Cross currents of right and wrong but always for the wrong reasons.

By David J. Lynch

March 7 (Bloomberg) — House Speaker John Boehner routinely offers this diagnosis of the U.S.’s fiscal condition: “We’re broke; Broke going on bankrupt,” he said in a Feb. 28 speech in Nashville.

Boehner’s assessment dominates a debate over the federal budget that could lead to a government shutdown. It is a widely shared view with just one flaw: It’s wrong.

“The U.S. government is not broke,” said Marc Chandler, global head of currency strategy for Brown Brothers Harriman & Co. in New York. “There’s no evidence that the market is treating the U.S. government like it’s broke.”

Wrong reason! Broke implies not able to spend.

The US spends by crediting member bank accounts at the Fed, and taxes by debiting member bank accounts at the Fed.

It never has nor doesn’t have any dollars.

The U.S. today is able to borrow at historically low interest rates, paying 0.68 percent on a two-year note that it had to offer at 5.1 percent before the financial crisis began in 2007.

That’s simply a function of where the Fed, a agent of Congress, has decided to set rates, and market perceptions of where it may set rates in the future. Solvency doesn’t enter into it.

Financial products that pay off if Uncle Sam defaults aren’t attracting unusual investor demand. And tax revenue as a percentage of the economy is at a 60-year low, meaning if the government needs to raise cash and can summon the political will, it could do so.

All taxing does is debit member bank accounts. The govt doesn’t actually ‘get’ anything.

To be sure, the U.S. confronts long-term fiscal dangers.

For example???

Over the past two years, federal debt measured against total economic output has increased by more than 50 percent and the White House projects annual budget deficits continuing indefinitely.

So?

“If an American family is spending more money than they’re making year after year after year, they’re broke,” said Michael Steel, a spokesman for Boehner.

So?

What does that have to do with govts ability to credit accounts at its own central bank?

$1.6 Trillion Deficit

A person, company or nation would be defined as “broke” if it couldn’t pay its bills, and that is not the case with the U.S. Despite an annual budget deficit expected to reach $1.6 trillion this year, the government continues to meet its financial obligations, and investors say there is little concern that will change.

Still, a rhetorical drumbeat has spread that the U.S. is tapped out. Republicans, including Representative Ron Paul of Texas, chairman of the House domestic monetary policy subcommittee, and Fox News commentator Bill O’Reilly, have labeled the U.S. “broke” in recent days.

Chris Christie, the Republican governor of New Jersey, said in a speech last month that the Medicare program is “going to bankrupt us.” Julian Robertson, chairman of Tiger Management LLC in New York, told The Australian newspaper March 2: “we’re broke, broker than all get out.”

A similar claim was even made Feb. 28 by comedian Jon Stewart, the host of “The Daily Show” on Comedy Central.

So much for their legacies.

Cost of Insuring Debt

Financial markets dispute the political world’s conclusion. The cost of insuring for five years a notional $10 million in U.S. government debt is $45,830, less than half the cost in February 2009, at the height of the financial crisis, according to data provider CMA data. That makes U.S. government debt the fifth safest of 156 countries rated and less likely to suffer default than any major economy, including every member of the

G20.

There are two factors in default insurance. Ability to pay and willingness to pay. While the US always has the ability to pay, Congress does not always show a united willingness to pay. Hence the actual default risk.

Creditors regard Venezuela, Greece and Argentina as the three riskiest countries. Buying credit default insurance on a notional $10 million of those nations’ debt costs $1.2 million, $950,000 and $665,000 respectively.

“I think it’s very misleading to call a country ‘broke,'” said Nariman Behravesh, chief economist for IHS Global Insight in Lexington, Massachusetts. “We’re certainly not bankrupt like Greece.”

In any case, the euro zone member nations put themselves in the fiscal position of US states when they joined the euro.

That means a state like Illinois could be the next Greece, but not the US govt.

Less Likely to Default

CMA prices for credit insurance show that global investors consider it more likely that France, Japan, China, the United Kingdom, Australia or Germany will default than the U.S.

Pacific Investment Management Co., which operates the largest bond fund, the $239 billion Total Return Fund, sees so little risk of a U.S. default it may sell other investors insurance against the prospect. Andrew Balls, Pimco managing director, told reporters Feb. 28 in London that the chances the U.S. would not meet its obligations were “vanishingly small.”

Presumably a statement with regard to willingness of Congress to pay.

George Magnus, senior economic adviser for UBS Investment Bank in London, says the U.S. dollar’s status as the global economy’s unit of account means the U.S. can’t go broke.

That has nothing to do with it.

“You have the reserve currency,” Magnus said. “You can print as much as you need. So there’s no question all debts will be repaid.”

Any nation can do that with its own currency

The current concerns over debt contrast with the views of founding father Alexander Hamilton, the nation’s first Treasury secretary. At Hamilton’s urging, the federal government in 1790 absorbed the Revolutionary War debts of the states and issued new government securities in about the same total amount.

Alexander Hamilton

Unlike today’s debt critics, Hamilton “had no intention of paying off the outstanding principal of the debt,” historian Gordon S. Wood wrote in “Empire of Liberty: A History of the Early Republic 1789-1815.”

Instead, by making regular interest payments on the debt, Hamilton established the U.S. government as “the best credit risk in the world” and drew investors’ loyalties to the federal government and away from the states, wrote Wood, who won a Pulitzer Prize for a separate history of the colonial period.

Far be it from me to argue with a Pulitzer Prize winner…

From Oct. 1, 2008, the beginning of the 2009 fiscal year, through the current year, which ends Sept. 30, 2011, the U.S. will have added more than $4.3 trillion of debt. Despite White House forecasts of an additional $2.4 trillion of debt over the next three fiscal years, investors’ appetite for Treasury securities shows little sign of abating.

It’s just a reserve drain- get over it!

Govt spending credits member bank reserve accounts at the Fed

Tsy securities exist as securities accounts at the Fed.

‘Going into debt’ entails nothing more than the Fed debiting Fed reserve accounts and crediting Fed securities accounts and ‘paying off the debt’ is nothing more than debiting securities accounts and crediting reserve accounts

No grandchildren involved.

Longer-Term Debt

In addition to accepting low yields on two-year notes, creditors are willing to lend the U.S. money for longer periods at interest rates that are below long-term averages. Ten-year U.S. bonds carry a rate of 3.5 percent, compared with an average 5.4 percent since 1990. And U.S. debt is more attractive than comparable securities from the U.K., which has moved aggressively to rein in government spending. U.K. 10-year bonds offer a 3.6 percent yield.

“You are never broke as long as there are those who will buy your debt and lend money to you,” said Edward Altman, a finance professor at New York University’s Stern School of Business who created the Z-score formula that calculates a company’s likelihood of bankruptcy.

Who also completely misses the point.

Any doubts traders had about the solvency of the U.S. would immediately be reflected in the markets, a fact noted by James Carville, a former adviser to President Bill Clinton, after he saw how bond investors could determine the success or failure of economic policy.

No they can’t.

“I used to think if there was reincarnation, I wanted to come back as the president or the Pope or a .400 baseball hitter,” Carville said. “But now I want to come back as the bond market. You can intimidate everyone.”

Only those who don’t know any better.

Republican Dissenters

Republican assertions that the U.S. is “broke” are shorthand for a complex fiscal situation, and some in the party acknowledge the claim isn’t accurate.

“To say your debts exceed your income is not ‘broke,'” said Tony Fratto, former White House and Treasury Department spokesman in the George W. Bush administration.

The U.S. government nonetheless faces a daunting gap between its expected financial resources

It’s not about ‘financial resources’ when it comes to a govt that never has nor doesn’t have any dollars, and just changes numbers in our accounts when it spends and taxes

and promised future outlays. Fratto said the Obama administration’s continued accumulation of debt risked a future crisis, as most major economies also face growing debt burdens.

The burden is that of making data entries.

In the nightmare scenario, a crush of countries competing to simultaneously sell IOUs to global investors could bid up the yield on government debt and compel overleveraged countries such as the U.S. to abruptly slash public spending.

It could only compel leaders who didn’t know how it all worked to do that.

Not selling the debt simply means the dollars stay in reserve accounts at the Fed and instead of being shifted by the Fed to securities accounts. Why would anyone who knew how it worked care which account the dollars were in? Especially when spending has nothing, operationally, to do with those accounts.

Fratto dismissed the markets’ current calm, noting that until the European debt crisis erupted early last year, investors had priced German and Greek debt as near equivalents.

“Markets can make mistakes,” Fratto said.

So can he. That all applies to the US states, not the federal govt.

$9.4 Trillion Outstanding

If recent budgetary trends continue unchanged, the U.S. risks a fiscal day of reckoning, slower growth or both.

No it doesn’t.

Altman notes that the U.S. debt outstanding is “enormous.” As of the end of 2010, debt held by the public was $9.4 trillion or 63 percent of gross domestic product — roughly half of the corresponding figures for Greece (126.7 percent) and Japan (121 percent) and well below countries such as Italy (116 percent), Belgium (96.2 percent) and France (78.1 percent).

Once a country’s debt-to-GDP ratio exceeds 90 percent, median annual economic growth rates fall by 1 percent, according to economists Kenneth Rogoff and Carmen Reinhart.

Wrong, that’s for convertible currency/fixed exchange rate regimes, not nations like the US, Uk, and Japan which have non convertible currencies and floating exchange rates.

The Congressional Budget Office warns that debt held by the public will reach 97 percent of GDP in 10 years if certain tax breaks are extended rather than allowed to expire next year and if Medicare payments to physicians are held at existing levels rather than reduced as the administration has proposed.

So???

AAA Rating

For now, Standard & Poor’s maintains a stable outlook on its top AAA rating on U.S. debt, assuming the government will “soon reveal a credible plan to tighten fiscal policy.” Debate over closing the budget gap thus far has centered on potential spending reductions. S&P says a deficit-closing plan “will require both expenditure and revenue measures.”

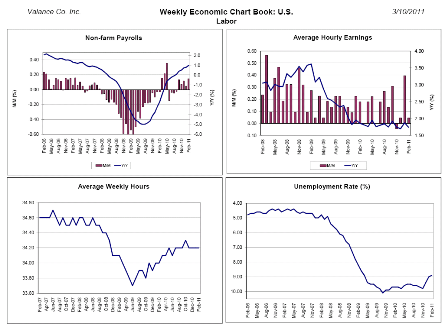

Measured against the size of the economy, U.S. federal tax revenue is at its lowest level since 1950. Tax receipts in the 2011 fiscal year are expected to equal 14.4 percent of GDP, according to the White House. That compares with the 40-year average of 18 percent, according to the Congressional Budget Office. So if tax receipts return to their long-term average amid an economic recovery, about one-third of the annual budget deficit would disappear.

Likewise, individual federal income tax rates have declined sharply since the top marginal rate peaked at 94 percent in 1945. The marginal rate — which applies to income above a numerical threshold that has changed over time — was 91 percent as late as 1963 and 50 percent in 1986. For 2011, the top marginal rate is 35 percent on income over $373,650 for individuals and couples filing jointly.

Not Overtaxed

Americans also aren’t overtaxed compared with residents of other advanced nations. In a 28-nation survey, only Chile and Mexico reported a lower total tax burden than the U.S., according to the Organization for Economic Development and Cooperation.

In 2009, taxes of all kinds claimed 24 percent of U.S. GDP, compared with 34.3 percent in the U.K., 37 percent in Germany and 48.2 percent in Denmark, the most heavily taxed OECD member.

“By the standard of U.S. history, by the standard of other countries — by the standard of where else are we going to get the money — increased tax revenues have to be a part of the solution,” said Jeffrey Frankel, an economist at Harvard University who advises the Federal Reserve Banks of Boston and New York.

So much for his legacy.