Stupid taken to new heights.

Retirement is about no longer producing real goods and services and instead living off of the real output of others, incuding China’s exports to you.

The only way this could make any sense is if China somehow was going to force the UK to net export at some time in the future, sort of like war reparations.

Not that the UK might not lose a war to China and be forced to export, but if history is any guide, China and the rest will still be pressing on with net export strategies, like Japan has done for the last 65 years and going strong.

And, of course, keeping millions who want to work from working (unemployment) is entirely counterproductive with regards to real output as well.

Brits May Have to Work Until 75, Thanks to China

By Katie Holliday

Feb 27 (CNBC) — A colossal savings glut in China, the world’s second largest economy, means British workers in their twenties will only be able to retire at 75, a report by the Center for Economic and Business Research (Cebr) showed on Thursday.

According to the report, excessive savings in emerging economies, especially in China, and the country’s growing share of the global economy will keep yields and interest rates down for many years. This will leave pension funds underfunded keeping annuity rates low.

“To retire at close to the standard of living that they (U.K. workers) have previously enjoyed, they will have to extend their working life and cut their number of years of retirement by working till they are much older than the present retirement age,” said Douglas McWilliams, executive chairman of economics consultancy Cebr.

The state pension age in the U.K. is 65 for men and 60 for women currently, but it is set to steadily rise to 66 for both by 2020, as set by the government’s Pensions Bill in October 2012.

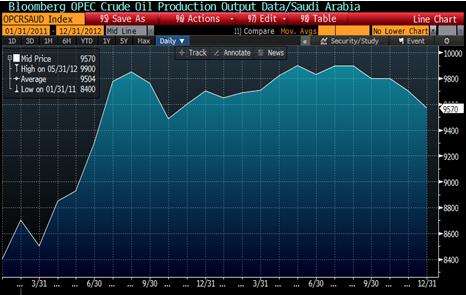

McWilliams pinpointed China’s savings glut as a key driver behind this trend.

China’s population holds a staggering 25 percent of the world’s savings, the report found, rising from $153 billion in 1990 to a likely $4.5 trillion this year – a figure Cebr expects to grow further.

Austerity

Weak state finances following austerity measures will also make it difficult for British workers to retire before the age of 75, the report said.

The U.K. economy was stripped of its Triple-A rating by credit ratings agency Moody’s this week on concerns over its subdued growth prospects and rising debt burden.

The British government is currently undergoing vigorous austerity, but the cuts have come at the expense of growth. The economy emerged from a nine-month recession in the third quarter of last year with 0.9 percent growth, however , it then contracted more than expected by 0.3 percent in the final quarter of last year.

According to Cebr, the long-term cost of the austerity measures will outweigh the cost of bailing out banks during the financial crisis.

It estimates that the cost of bailing out the banks will have cost the British taxpayer about 120 billion pounds ($181 billion) eventually, while the problems of excess deficits built up since 2000 will have cost the economy 1.5 trillion pounds by 2025.

“It will be well in the late 2020s at the earliest before austerity policies can be eased up,” said McWilliams.

Interest rates in the U.K. meanwhile are likely to stay low for at least 20 years, the report from Cebr said.

“Even the [U.K.] Pensions Regulator admits that most pension schemes are underfunded and many will never be able to be fully funded while low yields persist without bankrupting their guarantors,” McWilliams said.

“And for those on direct contribution pension schemes, the annuity yields that they are able to buy are unlikely to rise much from today’s very depressed levels. Workers could save more. But they are unlikely to do so and if they did so around the world, they would only add to the glut of savings that is a fundamental cause of the problem,’ he added.

Direct contribution pension schemes are retirement plans where an employer matches its employee’s contribution of his or her earnings each year.

Time to Learn Mandarin?

The tendency towards saving in China means the Chinese will eventually own a quarter of the world’s assets, as they invest heavily abroad to use up their savings, said Cebr.

“So far the Chinese have invested heavily in areas like Africa and South America which the West has neglected as well as in U.S. Treasury bonds. But they will have to turn increasingly to other assets like companies and properties in the West including U.K. companies,” he said.

“Better start learning Mandarin – your next boss may be Chinese,” said McWilliams.