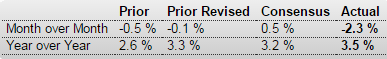

Germany : Retail Sales

Highlights

Retail sales followed a smaller revised 0.1 percent dip in February with a surprisingly hefty 2.3 percent monthly slump in March. The drop was the steepest since December 2013 but friendly base effects were enough to ensure that the first back-to-back decline since April/May 2014 still boosted unadjusted annual growth from 2.5 percent to 3.2 percent. Nonetheless, the level of sales at quarter-end was the weakest since last October.

March’s setback means that first quarter purchases were up only 0.5 percent versus the fourth quarter when they rose a solid 1.2 percent. This looks odd in the context of a raft of strong consumer surveys. In particular, at 53.0 the retail sector PMI last month posted its highest reading since last June.

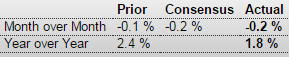

France : Consumer Mfgd Goods Consumption

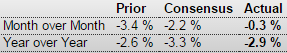

Japan : Industrial Production

Highlights

March industrial production dropped a much less than anticipated 0.3 percent on the month – analysts were expecting a drop of 2.2 percent. It was the second consecutive decline. On the year, output was down 2.9 percent. The monthly reading showed great fluctuations, but Thursday’s reading means it has been in negative territory for seven of the previous twelve months.

Exactly as I’ve discussed. Q1 was positive only because of the inventory build, which is likely normalize in Q2:

WSJ’s Hilsenrath says the sharp slowdown in Q1 growth has clouded the timing for rate liftoff. The piece argues the dollar’s strength, cautious consumer spending and a downturn in oil-related investment may limit the extent of a rebound in growth.

Highlighting a pattern of weak Q1 growth, the article notes that since 2010 first-quarter GDP growth has averaged 0.6%, compared to average growth of 2.9% in other quarters. It adds that the uneven nature of growth could mean the Fed takes a longer time to assess whether the economy is on track before raising rates.

The paper cites analysts who now anticipate liftoff in September or later. In offering a more guarded economic outlook, the article notes the job market hasn’t improved since the last Fed meeting and that after providing a 74 bp tailwind to Q1 growth, an inventory run down in Q2 could act as a new drag on growth.