Category Archives: MMT

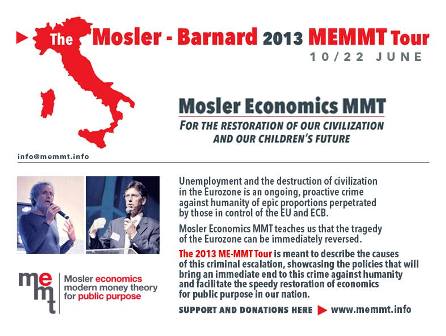

MEMMT tour

CBO Updated Budget Projections: Fiscal Years 2013 to 2023

Updated Budget Projections: Fiscal Years 2013 to 2023

Karim writes:

Deficit projected 200bn less than 3mths ago for current fiscal year. Projected at 2.1% of GDP for 2014-15, or 600bn less than 3mtgs ago.

No more grand bargain talk?

Maybe, but this is still being said:

For the 20142023 period, deficits in CBOs baseline projections total $6.3 trillion. With such deficits, federal debt held by the public is projected to remain above 70 percent of GDPfar higher than the 39 percent average seen over the past four decades. (As recently as the end of 2007, federal debt equaled 36 percent of GDP.) Under current law, the debt is projected to decline from about 76 percent of GDP in 2014 to slightly below 71 percent in 2018 but then to start rising again; by 2023, if current laws remain in place, debt will equal 74 percent of GDP and continue to be on an upward path (see figure below).

And it all begs the question of whether the proactive tax hikes and spending cuts will through the credit accelerators into reverse, as nominal GDP growth continues to decelerate.

I sat next to Al Gore at dinner at Monty Friedkin’s house in Boca for 45 minutes in front of that election. Cliff was there as well. Al asked me how we should spend the $5.6 trillion surplus projected for the next 10 years. I told him there wasn’t going to be a $5.6 trillion surplus as that implied a reduction of that much of net global $US financial assets, to the penny. Instead, a $5.6 trillion deficit was more likely to bring deficit spending back in line with ‘savings desires’ which I also described. He’s a pretty good student, went through the numbers, and agreed with the logic. He then said something like ‘You know I can’t get up and say any of this’ as he got up and explained how he was going to spend the $5.6 trillion surplus.

Point is, the CBO makes assumptions about growth that don’t recognize that growth can be a function of fiscal balance.

In other words the tax hikes and spending cuts (aka ‘austerity’) initially cause the deficit to fall, but if the deficit is proactively brought down too much then undermines private sector credit expansion/spending causing sales/output/employment to slow sufficiently for the deficit to rise to where it ‘needs to be’ from suddenly falling revenues and rising transfer payments. As demonstrated by proactive fiscal tightening in the UK, Europe, and Japan, for example.

This is not to say the tax hikes and spending cuts in the US have crossed that line.

Nor is it to say they haven’t.

For me the jury is still out.

Today’s Tepper rally apparently was based on the idea that the ‘QE money has to be invested somewhere’ which is of course total nonsense.

(See if you can spot any sign of QE in the attached nominal GDP chart)

But it moved the market nonetheless.

MEMMT activist tour June 10-23

Full size image

Google Translate:

Paul Barnard and Warren Mosler meet the activists of local groups on a tour that will begin on June 10 in Montalto Uffugo (Cosenza) and will end on 22 June in Cant (Como).

In this route there will be public meetings of which we will detail shortly.

It will also be available in the next few days, the material event disclosure.

It is a unique event: the economist who says “The eurozone is a crime against humanity, because unemployment creates social horrors and is kept on purpose” will be in Italy alongside Paul Barnard and activists ME-MMT .

The local groups are already working to organize the individual stages: contribute to the organization by donating a contribution.

Full size image

Market Watch

Radical fixes needed to make the euro work

Commentary: Warren Mosler has a plan but no takers

By Darrell Delamaide

May 8 (MarketWatch) — If youre ever tempted to think the euro zone has turned the corner and is on the right track, go have a chat with Warren Mosler and hell set you straight.

The former hedge-fund manager and an original proponent of what has come to be known as modern monetary theory gave a talk recently at a wealth management conference in Zurich that took a pessimistic view of the euro righting itself on its current path.

The European slow-motion train wreck will continue until theres recognition that deficits need to be larger, Mosler said at the conclusion of his analysis. The continuing efforts at deficit reduction will continue to make things worse.

Mosler suggested several measures that could turn around the situation in the euro zone, though he acknowledged there is little chance they will be adopted.

The euro authorities need to accept that deficits should be allowed to go up to 8% of gross domestic product, instead of the current 3%, as the only way to create the monetary conditions for full employment and economic growth.

The European Central Bank should make a policy rate of 0% permanent. The ECB, as the source of the euro zones fiat money, should guarantee the debt of all euro countries and guarantee deposit insurance for all euro-zone banks, which would entail taking over bank supervision.

Individual countries in the euro zone, like individual states in the U.S., are trapped in a procyclical monetary and fiscal environment. Because they have no sovereign currency, they must reduce spending in a downturn.

In the U.S., the federal government can operate countercyclically, by running a sufficiently large deficit to provide net savings to the private sector. The ECB is the only institution in the euro zone that does not have revenue constraints and could play a countercyclical role.

Because money is a public monopoly, when the monopolist restricts supply by not running a sufficient deficit, it creates excess capacity in the economy, as evidenced by high unemployment.

Mosler says the deficit can result from lower taxes or increased government spending, whatever your politics prefers. But policies aimed at reducing the deficit are doomed to keep an economy depressed.

And theres more. All successful currency unions include fiscal transfers, Mosler said. In Canada, this is written into the constitution and in the U.S. it is achieved through the federal budget.

In Europe, this would mean that some authority like an empowered European Parliament would direct government spending to the areas with the highest unemployment.

Clearly all of this is well beyond what Europe is currently capable of doing, and the leaders in power have implicitly or explicitly rejected all of these potential fixes.

The reality is, Mosler noted, that there is no political support for higher deficits, no political support for leaving the euro, and beyond reducing deficits the only remaining fixes are taxes on depositors and bondholders like those seen in Cyprus and Greece.

Mosler, who currently manages offshore funds and produces sports cars on the side, says his views, which have been taken up and elaborated by a post-Keynesian school of economics, are based on his experience as a money manager.

And, he adds, he has a substantial following of asset managers for his ideas because these are people who are paid to get it right.

The current stopgap measures proposed by the ECB notably the putative outright monetary transactions to bail out a country under certain conditions, which has yet to be used have a dubious legal basis and are so much smoke and mirrors, Mosler said.

In this Zurich talk, Mosler did not draw any further conclusions regarding his pessimistic view of the euros current course, but a website devoted to Mosler Economics in Italy, where MMT has a considerable following, spells out what it could mean in a post called 10 reasons to return to the lira.

These reasons include the ability to lower taxes, allow the government to pay off debts to the private sector and implement a works program to provide employment and improve the public infrastructure. Read the post (in Italian).

Lest this all seem like so much pie in the sky, keep in mind that the forces that gave the protest movement of Beppe Grillo a quarter of the vote in Italys recent election will only grow as continued austerity deepens Europes recession.

So remain optimistic if you like, but youve been warned.

Rogoff & Reinhart answering my call in FT – Austerity is not the only answer to a debt problem

Good to see Ken, who I’ve never met, and Carmen who I do know, no doubt assisted by her husband Vince, beginning to come clean with this response. While not complete, it’s the beginning of an encouraging, epic reversal and a first step in the right direction!

My comments added below:

Austerity is not the only answer to a debt problem

By Kenneth Rogoff and Carmen Reinhart

May 1 (FT) — The recent debate about the global economy has taken a distressingly simplistic turn. Some now argue that just because one cannot definitely prove very high debt is bad for growth (though the weight of the results still say it is),

They could add here ‘though likely via the reaction functions of govts and not the high debt per se.’

then high debt is not a problem. Looking beyond the recent public debate about the literature on debt we have already discussed our results on debt and growth in that context the debate needs to be reconnected to the facts.

Let us start with one: the ratios of debt to gross domestic product are at historically high levels in many countries, many rising above previous wartime peaks. This is before adding in concerns over contingent liabilities on private sector balance sheets and underfunded old-age security and pension programmes. In the case of Germany, there is also the likely need to further cushion the debt loads of eurozone partners.

Adding here ‘as they are ‘users’ of the euro the way US states are ‘users’ of the dollar, and not the actual issuer of the currency like the ECB, the Fed, the BOE, the BOJ, and the rest of the world’s central banks.’

Some say not to worry, pointing to bursts of growth after the world wars. But todays debts,

Add ‘while they pose no solvency risk for the issuer of the currency.’

will not be dealt with by boosts to supply from postwar demobilisation and to demand from the lifting of wartime controls.

To be clear, no one should be arguing to stabilise debt, much less bring it down, until growth is more solidly entrenched if there remains a choice, that is.

BRAVO!!!! And add ‘as is always the case for the issuer of the currency.’

Faced with, at best, haphazard access to international capital markets and high borrowing costs, periphery countries in Europe face more limited alternatives.

Add ‘as is the case for ‘users’ of a currency in general, including the US states, for example’.

Nevertheless, given current debt levels, enhanced stimulus should only be taken selectively and with due caution. A higher borrowing trajectory is warranted, given weak demand

BRAVO!

and low interest rates,

Add ‘which are confirmation by the CB policy makers who set the rates low that they too believe demand is weak’.

where governments can identify high-return infrastructure projects. Borrowing to finance productive infrastructure raises long-run potential growth, ultimately pulling debt ratios lower. We have argued this consistently since the outset of the crisis.

BRAVO! And add ‘additionally, weak demand can be addressed by tax reductions, recognizing that counter cyclical fiscal policy of currency users, like the euro zone members, requires funding support from the issuer of the currency, which in this case is the ECB.’

Ultra-Keynesians would go further and abandon any pretense of concern about longer-term debt reduction.

Add ‘without a credible long term inflation concern, as for the issuer of the currency inflation is the only risk from excess demand.’

This position has been in the rhetorical ascendancy in recent months, with new signs of weaker growth. It throws caution to the wind on debt

Add ‘with regards to solvency, as is necessarily the case for the issuer of the currency.’

and, to quote Star Trek, pushes governments to go where no man has gone before

Add ‘apart from war time, when the importance of maximum output and employment takes center stage.’

The basic rationale

Add ‘of the mainstream deficit doves (not the ultra Keynesian MMT school of thought)’

is that low interest rates make borrowing a free lunch.

Unfortunately,

Add ‘the mainstream believes’

ultra-Keynesians are too dismissive of the risk of a rise in real interest rates. No one fully understands why rates have fallen so far so fast,

Add ‘apart from the Central Bankers who voted to lower them this far and this fast, and in some cases provide guarantees to other borrowers.’

and therefore no one can be sure for how long their current low level will be sustained.

Add ‘as it’s a matter of second guessing those central bankers.’

John Maynard Keynes himself wrote How to Pay for the War in 1940 precisely because he was not blas about large deficits even in support of a cause as noble as a war of survival. Debt is a slow-moving variable that cannot and in general should not be brought down too quickly. But interest rates can change rapidly.

Add ‘all it takes is a vote by central bankers.’

True, research has identified factors that might combine to explain the sharp decline in rates.

Add ‘in fact, all you have to do is research the votes at the central bank meetings.’

Greater concern

Add ‘by central bankers’

over potentially devastating future events such as fresh financial meltdowns may be depressing rates. Similarly, the negative correlation between returns on stocks and long-term bonds, while admittedly quite unstable, also makes bonds a better hedge. Emerging Asias central banks have been great customers for advanced economy debt, and now perhaps the Japanese will be once more. But can these same factors be relied on to keep yields low indefinitely?

Add ‘In the end, it’s all a matter of the central bank’s reaction function.’

Economists simply have little idea how long it will be until rates begin to rise. If one accepts that maybe, just maybe, a significant rise in interest rates in the next decade

Add ‘due to inflation concerns’

might be a possibility, then plans for an unlimited open-ended surge in debt should give one pause.

Add ‘if he does not see the merits of leaving risk free rates near 0 in any case, as there is no convincing central bank research that shows rate hikes reduce inflation rates, and even credible theory and evidence to be concerned that rate hikes instead exacerbate inflation.’

What, then, can be done? We must remember that the choice is not simply between tight-fisted austerity and freewheeling spending. Governments have used a wide range of options over the ages. It is time to return to the toolkit.

First and foremost,

Add ‘only’

governments

Add ‘who fail to recognize that these are merely matters of accounting that don’t themselves alter output and employment’

must be prepared to write down debts rather than continuing to absorb them. This principle applies to the senior debt of insolvent financial institutions, to peripheral eurozone debt and to mortgage debt in the US.

Add ‘Additionally’

For Europe, in particular, any reasonable endgame will require a large transfer

Add ‘of public goods production’

from Germany to the periphery.

Add ‘which in fact would be a real economic benefit for Germany.’

The sooner this implicit transfer becomes explicit, the sooner Europe will be able to find its way towards a stable growth path.

There are other tools. So-called financial repression, a non-transparent form of tax (primarily on savers), may be coming to an institution near you. In its simplest form, governments cram debt into domestic pension funds, insurance companies and banks

By removing governmental support of higher rates from their net issuance of debt instruments, particularly treasury securities.

Europe is there already and it has been there before, several times. How to Pay for the War was, in part, about creating captive audiences for government debt. Read the real Keynes, not rote Keynes, to understand our future.

One of us attracted considerable fire for suggesting moderately elevated inflation (say, 4-6 per cent for a few years) at the outset of the crisis. However, a once-in-75-year crisis is precisely the time when central banks should expend some credibility to take the edge off public and private debts, and to accelerate the process bringing down the real price of housing and real estate.

It is therefore imperative for the central bankers to make it clear to the politicians that there is no solvency risk, and that central bankers, and not markets, are necessarily in control of the entire term structure of risk free rates, and that their research shows that rate hikes are not the appropriate way to bring down inflation, should the question arise’

Structural reform always has to be part of the mix. In the US, for example, the bipartisan blueprint of the Simpson-Bowles commission had some very promising ideas for simplifying the tax codes.

There is a scholarly debate about the risks of high debt. We remain confident in the prevailing view in this field that high debt is associated with lower growth

Add ‘but must add that the risk is that of misguided policy response, and not the level of debt per se.’

Certainly, lets not fall into the trap of concluding that todays high debts are a non-issue.

Add ‘as we must be ever mindful of the possibility of excess demand using up our productive capacity’

Keynes was not dismissive of debt. Why should we be?

The writers are professors at Harvard University. They have written further on carmenreinhart.com

Super Seccareccia on R&R

Dear all,

I am amazed at how much media coverage since yesterday this study criticizing the Reinhart-Rogoff work is getting thanks largely, apparently, to the Roosevelt Institute research support which I think is great (see below)! Needless to say, I am convinced that there was hardly any error from some incompetent research assistant but that it was most likely an exercise in data mining and selective use of data series that are rampant and that practically all economists engage in … not to mention the causality issue in interpreting the statistical evidence to which many now are also referring.

What bothers me about this is to suggest that the rejection of austerity is predicated on the basis of faulty data series. We know that, regardless of the amount of empirical evidence that one has to disprove a theory, unless there is a coherent alternative that is espoused and around which political forces can coalesce, the theory will remain intact and the proponents of austerity will continue to spew their toxic ideas and implement their destructive measures worldwide. That is why Krugman and his disciples will not get very far with this, since they do not have a coherent alternative to some loanable funds theory. All of them subscribe to some notion of debt stability as being a constraint ultimately on public spending and thus on economic growth. Hence, instead of 90% debt/GDP ratio, they may find some other higher ratio, say, 150% and they will then have to say that Greece and Japan must now still implement austerity measures! The problem here is that they are stuck in a faulty and misleading paradigm that must eventually lead them to austerity. The only viable framework that is truly a paradigm shift is the broad circuitist cum MMT framework. Unless we can get that through to the media, all of this interesting debate over data series will not go anywhere …. much like the conclusions last year on the IMF fiscal multipliers being larger than originally assumed has hardly changed anything in preventing governments from continuing to apply austerity measures internationally.

But there is some hope because at least there is a shake-up in the profession! As Alain undoubtedly would say: Ce n’est qu’un dbut, continuons le combat!

All the best,

Mario Seccareccia

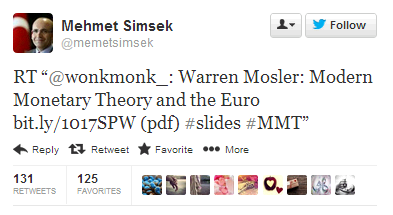

Turkish Fin Min tweet on mmt

Huffington Post article

MMT to Washington: There Is No Long-term Deficit Problem!

By Warren Mosler

Obama Renews Offer to Cut Social Safety Net in Big Budget Deal

MMT to Obama: THERE IS NO LONG TERM DEFICIT PROBLEM!!!!!!

Obama Renews Offer to Cut Social Safety Net in Big Budget Deal