[Skip to the end]

by Peter S Goodman

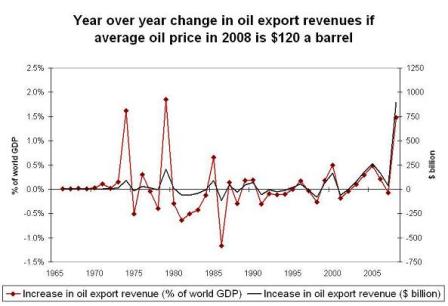

Using public money to spare Fannie and Freddie would increase the public debt, which now exceeds $9.4 trillion. The United States has been financing itself by leaning heavily on foreigners, particularly China, Japan and the oil-rich nations of the Persian Gulf.

This is ridiculous, of course. The US, like any nation with its own non-convertible currency, is best thought of as spending first, and then borrowing and/or collecting taxes.

Were they to become worried that the United States might not be able to pay up, that would force the Treasury to offer higher rates of interest for its next tranche of bonds.

Also ridiculous. Japan had total debt of 150% of GDP, 7% annual deficits, and were downgraded below Botswana, and they sold their 3 month bills at about 0.0001% and 10 year securities at yields well below 1% while the BOJ voted to keep rates at 0%. (Nor did their currency collapse.)

The CB sets the rate by voice vote.

And that would increase the interest rates that Americans must pay for houses and cars, putting a drag on economic growth.

As above.

For one thing, this argument goes, taxpayers  who now confront plunging house prices, a drop on Wall Street and soaring costs for food and fuel  will ultimately pay the costs. To finance a bailout, the government can either pull more money from citizens directly,

Yes, taxing takes money directly, and it’s contradictionary.

But when the government sells securities they merely provide interest bearing financial assets (treasury securities) for non-interest bearing financial assets (bank deposits at the Fed). Net financial assets and nominal wealth are unchanged.

or the Fed can print more money  a step that encourages further inflation.

This is inapplicable.

There is no distinction between ‘printing money’ and some/any other way government spends.

The term ‘printing money’ refers to convertible currency regimes only, where there is a ratio of bill printed to reserves backing that convertible currency.

Skip to next paragraph “They are going to raise the cost of living for every American,”

True, that’s going up!

[top]