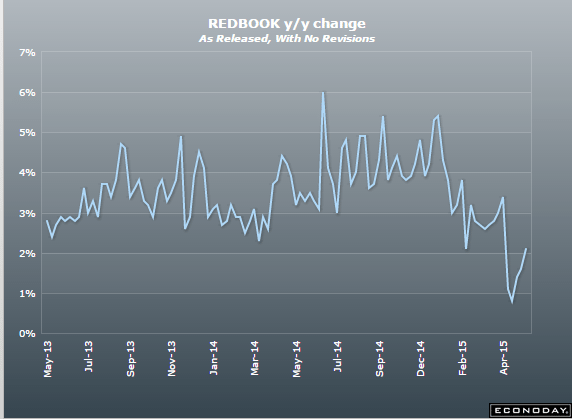

So now they don’t have Easter to kick around anymore and they’re still weak:

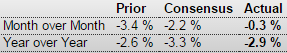

Redbook

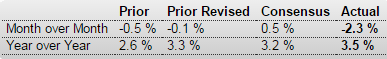

Retail sales picked up slightly in the May 9 week as Easter-effects finally fade, but at a year-on-year plus 2.1 percent sales remain soft. Redbook reports an as-expected Mother’s Day holiday in the week and reports early buying for graduation. Tomorrow the government will post its April retail sales report which is expected to show a solid rate excluding autos.

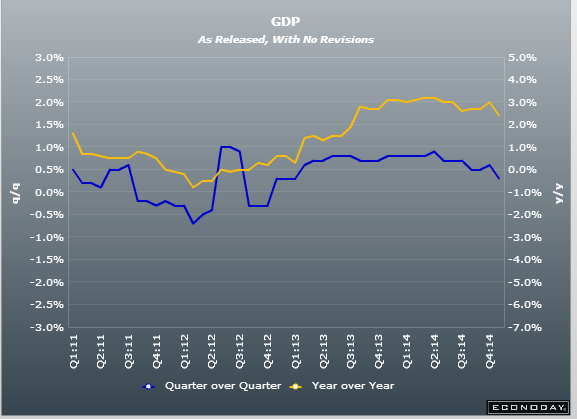

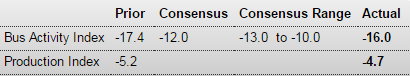

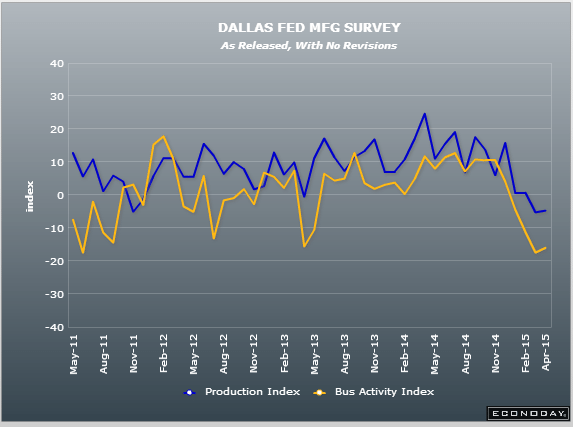

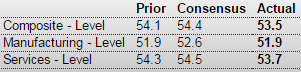

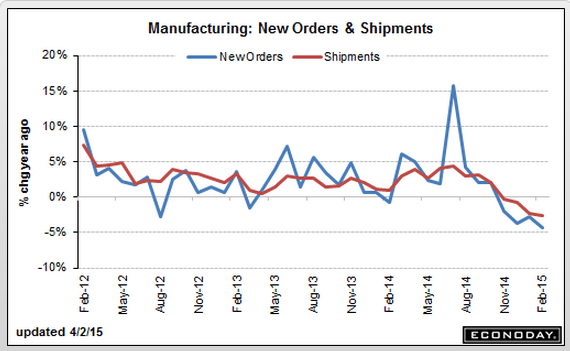

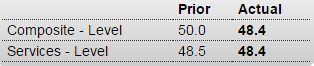

About the only things showing hope are some of the surveys, just like last quarter (which is now looking to be revised into negative territory):

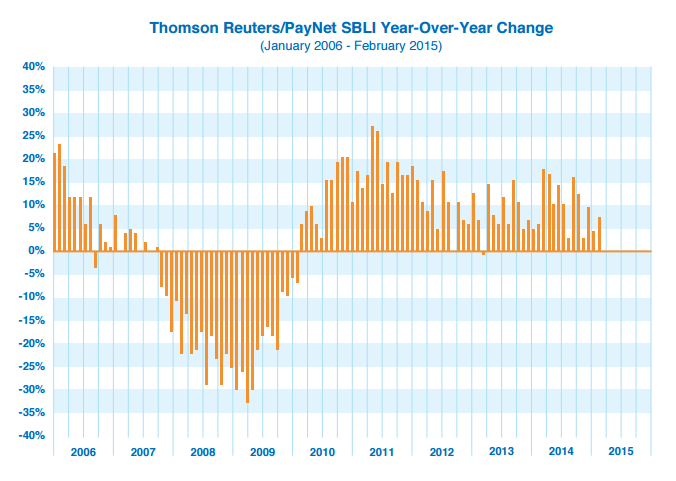

And you have to read pretty far into this story before you realize the numbers were down vs the prior month:

BLS: Jobs Openings at 5.0 million in March, Up 19% Year-over-year

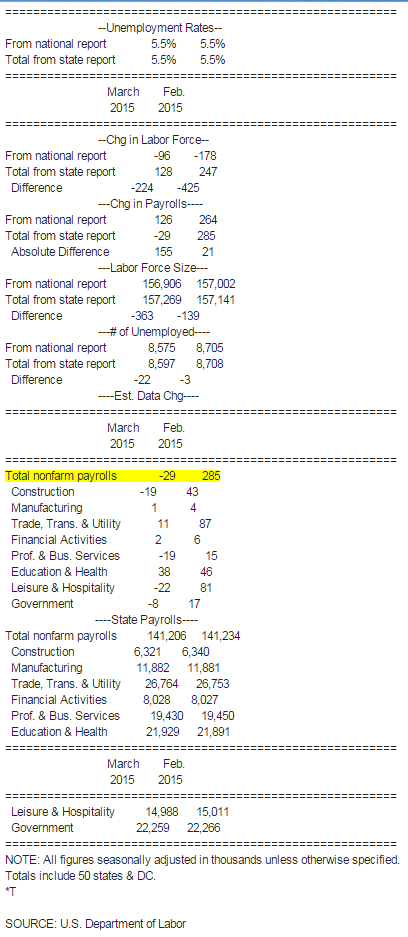

From the BLS:

There were 5.0 million job openings on the last business day of March, little changed from 5.1 million in February, the U.S. Bureau of Labor Statistics reported today. Hires were little changed at 5.1 million in March and separations were little changed at 5.0 million….

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. … There were 2.8 million quits in March, little changed from February.

JOLTS

Highlights

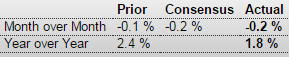

Yesterday’s labor market conditions index was very soft as is today’s JOLTS report where job openings fell 2.9 percent to 4.994 million in March from a revised 5.144 million in February. This is well below the Econoday consensus for 5.158 million.

Despite the March fall-off, workers appear to be confident in the labor market judging by their willingness to quit. The quits rate rose 1 tenth in the month to 2.0 percent. The hiring rate in the month held steady at 3.6 percent.

Last week’s employment report for April proved much better than March but was still soft, a description underscored by today’s report. Not soft, however, have been weekly jobless claims which will be posted on Thursday.

They still don’t get it:

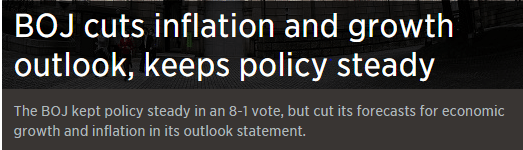

Japan seen targeting 1% primary deficit in fiscal 2018

May 12 (Nikkei) — Japan will likely aim to cut its primary deficit to about 1% of gross domestic product by fiscal 2018 through spending cuts and other measures, with an eye toward its goal of achieving a surplus by fiscal 2020. Japan’s potential growth rate currently falls short of 1%, and its primary deficit is expected to total 3.3% of GDP this fiscal year at 16.4 trillion yen ($135 billion). According to conservative calculations by the Cabinet Office, which assume real economic growth of 1% or so and nominal growth of over 1%, Japan would face a primary deficit of 15.7 trillion yen in fiscal 2018 — equivalent to 3% of GDP.