[Skip to the end]

It comes down to public purpose.

The agencies were set up to provide low cost funding for moderate income home buyers.

They have done that reasonably well.

However, for probably 20 years I’ve been saying the agencies should fund themselves directly with the Treasury or Fed financing bank (same as Treasury). This both lowers their cost of funds, which would get passed through to the home mortgages they originate, and eliminates the possibility of a liquidity crisis.

Market discipline should not be on the liability side. It subjects them to risk of a ‘liquidity crisis’ where those funding you can decide to go play golf one day and cut you off for no reason and put you out of business. (And any entity subject to private sector funding to continue operations is subject to this kind of liquidity risk.) Regulation should focus instead on the asset side with assets and capital fully regulated.

This was done for the most part, and this is the same as the general banking model which works reasonably well. Yes, it blows up now and then as banks find flaws in the regulations, but the losses are taken, regulations adjusted, and life goes on.

The agencies made some loans to lower income borrowers as that went bad.

Even with this, most calculations show that at today’s rates of mortgage default they still have adequate capital to squeak by – the cash flow from the remaining mortgages and their capital is pretty much adequate to pay off their lenders (those who hold their securities).

But if defaults increase their ‘cash flow net worth’ could turn negative; hence, it would currently not be prudent for the private sector to fund them.

Paulson has now moved funding to the Treasury where it should have been in the first place.

This removes the possibility of a liquidity crisis and allows the agencies to continue to meet their congressional charge of providing home mortgages for moderate and lower income borrowers at low rates.

There was no operational reason for Paulson to do more than that, only political reasons.

The agencies could then have continued to function as charged by Congress.

If there were any long-term cash flow deficiencies, they would be ‘absorbed’ by the Treasury as that would have meant some of the funding for new loans was in fact a Treasury expense as it transferred some funds to borrowers who defaulted.

Congress has always been free to change underwriting standards.

In fact, the program was all about easier underwriting for targeted borrowers.

If there were any ultimate losses, that was the cost of serving those borrowers.

To date there have been only profits, and the program has ‘cost’ the government nothing.

With Treasury funding and a review of underwriting standards the program could have continued as before, which it might still do.

The entire episode was a panic over a possible liquidity crisis due to the possibility of the Treasury not doing what it did, and what should have been done at inception.

I don’t think the Treasury getting 79.1% of the equity after making sure it took no losses and got a premium on any ‘investment’ it made served any non-political purpose.

There was no reason current equity holders could not have gotten the ‘leftovers’ after the government got its funds and a premium also determined by the government.

Equity IS the leftovers and could have been left alone. (It wouldn’t surprise me if some of the shareholders challenge this aspect of the move.)

Yes, holders of direct agency securities were ‘rescued’, but they were taking a below market rate to buy those securities due to the implied government backing and lines of credit to the government.

I don’t see it as a case of ‘market failure’ but instead poorly designed institutional structure with a major flaw that forced a change of structure.

It’s a failure of government to do it right the first time, probably due to politics, and much like the flaw in the eurozone financial architecture (no credible deposit insurance – another form of allowing the liability side of the banking system to be subject to market discipline), also due to politics.

As for compensation, that too was ultimately under the control of Congress, directly or indirectly.

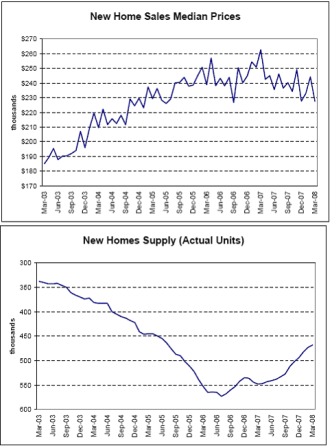

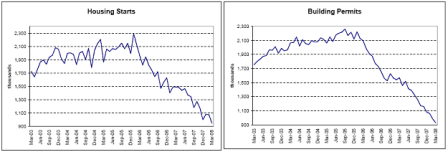

Lastly, in the early 1970s, with only 215 million people, housing starts peaked at 2.6 million per year.

Today, with over 300 million people we consider 2 million starts ‘gangbusters’ and a ‘speculative boom’.

And in the early 1970s, all there were was bunch of passive S&Ls making home loans – no secondary markets, no agencies, etc.

Point is, we don’t need any of this ‘financial innovation’ to further the real economy.

Rather, the financial sector preys on they real sectors, in both financial terms and real terms via the massive brain drain from the real sectors to the financial sector.

At the macro level, we’d be better off without 90% or more of the financial sector.

[top]