As previously discussed, the euro looks to keep going up until the trade surplus reverses. Problem is the strong euro doesn’t necessarily cause the trade surplus to reverse, at least not in the short term. But it does tend to work against earnings and growth. And there’s nothing the ECB can do about it, short of buying dollars via direct intervention, which would be counter to their core ideology, as building dollar reserves would give the appearance of the dollar backing the euro. The solvency issue has now been behind them for quite a while, and still no sign of any ‘official’ recognition that deficits need to be higher to restore output and employment.

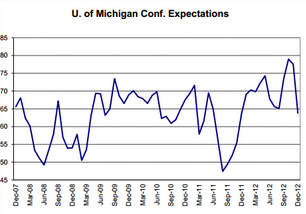

And, also as previously discussed, while the future was looking up for the US a few months ago, the caveat of ‘austerity’ has come into play with the year end FICA and other tax hikes, and now the odds are the sequesters are allowed to come into play March 1 as well. Note this has been Japan’s policy as well- fiscal tightening at the first sign of any hope for expansion. Fed policy also looks to remain restrictive as blatantly evidenced by the recent turn over of some $90 billion of ‘profits’ to the Treasury that otherwise would have been earned by the economy.

The headline ‘deficit doves’ pushing for larger deficits with their ‘out of paradigm’ arguments are also serving to continue to support austerity. They have been arguing that the low interest rates are a signal from the markets (as if they know anything about markets) indicating the economy wants the govt to sell more bonds. This is in response to the hawk’s equally out of paradigm argument that financing deficits will eventually drive up interest rates. So now that interest rates have started going higher, the dove’s case is for higher deficits is pretty much gone, removing the resistance to ‘getting our fiscal house in order’ just as the sequester date is approaching. Whether it’s gross ignorance or intellectual dishonesty doesn’t matter all that much at this point- it’s happening. At the same time oil and gasoline prices have been creeping up, taking a few more shekels away from consumers. January and it’s strong equity inflows/allocations and releases of December’s stats ends tomorrow. February’s releases of Jan stats will bring more post FICA hike clarity.

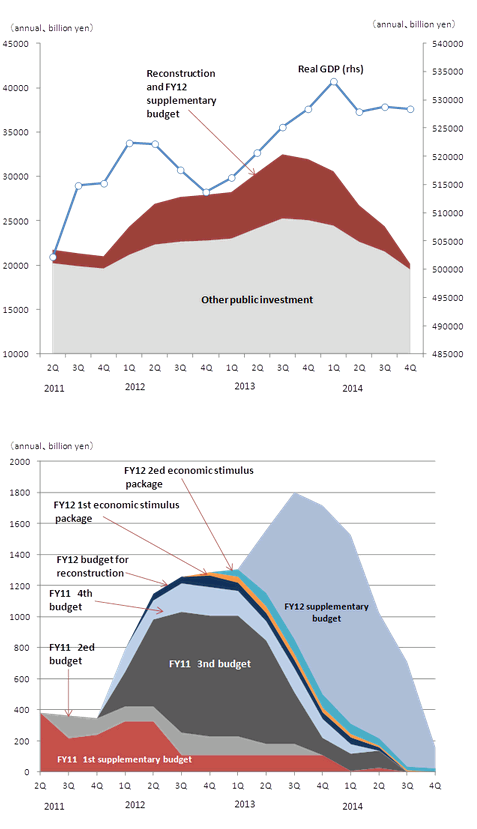

Japan’s weak yen, pro inflation policy seems to have been all talk with only a modest fiscal expansion to do the heavy lifting. Changing targets does nothing, nor does the BOJ have any tools that do the trick as evidenced now by two decades of using all those tools to the max. And while I’ve been saying all the while that 0 rates, QE, and all that are deflationary biases that make the yen stronger, there is no sign of that understanding even being considered by policy makers, so expect more of same. What has been happening to weaken the yen is a quasi govt policy of the large pension funds and insurance companies buying euro and dollar denominated bonds, which shifts their portfolio compositions from yen to euros and dollars, thereby acting to weaken the yen. I have no idea now long this will continue, but if history is any guide, it could go on for a considerable period of time. Yes, it adds substantial fx risk to those institutions, but that kind of thing has never gotten in the way before. And should it all blow up some day, look for the govt to simply write the check and move on.