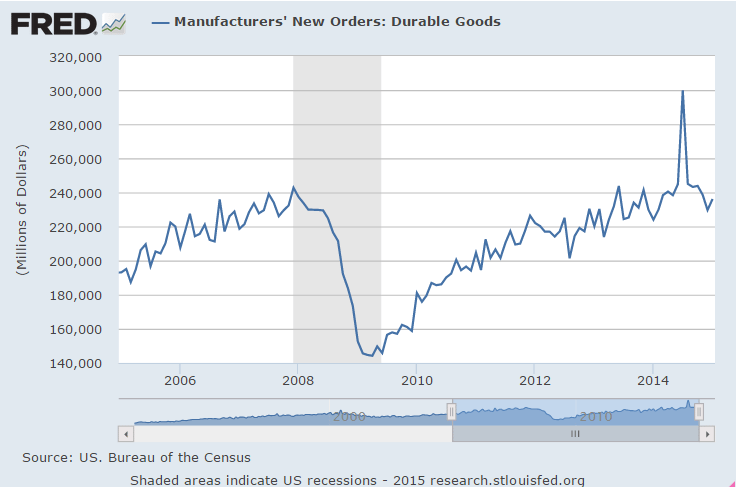

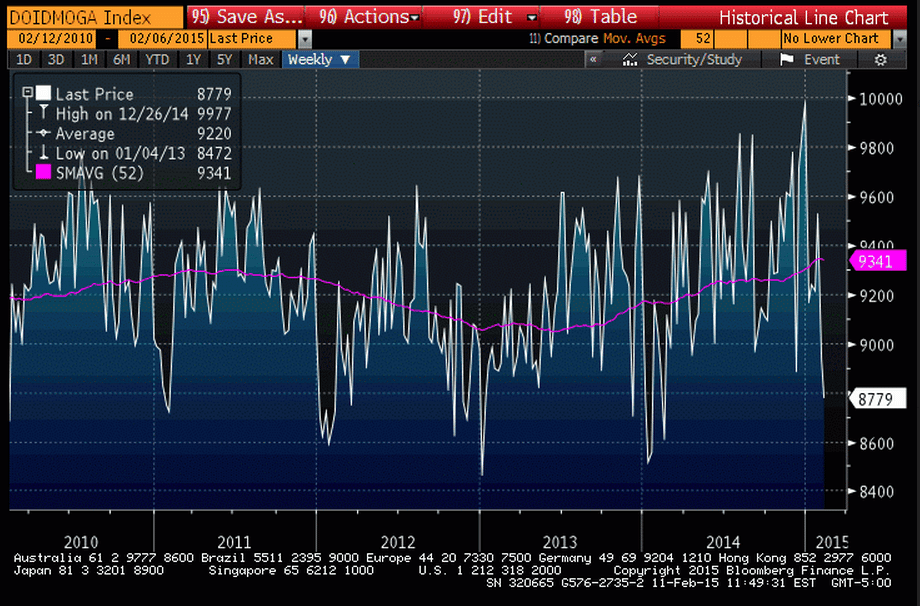

Another look at durable goods orders from earlier today:

From yesterday:

Category Archives: Housing

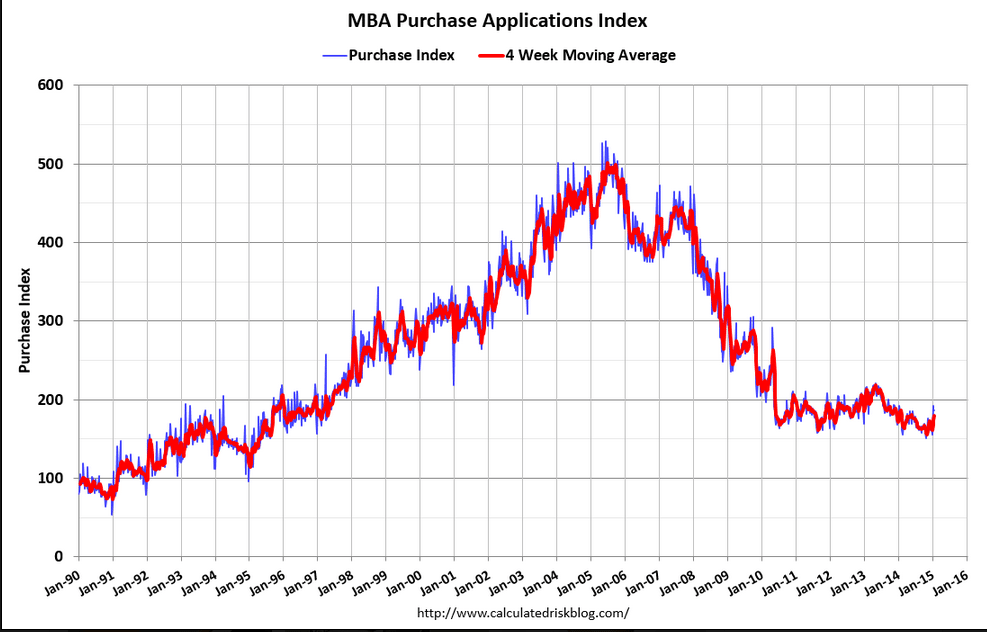

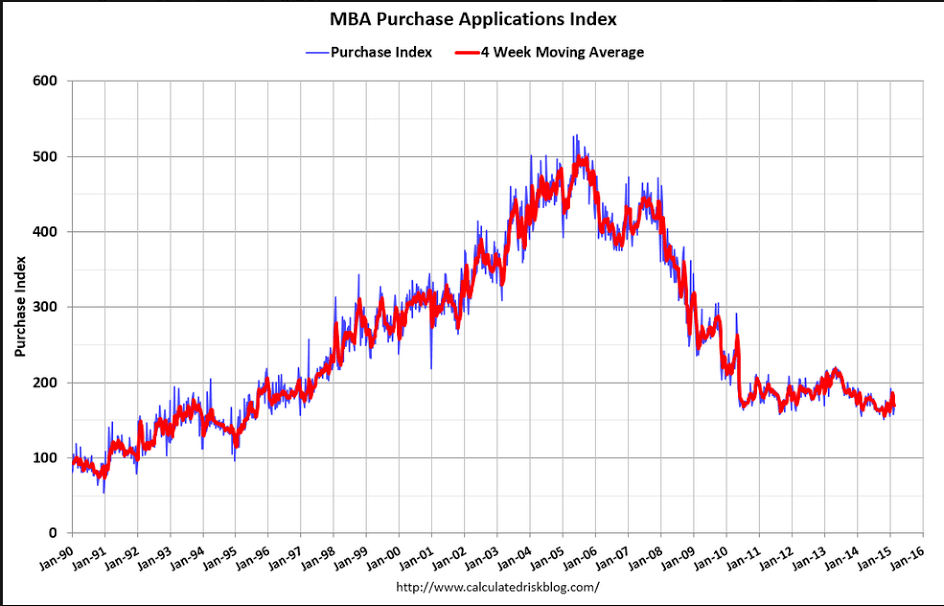

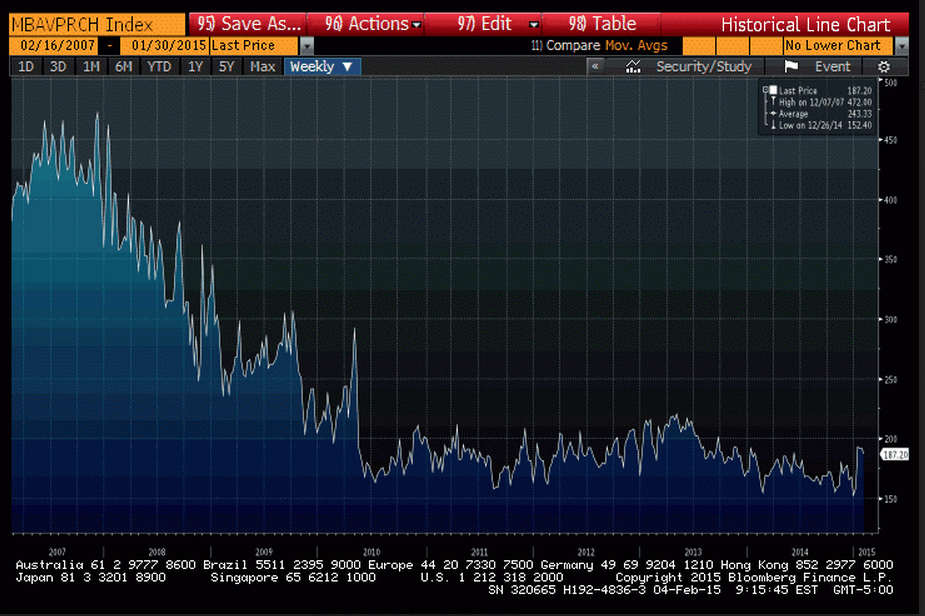

Mtg prch apps, New home sales

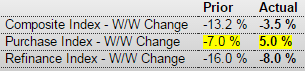

MBA Purchase Applications

Highlights

The purchase index ended 6 straight weeks of decline with a 5.0 percent rise in the February 20 week. Year-on-year, however, the index is in negative ground at minus 2.0 percent. The refinance index keeps falling, down 8.0 percent in the latest week for the 3rd straight large decline. Rates rose in the latest week with the average 30-year mortgage for conforming loans ($417,000 or less) up 6 basis points to 3.99 percent.

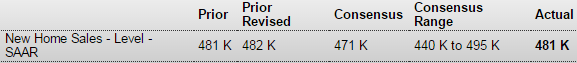

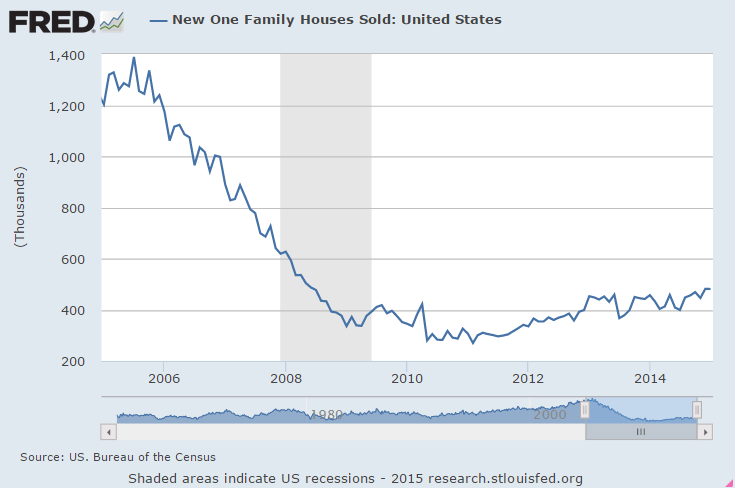

New Home Sales

Highlights

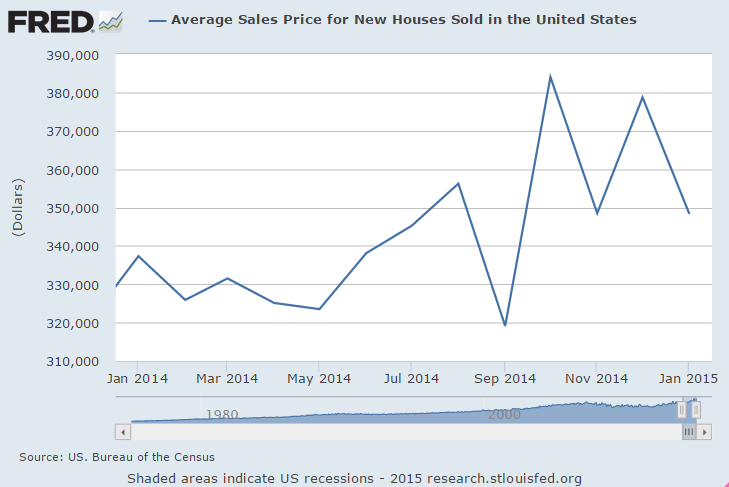

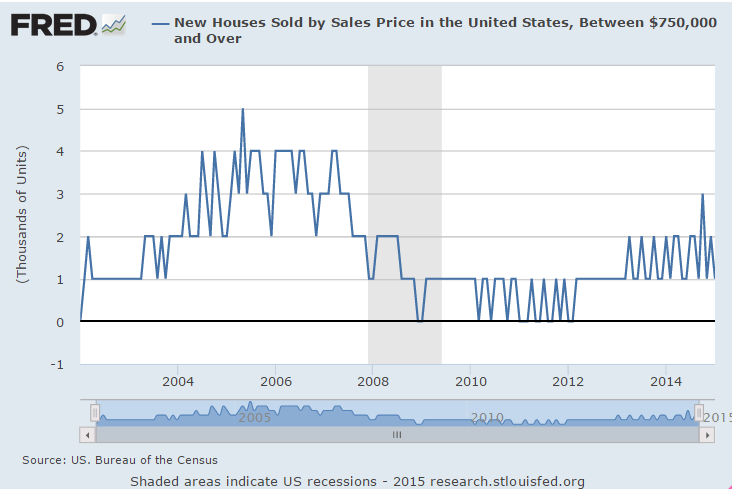

Sales of new homes in January, at a better-than-expected 481,000 annual pace, managed to hold onto December’s big surge when sales jumped 8.1 percent to 482,000 (revised). January’s strength is centered in what is by far the largest region, the South, where sales rose 2.2 percent. Sales slipped 0.8 percent in the West which is second, and a very distant second, in size to the South.Price concessions may have helped sales as the median fell 2.6 percent to $294,000. The dip is minor and the year-on-year median is still up significantly at plus 9.1 percent, but it does underscore price weakness in Monday’s existing home sales report.

Case-Shiller, Consumer confidence, Richmond Fed, pmi services

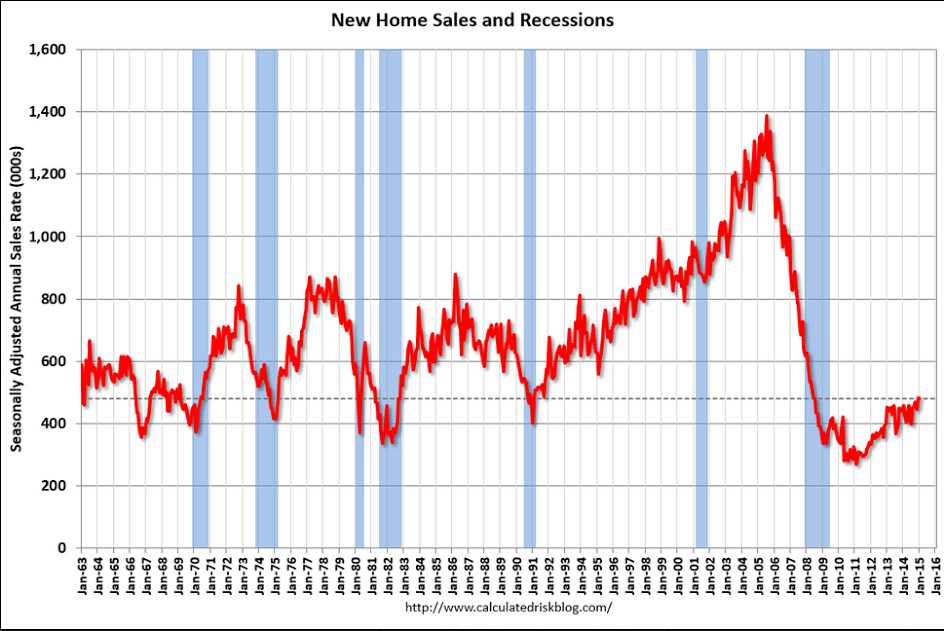

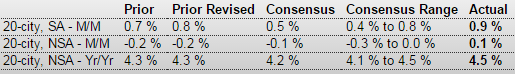

S&P Case-Shiller HPI

Highlights

Sales of existing homes may be slow but price traction is appearing, at least it did in December as Case-Shiller’s adjusted 20-city index shows a sharp month-on-month gain of 0.9 percent. This is the strongest monthly gain since March last year. Year-on-year growth, which had been slowing from the low double digits this time last year, is now leveling, at plus 4.5 percent vs November’s 4.3 percent which is the first gain for this reading since way back in November 2013.Consumer Confidence

Richmond Fed Manufacturing Index

Recent History Of This Indicator

The Richmond Fed manufacturing index slipped 1 point in January to plus 6. Growth in new orders, at 4, was steady but moderate while the draw in backlog orders picked up, to minus 9 from minus 5. Production, fed by the working down in backlogs, actually accelerated 5 points in the month to plus 10 but this pace can’t be sustained unless new orders pick up.PMI Services Flash

Highlights

A strong rebound in new work helped give a boost to Markit’s US service sector sample where the index rose to a 4-month high of 57.0. This compares with 54.2 in final January at 54.0 in the January flash.

Hiring is up this month in the sample as are backlogs. The outlook, however, is at a 4-month low, echoing similar weakness in last week’s Empire State and Philly Fed reports out of the manufacturing sector. Price readings remain low but did edge higher from January.

Existing home sales, Dallas Fed manufacturing, Chicago Fed

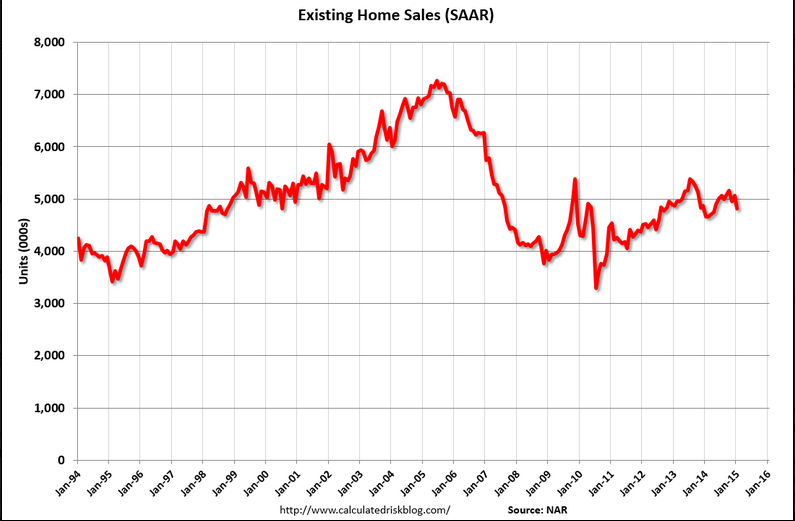

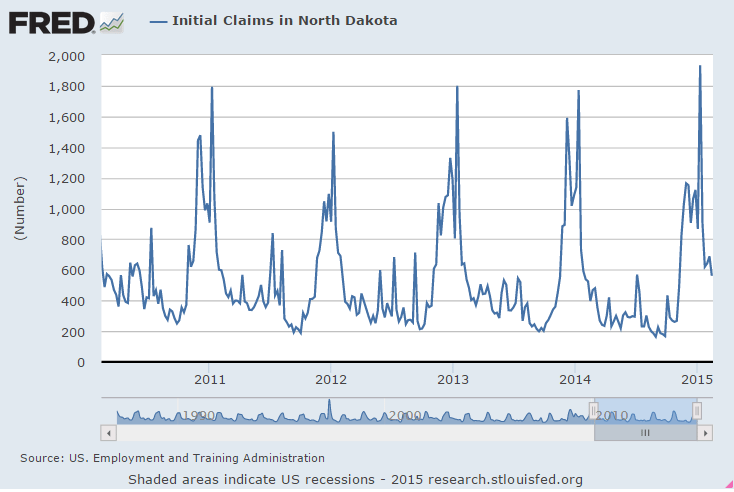

Again, with mtg purchase apps down and cash sales down why expect this to go up?

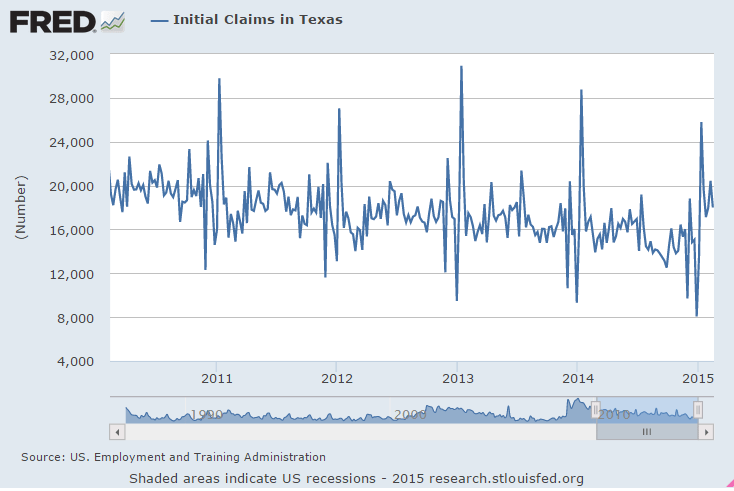

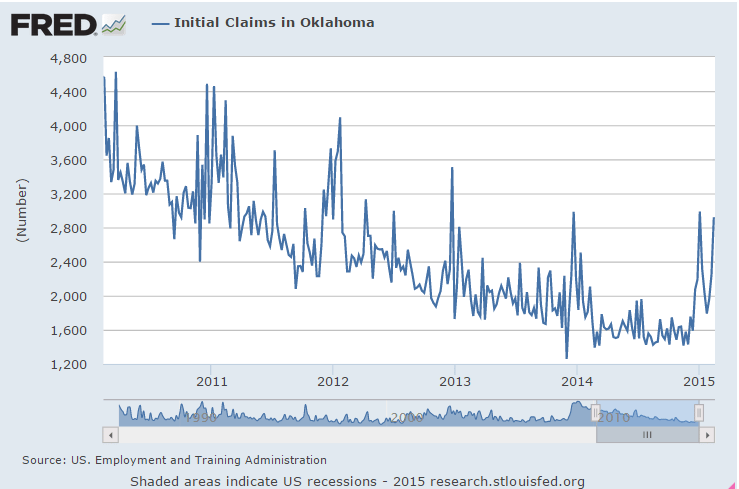

And with the oil credit expansion over it could get worse.

Existing Home Sales

Highlights

Despite a strong jobs market and low mortgage rates, demand for housing, whether for existing or new homes, remains flat. Sales of existing homes in January fell a very steep 4.9 percent to an annual rate of 4.82 million which is the lowest rate since April last year. All regions show single-digit declines with the West the deepest, at minus 7.1 percent. Declines hit both single-family homes, at minus 5.1 percent, and condos, at minus 3.5 percent.

Price concessions didn’t help the month’s sales with the median down 4.1 percent to $199,600. This is the first reading below $200,000 since March last year. The drop in sales made for a sizable rise in inventory relative to sales, to 4.7 months vs December’s 4.4 months.

The lack of sales punch has the National Association of Realtors wondering. The NAR says it’s “puzzled” that homeowners are now staying in their homes 10 years on average vs the long term average of 7 years, saying that homeowners may be happy with their mortgage rates and are perhaps doubtful that housing will rebound.

Dallas Fed Mfg Survey

Highlights

The latest regional Fed survey on manufacturing points to weakness in the manufacturing sector in February.

Texas factory activity posted a second month of no growth in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, remained near zero (0.7) and indicated output was essentially unchanged from January levels.

Other measures of current manufacturing activity reflected contraction in February. The new orders index pushed further into negative territory, coming in at minus 12.2, its lowest reading since June 2009. The shipments index fell to minus 3.3, also reaching a low not seen since 2009. The capacity utilization index turned negative as well, dropping from 5.1 to minus 4.9.

Perceptions of broader business conditions remained rather pessimistic this month. The general business activity index moved further negative to minus 11.2, posting its lowest reading in nearly two years. The company outlook index remained slightly negative and edged down from -3.8 to -4.4.

Labor market indicators reflected only minor employment growth and slightly shorter workweeks. The February employment index moved down from 9 to 1.3. Fifteen percent of firms reported net hiring, compared with 14 percent reporting net layoffs. The hours worked index edged further into negative territory, coming in at minus1.6.

Prices fell slightly in February and upward pressure on wages continued to ease. The raw materials prices index held steady at minus1.7, indicating marginal downward pressure on input costs. The finished goods prices index was also slightly negative but edged up from minus 6.7 to minus 4.4. Manufacturers are no longer expecting sizeable price increases six months ahead, as the indexes of future prices were in single digits this month, down markedly from 2014 readings. The wages and benefits index edged down for a second month in a row and came in at 16.8.

Expectations regarding future business conditions rebounded somewhat in February. The index of future general business activity shot up 12 points to 5.5 after posting a negative reading in January. The index of future company outlook rose nearly 10 points to 11.8, although it remains well below the index level seen throughout 2014. Indexes for future manufacturing activity showed mixed movements in February but remained in solidly positive territory.

The latest Dallas Fed report plays into the hands of the doves on the FOMC. Manufacturing activity is weak and inflation pressures are non-existent currently. It will be interesting to hear Dallas Fed president Richard Fisher’s comments in speech since he has been hawkish. Fed chair Janet Yellen will be speaking to Congress this Tuesday and Wednesday and likely will comment on sector strengths and weakness and on price pressures.

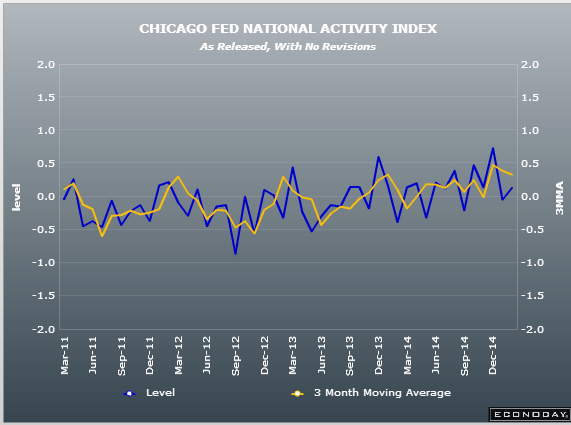

Chicago Fed National Activity Index

Highlights

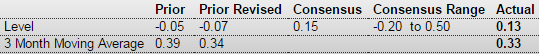

January was a good month for the economy based on the national activity index which jumped back into the plus column, to 0.13 from December’s revised minus 0.7. The 3-month average is very strong, little changed at plus 0.33.

The big swing factor for January is production-related indicators which rose to plus 0.02 from December’s minus 0.22 in a gain driven by a swing higher for industrial production. The negative reading from consumption & housing improved to minus 0.10 from minus 0.13 while the contribution from sales/orders/inventories held unchanged at plus 0.03. Employment remains a big plus but, due to a tick higher for the unemployment rate to 5.7 percent, a little less so, at plus 0.18 from plus 0.28.

Greek bank liquidity, Fed minutes, Architecture Billings Index

As previously discussed, and relayed to the finance minister in Greece, there is no reason to assume the ECB will cut off liquidity to Greek banks.

First, those banks are private institutions, and regulated and supervised by the ECB, who has deemed them ‘solvent’ and ‘adequately capitalized’ and therefore eligible for liquidity support as members in good standing.

Think of it this way, if NY went rogue, would the Fed cut off Citibank?

ECB extends liquity for Greek banks: Report

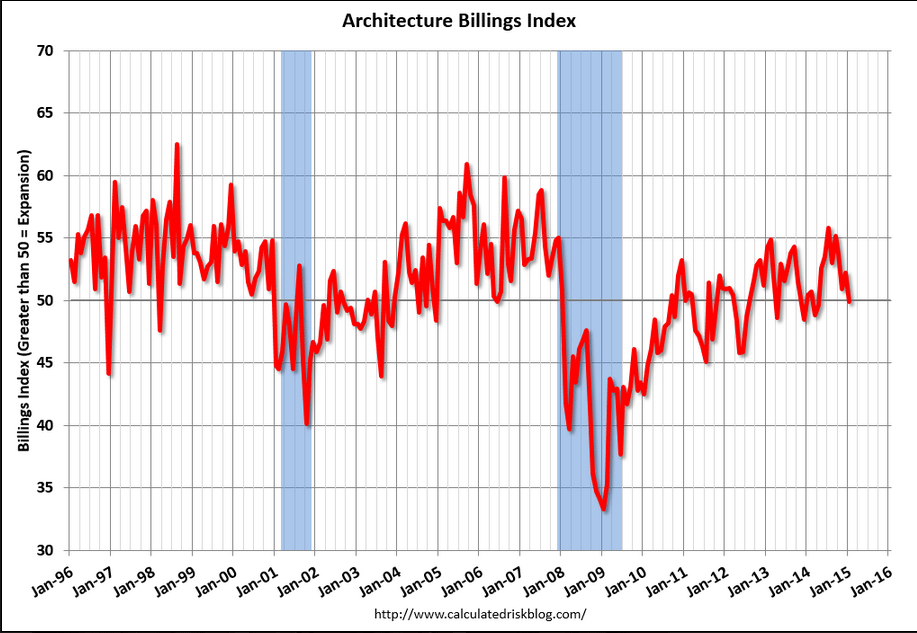

Seems the last thing the Fed wants to do now is engineer higher mtg rates and set back the anemic housing markets.

Sort of like Bernanke did just before housing turned south and has yet to recover…

Federal Reserve minutes indicate no rush to raise interest rates

Below 50, not good:

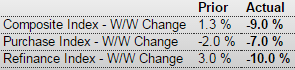

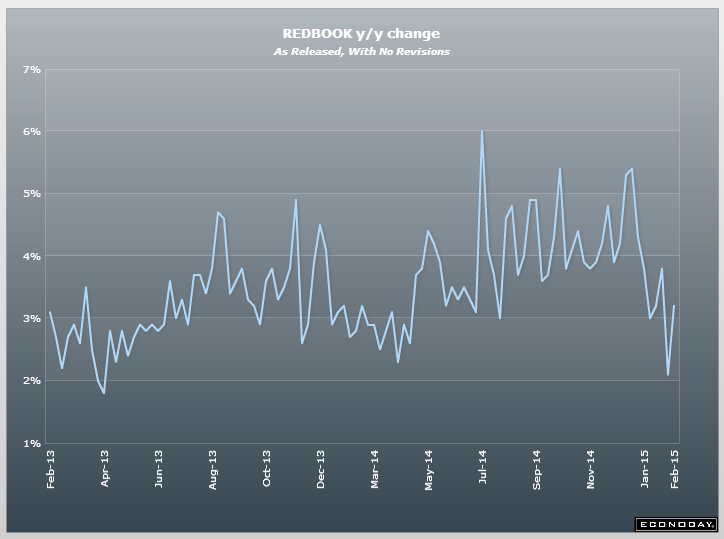

mtg prch apps, housing starts, Producer prices, Redbook retail sales

More bad housing news:

MBA Purchase Applications

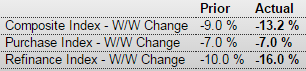

Highlights

The purchase index is down for a 5th straight week, 7.0 percent lower for the 2nd consecutive week. Rates have been rising in recent weeks including the latest week which is especially depressing refinancing activity where the index fell a very sharp 16.0 percent following the prior week’s 10 percent fall. The report notes that demand for larger refinancing loans is especially down.

The average mortgage for conforming loans ($417,000 or less) rose 9 basis points in the week to 3.93 percent. The decline in the purchase index is a negative signal for underlying home sales.

More bad housing news:

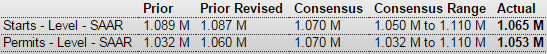

Housing Starts

Highlights

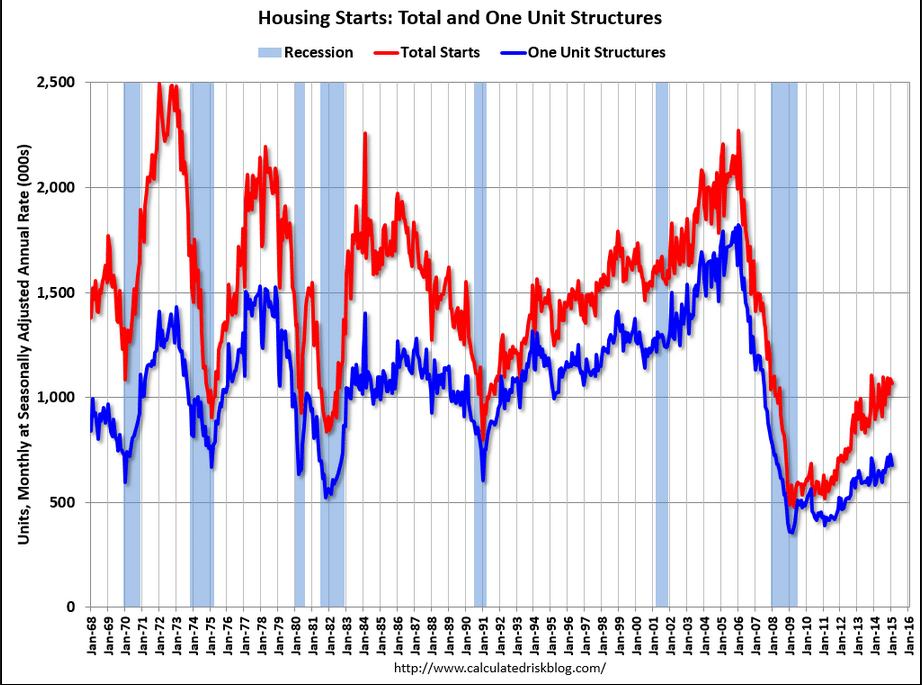

Housing is not adding to economic momentum. Housing starts slipped in January on weakness in single-family starts. Housing starts declined 2.0 percent in January after a 7.1 percent jump the month before. The 1.065 million unit pace was up 18.7 percent on a year-ago basis. Expectations were for a 1.070 million pace for January.

Single-family permits dropped 6.7 percent after a 7.9 percent boost in December. Multifamily starts gained 7.5 percent, following a 5.6 percent rise in December.

Again, permits suggest that housing activity is muted. Housing permits dipped 0.7 percent, following no change in December. The 1.053 million unit pace was up 8.1 percent on a year-ago basis. The market consensus was for a 1.070 million unit pace.

The bottom line is that housing is not adding to economic activity. This means the Fed likely will continue to reinvest mortgage-backed securities to keep rates low. But the long-term trend appears to be that single-family housing is not viewed as strong an investment as in the past.

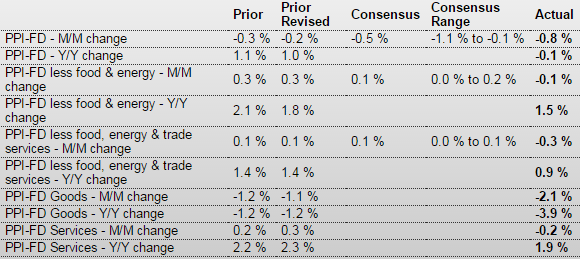

PPI-FD

Highlights

The PPI for total final demand decreased 0.8 percent after falling 0.2 percent in December. The consensus forecast a 0.5 percent drop. A sharp drop in energy pulled the headline number down. Excluding food and energy, producer price inflation slipped 0.1 percent after firming 0.3 percent the month before. Expectations were for a 0.1 percent rise.

The index for final demand goods fell 2.1 percent after dropping 1.1 percent in December. The January decrease was led by prices for final demand energy, which fell a monthly 10.3 percent. The decline in prices for final demand goods was led by the index for gasoline, which dropped 24.0 percent. Prices for diesel fuel, jet fuel, basic organic chemicals, dairy products, and home heating oil also moved lower. Conversely, the index for residential electric power moved up 1.2 percent. Prices for pharmaceutical preparations and for fresh and dry vegetables also advanced. Prices for final demand foods decreased 1.1 percent after slipping 0.1 percent in December.

The index for final demand services eased 0.2 percent after advancing 0.3 percent in December. In January, prices for final demand services less trade declined 0.3 percent after rising 0.1 percent the month before. This was the first decline since falling 0.3 percent in September 2014. In January, a major contributor to the decline in the index for final demand services was prices for outpatient care (partial), which fell 0.7 percent.

On a seasonally adjusted year-ago basis, PPI final demand was down 0.1 percent, compared to up 1.0 percent in December. Excluding food & energy, PPI final demand was up 1.5 percent versus 1.8 percent the month before.

Overall, inflation at the manufacturers’ level is muted even after discounting energy declines. The Fed is likely to see the numbers as allowing delayed rate increases.

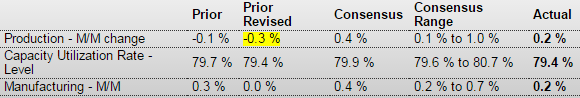

And yet another disappointing report:

Highlights

The industrial sector turned modestly positive in January-including for the manufacturing component. Industrial production for January rebounded 0.2 percent after a December decrease of 0.3 percent. Market expectations were for a 0.4 percent boost for January.

Manufacturing rose 0.2 percent in January after no change the month before. But the negative is that December manufacturing was revised down from a 0.3 percent gain. The manufacturing increase fell short of the 0.4 percent market forecast.

Manufacturing output rose 0.2 percent in January, as the production of durable goods advanced 0.4 percent and the production of nondurable goods was unchanged. Gains were posted by all major durable goods industries except motor vehicles and parts, aerospace and miscellaneous transportation equipment, and furniture and related products. Increases of more than 1.0 percent were recorded in the production of primary metals and of computer and electronic products. Among the major nondurable goods industries, gains in the indexes for apparel and leather, for chemicals, and for plastics and rubber products offset losses elsewhere. The production of other manufacturing industries (publishing and logging) moved down 0.4 percent.

Mining dropped 1.0 percent in January after a 2.1 percent jump the prior month. Utilities made a partial rebound of 2.3 percent after plunging 6.9 percent in December.

Overall capacity utilization was unchanged at 79.4 percent.

The biggest news from this report was the downward revision to December. Manufacturing is still sluggish although on a barely positive uptrend.

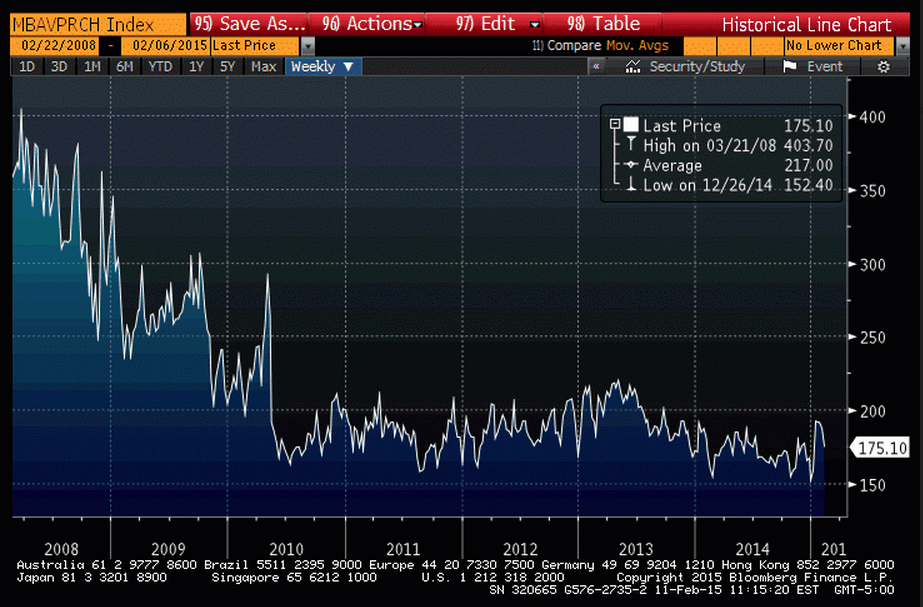

mtg purchase apps down again, Earnings, Greece chart, gasoline demand

Not good. Purchase apps back down to depressed levels after a dip in front of govt mortgage fee cuts followed by a small blip up after the cuts, and up only 1% from last year’s cold winter depressed levels:

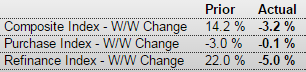

MBA Purchase Applications

Highlights

The purchase index fell 7.0 percent in the February 6 week for the 4th straight fall but still remains in the plus column on a year-on-year basis, but only by plus 1.0 percent. The refinance index, which unlike the purchase index has been showing life, fell back 10.0 percent in the week. Rates have been very low but did move higher in the week, up 5 basis points to an average 3.84 percent for conforming loans ($417,000 or less).

4Q14 earnings season is winding down and growth is slowing. After running close to +5% on a YoY basis, S&P operating earnings growth is now down to 3.5% and revenue growth is down to 1.3%

Gasoline demand down this week but may be moving up slightly vs last year but hard to say underlying demand is higher given last year’s extra cold winter

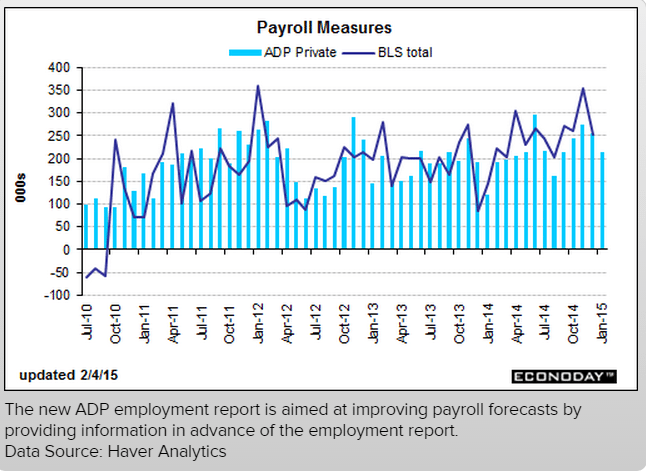

Mtg purchase apps, ADP, ISM

Looks like a dip anticipating lower gov fees a few weeks ago, followed by a blip up after, then returning to ‘trend’

Still very low:

A bit lower than expected, but last month revised up a bit. Remember, this is a forecast of Friday’s release, not actual hard numbers:

ADP Employment Report

Highlights

ADP sees slowing in job growth for January, to a lower-than-expected 213,000 for private payrolls vs the Econoday consensus for 220,000 and against ADP’s upwardly revised 253,000 for December (initial estimate 241,000). Turning to government data, the corresponding Econoday consensus for Friday’s jobs report is 229,000 vs December’s 240,000.

The 213,000 increase for January is the lowest since September which was also 213,000. Increases in ADP’s data from October to December averaged 257,000. By industries, the largest percentage gain for January comes from construction, up 0.3 percent or 18,000 jobs, and the lowest from manufacturing, up 0.1 percent or 14,000 jobs, and financial activities, also up 0.1 percent or 10,000 jobs.

Mark Zandi, chief economist of Moody’s Analytics, said, “Employment posted another solid gain in January, although the pace of growth is slower than in recent months. Businesses in the energy and supplying industries are already scaling back payrolls in reaction to the collapse in oil prices, while industries benefiting from the lower prices have been slower to increase their hiring. All indications are that the job market will continue to improve in 2015.”

ISM Non-Mfg Index

Recent History Of This Indicator

The composite index from the ISM non-manufacturing survey at 56.2 for December slowed substantially from November’s unusually strong 59.3. Details showed particular slowing in business activity, down 7.2 points to 57.2, followed by slowing in new orders, down 2.5 points to 58.9. A plus was respectable strength for employment, down only 7 tenths to 56.0. Prices paid, reflecting lower fuel costs, fell 4.9 points to 49.5 for the first sub-50 reading since September 2009.

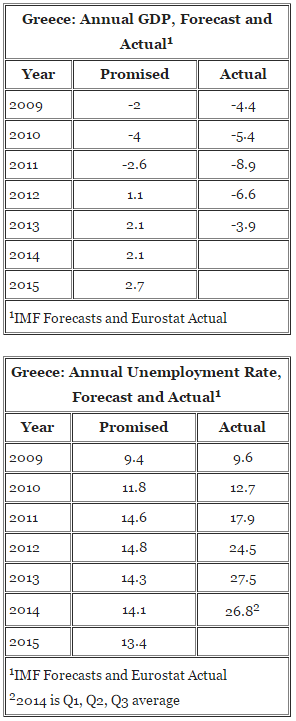

Jobless claims, Pending home sales, Danish CB cuts rate to -.5%, comments on Greece, Canada job losses, Shell capex cut, Gasoline and utility demand soft

Jobless Claims 265k, -43k to 15-Year Low in Holiday Week.

This is the lowest level for initial claims since April 15, 2000 when it was 259,000. The previous week’s level was revised up by 1,000 from 307,000 to 308,000. The 4-week moving average was 298,500, a decrease of 8,250 from the previous week’s revised average.

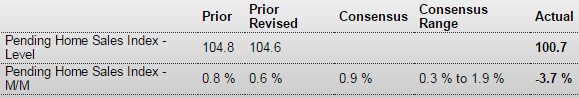

Pending Home Sales Index

Highlights

Indications on housing had been turning up — but not after today’s pending home sales index which fell a very steep 3.7 in December. A decline was not expected at all with the result far underneath the Econoday low estimate for plus 0.3 percent. All regions show single digit declines in the month including the two most closely watched regions, the South (down 2.6 percent) and the West (down 4.6 percent).

Final sales of existing homes did pop higher in last week’s report for December but amid a still flat trend. Today’s pending sales report doesn’t point to any improvement, which is a bit of a mystery given how low mortgage rates are and how strong the job market is.

Another CB ‘raises taxes’:

*DANISH CENTRAL BANK CUTS DEPOSIT RATE TO -0.5% FROM -0.35%

Reads like a showdown brewing.

Greece won’t be able to fund itself in euro and will bounce checks without at least implied ECB support. That leaves going back to their own new currency, which carries the usual high risks of mismanagement by leadership that gets in it way over their heads, etc. That is, even with its own currency Greece has been ‘in crisis’ with unemployment, inflation, and interest rates all in double digits along with the corresponding currency depreciation. And it would fundamentally be a ‘strong euro’ bias, as Greek euro debt and bank deposits would likely vanish.

Eurozone May Not Blink First in Confrontation With Greece (WSJ) Alexis Tsipras has been prime minister of Greece for only 48 hours and has done little to back his claim of wanting to keep his country in the eurozone. His strategy appears to be to put himself at the head of a Europe-wide leftist assault against “austerity,” playing to an anti-German gallery in the hope of isolating Berlin. Mr. Tsipras and his finance minister have already been in contact with leftist governments in France and Italy. Madrid is clear that any deal with the Greek leader must be based on reform commitments at least as tough as those demanded of former Prime Minister Antonis Samaras. Anything less would represent a win for Mr. Tsipras and fuel support for Spain’s own new radical leftist party, Podemos.

Greece Moves Quickly to Roll Back Austerity (WSJ) Prime Minister Alexis Tsipras said “our priority is to support the economy, to help it get going again. We are ready to negotiate with our partners in order to reduce debt and find a fair and viable solution.” Government ministers said that the planned sale of the state’s 67% stake in the main port of Piraeus had been halted, that Greece would freeze the planned restructuring and sell off the country’s dominant, state-controlled utility company, and that the government would reverse some of the thousands of layoffs imposed as part of the bailout. Labor Minister Panos Skourletis also said that an increase to Greece’s basic wage will be among the first bills the government will submit to parliament.

Oil capex cuts continue:

Canada December Job Losses Deeper After Revisions (WSJ) The Canadian economy shed 11,300 net jobs last month instead of the 4,300 decline reported earlier in January, Statistics Canada said. December’s jobless rate was 6.7%, compared with the previously estimated 6.6%. Adjusted to U.S. concepts, the jobless rate was 5.7% last month, compared with 5.6% south of the border, Statistics Canada said. Net job creation in Canada for all of 2014 totaled 121,300 positions, the lowest level since the country posted a net loss in jobs in 2009, at the height of the global recession.

Shell oil:

The $15 billion spending cut, which will involve cancelling and deferring projects through 2017, which would represent a 14 percent cut per year from 2014 capital investment of $35 billion.

Reflecting the new oil price environment, Shell, having said in October it would keep its 2015 spending unchanged, announced it would have to cut what is one of the largest capital investment programmes in the industry.

“Shell is considering further reductions to capital spending should the evolving market outlook warrant that step, but is aiming to retain growth potential for the medium term,” it said in a statement.

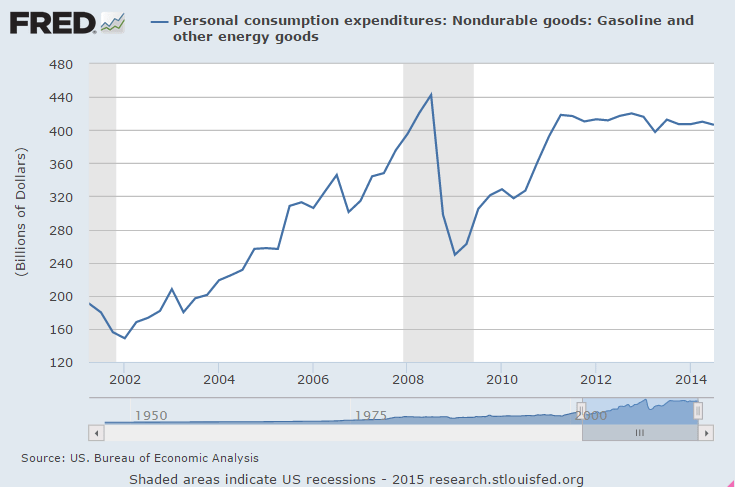

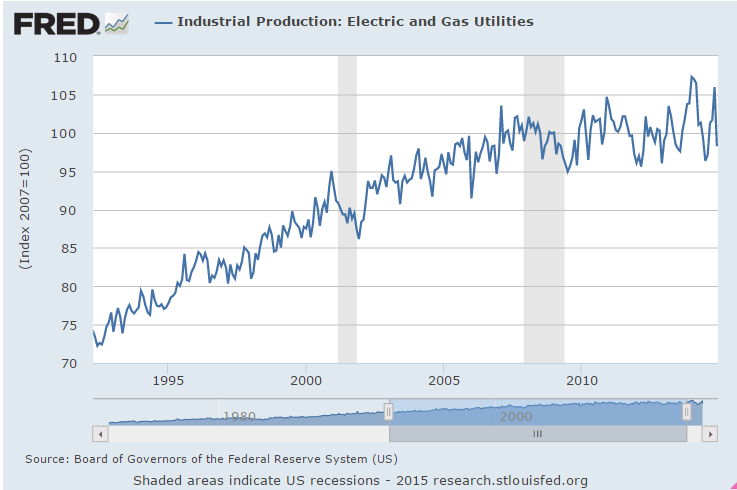

No sign yet of US gasoline or electric consumption materially increasing:

mtg purchase apps

Now up 1% vs last year which was hit by the cold weather:

MBA Purchase Applications

Highlights

Mortgage applications for home purchases were flat in the January 23 week, down 0.1 percent for a year-on-year rate of plus 1.0 percent. Refinancing applications fell 5.0 percent in the week. Rates remain very low but did edge higher in the week, up 3 basis points for an average 30-year fixed loan to 3.83 percent for conforming balances ($417,000 or less).