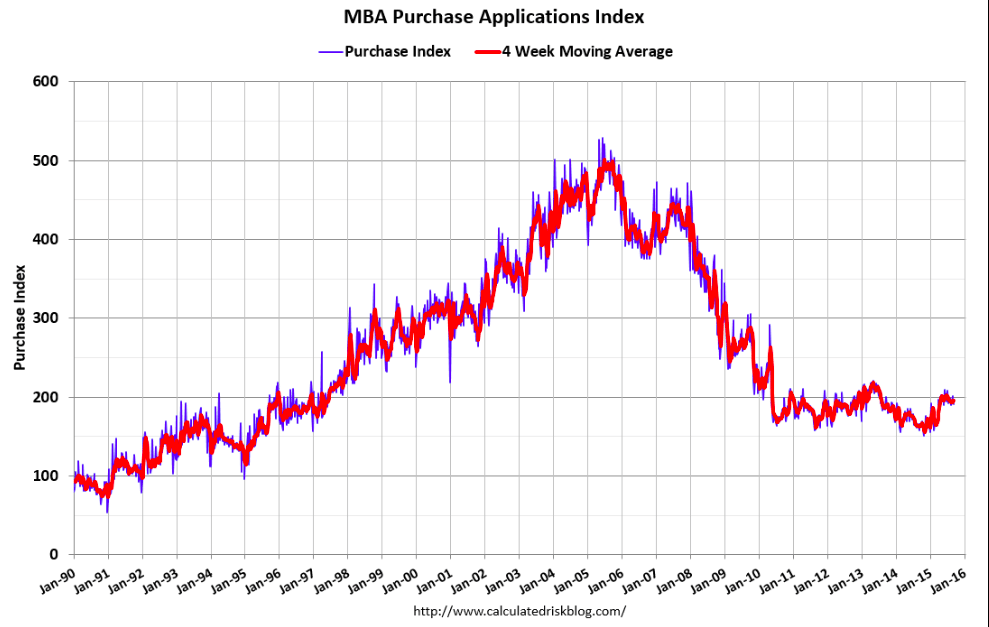

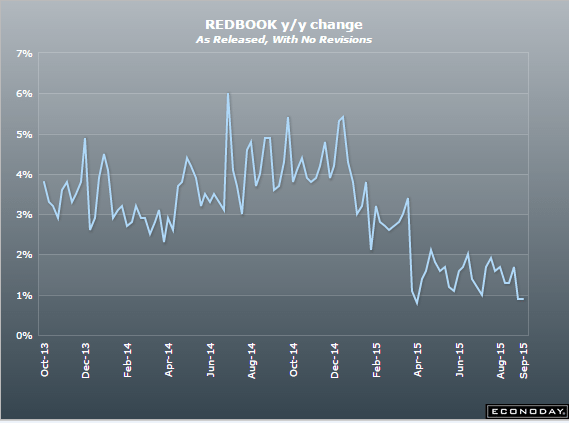

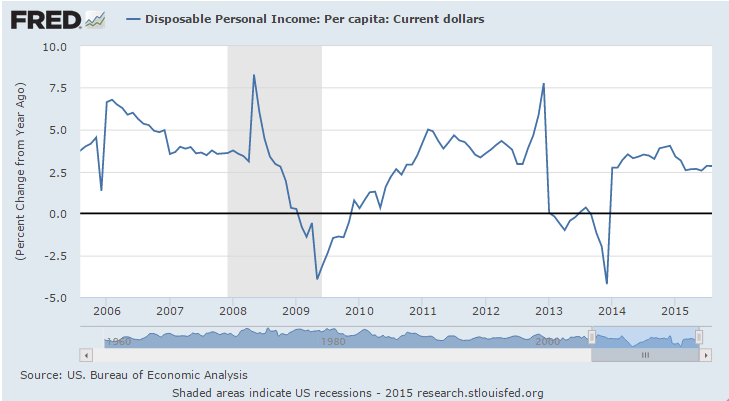

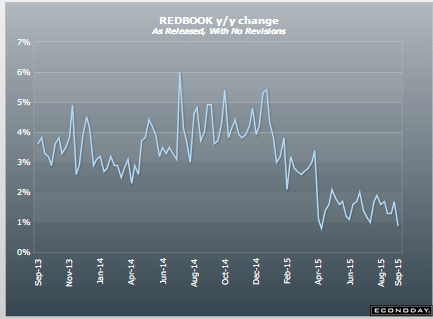

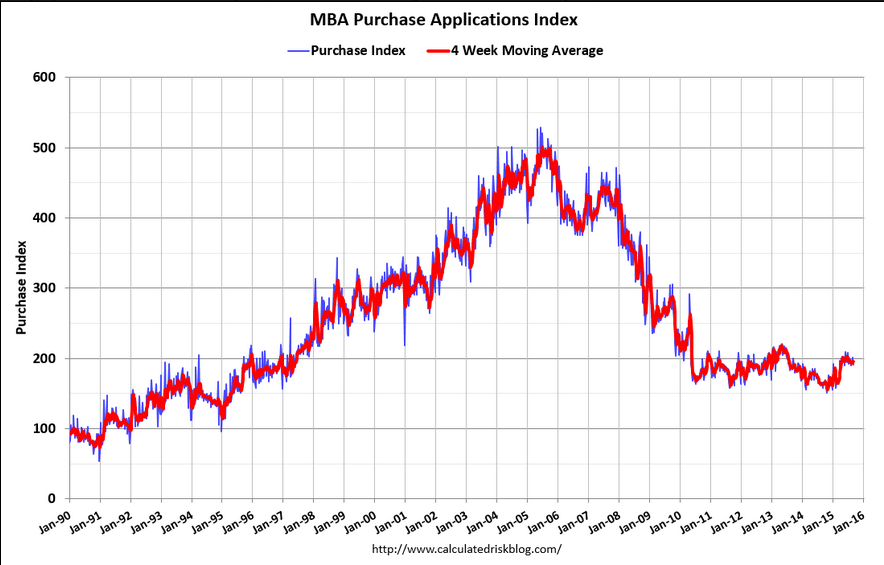

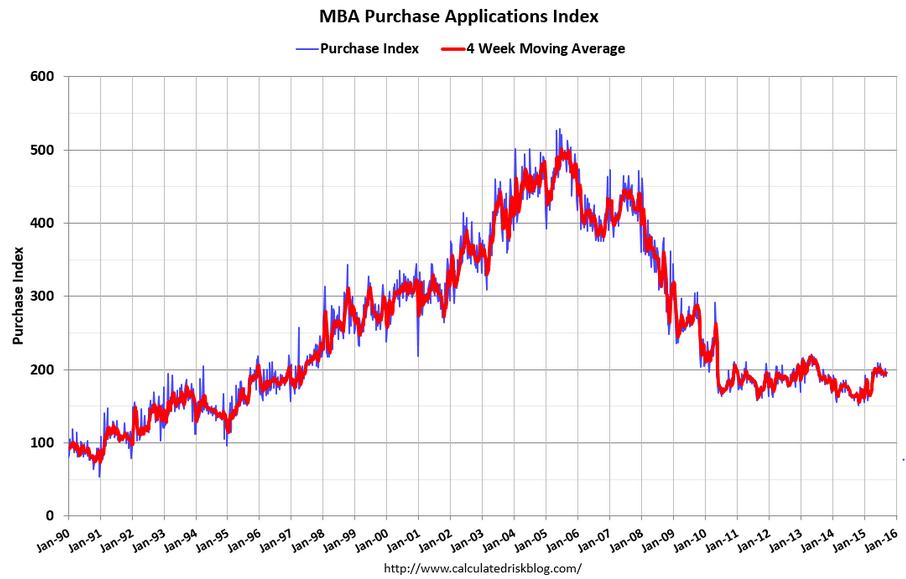

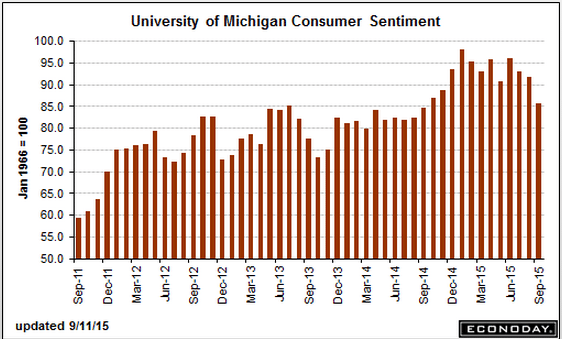

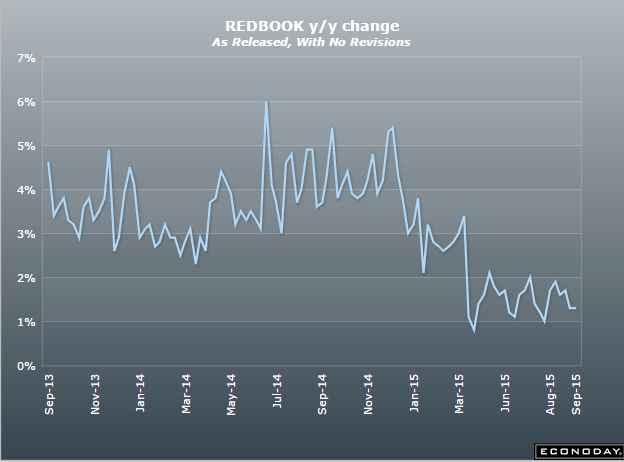

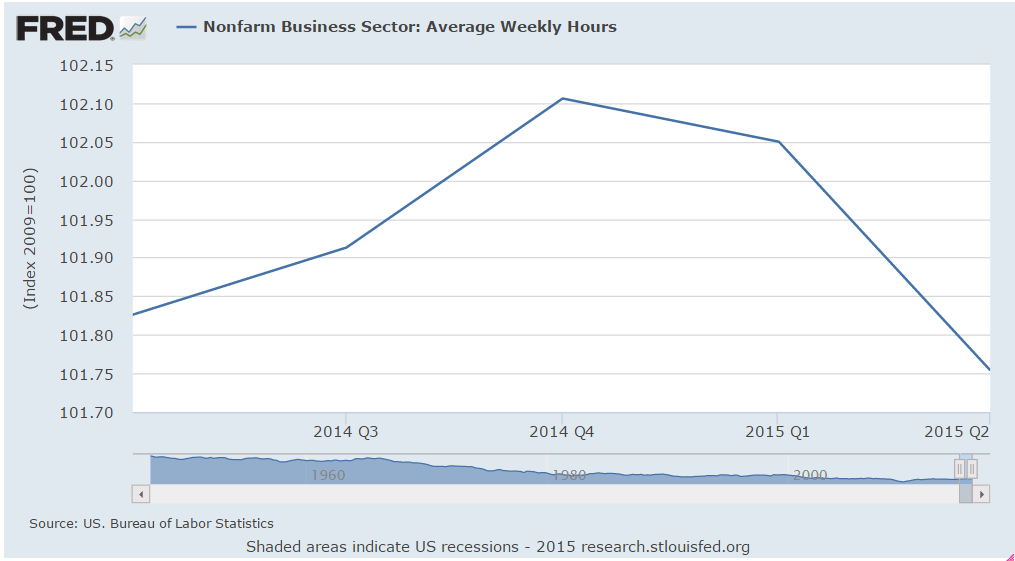

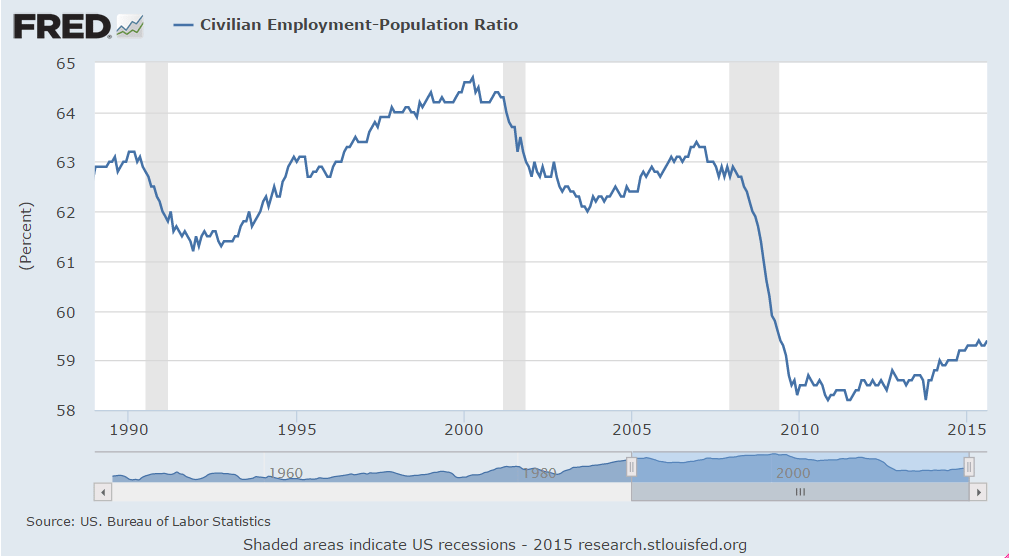

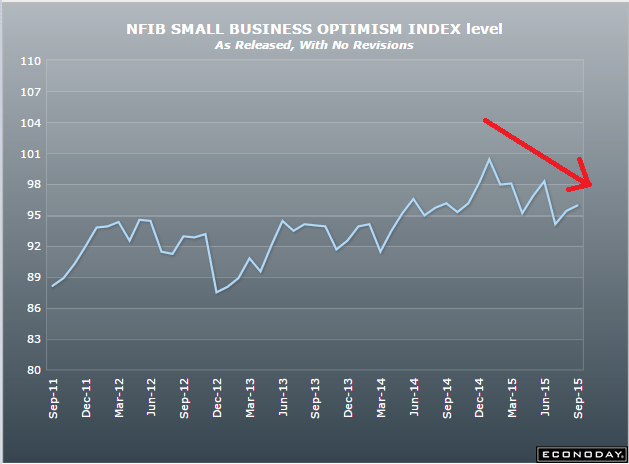

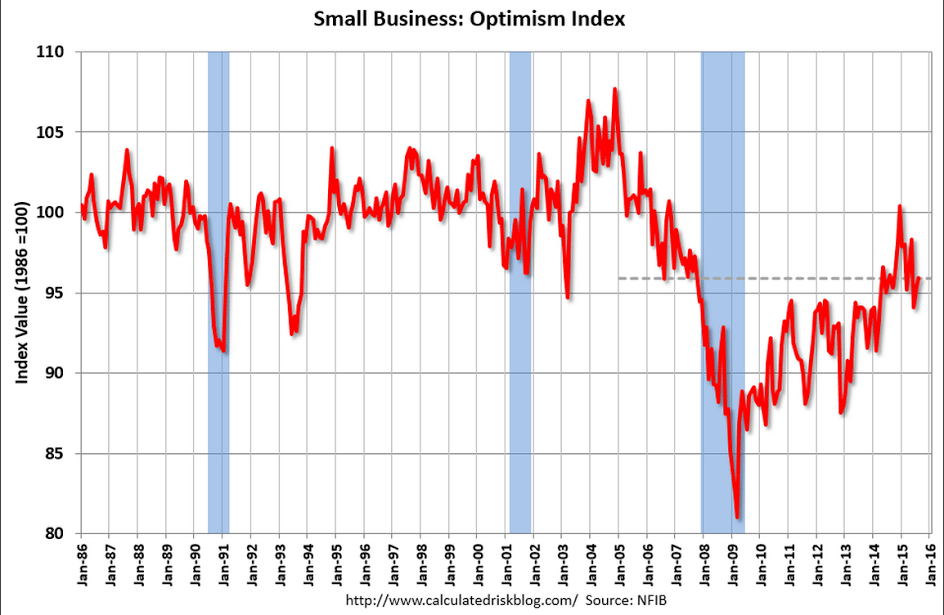

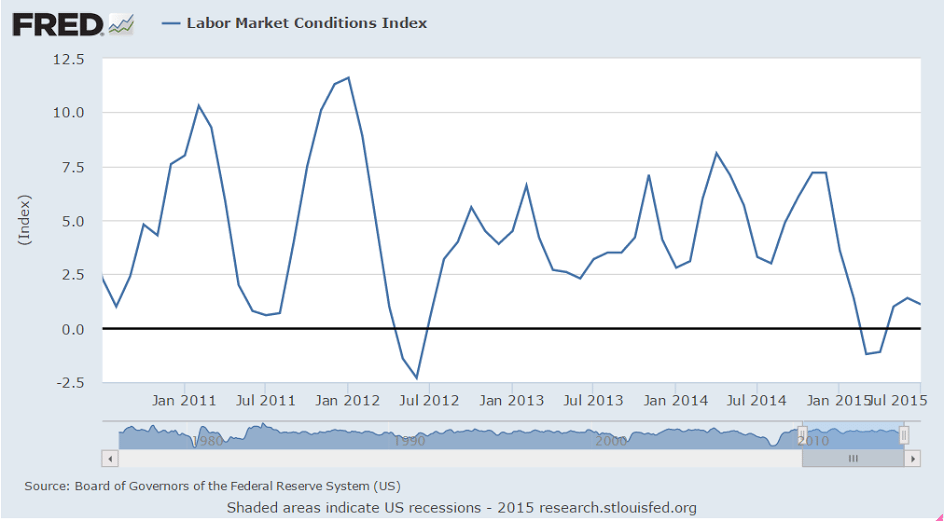

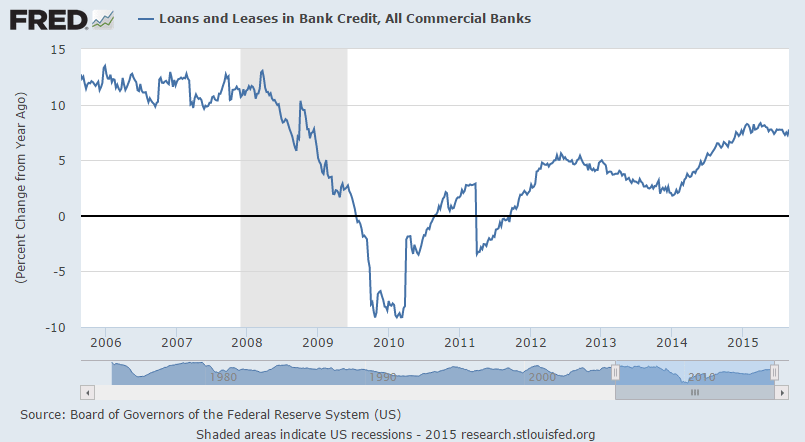

This is still going nowhere, and, most recently, trending lower, and obviously not responding positively to the ultra low rates of the last several years:

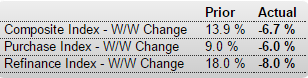

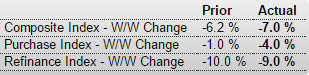

MBA Mortgage Applications

Highlights

After surging in the prior week following the FOMC’s decision against a rate hike, mortgage activity fell back in the September 25 week. The purchase index fell 6 percent in the week but still remains up strongly year-on-year, at plus 20 percent. The refinance index fell 8.0 percent in the week. Rates continued to move lower in the week with the average 30-year mortgage for conforming loans ($417,000 or less) down 1 basis point to an average 4.08 percent.

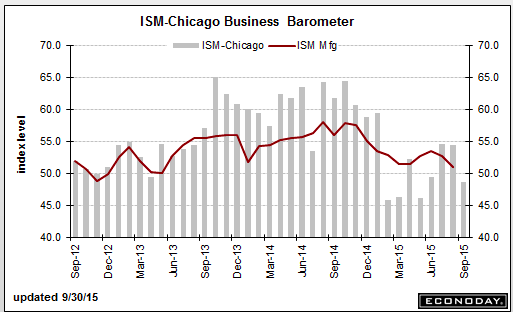

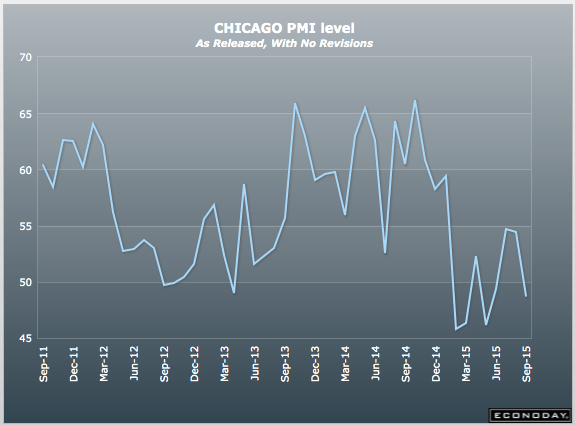

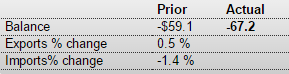

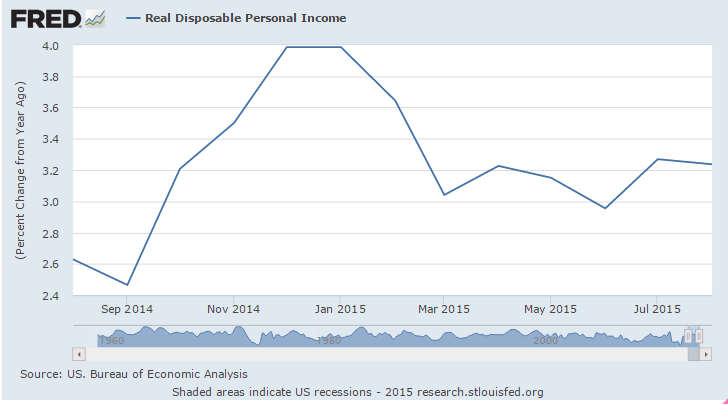

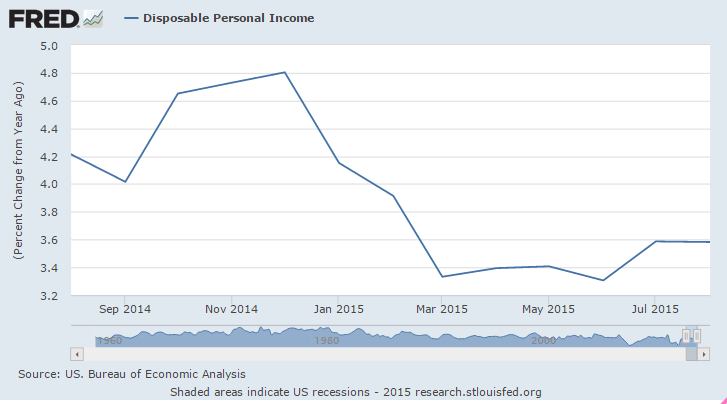

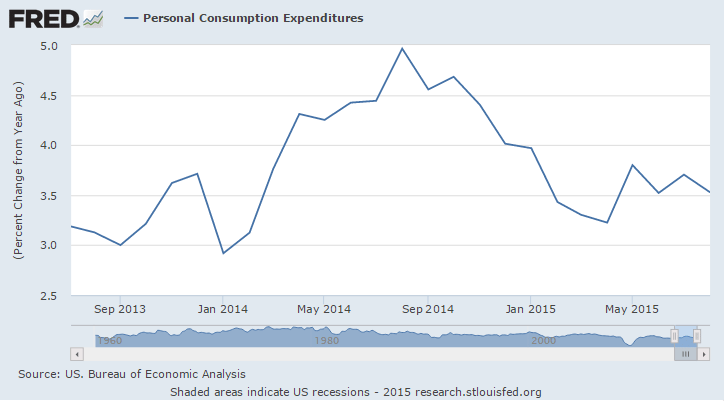

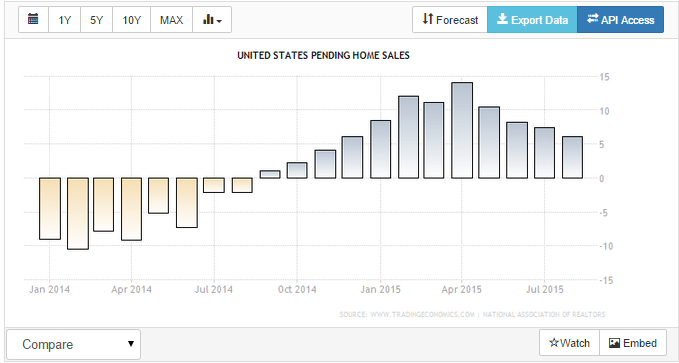

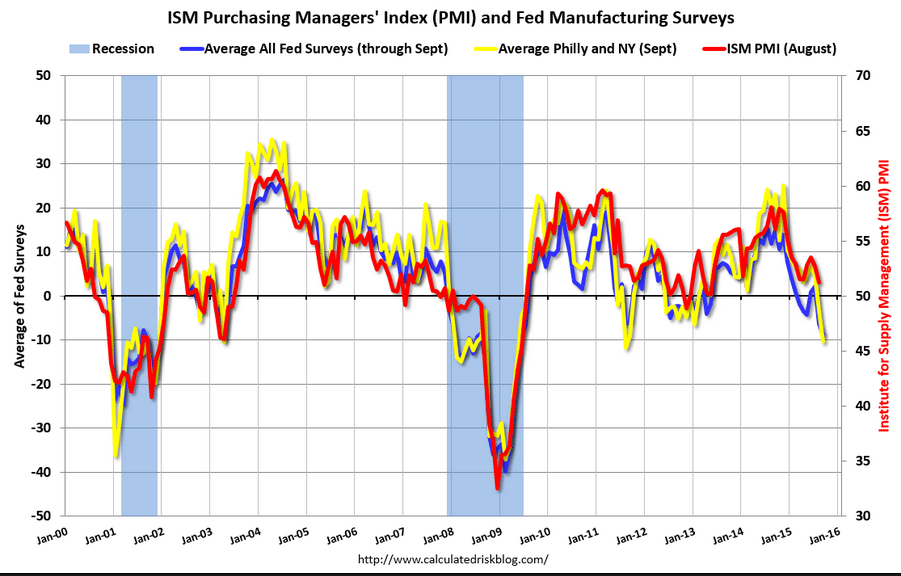

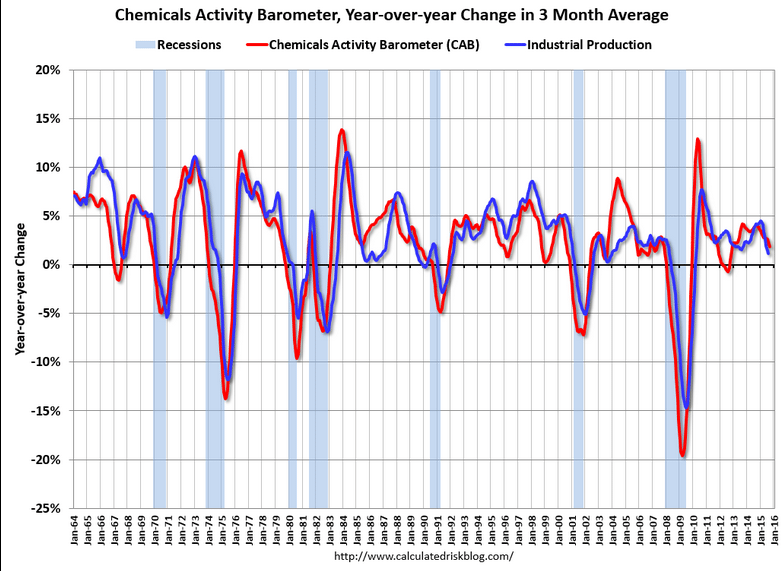

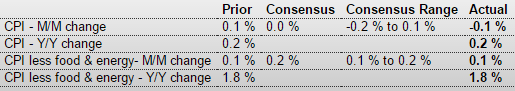

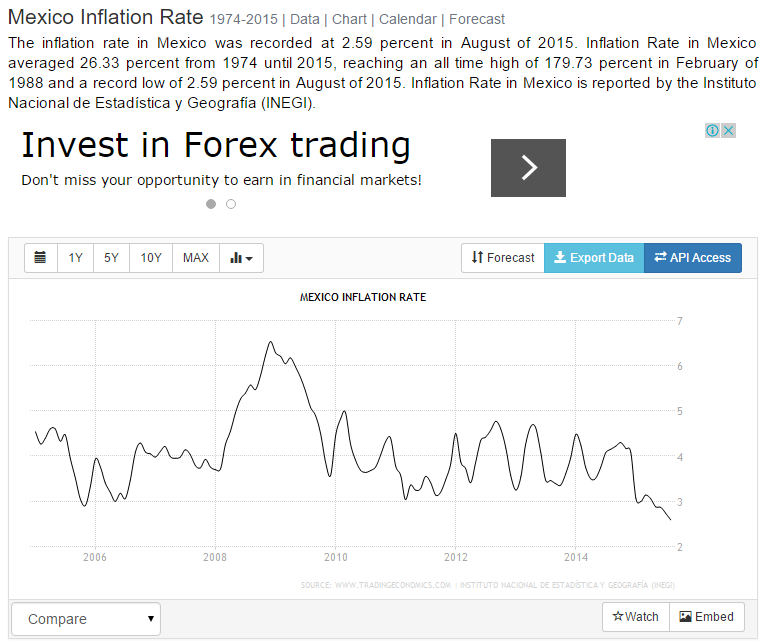

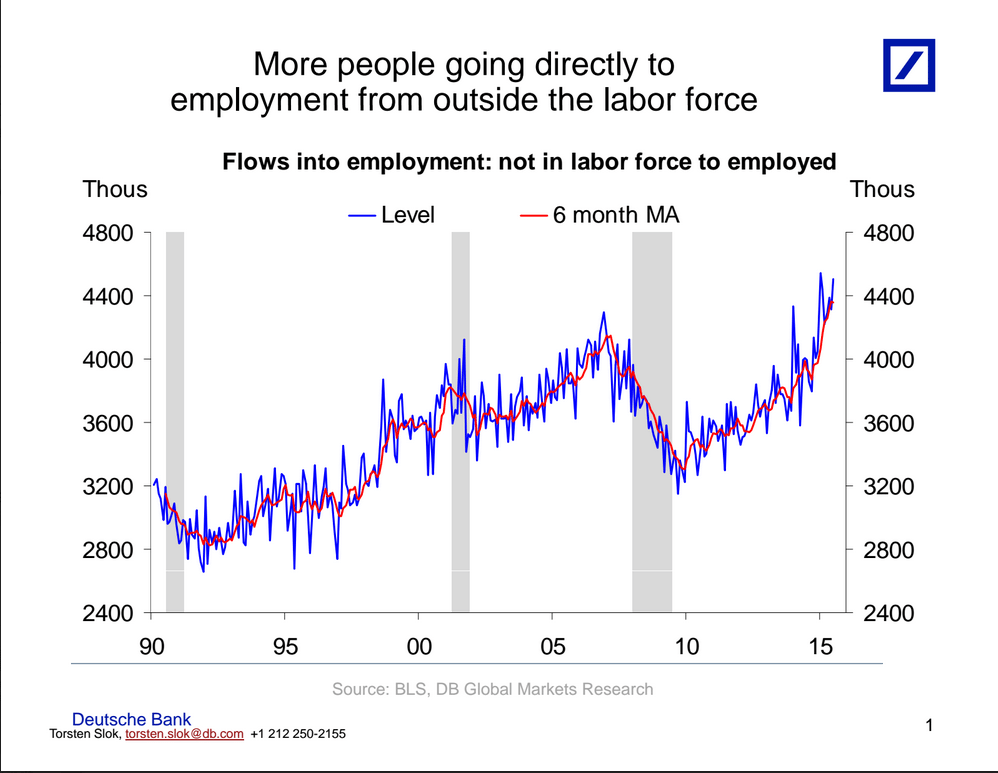

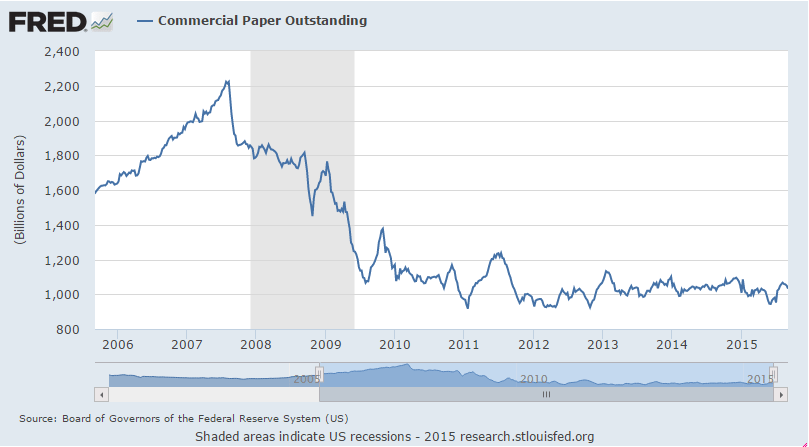

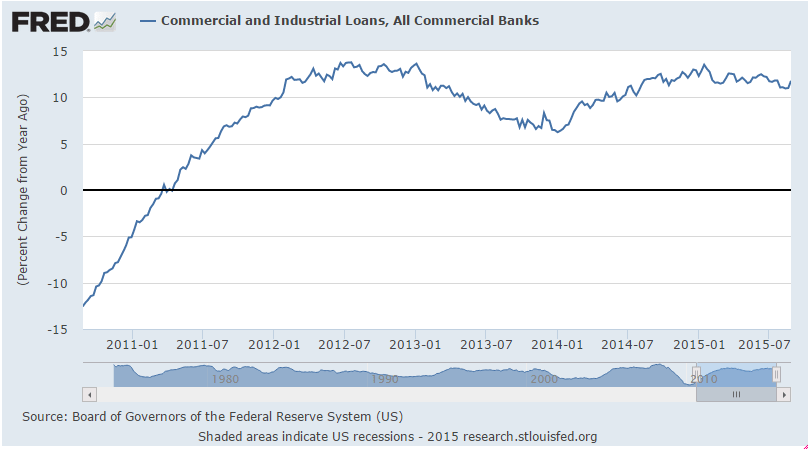

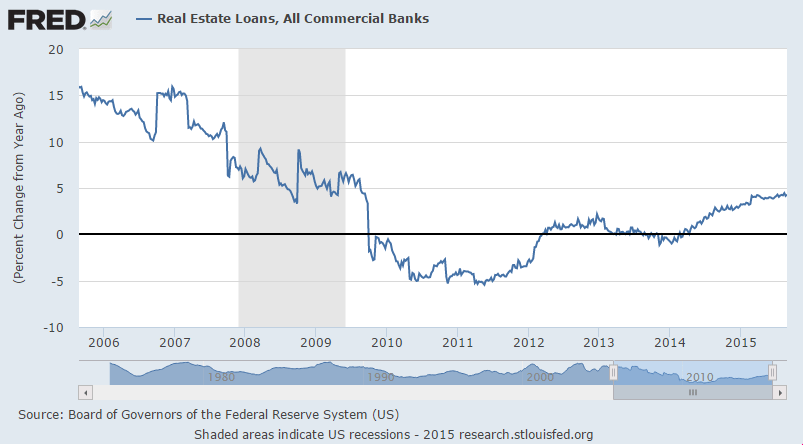

And note that it all went bad after the collapse in oil prices:

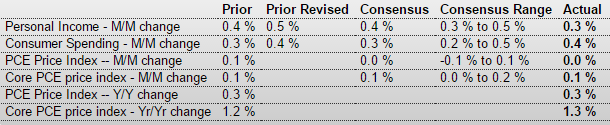

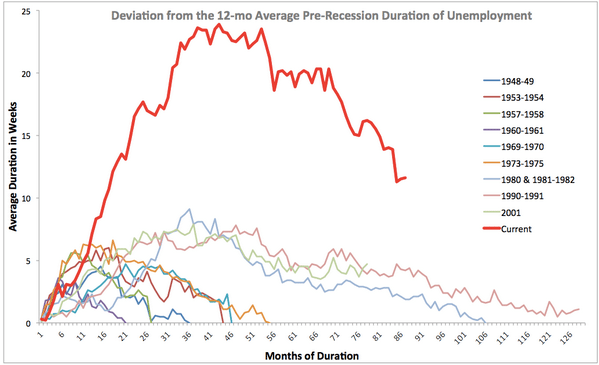

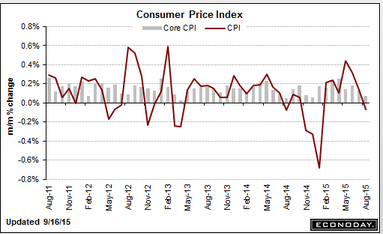

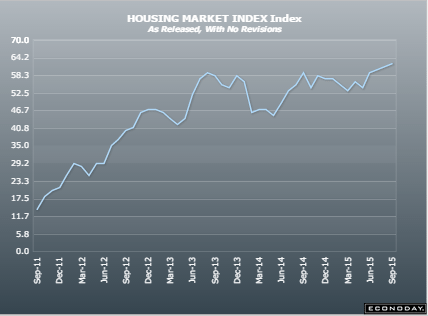

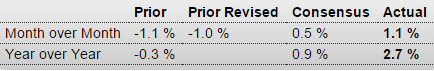

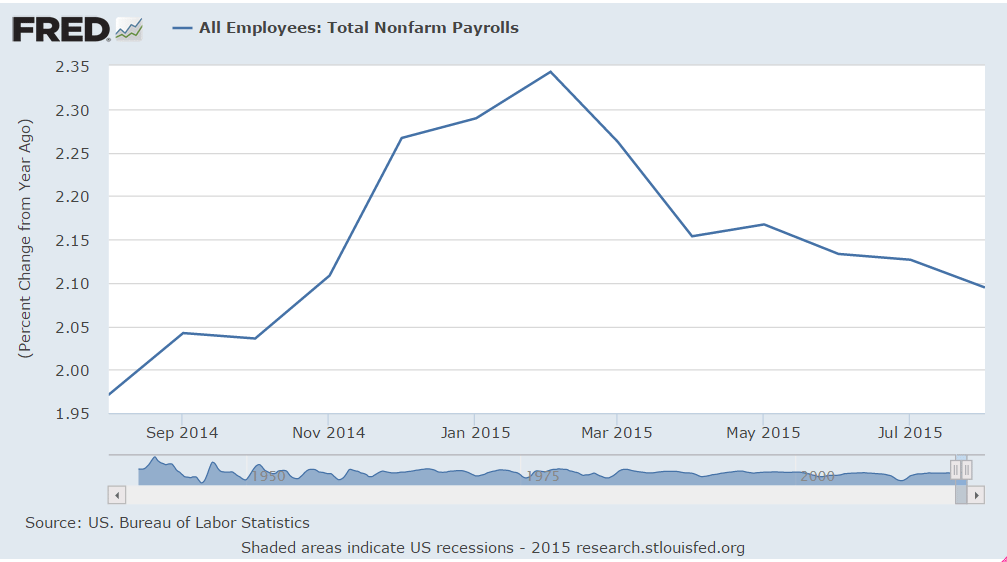

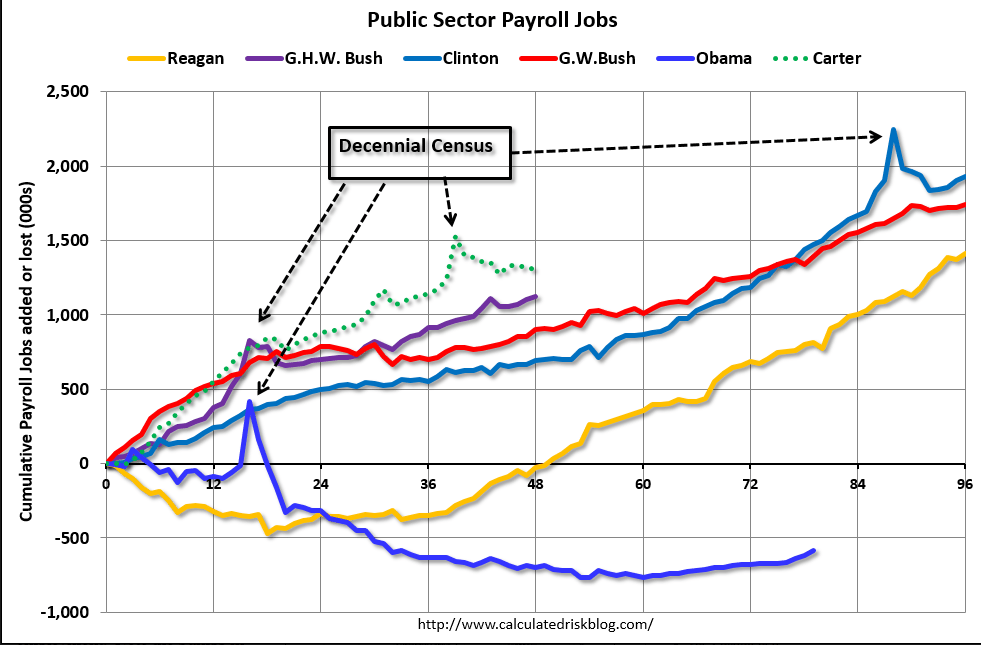

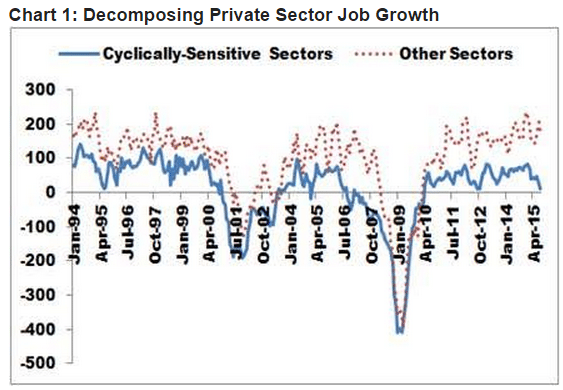

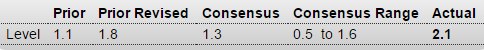

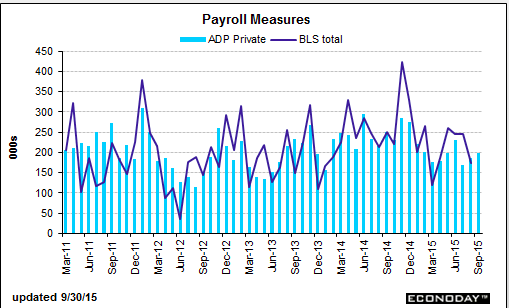

This is their forecast for Friday’s number, and the downward trend since November continues for both ADP and the BLS payroll series:

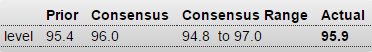

ADP Employment Report

Highlights

ADP’s call for Friday’s September employment report is on the high side but only slightly, at 200,000 for private payroll growth vs Econoday expectations for 190,000. ADP’s call for August, an initial 190,000 now revised to 186,000, proved much stronger than the initial government total of 140,000. Today’s result won’t likely shake up the outlook for Friday’s employment report where another month of moderate improvement is expected.

From ADP:

Goods-producing employment rose by 12,000 jobs in September, off from 15,000 the previous month. The construction industry added 35,000 jobs in September, almost double the 18,000 gained in August. Meanwhile, manufacturing dropped into negative territory losing 15,000 jobs in September, the worst showing since December 2010.

Revealing CNBC headline, as ultimately ‘purchasing power parity’ does hold. That is, high inflation means the value of the currency is falling, and longer term currencies that experience high inflation depreciate vs currencies with low inflation. That is, high inflation policy is not the stuff of strong currencies, regardless of interest rates.

So what the headline is implying, at best, is that the ECB policy response will be to lower rates/do more QE to promote inflation, and thereby weaken the currency. It is also probably implying that a lower rate and QE per se make

the euro weaker.

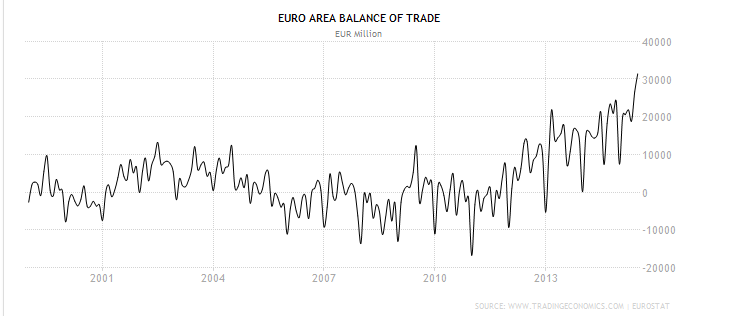

My narrative is a bit different. I see the deflation as further supporting the euro area’s record high and growing trade surplus, a force which fundamentally drives the euro higher, as non residents continuously sell their currencies to buy euro to pay for imports from the euro area. This ultimately drives the euro higher, as happened with the yen for the 2 decades it ran large and persistent trade surpluses, along with a zero rate policy, and far more QE than the ECB or the Fed has done.