[Skip to the end]

(an interoffice email)

On Thu, Jun 26, 2008 at 7:48 AM, Karim wrote:

>

>

>

Global Economic Integration and Decoupling

Vice Chairman Donald L. Kohn

At the International Research Forum on Monetary Policy, Frankfurt, Germany

June 26, 2008

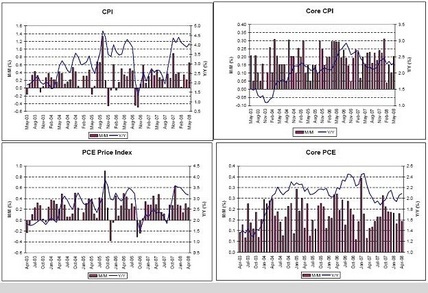

For the moment, higher headline rates of inflation have shown only a few tentative signs of embedding themselves in core inflation or in longer-term inflation expectations.

> -talking about u.s. here

>

>

>

However, policymakers around the world must monitor the situation carefully for signs that the increases in relative prices globally do not generate persistently higher inflation. Additionally, in those countries where strong commodity demands are associated with rapid growth in aggregate demand that outstrips potential supply, actions to contain inflation by restraining aggregate demand would contribute to global price stability.

> -not describing/talking about u.s. here;

> focusing on EM primarily.

>

>

right, gets back to bernankes testimony a while back that the falling dollar has been a good thing as it works to lower the trade gap via increasing US exports that sustain US demand. the old ‘beggar they neighbor’ policy from the 30’s.

unfortunately for us it’s actually a ‘beggar thyself’ policy on closer examination as most mainstream economists will attest. they all say you don’t ‘inflate your way to prosperity’ by weakening your currency. otherwise latin america and africa for example would be the most prosperous places in the world

seems they are still in the mercantalist mode where exports are good and imports bad, and this policy is making us look like a bananna republic at an increasing rate.

recall from previous emails the dollar decline has been triggered by paulson succeeding in keeping cb’s from buying $US, Bush keeping oil producing monetary authorities from accumulating $US, and Bernanke discouraging foreign portfolio managers from accumulating same.

(more later on how it’s actually not happening due to fed rate policy, but they think it is)

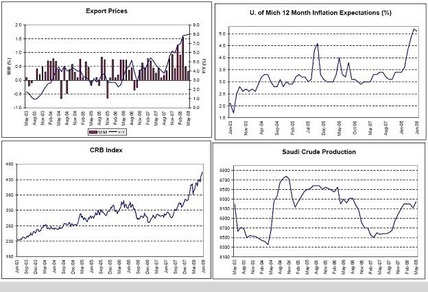

as suspected, the $US is most likely to take another major leg down as it adjusts to a level where the trade gap is in line with foreign desire to accumulate $US financial assets which is probably a lot lower than the current 55-60 billion per month.

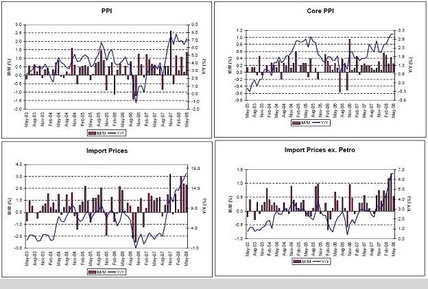

the ‘cost push inflation’ is pouring in through the trade channel, and the fed is increasingly taking the heat from the mainstream (not me- i’m the only one who thinks inflation isn’t a function of rates the way they do) for its apparent weak $US/inflate your way out of debt approach.

furthermore, the mainstream (and the stock market) sees the low interest rate/weak dollar policy as taking away US domestic demand as higher price for food/fuel leave less domestic income for everything else, including debt service.

that is, they see the falling dollar hurting us domestic demand more than the low interest rates are helping it.

the reality is there’s foreign monopolist- the saudis (and maybe russians)- that’s milking us for all they can with price hikes, and keeping us alive buying our goods and service and thereby keeping US gdp muddling through.

the real standard of living for most working americans has dropped by perhaps 10% as they work, get paid enough to eat and drive to work, and the rest of their real output is exported.

and our policy makers, including bernanke and paulson who’ve ‘engineered it’ think this is all a good thing- they think imports are bad and exports good and we are paying the price in declining real terms of trade.

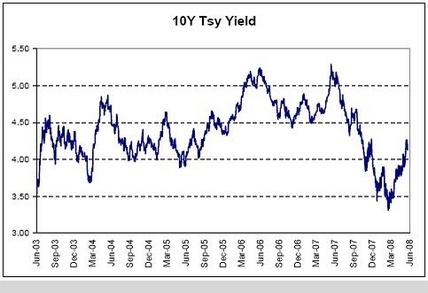

while in my book interest rates are not a factor, the mainstream thinks they are, and the response when the inflation gets bad enough will be higher interest rates. The ‘correct’ anti-inflation rate last August was 5.25 when the fed didn’t cut.

by Jan 08 it was probably at least 7% with headline moving through 3% to get a sufficient ‘real rate.’

today it’s probably moved up to 8%+ as cpi is forecast to go through 5% over the next few months and gdp muddles through around 1%.

the mainstream (not me) will say that by having a real rate that’s too low now the fed will need a rate that much higher down the road as inflation accelerates due to over accommodative fed policy.

by the time the cost push inflation works its way to core- probably over the two quarters- the fed will ‘suddenly’ feel itself way behind the inflation curve and recognize they made a horrible mistake and now the cost of bringing down inflation is far higher than it would have been early on- just like they’ve always said.

the mainstream knows this, and now sees a fed with its head in the sand regarding inflation. they also see this weak dollar policy as subversive as it undermines the currency and inflation accelerates.

i expect there will be a groundswell of mainstream economists calling for the replacement of bernanke, kohn and the entire fomc very soon.

ironically, in my book low rates have helped moderate inflation via cost channels and have helped moderate domestic demand via interest income channels.

rate hike will add to domestic demand as net interest income of the private sectors from higher government interest payments add to personal income and demand.

and rate hikes will add to the cost push inflation via higher interest costs for firms.

it’ all going down hill fast, with policy makers both going the wrong way on key issues as they have the fundamentals backwards.

the only near term ‘solutions’ are near term crude oil supply responses like 30 mph speed limits which isn’t even under consideration in any form, nor are any other crude supply responses. most other alternative energy sources don’t replace crude.

medium term supply responses include pluggable hybrids that only start being produced in late 2010.

longer term supply responses include nuclear which might come on line 15 years down the road.

a collapse in world demand is possible if china/india let up on their deficit spending and growth, but so far that doesn’t seem in the cards. all their ‘tightebning’ seems to be on the ‘monetary’ side which does nothing of consequence apart from further increase inflation.

so with no supply responses on the horizon expect the saudis to keep hiking prices, and keep spending the new revenues to keep world gdp muddling through, cb’s hiking interest rates that will bring results that will cause them to hike further, and continuously declining real terms of trade for oil importers.

what to do?

cds on germany- it’s one go all go over there, and germany is the least expensive insurance.

forward muni bmas over 80 with no interest rate hedge as markets should discount the obama lead and long move up with inflation.

[top]