This is my overall view of the economy.

The US was on the move by Q4 last year. A housing and cars (and student loans) driven expansion was happening, with slowing transfer payments and rising tax revenues bringing the deficit down as the automatic stabilizers were doing their countercyclical thing that would eventually reverse the growth. But that could take years. Look at it this way. Someone making 50,000 per year borrowed 150,000 to buy a house. The loan created the deposit that paid for the house. The seller of the house got that much new income, with a bit going to pay taxes and the rest there to be spent. Maybe a bit of furniture etc. was bought on credit as well, again adding income and (gross) financial assets to the recipients of the borrowers spending. And increasing sales added employment as well as output, albeit not enough to keep up with population growth etc.

I was very hopeful. Back in November, after the ‘Obama is a socialist’ sell off, I wrote that it was time to buy stocks and go play golf for three years, as, left alone, the credit accelerator in progress could go on for a long time.

But it wasn’t left along. Only a few weeks later the cliff drama began to intensify, with lots of fear of going over the ‘full cliff’. While that didn’t happen, we did go over about 1/3 cliff when both sides let the FICA reduction expire, thus removing some $170 billion from 2013, along with strong prospects of an $85 billion (annualized) sequester at quarter end. This moved me ‘to the sidelines’. Seemed to me taking that many dollars out of the economy was a serious enough negative for me to get out of the way.

But the Jan and then Feb numbers showed I was wrong, and that the consumer had continued to grow his spending as before via housing and cars, etc. Even the cliff constrained -.1 GDP of Q4 was soon revised up to .4. Stocks kept moving up and bonds moved higher in yield, even as the sequester kicked in, with the market view being the FICA hike fears were bogus and same for the sequester fears. Balancing the budget and getting the govt out of the way does indeed work to support the private sector. The UK, Eurozone, and Japan were exceptions. Austerity inherently does work. And markets were discounting all that, as it’s what market participants believed and the data supported.

Then, it all changed. April releases of March numbers showed not only suddenly weak March numbers, but Jan and Feb numbers revised lower as well. The slope of things post FICA hike went from positive to negative all at once. The FICA hike did seem to have an effect after all. And with the sequesters kicking in April 1, the prospects for Q2 were/are looking worse by the day.

My fear is that the FICA hikes and sequesters didn’t just take 1.5% of GDP ‘off the top’ as forecasters suggest, leaving future gains from the domestic credit expansion there to add to GDP as they had been. That is, the mainstream forecasts are saying when someone’s paycheck goes down by $100 per month from the FICA hike, or loses his job from the sequester, he slows his spending, but he still borrows to buy a car and/or a house as if nothing bad had happened, and so GDP is reduced by approximately the amount of the tax hikes and spending cuts, with a bit of adjustment for the ‘savings multipliers’. I say he may not borrow to buy the house or the car. Which both removes general spending and also slows the credit accelerator, shifting the always pro cyclical private sector from forward to reverse. And the ‘new’ negative data slopes have me concerned it’s already happening. Before the sequesters kicked in.

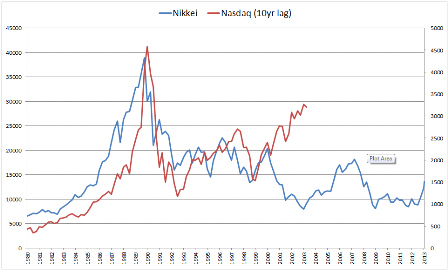

Looking at Japan, theory and evidence tells me the lesson is that lower interest rates require higher govt deficits for the same level of output and employment. More specifically, it looks to me like 0 rates may require 7-8% or even higher deficits for desired levels of output and employment vs maybe 3-4% deficits when the central bank sets rates at maybe 5% or so, etc. And US history could now be telling much the same.

And another lesson from Japan we should have learned long ago is that QE is a tax that does nothing good for output or employment and is, if anything, ‘deflationary’ via the same interest income channels we have here. Note that the $90 billion of profits the Fed turned over to the tsy would have been earned in the economy if the Fed hadn’t purchased any securities. So, as always in the past, watch for Japan’s QE to again ‘fail’ to add to output, employment, or inflation. However, their increased deficit spending, if and when it materialize, will support output, employment, and prices as it’s done in the past.

Oil and gasoline prices are down some, which is dollar friendly and consumer friendly, but only back to sort of ‘neutral’ levels from elevated ‘problematic’ levels And there is risk that the Saudis decide to cut price for long enough to put the kibosh on the likes of North Dakota’s and other higher priced crude, wiping out the value of that investment and ending the output and employment and currency support from those sources. No way to tell what they may be up to.

So my overall view is negative, with serious deflationary risks looming.

And the solution is still fiscal- a tax cut and/or spending increase.

However, that seems further away then ever, as the President is now moving towards an additional 1.8 trillion of deficit reduction.

:(