Seems no end to the stupidity that continues to spew out from all kinds of places.

You’d think the ratings agencies would have learned their lesson with Japan – downgraded below Botswana and still funded JGB’s at under 1% for years until the BOJ raised rates.

And last I saw ten year US credit default was around ten basis points?

I had a discussion with S&P years ago. Seem to remember a name ‘David’?

He seemed to sort of grasp that operationally governments with their own (non convertible) currencies and floating fx policies aren’t revenue constrained, but obviously didn’t quite get it when they downgraded Japan.

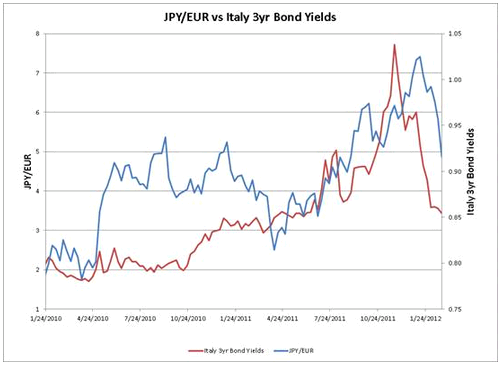

The eurozone is another issue, where they have downgraded national governments and that does mean something regarding risk, just like the US States, but with no legal safety net by the Federal authorities like the US. Fortunately the eurozone banking system hasn’t been tested, yet.

Simple trade: sell US credit default, buy Germany, for example.

by Aline van Duyn

The US government’s need to provide financial backing to the state-sponsored mortgage financiers that dominate the US housing market could pose a risk to the country’s triple-A credit rating, Standard & Poor’s, the credit rating agency, said on Monday.

In the event of a deep and prolonged US recession, S&P said the potential costs of propping up government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac, which have implicit government backing, could cost the US government up to 10 per cent of GDP.

The costs of supporting broker-dealers like Bear Stearns in a dire economic situation would be much lower, at below 3 per cent of GDP, S&P said.

“The size of GSEs, coupled with their current level of common equity, could create a material fiscal burden to the government that would lead to downward pressure on its rating,†the S&P report said.

The S&P comments come amid increased pressure for better regulation of the mortgage financiers, especially as their role in the US housing market is likely to increase as they are used to provide support for struggling homeowners.

Policymakers are pushing for Fannie Mae, Freddie Mac and the lesser-known Federal Home Loan Banks to pump liquidity into the US mortgage market and this has prompted regulators to call for stronger oversight of such institutions.

Fannie Mae, Freddie Mac and the Federal Home Loan Banks have become the backbone of the troubled US mortgage market as purely private sources of finance have all but dried up or are offered only at punitive terms.

In the second half of 2007, about 90 per cent of new mortgage funding was provided by GSEs. They have about $6,300bn of public debt and mortgage securities outstanding, more than the $5,100bn of outstanding US government debt.

Fannie Mae and Freddie Mac have no formal state guarantees but investors believe the US government would step in if the system got into trouble. This allows the agencies to raise funds at very low rates against a triple-A credit rating, in spite of high levels of leverage.

The capital surplus ratio for GSEs was recently reduced to 20 per cent from 30 per cent, allowing them to operate on a more leveraged basis.

In January, Moody’s Investors Service, another credit rating agency, said the US could risk its triple-A rating within a decade unless soaring healthcare costs and social security spending was curbed.