Published letter to the editor in FT.

Expect public-sector deficits and oil prices to go on rising

by Prof Philip Arestis, Dr John McCombie and Mr Warren Mosler.

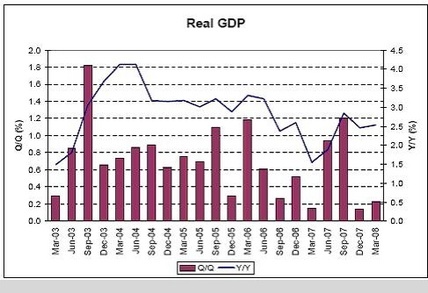

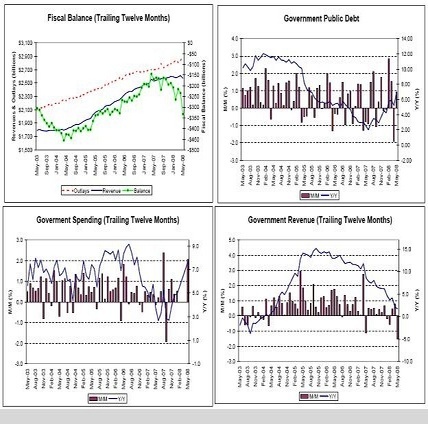

Sir, Public-sector deficits and crude oil prices will probably both continue rising. Chris Giles’ reports, “Treasury to reform Brown’s fiscal rules” and “Treasury sees storm clouds gathering” (July 18), recognise the inevitability of growing deficits due to economic weakness while also implying public-sector deficits are per se a “bad thing”.

What the articles fail to appreciate are three dimensions to the argument: the first is that public-sector deficits do not present a solvency issue, only an “inflation” issue. Second, public-sector deficits equal total non-government (domestic and foreign) savings of sterling financial assets and are the only source of non-government accumulation of sterling net financial assets. Third, public-sector deficits provide the net financial equity to the non-government sector that supports the private-sector credit structure.

It is the case that the public-sector deficit will increase in one of two ways. The “nice” way would be pro-actively with sufficient tax cuts or spending increases (depending on one’s politics) that support demand at desired levels. The “ugly” way is from a slowing of demand that reduces tax revenues and increases transfer payments. If, instead, the government tries to suppress the current deficit with any combination of tax increases or spending cuts, the resulting accelerated slowdown of the economy will then increase the deficit the “ugly” way.

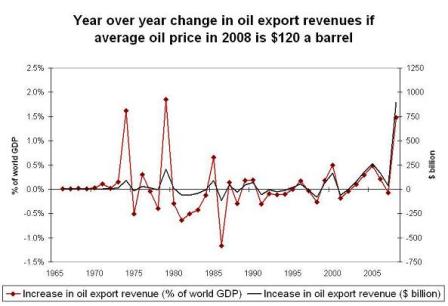

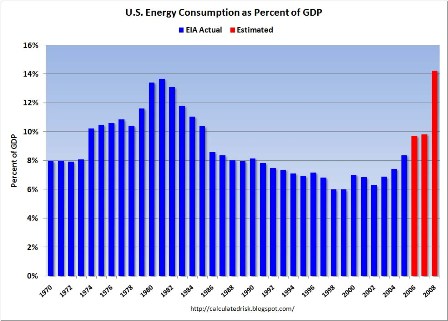

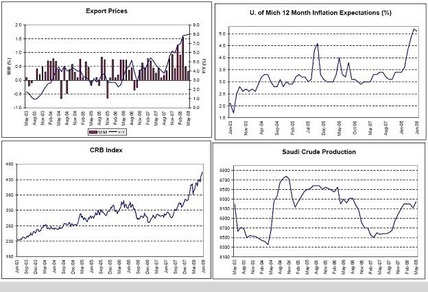

In any case, the current “inflation” is the result of Saudi Arabia acting as swing producer as it sets the oil price at ever-higher levels and then supplies all the crude demanded at that price. Our institutional structure then passes these prices through the entire economy over time, and there is nothing interest rates or fiscal policy can do to change these dynamics.

The ability to set crude prices can only be broken by a sufficiently large supply response, such as in the early 1980s when net supplies increased by more than 15m barrels per day, helped considerably by the US deregulating natural gas production, which allowed substitution away from crude oil products.

In sum, the deficit will go up either the nice way or the ugly way, as it always does when markets work to grant the private sector the desired net financial assets, which can come only from government deficit spending. “Inflation” will continue higher as long as the Saudis remain price-setter and continue to post ever-higher prices to their refiners.

Philip Arestis,

University Director of Research,

Cambridge Centre for Economic and Public Policy

John McCombie,

Director,

Cambridge Centre for Economic and Public Policy

Warren Mosler,

Senior Associate Fellow,

Cambridge Centre for Economic and Public Policy,

University of Cambridge, UK

[top]