Karim writes:

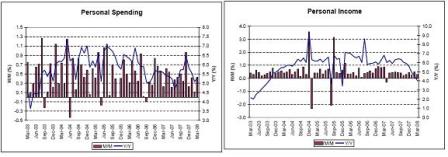

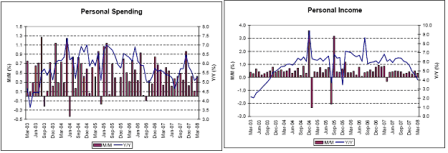

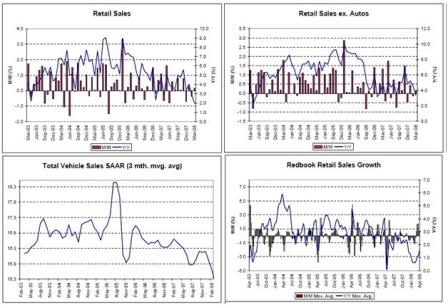

The ICSC weekly chain store sales index was unchanged for the week ending May 24 compared with the prior week and rose by 1.5% from the same week of the prior year–steady with the prior week. The ABC News/Washington Post Consumer Comfort Survey for the period ending May 25 continued to show a record low buying climate evaluation by consumers (for two consecutive weeks) with 81% of respondents calling it a bad time to spend money.

ICSC Research’s statistical analysis (combined with the consumer survey result) suggests that the record high gasoline prices at the pump are dragging down chain-store sales demand by nearly 1 percentage point currently, while the lift so far from higher income, because of the federal tax rebate, is only offsetting that spending drag by about a quarter of percentage point. As such, the net effect (approximately -0.75 pp.) continues to be negative on store spending. April chain store sales on a year-over-year comparable-store basis rose by 3.5%, based on ICSC’s tally of retail chains. However, the April 2008 increase was exaggerated by the shift in the date of Easter compared with April 2007. Over the prior two months, the average monthly year-over-year pace was 1.5%.

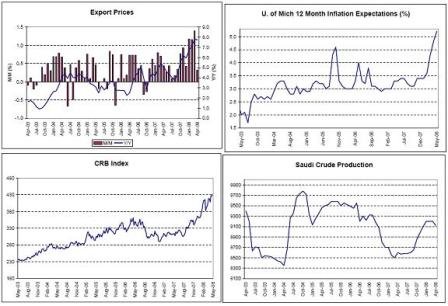

Yes, the key is whether the oil producers ‘spend’ the funds here or ‘save’ them and build reserves as they did in the 1970’s.

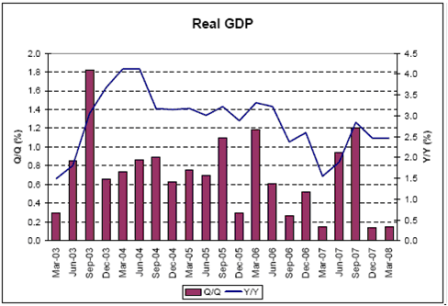

So far the booming US exports and annecdotal evidence of massive infrastructure expenditures in the middle east indicate they have been spending their higher revenues and sustaining US GDP at muddling through levels.

This means employment and growth muddle through but real terms of trade and our standard of living declines

As of May 23, 43% of the $107 bn. personal federal tax rebate already has been distributed to taxpayers, which should begin to turn the consumer spending tide a bit. In a special consumer tracking survey taken between May 22 and 25, 12% of households reported spending most of the rebate already. Based on the latest tax rebate flow that would imply approximately $5 to $10 bn. of the rebate was spent already by the 51.7 million taxpayers receiving a rebate check so far.

According to an ICSC Research tax rebate survey, released on May 19, ultimately 22% of households expect to spend the rebate, which will potentially mean nearly $25 bn of spending power over the next several months. For the fiscal month of May, ICSC Research expects monthly sales will grow by between 1% and 2% on a year-over-year same-store basis.

My best guess is more will be spent with a relatively short lag of maybe 30 days after receiving the checks. This includes using the checks to make down payments on deferred purchases, such as small appliances and home improvements, which has a multiplier effect.

[top]