Due to popular demand, I’ve begun outlining a Greek exit strategy to exit the euro currency,

and instead use its own new currency to provision itself:

1. The Greek government would announce that it will begin taxing exclusively in the new currency.

2. The Greek government would announce that it will make all payments in the new currency.

That’s it, deed done!

The govt can now provision itself and continue to function on a sustainable basis.

Now some Q and A:

Q. How will the new currency exchange for euro?

A. The new currency will be freely floating, with exchange between willing buyers and sellers at market prices.

Q. What about the existing euro debt?

A. Announce that it will consider it on a ‘when and if’ basis with no specific payment plans.

Q. What about existing govt contracts for goods and services?

A. They will be redenominated in the new currency.

Q. What about euro bank deposits and euro bank loans?

A. They remain in place.

Q. What about foreign trade?

A. Markets forces will function to adjust the trade balance to reflect foreign desires to accumulate financial assets denominated in the new currency.

To maintain full employment and internal price stability, I would further recommend the following:

1. The govt would fund a minimum wage job for anyone willing and able to work.

2. For any given size government, taxes should be adjusted to ensure the labor force that works for that minimum wage be kept to a minimum.

3. I would recommend the govt levy only a tax on real estate for the following reasons:

a. Compliance is maximized and compliance costs and related issues are minimized- if the

tax isn’t paid the property can be simply sold at auction.

b. Everyone contributes as either an owner of the property or as a renter as the owner’s costs

are ultimately passed through to renters.

c. Transactions taxes are eliminated, thereby removing those restrictions on transactions.

Freedom to transact is the source of that substantial contribution to real wealth.

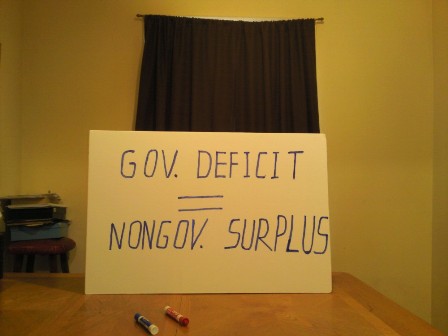

4. A zero rate policy where govt deficit spending remains as non interest bearing balances held by counter parties at the Bank of Greece, and no govt securities are permitted.

5. All bank deposits in the new currency will be fully insured by the govt.

6. Banks will be govt regulated and supervised, which will include a 15% capital requirement, govt guaranteed liquidity, and a prohibition from any secondary market activity.

Comments welcome with additional questions, thanks!