Clinton Vs. Trump: IBD/TIPP Presidential Election Tracking Poll (IBD/TIPP) The IBD/TIPP poll — a collaboration between Investor’s Business Daily (IBD) and TechnoMetrica Market Intelligence (TIPP) — has been the most accurate poll in recent presidential elections (About IBD/TIPP Poll). The latest results for the IBD/TIPP Presidential Election Tracking Poll will be released each morning by 6 a.m. ET.

Trump Leads Clinton By 1 Point Going Into Debate (IBD/TIPP) Donald Trump has managed to pull ahead of Hillary Clinton by a 1.3 percentage point margin — 41.3% to 40% — in a four-way matchup. Libertarian Gary Johnson got 7.6% and Green Party Jill Stein got 5.5%. In a two-way matchup, Clinton is up by 3 points — 43.6% to 40.6%. 67% of Trump backers saying they strongly support him, compared with 58% of Clinton supporters who say they strongly back their candidate. Clinton does much better among women — 47% to 37% — but Trump’s lead among men is just as strong at 47% to 32%.

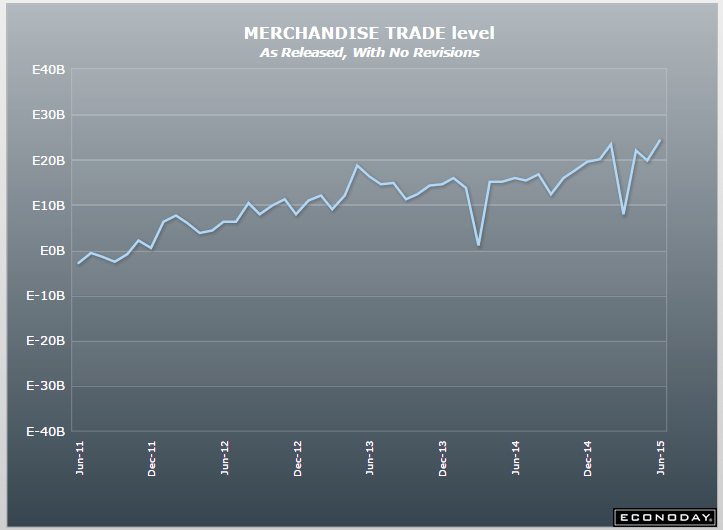

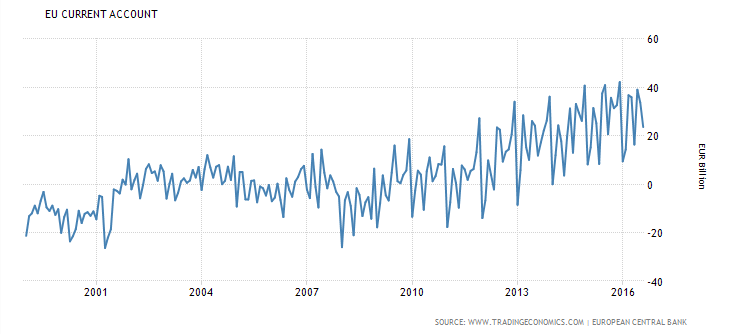

Euro Area Current Account

Eurozone’s current account surplus increased to €23.6 billion in August 2016 from a €20.7 billion a year earlier. If adjusted for seasonal factors, the current account surplus rose to €29.7 billion compared to €27.7 billion in August 2015, as the goods surplus widened to €30.9 billion (from €26.2 billion a year earlier) and the primary income surplus rose to €6.6 billion (from 3.4 billion). Meanwhile, the services surplus narrowed to €4.8 billion (from €5.3 billion) and the secondary income deficit increased to €12.6 billion (from €10.6 billion).

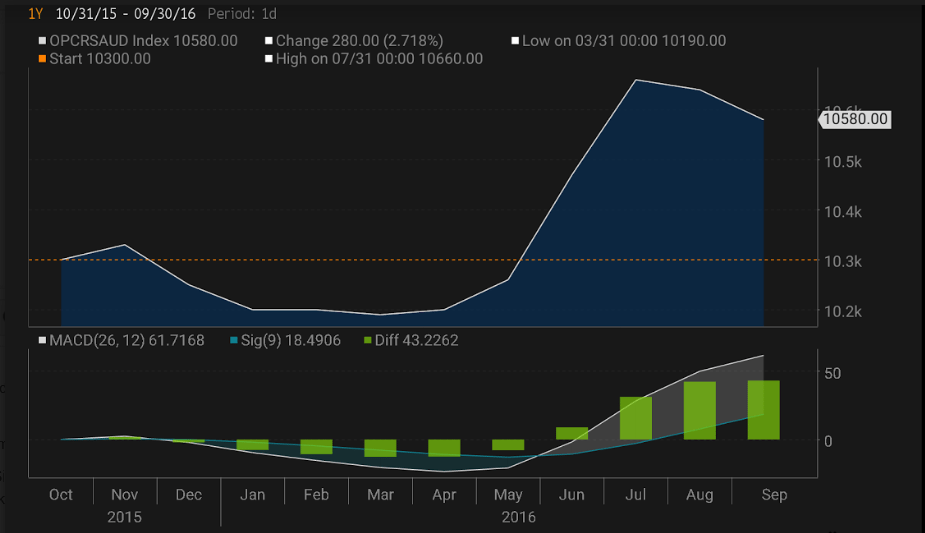

Saudi output went down some, indicating a lack of residual net global demand, as they set prices (via discounts or premiums to benchmarks) and let the market buy all it wants at those prices:

As if our government has any ideas on what we can do anything about this:

U.S. says Russia broke nuclear missile treaty – The U.S. has summoned Russia to a mandatory meeting before a special treaty commission to answer accusations that Moscow has violated a Cold War-era pact that bans the production, maintenance or testing of medium-range missiles, according to U.S. and Western officials. {http://on.mktw.net/2emOBY8}