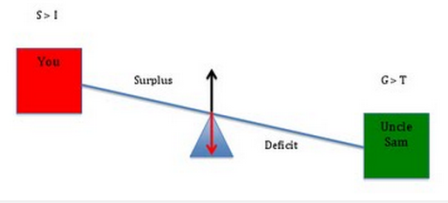

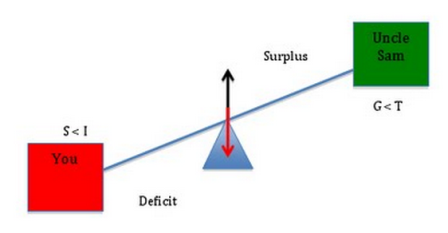

The deficit hawks have ripped the headline deficit doves to shreds.

The problem is the deficit doves, as previously discussed.

Again, here’s why:

How to avoid our own lost decade

By Lawrence Summers

June 12 (FT) — Even with the 2008-2009 policy effort that successfully prevented financial collapse, the US is now halfway to a lost economic decade. In the past five years, our economy’s growth rate averaged less than one per cent a year, similar to Japan when its bubble burst. At the same time, the fraction of the population working has fallen from 63.1 per cent to 58.4 per cent, reducing the number of those in jobs by more than 10m. Reports suggest growth is slowing.

True!

Beyond the lack of jobs and incomes, an economy producing below its potential for a prolonged interval sacrifices its future. To an extent once unimaginable, new college graduates are moving back in with their parents. Strapped school districts across the country are cutting out advanced courses in maths and science. Reduced income and tax collections are the most critical cause of unacceptable budget deficits now and in the future.

True!

You cannot prescribe for a malady unless you diagnose it accurately and understand its causes. That the problem in a period of high unemployment, as now, is a lack of business demand for employees not any lack of desire to work is all but self-evident, as shown by three points: the propensity of workers to quit jobs and the level of job openings are at near-record low; rises in non-employment have taken place among all demographic groups; rising rates of profit and falling rates of wage growth suggest employers, not workers, have the power in almost every market.

True!

A sick economy constrained by demand works very differently from a normal one. Measures that usually promote growth and job creation can have little effect, or backfire.

A ‘normal’ economy is one with sufficient demand for full employment, so there’s no particular need to promote even more demand.

When demand is constraining an economy, there is little to be gained from increasing potential supply.

True. The mainstream theory is that increased supply will lower prices so the same incomes and nominal spending will buy the additional output. But it doesn’t work because the lower prices (in theory) work to lower incomes to where the extra supply doesn’t get sold and therefore doesn’t get produced. And it’s all because the currency is a (govt) monopoly, and a shortage in aggregate demand can only be overcome by either a govt fiscal adjustment and/or a drop in non govt savings desires, generally via increased debt. And in a weak economy with weak incomes the non govt sectors don’t tend to have the ability or willingness to increase their debt.

In a recession, if more people seek to borrow less or save more there is reduced demand, hence fewer jobs. Training programmes or measures to increase work incentives for those with high and low incomes may affect who gets the jobs, but in a demand-constrained economy will not affect the total number of jobs. Measures that increase productivity and efficiency, if they do not also translate into increased demand, may actually reduce the number of people working as the level of total output remains demand-constrained.

True!

Traditionally, the US economy has recovered robustly from recession as demand has been quickly renewed. Within a couple of years after the only two deep recessions of the post first world war period, the economy grew in the range of 6 per cent or more – that seems inconceivable today.

True!

Why?

Inflation dynamics defined the traditional postwar US business cycle. Recoveries continued and sometimes even accelerated until they were murdered by the Federal Reserve with inflation control as the motive. After inflation slowed, rapid recovery propelled by dramatic reductions in interest rates and a backlog of deferred investment, was almost inevitable.

Not so true, but not worth discussion at this point.

Our current situation is very different. With more prudent monetary policies, expansions are no longer cut short by rising inflation and the Fed hitting the brakes. All three expansions since Paul Volcker as Fed chairman brought inflation back under control in the 1980s have run long. They end after a period of overconfidence drives the prices of capital assets too high and the apparent increases in wealth give rise to excessive borrowing, lending and spending.

Not so true, but again, I’ll leave that discussion for another day.

After bubbles burst there is no pent-up desire to invest. Instead there is a glut of capital caused by over-investment during the period of confidence – vacant houses, malls without tenants and factories without customers. At the same time consumers discover they have less wealth than they expected, less collateral to borrow against and are under more pressure than they expected from their creditors.

True!

Pressure on private spending is enhanced by structural changes. Take the publishing industry. As local bookstores have given way to megastores, megastores have given way to internet retailers, and internet retailers have given way to e-books, two things have happened. The economy’s productive potential has increased and its ability to generate demand has been compromised as resources have been transferred from middle-class retail and wholesale workers with a high propensity to spend up the scale to those with a much lower propensity to spend.

Probably has some effect.

What, then, is to be done? This is no time for fatalism or for traditional political agendas. The central irony of financial crisis is that while it is caused by too much confidence, borrowing and lending, and spending, it is only resolved by increases in confidence, borrowing and lending, and spending. Unless and until this is done other policies, no matter how apparently appealing or effective in normal times, will be futile at best.

Partially true. It’s all about spending and sales. We lost 8 million jobs almost all at once a few years back because sales collapsed. Businesses hire to service sales. So until we get sales high enough to keep everyone employed who’s willing and able to work we will have over capacity, an output gap, and unemployment.

The fiscal debate must accept that the greatest threat to our creditworthiness is a sustained period of slow growth.

NOT TRUE!!! And here’s where the headline deficit doves lose the battles and now the war. There is no threat to the credit worthiness of the US Government. We can not become the next Greece- there simply is no such thing for the issuer of its currency. Credit worthiness applies to currency users, not currency issuers.

Discussions about medium-term austerity need to be coupled with a focus on near-term growth.

There he goes again. This is the open door the deficit hawks have used to win the day, with both sides now agreeing on the need for long term deficit reduction. And in that context, the deficit dove position that we need more deficit spending first, and then deficit reduction later comes across as a ploy to never cut the deficit, and allow the ‘problem’ to compound until it buries us, etc.

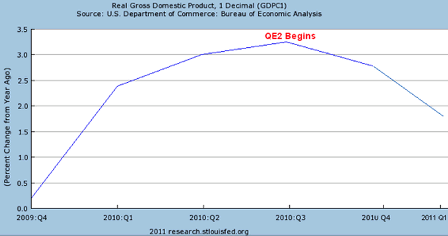

Without the payroll tax cuts and unemployment insurance negotiated last autumn we might now be looking at the possibility of a double dip.

They certainly helped, and ending work for pay hurt, and even with whatever support that provided, we are still facing the prospect of a double dip.

Substantial withdrawal of fiscal stimulus at the end of 2011 would be premature. Stimulus should be continued and indeed expanded by providing the payroll tax cut to employers as well as employees.

True, except the extension to employers works to lower prices, as it lowers business costs. This is a good thing, but it adds to aggregate demand only very indirectly. To get it right, I’d suspend all FICA taxes to increase take home pay of those working for a living which will help sales and employment, and to cut business costs, which, in competitive markets, works to lower prices.

Raising the share of payroll from 2 per cent to 3 per cent is desirable, too. These measures raise the prospect of sizeable improvement in economic performance over the next few years.

True, as far as it goes. Too bad he reinforces the overhanging fears of deficit spending per se. You’d think he’d realize everyone would like to cut taxes, and that it’s the fears of deficit spending that are in the way…

At the same time we should recognize that it is a false economy to defer infrastructure maintenance and replacement,

True!

and take advantage of a moment when 10-year interest rates are below 3 per cent

Bad statement!!! This implies that if rates were higher it would make a difference with regards to our infrastructure needs during times of a large output gap, as it perpetuates the myths about the govt somehow being subjected to market forces with regard to its ability to deficit spend. Again, this mainstream deficit dove position only serves to support the deficit hawk fear mongering that’s won the day.

and construction unemployment approaches 20 per cent to expand infrastructure investment.

It is far too soon for financial policy to shift towards preventing future bubbles and possible inflation, and away from assuring adequate demand.

True! But, as above, he’s already defeated himself by reinforcing the fears of deficits and borrowing.

The underlying rate of inflation is still trending downwards and the problems of insufficient borrowing and investing exceed any problems of overconfidence. The Dodd-Frank legislation is a broadly appropriate response to the challenge of preventing any recurrence of the events of 2008. It needs to be vigorously implemented. But under-, not overconfidence is the problem, and needs to be the focus of policy.

Policy in other dimensions should be informed by the shortage of demand that is a defining characteristic of our economy. The Obama administration is doing important work in promoting export growth by modernising export controls, promoting US products abroad and reaching and enforcing trade agreements. Much more could be done through changes in visa policy to promote exports of tourism as well as education and health services. Recent presidential directives regarding relaxation of inappropriate regulatory burdens should also be rigorously implemented.

Too bad he’s turned partisan here, as I’m sure he’s aware of how exports are real costs, and imports real benefits, and how real terms of trade work to alter standards of living. So much for intellectual honesty…

Perhaps the US’ most fundamental strength is its resilience. We averted Depression in 2008/2009 by acting decisively. Now we can avert a lost decade by recognising economic reality.

First we need to recognize financial reality, and unfortunately he and the other headline deficit doves continue to provide the support for the deficit myths and hand it all over to the deficit hawks. Note that, as per the President, everything must be on the table, including Social Security and Medicare. To repeat, fearing becoming the next Greece is working to turn ourselves into the next Japan.

The writer is Charles W. Eliot University Professor at Harvard and former US Treasury Secretary. He is an FT contributing editor

(Feel free to distribute, repost, etc.)