an inflationary impact on the American consumer.

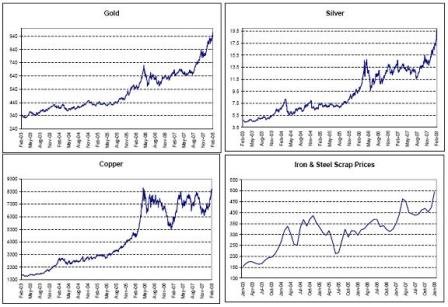

I believe one of the reasons that oil is $100 a barrel today is because of our declining dollar. People settle oil in dollars, and I think a lot of them have, obviously, just increased the price of the commodity.

And so I really have two questions.

One is, what do you believe the continuing decline of the dollar is — what kind of inflationary impact do you think that is going to have?

And then, secondly, as this dollar declines, one of the things that I begin to get concerned with is all of these people that have all of these dollars have taken a pretty big hickey over the last year or so and continue to do that.

At what point in time do people say, you know, “We want to stop trading in dollars and trade in other currencies”? And what implication do you think then that has on the capital markets in U.S.?

BERNANKE:

Well, Congressman, I always need to start this off by saying that treasury is the spokesman for the dollar. So let me just make that disclaimer.

We, obviously, watch the dollar very carefully. It’s a very important economic variable.

As you point out, it does increase U.S. export competitiveness, and in that respect it’s expansionary but it also has inflationary consequences. And I agree with you that it does affect the price of oil. It has probably less effect on the price of consumer goods or finished goods that come in from out of the country, but it does have an inflationary effect.

Our mandate, of course, is to try to achieve full employment and price stability here in the United States, and so we look at what the dollar’s doing. And we think about that in the context of all the forces that are affecting the economy, and we try to set monetary policy appropriately.

So we don’t try to — we don’t have a target for the dollar or anything like that. What we’re trying to do is, given what the dollar’s doing, we try to figure out where we need to be to keep the economy on a stable path.

Sidestepped the heart of the question.

With respect to your other question, there is not much evidence that investors or holders of foreign reserves have

shifted in any serious way out of the dollar to this point.

The drop in the trade deficit = The change in non-resident desires to hold $US financial assets.

And, indeed, we’ve seen a lot of flows into U.S. treasuries,

Those are not evidenced of increased foreign holding of $US financial assets

which is one of the reasons why the rates of short-term U.S. treasuries are so low, reflecting their safety, liquidity and general attractiveness to international investors.

Who are scared of other $US financial assets.

In fact, the low treasury rates are probably partially responsible for the rush to get out of $US financial assets.

So we’ve not yet seen the issue that you’re raising.

And he is sincere in that answer.

NEUGEBAUER:

One of the other questions that I have — and just your thoughts — is the U.S. economy is based on encouraging the consumer to consume as much as he possibly can. And, in fact, the stimulus package that we just passed the other day, $160 billion, was really, by and large, saying to the American people, “Go out and spend.”

And this consumption mentality away from any kind of a savings mentality concerns me that makes the economy always going to be a lot more volatile because there’s not much margin.

And now — a year ago, people were testifying before this — “Don’t worry about the low savings rates,” because people had these huge equities in their homes, and so that was compensating for the lack of savings in the U.S.

That now, we see, as some reports, devaluation of real estate, 10, 12, 15 percent, and the savings rates at zero and negative rate.

Does that concern you long term that we’re trying to build an economy on people to use up every resource that they have?

BERNANKE:

Yes, Congressman.

Wonder if he is aware the only source of net financial assets for the non-government sectors is government deficit spending, by identity?

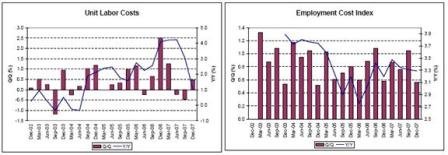

I think we — in the long term, we need to have higher saving, and we need to devote our economy more toward investment and more to foreign exports than to domestic consumption.

This is a troubling long-term view and reflects his mercantilist tendencies reviewed in earlier posts.

And that’s a transition we’re going to have to make in order to get our current account deficit down, in order to have enough capital in

(I think it should be ‘and’ – transcript error?)

foreign income to support an aging population as we go forward the next few decades.

This is a very peculiar position to be taking, not to mention formulating policy on this notion.

The stimulus package, which is going to support consumption in the very near term, there’s a difference between the very short run and the long run.

In the very short run, if we could substitute more investment, more exports, that would be great.

Exports better than consumption? He’s calling for a reduced standard of living -lower real wages- just like what has been happening.

But if we — since we can’t in the short run, a decline in total demand will just mean that less of our capacity’s being utilized, we’ll just have a weaker economy.

So that’s the rationale for the short-term measure. But I agree with you that over the medium and long term we should be taking measures to try to move our economy away from consumption dependence, more toward investment, more toward net exports.

Restating the same mercantilist view that’s non-applicable with non-convertible, floating fx $US as in my previous posts.

GREGORY MEEKS, U.S. REPRESENTATIVE (D-NY):

Thank you, Madam Chair.

Good to be with you, Mr. Chairman.

You know, you get some of these conditions, and you do one thing and it helps or you do something else and it hurts. And such is the situation that I think that we’re currently in.

It seems to me that if you move aggressively to cut interest rates and stimulate the economy, then you risk fueling inflation, on top of the fact that we’ve got a weak dollar and a trade deficit. You know, you’ve got to go into one direction or another.

Which direction do you think — are you looking at focusing on first?

BERNANKE:

Congressman, I think I’ll let my testimony speak for itself in terms of the monetary policy.

I just would say that, you know, we do face a difficult situation. We have — inflation has been high. And oil prices and food prices have been rising rapidly.

We also have a weakening economy, as I discussed. And we have difficulties in the financial market and the credit markets.

So that’s three different areas where the Fed has to, you know, worry about — three different fronts, so to speak. So the challenge for us, as I mentioned in my testimony, is for us to try to balance those risks and decide at a given point in time which is more serious, which has to be addressed first, which has to be addressed later.

That’s the kind of balancing that we just have to do going forward.

MEEKS:

So you just move back and forth as you see and try to see if you can just have a level —

BERNANKE:

Well, the policy is forward looking. We have to deal with what our forecast is. So we have to ask the question where will the economy be six months or a year down the road? And that’s part of our process for thinking about where monetary policy should be.

And that forecast is for growth to increase and prices to moderate.

Seems contradictory.

MEEKS:

Well, let me also ask you this: The United States has been heavily financed by foreign purchasers of our debt, including China, and there has been a concern that they will begin to sell our debt to other nations because of the falling dollar and the concerns about our growing budget deficits.

Will the decrease in short-term interest rates counterbalance other reasons for the weakening dollar enough to maintain demand for our debt? And, if that happens, what kind of damage does it do to our exports?

MEEKS:

And I’d throw into that, because of this whole debate currently going on about sovereign wealth funds, and some say that these sovereign wealth funds are bailing out a lot of our American companies. So, is the use of sovereign wealth funds good or bad?

BERNANKE:

Well, to address the question on sovereign wealth funds, as you know, a good bit of money has come in from them recently to invest in some of our major financial institutions.

I think, on the whole, that it’s been quite constructive. The capitalization — extra capital in the banks is helpful because it makes them more able to lend and to extend credit to the U.S. economy.

The money that’s flowed in has been a relatively small share of the ownership or equity in these individual institutions and, in general, has not involved significant ownership or control rights.

So, I think that’s been actually quite constructive. And, again, I urge banks and financial institutions to look wherever they may find additional capitalization that allow them to continue normal business.

More broadly, we have a process in place called the CFIUS process, as you know, where we can address any potential risks to our national security created by foreign investment. And that process is — I think is a good process.

Otherwise, to the extent that we are confident that sovereign wealth funds are making investments on economic basis for returns, as opposed to for some other political or other purpose, I think that’s — it’s quite constructive and we should be open to allowing that kind of investment.

Bernanke doesn’t realize there is no need for investment $ per se from sovereign wealth funds.

Part of the reciprocity of that is to allow American firms to invest abroad, as well. And so, there’s a quid pro quo for that, as well.

MEEKS:

What about the first part of my question?

BERNANKE:

I don’t see any evidence at this point that there’s been any major shift in the portfolios of foreign holders of dollars. So, I — you know, we do monitor that to the extent we can, and so far, I have not seen any significant shift in those portfolios.

Sad, but true.

SPENCER BACHUS, U.S. REPRESENTATIVE (R-AL):

Thank you.

Chairman Bernanke, have the markets repriced risk? Where do we stand there?

You know, we talked about the complex financial instruments, and…

BERNANKE:

That’s an excellent question.

Part of what’s been happening, Congressman, is that risk perhaps got underpriced over the last few years. And we’ve seen a reaction, where, you know, risk is being, now, priced at a high price.

It’s hard to say, you know, whether the change is fully appropriated or not. Certainly, part of it, at least — certainly, part of the recent change we’ve seen is a movement toward a more appropriate, more sustainable pricing of risk.

But in addition, we are now also seeing additional concerns about liquidity, about valuation, about the state of the economy, which are raising credit spreads above, sort of, the normal longer-term level. And those increased spreads and the potential restraint on credit is a concern for economic growth. And we’re looking at that very carefully.

But he does recognize they, too, are market pricing of risk.

This implies that markets are ‘functioning’.

BACHUS:

I see.

One thing you didn’t mention in your testimony is the municipal bond market and the problems with the bond insurers. Would you comment on its affect on the economy and where you see the situation?

BERNANKE:

Yes, Congressman.

The problems — the concerns about the insurers led to the breakdown of these auction-rate securities mechanisms which were a way of using short-term financing to finance longer-term municipal securities.

And a lot of those auctions have failed, and some municipal borrowers have been forced into, at least for a short period, have been forced to pay the penalty rates.

So there may be some restructuring that’s going to have to take place to get the financing for those municipal borrowers.

But as a general matter, municipal borrowers are very good credit quality. And so my expectation is that within a relatively short period of time we’ll see adjustments in the market to allow municipal borrowers to finance reasonable interest rates.

Agreed!

BACHUS:

Let me ask one final question.

You’re a former professor, and I think the word is “financial accelerator process.” What we mean there is problems in the economy cause sentiment problems; a lack of confidence.

Where do you see — is negative sentiment a part of what we’re seeing now?

I know I was in New York, and bankers there said there were a lot of industries making a lot of money who were just waiting, because of what they were reading in the papers as much as anything else, to invest.

BERNANKE:

Well, there’s an interaction between the economy and the financial system, and perhaps even more enhanced now than usual, in that the credit conditions in the financial market are creating some restraint on growth.

So far, the pass-through to the real economy has been modest, which means he’s saying that in normal times it’s even less.

I agree with that.

And slower growth, in turn, is concerning the financial markets because it may mean that credit quality is declining.

And so that’s part of this financial accelerator or adverse feedback loop is one of the concerns that we have, and one of the reasons why we have been trying to address those issues.

Never mentions in countercyclical tax structure – the automatic stabilizers that Fed research has shown to be highly effective in dampening cycles since WWII.

RON PAUL, U.S. REPRESENTATIVE (R-TX):

Thank you, Mr. Chairman.

(rant snipped)

And when you look at it — and I mentioned in my opening statement that M3, now, measured by private sources, is growing by leaps and bounds. In the last two years, it increased by 40, 42 percent. Currently, it’s rising at a rate of 16 percent.

It’s all in the definition of that aggregate.

The Fed dropped it for a good reason.

(more rant snipped)

So if we want stable prices, we have to have stable money. But I cannot see how we can continue to accept the policy of deliberately destroying the value of money as an economic value. It destroys — it’s so immoral in the sense that, what about somebody who’s saved for their retirement and they have CDs and we’re inflating the money at a 10 percent rate? Their standard of living is going down.

And that’s what’s happening today. The middle class is being wiped out and nobody is understanding that it has to do with the value of money. Prices are going up.

So, how are you able to defend this policy of deliberate depreciation of our money?

BERNANKE:

Congressman, the Federal Reserve Act tells me that I have to look to price stability — price stability, which I believe is defined as the domestic prices — the consumer price index, for example — and that’s what we aim to do. We look for low domestic inflation.

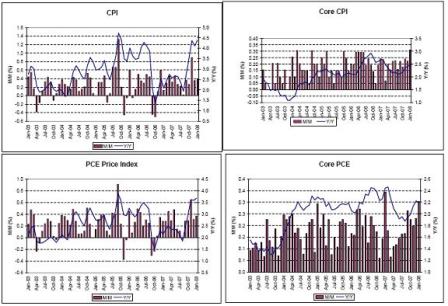

CPI and core is way above Fed comfort zones and rising.

Now, you’re correct that there are relationships, obviously, between the dollar and domestic inflation and the relationships between the money supply and domestic inflation. But those are not perfect relationships. They’re not exact relationships.

And, given a choice, we have to look at the inflation rate — the domestic inflation rate.

Now, I understand that you would like to see a gold standard, for example, but that it is really something for Congress. That’s not my decision.

PAUL:

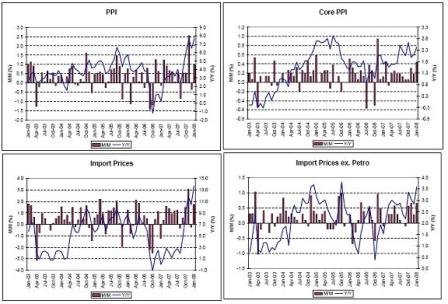

But your achievement — we have now PPI going up at a 12 percent rate. I would say that doesn’t get a very good grade for price stability, wouldn’t you agree?

BERNANKE:

No, I agree. It’s not — the more relevant one, I think, is the consumer price index, which measures the price consumers have to pay, and that was, last year, between 3.5 and 4 percent.

It finished the year North of 4%.

And I agree, that’s not a good record.

PAUL:

And the PPI is going to move over into the consumer index, as well.

BERNANKE:

We’re looking forward this year and we’re trying to estimate what’s going to happen this year. And a lot of it depends on what happens to the price of oil.

And if oil flattens out, we’ll do better. But if it continues at the rate in 2007, it’ll be hard to maintain low inflation. I agree.

PAUL:

Thank you.

Expected more from Mr. Paul.