As previously discussed, all policies seem to be ‘strong euro’ first.

And the ‘success’ of the euro continues to be gauged by its ‘strength’.

The haircuts on the Greek bonds are functionally a tax that removes that many net euro financial assets. Call it an ‘austerity’ measure extending forced austerity to investors.

Other member nations will likely hold off on turning towards that same tax until after Greece is a ‘done deal’ as early noises could work to undermine the Greek arrangements, and take the ‘investor tax’ off the table.

Like most other currencies, the euro has ‘built in’ demand leakages that fall under the general category of ‘savings desires’. These include the demand to hold actual cash, contributions to tax advantaged pension contributions, contributions to individual retirement accounts, insurance and other corporate ‘reserves’, foreign central bank accumulations euro denominated financial assets, along with all the unspent interest and earnings compounding.

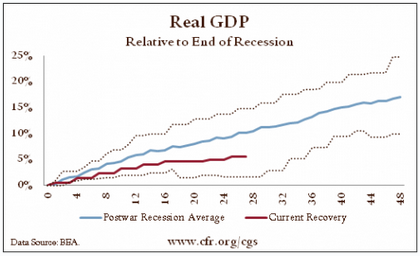

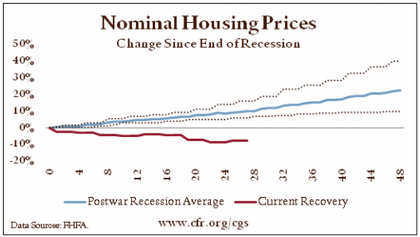

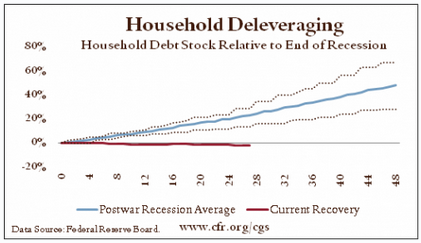

Offsetting all of that unspent income is, historically, the expansion of debt, where agents spend more than their income. This includes borrowing for business and consumer purchases, which includes borrowing to buy cars and houses. In other words, net savings of financial assets are increased by the demand leakages and decreased by credit expansion. And, in general, most of the variation is due to changes in the credit expansion component.

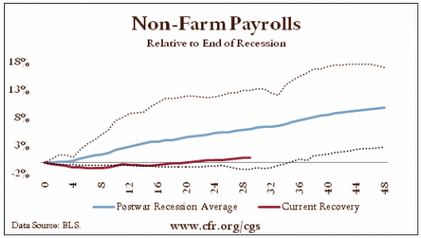

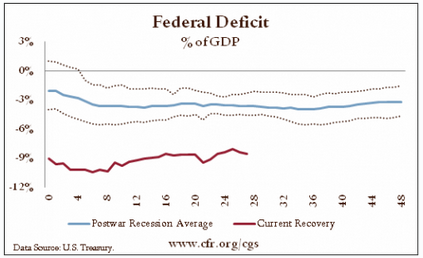

Austerity in the euro zone consists of public spending cuts and tax hikes, which have both directly slowed the economies and increased net savings desires, as the austerity measures have also reduced private sector desires to borrow to spend. This combination results in a decline in sales, which translates into fewer jobs and reduced private sector income. Which further translates into reduced tax collections and increased public sector transfer payments, as the austerity measures designed to reduce public sector debt instead serve to increase it.

Now adding to that is this latest tax on investors in Greek debt, and if the propensity to spend any of the lost funds of those holders was greater than 0, aggregate demand will see an additional decline, with public sector debt climbing that much higher as well.

All of which serves to make the euro ‘harder to get’ and further support the value of the euro, which serves to keep a lid on the net export channel. The ‘answer’ to the export dilemma would be to have the ECB, for example, buy dollars as Germany used to do with the mark, and as China and Japan have done to support their exporters. But ideologically this is off the table in the euro zone, as they believe in a strong euro, and in any case they don’t want to build dollar reserves and give the appearance that the dollar is ‘backing’ the euro.

And all of which works to move all the euro member nation deficits higher as the ‘sustainability math’ of all deteriorate as well, increasing the odds of the ‘investor tax’ expanding to the other member nations that continues the negative feedback loop.

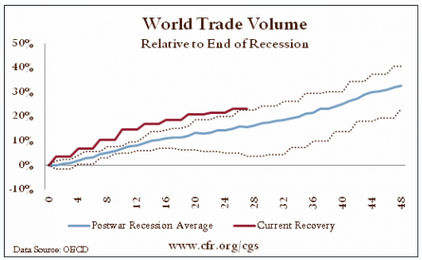

Given the demand leakages of the institutional structure, as a point of logic prosperity can only come from some combination of increased net exports, a private sector credit expansion, or a public sector credit expansion.

And right now it looks like they are still going backwards on all three.