Credit and Credibility

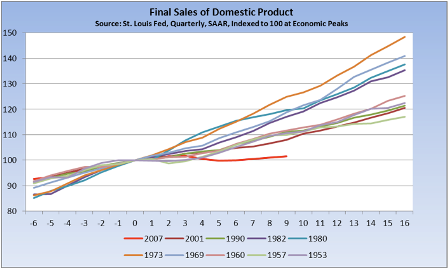

Final sales

Haven’t yet hit the ‘get a job buy a car’ accelerator.

Watch for car sales to be the indicator of more rapid growth.

Meantime, muddling through with modest growth remains an ok equity environment as fear of becoming the next Greece is turning us into the next Japan.

And, of course, we continue to underestimate the deflationary effect of the Fed’s zero rate policy which should be a good thing in that it allows us to have lower taxes for a given size govt.

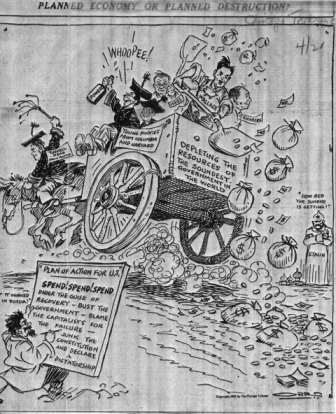

1934 Cartoon

We went off the gold standard in 1934 and solvency was never again an issue for the Federal government.

Those ‘sound money’ people were wrong then and are wrong now as taxes function to regulate aggregate demand and not to raise revenue per se.

This cartoon is claimed to be from the Chicago Tribune in 1934. Look carefully at the plan of action in the lower left corner.

euro zone issues

Asian players are a worry for eurozoneBy Gillian Tett

July 14 (FT)

The saga behind next week’s stress test release is a case in point. During most of the past year, governments of countries such as Germany, Spain and France have resisted the idea of conducting US-style stress tests on their banks, in spite of repeated, entreaties from entities ranging from the International Monetary Fund to the Bank for International Settlements, and the US government.

However, after a meeting of G20 leaders in Busan last month, those same eurozone governments performed a U-turn, by finally agreeing to publish the results of such tests.

Some observers have blamed the volte-face on lobbying inside the senior echelons of the European Central Bank. Others point the finger to American pressure. In particular, Tim Geithner, the US Treasury secretary, had some strongly worded discussions with some of his eurozone counterparts in Busan, where he urged – if not lectured – them to adopt these tests.

However, Europeans who participated in the Busan meeting say it was actually comments from Asian officials that created a tipping point. In the days before and after that G20 gathering, eurozone officials met powerful Asian investment groups and government officials who expressed alarm about Europe’s financial woes. And while those officials did not plan to sell their existing stock of bonds, they specifically said they would reduce or halt future purchases of eurozone bonds unless something was done to allay the fears about Europe’s banks.

That, in turn, sparked a sudden change of heart among officials in places such as Germany and Spain. After all, as one European official notes, the last thing that any debt-laden European government wants now is a situation where it is tough to sell bonds. “It was the Asians that changed the mood, not anything Geithner said,” says one eurozone official.

This raises some fascinating short-term issues about how the bond markets might respond to the stress tests. It is impossible to track bond purchase patterns with any precision in a timely manner in Europe, since there is no central source of consolidated data.

However, bankers say there are signs that Asian investors are returning to buy eurozone bonds. This week, for example, China’s State Administration of Foreign Exchange bid for €1bn (£1.27bn, £835m) of Spanish bonds, helping to produce a very successful auction.

Yes, it’s a two edged sword.

Asian nations want to accumulate euro net financial assets to facilitate exports to the euro zone.

Before the crisis euro nations were concerned that the strong euro, partially due to Asian buying, was hurting euro zone exports

However, as the crisis developed, euro nations got to the point where they were concerned enough about national govt solvency and the precipitous fall of the euro (which was in some ways welcomed by exporters but worrying with regards to a potential inflationary collapse) to agree to measures to support their national govt debt sales which also meant a stronger euro.

So now the pendulum is swinging the other way. Solvency issues have been sufficiently resolved by the ECB to avert default, but at the ‘cost’ of a resumption Asian buying designed to strengthen the euro to support Asian exports to the euro zone.

As before the crisis, however, the euro zone has no tools to keep a lid on the euro (apart from re introducing the solvency issue to scare away buyers, which makes no sense), as buying dollars and other fx is counter to their ideology of having the euro be the world’s reserve currency.

So the same forces remain in place that drove the euro to the 150-160 range, which kept net exports from climbing.

The export driven model is problematic enough without adding in the additionally problematic idiosyncratic financial structure of the euro zone.

As for the stress tests, as long as the ECB is funding bank liabilities and buying national govt debt banks and the national govts can continue to fund themselves with or without Asian buying.

I’d have to say at this point in time the euro zone hasn’t gotten that far in their understanding of their monetary system or they probably would not be making concessions to outside forces.

Good quote

“All the perplexities, confusion and distress in America arise not from defects in the Constitution

or Confederation, nor from want of honor or virtue, so much as downright ignorance of the

nature of coin, credit, and circulation.” – John Adams in a letter to Thomas Jefferson

Fed Minutes

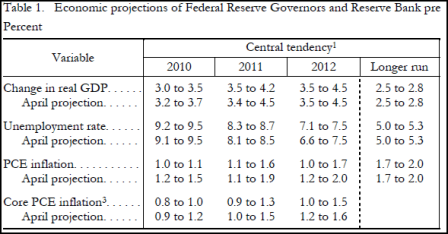

The staff still expected that the pace of economic activity through 2011 would be sufficient to reduce the existing margins of economic slack, although the anticipated decline in the unemployment rate was somewhat slower than in the previous projection.

Karim writes:

Staff still forecasting above trend growth, though not as firm as before. Activity indicators coming in as expected, with financial strains in May and June the cause for the revision.

Table below is average of FOMC members, not staff, but appears to have similar profile. Average expectations for 2011 growth at 3.85% from 3.95% prior..

A few participants cited some risk of deflation. Other participants, however, thought that inflation was unlikely to fall appreciably further given the stability of inflation expectations in recent years and very accommodative monetary policy. Over the medium term, participants saw both upside and downside risks to inflation.

Deflation talk still seems contained to a ‘few’ members.

Members noted that in addition to continuing to develop and test instruments to exit from the period of unusually accommodative monetary policy, the Committee would need to consider whether further policy stimulus might become appropriate if the outlook were to worsen appreciably.

This was only mention of QE2 – not very extensive.

Small banks being crushed by Fed’s game of musical chairs

Small banks, already penalized with a higher cost of funds than the large banks (link) have more recently been forced to contract due to ‘wholesale funding’ restrictions being imposed by the regulators.

Bank regulators distinguish between what they call ‘retail’ and ‘wholesale’ funding, and have set limits of small banks for ‘wholesale’ funding. This policy is meant to reduce the liquidity risk of a bank not being able to roll over its funding should depositors decide to take their dollars to another bank. The theory is that ‘retail’ deposits are ‘sticky’ and less likely to move to another bank, while ‘wholesale’ deposits are more likely to move. And the ‘better’ the ‘account relationship’ the more likely the funds are to stay with the bank. Oddly, when I inquired if the maturity of the deposit is a consideration the regulators responded ‘no.’ So that means a 10 year CD obtained through a broker is considered a wholesale deposit, which must be limited, while money market deposits from local depositors that can leave the next day are the core retail deposits required by the regulators for ‘stability.’

But apart from this obvious regulatory failure to recognize what’s more stable and what’s less stable for individual banks, there is also a highly problematic macro issue. In the banking system as a whole, loans create deposits, meaning that for each loan made by a bank (bank assets) there exists a bank deposit of the same amount originally created at the time of the loan as that bank’s liability. In short, for the banking system as a whole, loans equal deposits.

The problem is that money center banks attract more of these total deposits than the small banks in the normal course of business. That leaves the small banks short of deposits by an equal amount. This is easily resolved by the small banks needing funding borrowing the excess funds held by the large banks. And if the large banks decide to keep their excess funds at the Federal Reserve Bank the small banks can simply borrow from the Fed to cover their shortage. In any case the total funding of the banking system remains equal to the total loans outstanding, with the Fed acting as a ‘broker’ to facilitate system wide liquidity. However, when regulators restrict this ‘wholesale funding’ between banks, and also deem borrowings from the Fed ‘wholesale funding,’ they put powerful forces in place that force the small banks to either pay higher rates to attract deposits from the large banks, which is often impossible as large corporate customers can’t deal with small banks, or force the small banks to cut back on lending to reduce their dependence on wholesale funding.

The net result is a misguided regulatory policy that is both increasing the cost of funds to small banks and forcing small banks to cut back on lending.

The remedy is quite simple, have the Fed offer funding (fed funds) to all member banks at it’s target interest rate, which is the rate the Fed desires to in fact be the cost of funds for its banking system as a matter of public policy. In any case, bank borrowing and lending is rightly constrained by capital and other regulatory requirements, and not available funding, which is always attainable at a price. Using the liability side of banking for market discipline, as is currently the practice for small banks, is always evidence of a lack of understanding of banking fundamentals and counter to further public purpose.

Please distribute this to your favorite regulator, Congressman, and Fed official, thanks!

CNBC article quoted me today

I got a nice mention in a CNBC article today:

Why Portugal Downgrade Didn’t Slam StocksBy Antonia Oprita

July 13 (CNBC) — Investors do not see Portugal’s rating downgrade by Moody’s as an event that will shake the markets, but it confirms the fact that the outlook for some economies in the euro zone is still cloudy, economists and market analysts told CNBC Tuesday.

Moody’s slashed Portugal’s credit rating by two notches to A1, citing a deterioration of the country’s debt ratios and weak growth prospects.

Portugal’s debt-to-GDP and debt-to-revenue ratios have risen rapidly in the past two years, Anthony Thomas, vice president and senior analyst in Moody’s Sovereign Risk Group, said in a statement.

The euro fell after the announcement and the spread between Portuguese and German 10-year government bonds widened by 4 basis points to 290 points.

“The bond markets response hasn’t been dramatic,” Martin van Vliet, euro-zone economist at ING Bank, told CNBC.com.

The downgrade came a little before a Greek auction to sell 6-month T-bills, the first since a bailout package agreed by the European Union and the International Monetary Fund in May.

Greece sold 1.625 billion euros ($2.03 billion) of 6-month instruments at a yield of 4.65 percent, up from 4.55 percent in a similar auction on April 13, according to Reuters.

“The markets will probably reason that the risk of default in six months is small,” van Vliet said.

Growth Is Key

Economic growth in Europe’s peripheral countries will be crucial to bring back investor confidence but more and more analysts fear a slowdown in the second quarter everywhere in the world.

“The outlook for Portugal is not particularly optimistic,” David Tinsley, economist at National Bank of Australia, said. “It is in a very slow growth trajectory and therefore all its fiscal retrenchment has got to come from public spending cuts.”

Over the longer term, investors are still afraid of the risk of default and European Central Bank President Jean-Claude Trichet hinted that the need to intervene by buying bonds is not that strong any longer, according to van Vliet.

“My guess is that they will have to continue buying bonds,” he said. “It all depends on whether the economy will start growing in Greece.”

The risk of default by one of the southern European countries was the main fear in the markets earlier this year, when ratings downgrades sparked massive selloffs in stocks as well as bonds and investors were taking refuge in US Treasurys, gold and cash.

“The process of credit downgrades reinforcing confidence erosion, I think that’s a bit over,” van Vliet said.

Default Risk Is Gone

Investors will slowly realize that the risk of default by European nations on their debt is gone, and they will push up stock prices and the euro, according to economist Warren Mosler, founder and principal of broker/dealer AVM.

In June, Mosler told CNBC.com the euro was likely to rise to between $1.50 and $1.60 because of the austerity measures in Europe.

He reaffirmed his stance, saying that there had been a “mad rush for the exits” by Europeans, who bought dollars and gold, pushing the euro down, when the default risk was high.

But the ECB’s decision to buy Greek bonds showed the bank was ready to spend money to defend countries in the euro zone and “there is no limit to what the ECB can spend,” Mosler told CNBC.com.

The ECB has put itself in a top position by doing this, as it can impose terms and conditions on any country that sells it its bonds, he explained.

“What that did is it shifted power from fiscal policy to the ECB,” Mosler said. “I would say they will not buy these bonds unless they can impose their terms and conditions.”

“It allows them to cut out one member selectively, without the whole system collapsing,” he said.

UK Economy Grew Unrevised 0.3% in First Quarter

Still looks to me like the UK budget deficit has been more than sufficient to support at least modest GDP growth.

UK Headlines:

U.K. Economy Grew Unrevised 0.3% in First Quarter

U.K. Consumers Predict Economy Will Worsen, GfK Survey Shows

U.K. Mortgage Approvals Rose 2% in May From April, CML Says

U.K. Profit Warnings to Climb as Deficit Cuts Kick In, E&Y Says

Osborne Says U.K. Budget Cuts Needed to Avoid ‘Downward Spiral’

U.K.’s Budd to Propose More Independent OBR, Telegraph Says

Blanchflower Says Economy May See Long Decade of Slow Growth

DPJ Suffers Crushing Defeat; LDP Wins Most Seats

The loss seems to have been over the proposed sales tax increase, which would have been a strong negative for GDP, so this result is equity friendly:

“Public support for the DPJ rebounded when Kan took, but tumbled quickly after he floated a rise in the sales tax from 5 percent to help rein in debt.”

“Critics blame Kan’s eagerness to hike the rate for causing the DPJ’s major defeat in Sunday’s Upper House election.”

Japan Headlines:

DPJ Suffers Crushing Defeat; LDP Wins Most Seats

Corp Goods Prices Up 0.5% On Year In June

Japan’s used vehicle sales in Jan.-June fall to 2nd-lowest level

IMF Shinohara: Japan Must Be Cautious Discussing Taxes; No Sharp Yuan Rise

Edano: Won’t Rigidly Stick To Drafting Sales Tax Hike This Fiscal Year

LEAD: Tokyo stocks edge lower as post-election uncertainty weighs+