Comments and ramblings:

“Strong multiplier effects from construction jobs to broader economy.”

Good report!!!

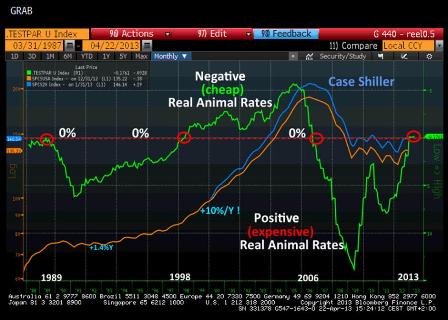

I used to call this the ‘get a job, buy a car, get a job buy a house’ accelerator. And yes, it has happened in past business cycles and been a strong driver. But going back to the last Bush up leg, turns out it was supported to a reasonably large degree by the ‘subprime fraud’ dynamic of ‘make 30k/year, buy a 300k house’ with fraudulent appraisals and fraudulent income statements. And the Clinton up leg was supported by the funding of impossible .com business plans and y2k fear driven investment, and the Reagan years by the S&L up leg that resulted in 1T in bad loans, back when that was a lot of money. Japan, on the other hand, has carefully avoided, lets say, a credit boom based on something they would have regretted in hindsight, as was the case in the US.

The point is it takes a lot of deficit spending to overcome the demand leakages, and with the govt down to less than 6% of GDP this year, yes, ‘legit’ housing can add quite a bit, but can it add more than it did in Japan, for example? And, to the point of this report, will it be enough to move the Fed?

Also, looks to me like, at the macro level, credit is driven by/limited by income (real or imagined), and the proactive deficit reduction measures like the FICA hikes and the sequesters have directly removed income, as had QE and the rate cuts in general. So yes, debt is down as a % of income, but the level of income is being suppressed (call it income repression policy?) through pro active fiscal and the low number of people working and getting paid for it.

Domestic energy production adds another interesting dimension. It means dollar income is being earned by firms operating domestically that would have been earned by overseas agents. The question here is whether that adds to incomes that gets spent domestically. That is, did the dollars go to foreigners who spent it all on fighter jets, or did they just let them sit in financial assets vs the domestic oil company? Does it spend more of its dollar earnings domestically than the foreign agent did, or just build cash, etc? And either way its dollar friendly, which also means more non oil imports, particularly with portfolio managers ‘subsidizing’ exports from Japan with their currency shifting. That should be a ‘good thing’ for us, as it means taxes can be that much lower for a given size govt, but of course the politicians don’t have enough sense to do that. It all comes back to the question of whether the deficit is too small.

As for banking and lending, anecdotally , my direct experience with regulators is that they are ‘bad’ and vindictive people, much like many IRS agents I’ve come across, and right now they are engaging in what the Fed calls ‘regulatory over reach’, particularly at the small bank level, but also at the large bank level. This makes a bank supported credit boom highly problematic. And without bank support, the non bank sector is limited as well.

Lastly, there’s a difference between deficits coming down via automatic stabilizers and via proactive deficit reduction. The automatic stabilizers bring the deficit down when non govt credit growth is ‘already’ strong enough to bring it down, while proactive deficit reduction, aka ‘austerity’ does it ‘ahead of’ non govt credit growth, which means austerity can/does keep non govt credit growth from materializing (via income/savings reduction).

Conclusion- the Fed is correct in being concerned about our domestic dynamics. And they are right about being concerned about the rest of the global economy. Europe is still going backwards, as is China where they are cutting back on the growth of debt by local govts and state banks, all of which ‘counts’ as part of the deficit spending that drove prior levels of growth. And softer resource prices hit the resource exporters who growth is leveraged to the higher prices. I wrote a while back about what happens when the longer term commodity cycle peaks, supply tends to catch up and prices tend to fall back to marginal costs of production, etc.

And the Fed has to suspect, at least, the QE isn’t going to do anything for output and employment in Japan, any more than it’s actually done for the US.