Japan’s Hidden Jobless Hits 4.69mn, Worse Than After Lehman Shock

November 16 (Nikkei) —The number of Japanese that want to work but are not actively seeking employment has surpassed levels from after the global financial crisis erupted, according to government data released on Tuesday.

Some people have given up searching for work because they believe that the jobs they desire are not available. Known as hidden unemployment, such individuals are not reflected in official unemployment statistics, which cover those actively hunting for jobs by going to employment centers, for example.

The hidden jobless in Japan jumped by 190,000 from a year earlier to 4.69 million in the July-September quarter, excluding the three prefectures hit hardest by the March 11 disaster, the Internal Affairs Ministry said.

The figure is nearly 70% larger than the number of officially unemployed people. It is also higher than the 4.61 million in the July-September quarter of 2009, when the employment market deteriorated sharply after the financial crisis.

Of the hidden jobless, the number of women grew by 60,000 while men surged by 130,000. Asked why they are not seeking work, more people replied that there are no jobs that match their skills or their desired conditions such as pay and work hours. The strong yen and concerns over power shortages are seen as factors resulting in a dearth of openings for good jobs.

The number of unemployed people fell 430,000 on the year to 2.77 million for the July-September quarter, excluding the three disaster-hit prefectures. Of this figure, those that have been out of work for at least a year declined by 190,000 to 1.03 million, down for the second straight quarter. While this suggests that fewer people are without work over the long term, some may have exited the employment market by giving up on the job search.

Category Archives: Employment

Merkel comments

*DJ Merkel: “Euro Zone Solidarity Must Be Combined With Sound Budget Measures”

To make sure unemployment never comes down and unit labor costs stay down.

*DJ Merkel: Italy Will Put Through Planned Austerity Measures Soon

Also to make sure unemployment never comes down and unit labor costs stay down.

Most of the unemployed no longer receive benefits – CNBC

There is a silver bullet.

The right amount of aggregate demand keeps labor the scarce resource it actually is.

Most of the unemployed no longer receive benefits

November 5 (CNBC) —The jobs crisis has left so many people out of work for so long that most of America’s unemployed are no longer receiving unemployment benefits.

Early last year, 75 percent were receiving checks. The figure is now 48 percent — a shift that points to a growing crisis of long-term unemployment. Nearly one-third of America’s 14 million unemployed have had no job for a year or more.

Payrolls and a Fed rant

Utter failure of policy.

The Fed was certain it knew what Japan had done wrong and wasn’t going to make THOSE mistakes.

So it

Cut rates much more aggressively.

Said it would do whatever it takes.

Figured out how to do its job as liquidity provider after only 6 months of alphabet soup programs.

Did heaps of Quantitative Easing.

Did the twist.

And now, realizing its done about all it can do, says monetary policy can’t do it all.

And still fails to recognize publicly the actual problem is the budget deficit is way too small.

And doesn’t directly inform Congress that

there is no such thing as a solvency problem,

the Fed controls government interest rates, and not the market,

there is no long term deficit problem with regards to finance,

the only thing we owe China is a bank statement,

Quantitative Easing and rate cuts remove interest income from the economy, which allows the deficit to be that much larger,

etc.

as we continue to go the way of Japan.

Karim writes:

Some improvement around the edges but the larger narrative is employment rising only at a rate fast enough to keep the unemployment rate stable (not higher or lower)

- NFP 80k with net revisions 102k

- Unemp rate down to 9% from 9.1%

- Average hourly earnings 0.2% and aggregate hours 0.1% barely ok for labor income once adjusted for inflation

- Weather may have played a small role as construction employment turned from +27k to -20k

- Diffusion index improved from 56.7 to 60.7; while encouraging in that the majority of industries are adding jobs, doesn’t say or mean they are necessarily adding jobs at an increasing rate

- Other positives are median duration of unemployment falling from 22.2 weeks to 20.8 weeks and U6 measure falling from 16.5% to 16.2%

- Don’t think this would have a big impact on the new Fed forecasts we saw the other day

Cain’s Opportunity Zones suspend the minimum wage

Seems to be working for him…

:(

However, Cain, the former Godfather’s Pizza CEO, is expected to propose an addition to his signature tax reform plan in a speech today in Detroit. The new plan is expected to create “opportunity zones” in cities to foster small businesses and create jobs.

Major feature of opportunity zones is they suspend the minimum wage.

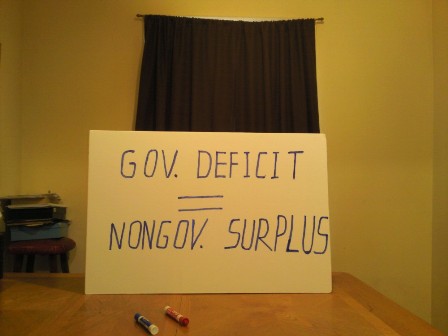

The deficit isn’t large enough

MMT joined OWS

MMT proposals for the 99%

1. A full FICA suspension to end that highly regressive, punishing tax and restore sales, output, and jobs.

2. $150 billion in federal revenue sharing for the state goverments on a per capita basis to sustain essential services.

3. An $8/hr federally funded transition job for anyone willing and able to work to facilitate the transition from unemployment to private sector employment.

4. See my universal health care proposals on this website (Health Care Proposal).

5. See my proposals for narrow banking, the Fed, the Treasury and the FDIC on this website (Banking Proposal).

6. See my proposal’s to take away the financial sector’s ‘food supply’ by banning pension funds from buying equities, banning the Tsy from issuing anything longer than 3 month bills, and many others.

7. Universal Social Security at age 62 at a minimum level of support that makes us proud to be Americans.

8. Fill the Medicare ‘donut hole’ and other inequities.

9. Enact my housing proposals on this website (Housing proposal).

10. Don’t vote for anyone who wants to balance the federal budget!!!!

Claims/Trade/ECB/Fed/swiss/euro

Seems several reasons Fed unlikely to ‘ease’ further:

GDP continues to move up sequentially since year end

Fed forecasts showing continuing modest growth

Core CPI remains firm

Employment still at least modestly growing (ex Verizon, household sector, etc)

Financial burdens ratios way down indicating the potential for a credit expansion is there.

China and much of the FOMC doesn’t seem to like QE or anything even vaguely related, including long term rate commitments.

Also, with the Swiss ‘peg’ vs the euro, as long as the Swiss remain relatively strong buying the franc, it translates into buying of euro. So this new buyer of euro offers further euro support/deflation to an already highly deflationary environment.

Karim writes:

- Claims rise 9k to 414k; 400-425k range now holding for about 2mths; not a lot of firing, not a lot of hiring

- Large drop in trade deficit in July, both nominal and real.

- Exports rose 3.6% while imports fell 0.2%; supply chain coming back on stream helped industrial exports, while lower oil prices dampened imports

- Q3 GDP still looking like 2%; forward looking survey measures mixed, with consumer surveys much weaker than business surveys.

- ECB shifts from ‘inflation risks to upside and policy is accommodative’ to…

- Inflation risks are ‘balanced’, ‘downside risks’ to growth forecasts (which were reduced), and while policy is still accommodative, financial conditions have tightened

- While LTROs and SMP help with the transmission of policy, if financial conditions still tighten further, the changed forecasts and biases leave the door open for rate cuts

- Staff forecasts for inflation were left unchanged at 2.6% for 2011 and 1.7% for 2012; Growth forecasts were cut from 1.9% to 1.6% for 2011, and 1.7% to 1.3% for 2012