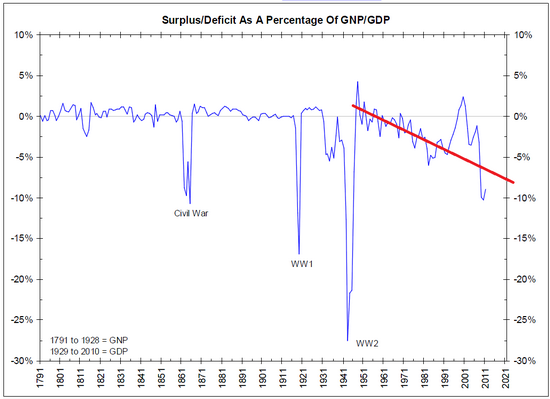

I recently sent this with regard to the question of how high the deficit might need to be for full employment, as per my earlier post showing we may be needing ever lower taxes for a given size govt (a higher deficit) for full employment:

The federal surplus years of the late 90’s were supported by the private sector willing and able to borrow to both fund consumption and fund impossible and often fraudulent .com business plans. Private sector debt was growing at about 7% of gdp into y2k, with 2% of gdp being eaten up by the federal surplus, and the other 5% and more by other demand leakages/net savings of financial assets- trade deficit, pension fund contributions and asset appreciation, etc.

This unsustainable process bled us dry and shortly after y2k it all went bad. Near 0 rates and a small ‘stimulus’ did nothing to close the output gap. Finally, in 2003, Bush came through with a then massive fiscal adjustment that got the deficit up to about 8% of gdp (annualized) for q3 03 which was enough to turn things around, and the economy improved enough to not cost him the election.

But it was pretty modest growth, like today, until it picked up to a respectable pace with the agg demand created by what was later to be recognized as the housing fraud. The borrowing to buy housing binge was the consumer debt expansion that drove gdp growth for the year or so before it was discovered.

After the frauds were discovered, maybe in mid 06 or so, the new borrowing to buy housing fell off. With that support from aggregate demand pulled, there was no longer enough demand to sustain employment and home prices, which leveled off and began to fall, undermining the asset side of the banking system. The 170 billion stimulus in the first half of 08 worked to support demand, allow people to make mtg payments, etc. and gdp returned to about +2.5% in q2 08.

However, the fall in real estate values took down Bear and Lehman, and the fed failed to adequately support the liability side of its banking system (that is, provide continuous liquidity regardless, and do the deed on the asset side- wiping out shareholders and other capital including bond holders to absorb losses, liquidate insolvent firms no one wants to buy, put people in jail, etc. etc. but NEVER allow even the implication of a liquidity crisis. This was done during the s and l crisis which prevented that from spilling over to the real economy the way this one did.) Around July/aug 2008, in fact, is when I began calling for a full payroll tax holiday as the right response to a financial crisis like the one we were in. The real economy needed the people who were working for a living armed with enough income to make their payments (if the wanted to) and do their normal shopping from income rather than credit which the banking system was failing to provide. That simple keystroke could have prevented the entire real sector collapse, and the financial sector could have been left to more or less fend for itself and hopefully come through in a greatly reduced fashion.

So my point is, the mtg fraud first accelerated the economy, and then when that support was pulled the economy collapsed when govt was not forthcoming with a fiscal adjustment to replace the lost aggregate demand.

That is, the sub prime fiasco first added support to gdp that would not have been there, and then that support was removed when the frauds were discovered.

I see the real lesson to be learned as the govt always has the means and even responsibility to make immediate fiscal adjustments to support demand. In other words, make sure there are enough consumer spending dollars for business to compete for.

And, at the same time, to not support moral hazard by letting companies (particularly financial institutions) fail and investors take all the losses first during organized insolvency proceedings.

If govt. had done this in mid 08- provide the continuous liquidity to the banking system and suspend all FICA contributions- it all would have been much different. The fall in housing prices and new construction would not have been nearly as severe, delinquencies and foreclosures would have been much lower, far fewer banks would have failed, car sales would not have fallen nearly as far and the car companies would not have needed bailouts, and so on down the line. Note that even the crash of 1987 did not take out the real economy, even though it followed the then staggering losses from the s and l crisis, as bank liquidity was never allowed to be in question.