NAHB Housing Market Index (Feb)

| Survey | 19 |

| Actual | 20 |

| Prior | 19 |

| Revised | – |

Still a possible bottom forming.

Coming out later today..

ABC Consumer Confidence (Feb 17)

| Survey | -37 |

| Actual | — |

| Prior | -37 |

| Revised | — |

[comments]

| Survey | 19 |

| Actual | 20 |

| Prior | 19 |

| Revised | – |

Still a possible bottom forming.

Coming out later today..

| Survey | -37 |

| Actual | — |

| Prior | -37 |

| Revised | — |

[comments]

(an email)

> On Feb 19, 2008 10:03 AM, Mike wrote:

> Warren, note spec comments and dollar issues, a big hurdle to overcome

> if they go the other way …

> Mike

Hi Mike,

Agreed the dollar may have bottomed. Seems to have reached a level where exports are now growing at about 13% which maybe is the right number to accommodate the pressure from the non resident sector to slow it’s accumulation of $US financial assets.

However I continue to conclude the price of crude is being set by the Saudi’s/Russians acting as swing producer, and that there is sufficient demand to keep them in the driver’s seat. Quantity pumped keeps creeping up at current prices, with Saudis last reporting 9.2 million bpd output.

Crude at 98.70 now. Note crude goes up on news a refinery is down, when refineries are the only buyers of crude, so in fact it’s going up for other reasons (price setting by the swing producer?). Also, WTI is now ahead of Brent, indicating whatever was causing the sag in WTI vs Brent is over. WTI would ordinarily trade higher than Brent due to shipping charges.

Warren

Interesting they would take a shot like that at the Fed. Probably concerned about Euro strength and the US gaining export share.

Bank of France Says Fed Overreacted to Market Decline

By Francois de Beaupuy

(Bloomberg) The Bank of France said the U.S. Federal Reserve may have cut interest rates too much and too quickly in response to financial-market declines.

An unsigned article in the Paris-based bank’s monthly bulletin, published today, said new financial products have amplified asset price swings.

That may lead to “stronger monetary reactions than what would otherwise be necessary, as shown by the recent decision of the Federal Reserve,” the article said.

The unusual criticism by one central bank of another may reflect the European Central Bank’s reluctance to follow its U.S. and U.K. counterparts in cutting rates to cushion against an economic slowdown. The ECB left its benchmark rate at 4 percent this month even as growth prospects deteriorate.

“The Bank of France is simply going along the ECB line, trying to manage expectations away from any response similar to the Fed,” said Gareth Claase, an economist at Royal Bank of Scotland Plc in London. “The Fed moved quickly and far. The ECB is likely to move slowly and little.”

The Fed has lowered its benchmark rate by 2.25 percentage points since September to 3 percent — including a three-quarter point emergency cut on Jan 22 — and traders expect another reduction next month.

‘Unusually High’

German Finance Minister Peer Steinbrueck said Feb. 12 he didn’t see ECB Bank President Jean-Claude Trichet shifting to a neutral stance, which might be a prelude to cutting rates. At a press conference last week, Trichet said uncertainty about growth prospects is “unusually high,” prompting traders to raise bets on a rate cut.

“Pressure on the ECB increased after the massive Fed rate cuts,” said Michael Schubert, an economist at Commerzbank AG in Frankfurt. “The ECB has said that it won’t act anytime soon. It doesn’t want to be driven by the Fed.”

German investor confidence unexpectedly increased this month, a sign the European economy can weather the U.S. slowdown.

“It’s unusual for central banks to criticize the actions of others,” said Dominic Bryant, an economist at BNP Paribas in London. “The U.S. is in recession, so it’s somewhat difficult to say the Fed overreacted.”

♥

Might be a revealing day coming up.

I’m watching for markets to begin to link higher oil prices to the potential for higher interest rates, rather than the reverse as has been the case since August.

With oil up to the mid 97 range this am, the question is whether short term interest rates move higher due to possible Fed concerns about inflation, even with weak growth and continuing financial sector issues. Even Yellen recently voiced concerns about energy prices now feeding into core inflation measures which are now above her ‘comfort zone.’ And Friday Mishkin said more than once in a short speech that the Fed had to be prepared to reverse course if inflation expectations elevate.

Yes, credit spreads are a lot wider, but when, for example, I ask the desk if any of the wider AAA’s are ultimately money good, I get a lot of uncertainty. So it seems to me in many cases markets are functioning to price risk at perceived potential default levels? So some of the current spreads may be wider than they ‘should be’ but maybe not all that much?

Yes, the financial sector has been damaged (and damnaged).

Yes, housing is weak without the bid for subprime housing of 18 months ago.

And yes, the consumer has slowed down some.

However, exports are booming like a third world country- growing around 13% per year, also do to financial market shifts, this time away from $US financial assets.

This is offsetting weakening domestic demand and keeping gdp positive, at least so far.

Meanwhile, it looks like a full blow 1970’s inflation in the making if food, fuel, and import/export prices keep doing what they are doing.

And with Saudi production continuing to creep up at current pricing, seems demand is more than strong enough for them to keep hiking prices.

And suddenly Yellen and Mishkin, both doves, substantially elevate their anti inflation rhetoric, as core levels have gone just beyond even their comfort zones.

From today’s speech:

A central bank must always be concerned with inflation as well as growth. As I have emphasized in an earlier speech about inflation dynamics, the behavior of inflation is significantly influenced by the public’s expectations about where inflation is likely to head in the long run (Mishkin, 2007a). Therefore, preemptive actions of the sort I have described here would be counterproductive if these actions caused an increase in inflation expectations and in the underlying rate of inflation; in other words, the flexibility to act preemptively against a financial disruption presumes that inflation expectations are firmly anchored and unlikely to rise during a period of temporary monetary easing.

There have been recent signs of inflation expectations rising, including today’s jump in the one year Michigan expectation to 3.7%.

Indeed, as I have argued elsewhere, a commitment to a strong nominal anchor is crucial for both aspects of the dual mandate, that is, for achieving maximum employment as well as for keeping inflation low and stable (Mishkin, 2007b). Policymakers therefore need to closely monitor information about underlying inflation and longer-run inflation expectations, and the central bank must be ready to hold steady or even raise the policy rate if the evidence clearly indicates a significant rise in inflation expectations.

Says here he will vote to hike if expectations elevate.

♥

| Survey | 6.5 |

| Actual | -11.7 |

| Prior | 9.0 |

| Revised | n/a |

Down, but it has been lower, not yet to previous recession levels.

| Survey | 0.1% |

| Actual | 0.1% |

| Prior | 0.0% |

| Revised | 0.1% |

Modestly positive, and not at recession levels.

| Survey | 81.3% |

| Actual | 81.5% |

| Prior | 81.4% |

| Revised | 81.5% |

Holding up reasonably well.

| Survey | 76.0 |

| Actual | 69.6 |

| Prior | 78.4 |

| Revised | n/a |

The CNBC effect keeping expectations down.

One year inflation expectations jumped to 3.7% putting the Fed on high alert.

♥

Survey shows people are watching TV and reading the newspapers.

For the third consecutive month, more households reported that their financial situation had worsened rather than improved over the past year.

But due to inflation, not falling nominal income:

Moreover, due to a higher expected inflation rate and smaller expected wage gains, 46% of all households anticipated declines in their inflation adjusted incomes during the year ahead, the worst reading since the 1990 recession.

Overall, consumers expected a year-ahead inflation rate of 3.7% in early February, up from 3.4% in the prior three months.

The Fed uses this as one of their inflation expectation indicators. It has gone from too high to even higher.

In contrast, long term inflation expectations, a proxy for core inflation, was unchanged and well anchored at 3.0% in February.

Yes, but still too high.

Eighty-six percent of all consumers thought that the national economy was in decline, the highest level recorded since 1982. Year-ahead prospects for the national economy were just as bleak as 72% expected bad times, a level comparable to the worst levels in the recessions of the early 1990’s and 1980’s. The anticipated downturn is expected to result in more joblessness in the year ahead, a prime concern of consumers. A rising unemployment rate was expected by 52% of all consumers in early February, up from 33% a year ago, and comparable to the peak levels recorded in the months surrounding prior recessions.

The rest is more of the same and shows influence of the media.

Personal Financesâ€â€ÂCurrent went from 98 to 96

Not bad.

Personal Financesâ€â€ÂExpected 116 to 108

As above.

The survey clearly shows expectations have deteriorated for both the economy and inflation.

♥

(an interoffice email)

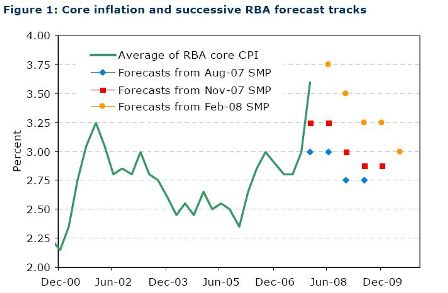

Looks familiar – the CB forecasting inflation falling from higher and higher levels as it move up rather than down as originally forecast.

———- Forwarded message ———-

From: Milo

Date: 2008/2/14

Subject: This Picture says it all, I recon – 86% OIS odds of a hike in March

To: Warren Mosler, Karim

The RBA has come to grips with Australia’s stark inflation reality. Inflation forecasts have been revised up significantly (see Figure 1), the RBA will deliver

more rate hikes and domestic demand will eventually slow. At the moment, forecasters are grappling with how high the terminal cash rate will be. Is it

7.5%, 8.0% or higher?

“However, the downside risks to growth have intensified since the last meeting, and markets are pricing in another rate cut..”

Zimbabwe’s Inflation Rises to Record 66,212%

by Brian Latham

(Bloomberg) Zimbabwe’s annual inflation more than doubled to 66,212 percent in December, the Central Statistical Office said in a document released to local banks.

The December figure “was an increase of 39,741 percentage points on the November rate of 26,470 percent,” the office said in the document released in the capital, Harare, this week.

Food and non-alcoholic beverages rose 79,412 percent in December, while non-food inflation was 58,492 percent, the office said.

Zimbabwe has the world’s highest rate of inflation and the world’s fastest-shrinking peace-time economy, according to the World Bank. The International Monetary Fund estimated inflation reached 150,000 percent in January, the Zimbabwe Independent reported, citing a document that hasn’t been officially released by the lender.

♥