G20 Says Expansionary Fiscal Policy Not Sustainable

The G20 has dropped its support for fiscal expansion. The deficit hawks are prevailing. But why is that? We all either know or should know that operationally Federal spending is not constrained by revenues, as Chairman Bernanke stated last year, when asked on ’60 Minutes’ by Scott Pelley where the funds given to the banks came from :

“…we simply use the computer to mark up the size of the account that they have with the Fed.”

We know that when the Fed spends on behalf of the Treasury it simply credits a member bank or foreign government’s reserve account at the Fed.

We know that a US Treasury security is a credit balance in a securities account, also at the Fed.

We know that buying a Treasury security means US dollars (numbers on the Fed’s spreadsheet) shift from a Fed reserve account to a Fed securities account, which adds to the ‘national debt.’

We know that government deficits = ‘non government’ saving (net dollar financial assets) to the penny, as a matter of national income accounting.

And we know paying off the Treasury securities happens continuously when Treasury securities mature and the Fed simply shifts those US dollars from the securities account back to a Fed reserve account (including the interest).

So why should we care if US dollars are in a Fed reserve account or a Fed securities account?

We should not, yet most still do.

There are two featured sides to the argument, pro and con, deficit hawks and deficit doves. The deficit hawks aren’t the problem. They have no argument that makes any sense as a point of simple monetary operations. There is no such thing as the Federal Government running out of money, being dependent on foreigners or anyone else for funding to be able to spend, and the US is not the next Greece.

The problem is the deficit doves featured by the media don’t understand actual monetary operations and reserve accounting, and so they take the same ‘fundamentally wrong’ positions as the deficit hawks. The difference is nothing more than timing and degree. In effect, the media is showing only one side of the argument.

To be a credible media deficit dove, you agree deficits are ‘bad’ but in the long term, arguing that in the short term we need tax cuts or spending increases now, and deficit reduction later. You agree that deficits can be too high, but argue they have been higher, particularly in World War II, so current levels should be easily manageable, further agreeing there is a level that could not be manageable. You agree markets could be ‘unfriendly’ and a lack of confidence could translate into far higher interest rates, but argue that the current low rates for Treasury securities are the markets telling us that currently they do have confidence in the US and they are eager to fund current deficits. You agree that ‘bang for the buck’ matters and support tax cuts and spending increases based on higher ‘multipliers.’

The two ‘sides of the story’ are in fact on the same side, just with differing degrees. The media does not feature the true deficit dove story. Nor do any of the true doves have even a small piece of the administration’s ear, or the ear of anyone in Congress willing to speak out. There are maybe a hundred of them, including many senior economics professors. The nagging question is why this professional, highly educated, highly experienced collection of true doves, who happen to be correct and could get us back to full employment and prosperity in reasonably short order, does not get a fair hearing.

The answer may be credentials. My BA in Economics from the University of Connecticut in 1971 doesn’t cut it, nor the fact that the very large fund I managed was the highest rated firm for the time I ran it. And my net worth never getting anywhere near a billion hasn’t helped either. Seems billionaires get celebrity status and airtime for just about anything they want to say.

The same is true of the Economics professors who’ve got it right. Without being from and at the usual ‘top tier’ schools none can even get published in main stream economics journals, where submissions featuring obvious accounting realities are routinely rejected. In fact, any economist who states accounting identities and operational realities such as ‘deficits = savings’ or ‘loans create deposits’ or ‘Federal spending is not constrained by revenues’ is immediately labeled ‘heterodox’ and unworthy of serious mainstream consideration. Even the late Wynne Godley, who did have reasonable credentials as head of Cambridge Economics, and was the number one UK economics forecaster, was labeled ‘unorthodox’ because his mathematical models featured the deficits = savings accounting identity.

The breakthrough could happen at any time, in addition to economists at the ‘right schools’ or right financial sector firms, there are government officials with sufficient credentials to lead the breakthrough, including the head of the CBO and OMB, the Treasury Secretary and Fed Chairman, as well as former Fed officials, particularly from monetary operations.

Unfortunately Treasury Secretary Geithner, a potential hero due to the celebrity of his office, and the rest of the G20 are acting out the deficit hawk position, acting as if they do indeed believe the US has run out of money, is dependent on its creditors, and could be the next Greece. They speak as if they have no idea that the euro nations operate within a unique institutional structure that puts them in a ‘revenue constrained’ financial position similar to the US States, but with nothing equivalent to the US Treasury to run the countercyclical deficits for them. They speak as if they have no idea that the US, UK, Japan, and others with ‘normal’ central governments taxes function to regulate aggregate demand, and not to raise revenue per se. They act as if they don’t realize they can immediately make the fiscal adjustments- cut taxes and/or increase government spending- that will restore aggregate demand, employment, and output. In short, they act as if they were all still on the gold standard, an institutional arrangement where indeed government spending was constrained by revenues, and, as a consequence, the world witnessed repetitive, devastating deflationary depressions, far worse than what we’ve seen so far in this cycle.

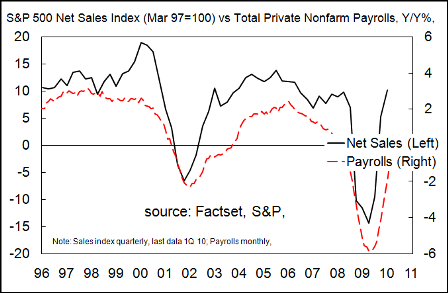

The results of unnecessarily allowing a universal lack of aggregate demand to persist are already tragic, and if policy continues along the line of this weekend’s G20 results no relief is in sight, and it could all get a whole lot worse.