Looks to me like the lack of noises out of Japan means there won’t be a sufficient fiscal response to restore demand.

If anything, the talk is about how to pay for the rebuilding, with a consumption tax at the top of the list.

That means they aren’t going to inflate.

More likely they are going to further deflate.

Yes, the yen will go down by what looks like a lot, maybe even helped by the MOF, but I doubt it will be enough to inflate.

In fact, all the evidence indicates that Japan doesn’t don’t know how to inflate, nor does anyone else.

Worse, what they all think inflates, more likely actually deflates.

0 rate policies mean deficits can be that much higher without causing ‘inflation’ due to income channels and supply side effects.

There is no such thing as a debt trap springing to life.

Debt monetization is a meaningless expression with non convertible currency and floating fx.

QE mainly serves to further remove precious income from an already income starved economy.

Only excess deficit spending can directly support prices, output, and employment from the demand side, as it directly adds to incomes, spending, and net savings of financial assets.

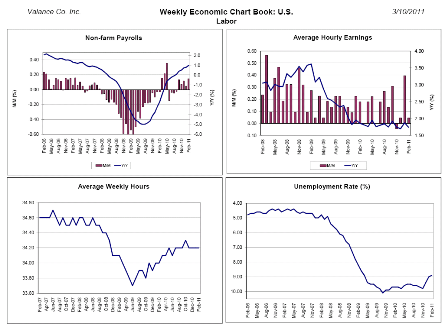

The international fear mongering surrounding deficits and debt issues is entirely a chicken little story that’s keeping us in this depression (unemployment over 10% the way it was measured when the term was defined) that’s now taking a turn for the worse.

The euro zone is methodically weakening it’s ‘engines of growth’- its own (weaker) members being subjected to austerity measures that are reducing their deficit spending that paid for their imports from Germany. And now China, Japan, the US and others will be cutting imports as well.

UK fiscal austerity measures are accelerating on schedule.

The US is also working to tighten fiscal policy, particularly now that both sides agree that deficit reduction is in order, beaming as they make progress towards agreeing on the cuts.

The US had 6 depressions while on the gold standard, which followed the only 6 periods of budget surpluses.

And now, even with a floating fx policy and non convertible currency that allows for immediate and unlimited fiscal adjustments,

we have allowed the deflationary forces unleashed by the Clinton budget surpluses to result in this 7th depression.

We were muddling through with modest real growth and a far too high output gap and may have continued to do so all else equal.

But all else isn’t equal.

Collective, self inflicted proactive austerity has been working against growth, including China’s ‘fight against inflation.’

And now Japan’s massive disaster will be deflationary shock that, in the absence of a proactive fiscal adjustment, is highly likely to further reduce world demand.

Hopefully, the Saudis capitulate and follow the price of crude lower, easing the burden somewhat on the world’s struggling populations.

If so, watch for a strong dollar as well.

And watch for a lot more global civil unrest as no answers emerge to the mass unemployment that will likely get even worse. Not to mention food prices that may come down some, but will remain very high at the consumer level as we continue to burn up our food supply for motor fuel.

And it’s all only likely to get worse until the world figures out how its monetary system actually works.