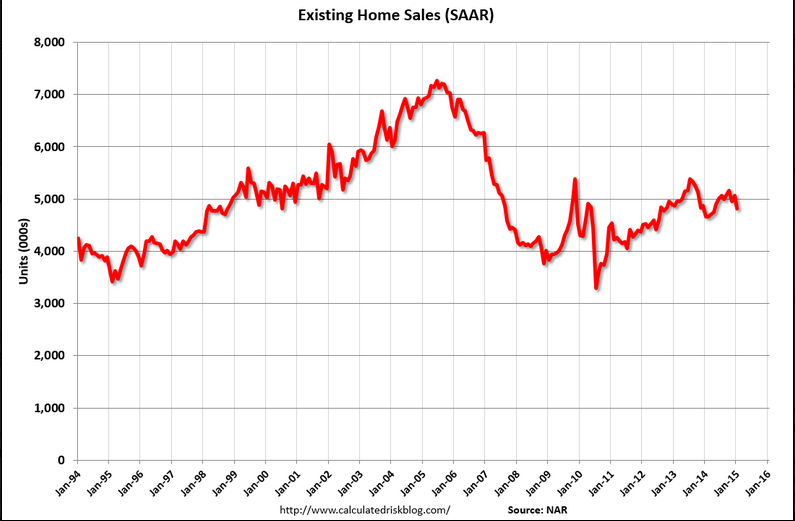

Again, with mtg purchase apps down and cash sales down why expect this to go up?

And with the oil credit expansion over it could get worse.

Existing Home Sales

Highlights

Despite a strong jobs market and low mortgage rates, demand for housing, whether for existing or new homes, remains flat. Sales of existing homes in January fell a very steep 4.9 percent to an annual rate of 4.82 million which is the lowest rate since April last year. All regions show single-digit declines with the West the deepest, at minus 7.1 percent. Declines hit both single-family homes, at minus 5.1 percent, and condos, at minus 3.5 percent.

Price concessions didn’t help the month’s sales with the median down 4.1 percent to $199,600. This is the first reading below $200,000 since March last year. The drop in sales made for a sizable rise in inventory relative to sales, to 4.7 months vs December’s 4.4 months.

The lack of sales punch has the National Association of Realtors wondering. The NAR says it’s “puzzled” that homeowners are now staying in their homes 10 years on average vs the long term average of 7 years, saying that homeowners may be happy with their mortgage rates and are perhaps doubtful that housing will rebound.

Dallas Fed Mfg Survey

Highlights

The latest regional Fed survey on manufacturing points to weakness in the manufacturing sector in February.

Texas factory activity posted a second month of no growth in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, remained near zero (0.7) and indicated output was essentially unchanged from January levels.

Other measures of current manufacturing activity reflected contraction in February. The new orders index pushed further into negative territory, coming in at minus 12.2, its lowest reading since June 2009. The shipments index fell to minus 3.3, also reaching a low not seen since 2009. The capacity utilization index turned negative as well, dropping from 5.1 to minus 4.9.

Perceptions of broader business conditions remained rather pessimistic this month. The general business activity index moved further negative to minus 11.2, posting its lowest reading in nearly two years. The company outlook index remained slightly negative and edged down from -3.8 to -4.4.

Labor market indicators reflected only minor employment growth and slightly shorter workweeks. The February employment index moved down from 9 to 1.3. Fifteen percent of firms reported net hiring, compared with 14 percent reporting net layoffs. The hours worked index edged further into negative territory, coming in at minus1.6.

Prices fell slightly in February and upward pressure on wages continued to ease. The raw materials prices index held steady at minus1.7, indicating marginal downward pressure on input costs. The finished goods prices index was also slightly negative but edged up from minus 6.7 to minus 4.4. Manufacturers are no longer expecting sizeable price increases six months ahead, as the indexes of future prices were in single digits this month, down markedly from 2014 readings. The wages and benefits index edged down for a second month in a row and came in at 16.8.

Expectations regarding future business conditions rebounded somewhat in February. The index of future general business activity shot up 12 points to 5.5 after posting a negative reading in January. The index of future company outlook rose nearly 10 points to 11.8, although it remains well below the index level seen throughout 2014. Indexes for future manufacturing activity showed mixed movements in February but remained in solidly positive territory.

The latest Dallas Fed report plays into the hands of the doves on the FOMC. Manufacturing activity is weak and inflation pressures are non-existent currently. It will be interesting to hear Dallas Fed president Richard Fisher’s comments in speech since he has been hawkish. Fed chair Janet Yellen will be speaking to Congress this Tuesday and Wednesday and likely will comment on sector strengths and weakness and on price pressures.

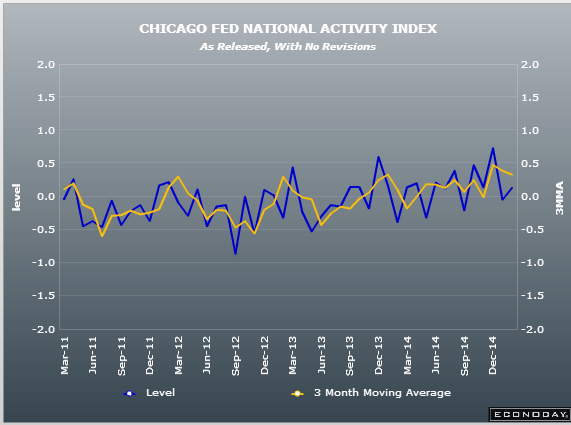

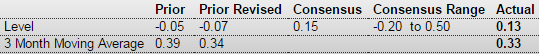

Chicago Fed National Activity Index

Highlights

January was a good month for the economy based on the national activity index which jumped back into the plus column, to 0.13 from December’s revised minus 0.7. The 3-month average is very strong, little changed at plus 0.33.

The big swing factor for January is production-related indicators which rose to plus 0.02 from December’s minus 0.22 in a gain driven by a swing higher for industrial production. The negative reading from consumption & housing improved to minus 0.10 from minus 0.13 while the contribution from sales/orders/inventories held unchanged at plus 0.03. Employment remains a big plus but, due to a tick higher for the unemployment rate to 5.7 percent, a little less so, at plus 0.18 from plus 0.28.