Positive Currency Wars!

19 February 2013

Financial markets are today being buffeted about by a slew of highly complex and changing influences. As readers may recall, at end-January (Thaler’s Corner 31/01: Too Cloudy), we advised people to favor Risk Off positions (references 2725 Euro Stoxx and 141.85 Bund), but this morning we returned to a neutralization of asset allocation biases (references 2635 and 142.85).

Not only do European markets seem to have lagged too far behind their American and Japanese peers, but, above all, I consider the current jitters about currency wars to be completely off the wall!

That said, there are still dark clouds hovering over Europe, mainly the eurozone, which is why we have yet to join the clan of the optimists.

Let us examine the macroeconomic situation area-by-area.

United States

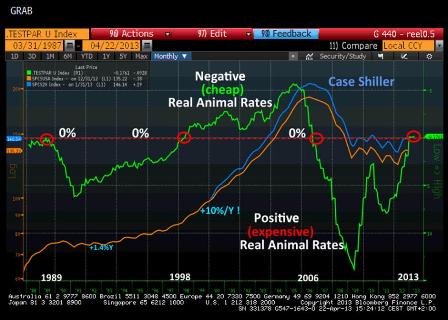

The Fed is pursuing its easy money policies, the target QE, and I do not see them ending these policies any time soon. Despite the prevailing conventional wisdom, these policies are not boosting inflation at all, quite the contrary!

By continuously removing treasuries and MBS from the private sector via its QE asset-purchasing program and by replacing them with base money reserves, the Fed is in reality absorbing the interest that the private sector would have received on these bonds, as base money does not pay a coupon! The best illustration of the absorption carried out by the government is the amount of profits earned and transferred to the Treasury, a total of €335 billion since 2009!

This QE program functions like a tax, or more specifically, a savings tax somewhat like the French ISF or wealth tax (except that it is not at all progressive). It is nonetheless “progressive” in that it has helped the federal government, among others.

The 0% interest rate policy is certainly supposed to help reignite the American economy by making its easier for investment projects to achieve profitability, but at a time when the private sector feels overloaded with debt (deleveraging), its “inflationist” aspect is limited to the value of financial assets.

As long as US government budget policy remains frankly expansionist, with cumulative deficits totaling over $5 trillion since 2009, this deflationist aspect of the QE has little importance. However, not only have US budget deficits been trending downwards since 2009 (at a record high of $1.415 trillion), falling from 10.4% to 6.7% of GDP, but the latest budget measures raise concerns that the trend will accelerate.

In the first place, the hike in the payroll tax has had a direct impact on the American consumer. This 2% decrease in take-home income, for which employees were hardly prepared, led Wal-Mart Vice President Jerry Murray to declare February sales figures to be a “total disaster”:

“In case you haven’t seen a sales report these days, February MTD (month-to-date) sales are a total disaster. The worst start to a month I have seen in my seven years with the company. Where are all the customers? And where’s their money?”

Moreover, if sequester negotiations between Congress and the White House do not lead to a deal by the beginning of March, the ensuing decline in spending would represent about 1% of GDP and thus a new tightening of budget policy.

In contrast, the real estate market continues to give encouraging signs of a rebound. I will provide you the stats fresh February 22nd publication date.

The yen’s decline (currency wars) is a positive factor, which I will examine in the conclusion.

Europe

The eurozone is the world’s weakest economic zone, with the economic outlook as desperate as ever. The zone is suffering from an unfortunate mix of pro-cyclical budgetary policies and monetary policy, which refuses to use all the means available to counter recessive austerity.

Aside from their crazy devotion to Ricardian theories, supporters of “expansionist austerity” do not seem to take into account that the rare examples of such policies being successful are with very open small economies who, boasting their own currency, devalue their money and cut interest rates while defaulting on or restructuring foreign debt!

As for the distressed eurozone countries, which mainly trade with their neighbors, they not only lack their own currency and thus the possibility of devaluation, but also, in addition, suffer from a euro that remains high compared to the currencies of its trading partners!

And that’s leaving aside monetary policy and how its non-transmission to peripheral countries is making their economies even worse.

In addition, there are the problems specific to the zone, as exemplified by the Cypriot turmoil, the Italian elections, the protest movements in Spain and Portugal and the painful establishment of a common banking solution, etc.

But a ray of hope may be on the horizon, with the restructuring plan of the Promissory Notes just established by Ireland. Without going into the highly technical details, you can believe me when I say that this is the closest thing to fiscal financing ever carried out by a central bank on the eurozone or even in a developed country!

Quite simply, the Irish state has issued very long-term bonds, at very low interest rates, directly into the capital of the restructured bank, which then refinances it with the Irish central bank. The state thus skirts appealing to markets; this is monetary financing, albeit indirectly so. In any case, it would have had a hard time raising capital on such good terms with the public.

And Mario Draghi’s apparent nod to this operation, limiting himself to stating the ECB board had unanimous taken note of the deal, augurs well! We will not be surprized to hear the screams of alarm from Mr Weidmann and the Bundesbank, but they seem to have definitely lost control.

In short, while the euro’s rise is a drag on European exporters in the short term, reflecting more far more restrictive monetary and budgetary policies than those of our trading partners, this is also a case of the tree hiding the forest, as I will explain in the case of the Land of the Rising Sun.

Japan

This is where things are really going to play out!

The latest comments by Japanese government officials suggest that the next BoJ President will not only be a lot more dovish than his predecessors but that he will also work much more closely with the government.

Such coordination is absolutely necessary in times of deflation when the country has been faced with 0 Lower Bound for so many years. Check out the excellent paper written by Paul McCulley and Zoltan Pozsar on this topic in MG.

If a country in the midst of severe deflation/recession, like Japan, whose trade balance has deteriorated so abruptly since 2011, does not have the right to use all the tools at its disposal to pull itself out of this quagmire, who does?

I would farther than the prevailing discourse, with its focus on Japanese-style quantitative easing, and say flat out that the country should electronically print money!

Screams of a Weimer situation aside, such an approach would technically change little, since it would amount to injecting the budget deficit into the economy in the form of Monetary Financing instead of JGBs (Bonds Financing), which are nearly identical to cash (floor rate and possibility of going through the repo market).

In contrast, one thing is for sure: the fears generated by such an announcement would be enough to send the yen back to 110 vis-à-vis the dollar, which is in no way catastrophic. Bear in mind that this parity averaged 118.40 between the two shocks of 1987 and 2008!

These jitters would also fuel inflationist expectations, which is precisely the goal of a country in which the latest statistics show the economy stuck in deflation.

But the main reason I say that such a monetary and budgetary turnabout by Japan would be good for the rest of the world is that one of its main goals is to reignite domestic consumption, a natural corollary of easier monetary conditions and higher inflationist expectations.

And that would also benefit its foreign trading partners!

We are not witnessing so much a race to competitive devaluation (currency wars) as a race to more accommodative monetary policies, under the impulsion of the Fed and the BoJ, not to mention the BoE and the SNB, among others.

And all this will end up influencing the ECB, which, if it does not change its policies, will end up with a euro climbing toward 140 against the yen and 1.45 against the dollar. Let’s not forget that in 2007-2008, the euro was trading at 170 against the yen and 1.60 against the dollar, mainly due to the ECB’s intransigence, with the results we all know.

As Mr Draghi has declared that he will take the euro’s level into consideration, not as a target, but as a variable in monetary policy, we can only hope that it will continue to appreciate and thus force our central banks to carry out its own Copernican revolution and enter into concertation with the world’s central banks managing modern currencies.

In conclusion, thanks to these monetary hopes stemming from the Japanese initiatives, I have decided to put between parentheses the still heavy clouds, cited above, and advise clients this morning to abandon the Risk Off bias to capture profits offered by the last market shifts and to, at minimum, put ourselves in a position of maximum reactivity.