From JPM:

In light of the data we’ve received this week – January reports for real consumer spending, construction spending, and net exports that varied from disappointing to downright weak, as well as a softer February print for car sales –– we are marking down our tracking for annualized real GDP growth in Q1 from 2.5% to 2.0%. Even after this revision risks are more skewed to the downside than upside. By way of comparison, the Atlanta Fed’s tracking estimate of Q1 recently came down to 1.2%.

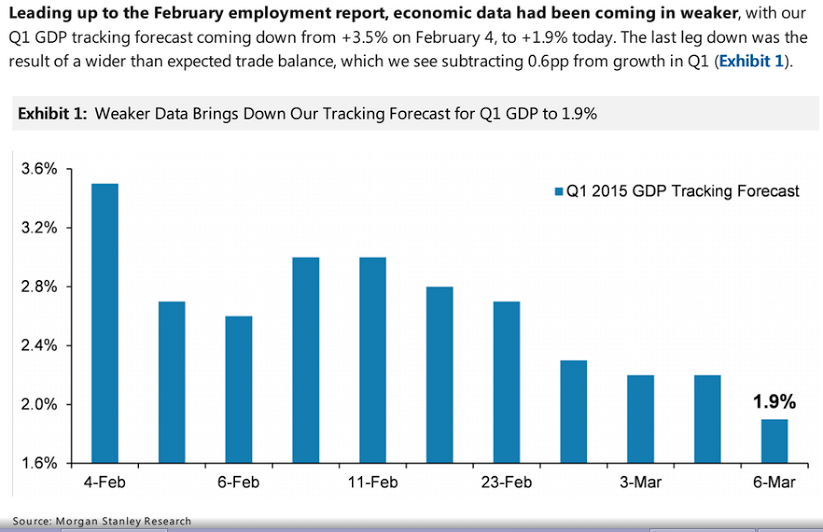

From MS:

Labor Market Conditions Index

Highlights

The Fed’s Labor Market Conditions Index remained positive in February but decelerated to 4 in February from 4.8 in January. This was despite stronger-than expected payroll gains this past Friday. One area of weakness likely was soft wage growth. The Fed’s Research Department does not give details on this unofficial report. While the employment situation’s payroll numbers have some analysts suggesting a June rate hike by the Fed, today’s LMCI indicates that there may be considerable debate within the Fed on “liftoff” timing-especially since inflation is very sluggish.

German exports post biggest drop in five months in January

Mar 9 (Reuters) — Seasonally-adjusted exports decreased by 2.1 percent in January after a sharp rise in December. The data for December was revised down to a 2.8 percent gain from a previously reported 3.4 percent increase. An unadjusted breakdown showed shipments to the euro zone dropped by 2.8 percent in January compared with a year ago while Germany sent 0.5 percent fewer goods to countries outside of the European Union. Exports to countries within the EU that do not use the euro were the only ones to post a gain.

Japan’s 4th-qtr GDP downgraded as business investment falls

Mar 9 (Kyodo) — Gross domestic product for October-December grew an annualized real 1.5 percent, downgraded from 2.2 percent. The figure translated into a 0.4 percent increase from the previous quarter, against 0.6 percent growth in a preliminary report released Feb. 16 by the Cabinet Office. Business investment dropped 0.1 percent, against an earlier-reported 0.1 percent growth, for the third straight quarter of decline. Private consumption was upgraded to a 0.5 percent rise from a 0.3 percent increase. Exports grew 2.8 percent, revised upward from a 2.7 percent increase.