More US consumption of imports indicated here as well as with US trade data, as US growth continues to get downgraded post oil price collapse:

Japan’s annual exports jump most since late 2013 in boost to economy

May 25 (Reuters) — Japan’s annual exports in January jumped the most since late 2013. The 17.0 percent year-on-year gain in exports marked the fifth straight month of increase, supported by brisk shipments of cars to the United States and of electronics parts to Asia. The export data followed a 12.8 percent rise in December.

And US exports looking suspect as well:

Growth remains steady in Markit’s US manufacturing sample where the flash February reading is holding little changed, at 54.3 vs 53.9 at month-end January and 53.7 at mid-month January. The plus side is led by production volumes, which are at a 4-month high. Dragging on the index are slower growth in employment, the slowest in 7 months, and slower growth in new business, the slowest in 13 months and weighed down especially by weakness in exports and also by weakness among oil & gas customers.

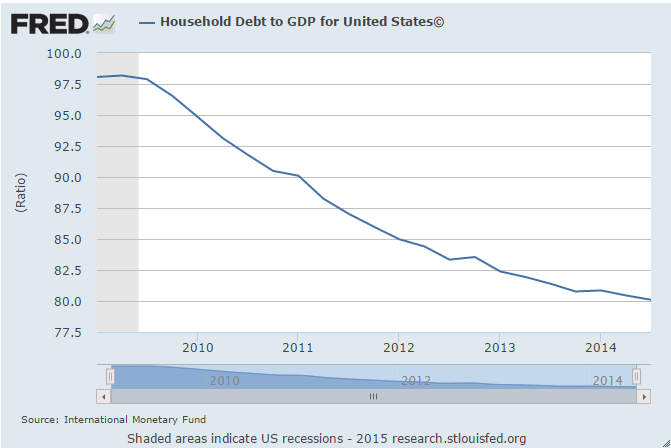

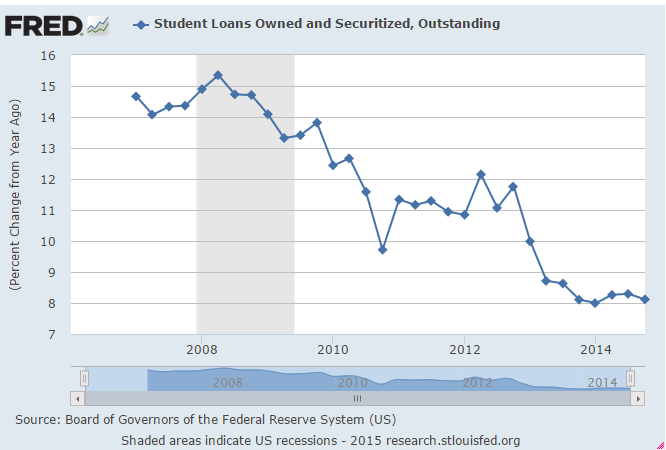

As the US demand leakages (agents spending less than their incomes) grow relentlessly, I look for the deficit spending required to sustain GDP growth. Turns out last year it came from the energy sector which ended abruptly in Q4 2014, with GDP growth sagging accordingly. And so far no sign of a credit expansion from the household sector. You can argue debt is more affordable, but not that it’s happening: