This is how it all starts.

The $10.1 billion gain in non revolving is the key.

That, along with housing, is the borrowing to spend the drives consumer credit expansions.

And the ongoing federal deficit spending continues to add to savings via less credit card debt that’s generally used for current consumption.

It’s only one month, and the series has volatility, but it does fit with the financial burdens ratios.

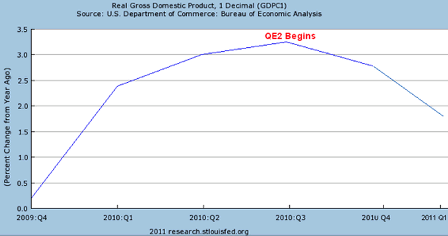

Without the external risks, the Obama boom that began in Jan 09 (before he added a bit with his fiscal package) looks intact and ready to accelerate.

Unfortunately there are risks.

Taxes are scheduled to go up at year end if gridlock isn’t broken. And even if they do extend the current tax structure, it’s not a tax cut, just not an increase.

Congress is bent on ‘paying for’ everything and proactively reducing the federal deficit, one way or another, including paying for not letting taxes rise should that happen.

The sustainability report is due Dec 1 which could further scare everyone into more proactive deficit reduction.

This kind of stuff. There are probably enough votes for the balanced budget constitutional amendment to pass Congress:

November 7 (AP) — Republican Sen.-elect Rand Paul says GOP lawmakers must be open to cutting military spending as Congress tries to reduce government spending.

The tea party favorite from Kentucky says compromise with Democrats over where to cut spending must include the military as well as social programs. Paul says all government spending must be “on the table.”

Paul tells ABC’s “This Week” that he supports a constitutional amendment calling for a balanced budget.

The rising crude oil price is like a tax hike for us.

The $US could head north in a ‘hey, QE doesn’t in fact weaken the dollar and we’re all caught short with no newly printed money to take us out of our trade’ rally, further fueled by the automatic fiscal tightening that comes with the modest GDP growth reducing spending via transfer payments and increasing tax revenues, making dollars ‘harder to get.’

Also an even modestly growing US economy does attract foreign direct investment as well as equity investors in a big way.

And, real US labor costs are low enough for us to be exporting cars- who would have thought we would have sunk this low!

On the other hand, higher crude prices does make $US ‘easier to get’ overseas and tend to weaken it fundamentally.

The falling dollar was supporting a good part of the latest equity rally- better foreign earnings translations, more exports, etc.- so a dollar reversal could create a set back for the same reasons.

China is looking at maybe 10% inflation, and their currency fix seems to be closer to ‘neutral’ as their fx holdings seem to have stabilized.

It’s possible their currency adjustment has come via internal inflation, and now the question could be whether and how they ‘fight’ their inflation. In the past inflation has been a regime changer, so political pressures are probably intense.

Euro zone austerity is resulting in ‘political imbalances’ as Germany sort of booms and the periphery suffers.

It’s all muddling through with high and rising over all unemployment, modest growth, and the ECB dictating terms and conditions for its support.

Conclusion- clear sailing, Obama boom intact, unless the ‘external’ risks kick in. The most immediate risk is a dollar rally, closely followed by fiscal tightening

November 5 (AP) — Consumer borrowing increased in September for the first time since January even though the category that includes credit cards dropped for a record 25th straight month.

The Federal Reserve said Friday that consumer credit increased at an annual rate of $2.1 billion in September after having fallen at a rate of $4.9 billion in August. It was only the second increase in the past 20 months.

Americans have been reducing their borrowing for nearly two years as they try to repair their balance sheets in the wake of a steep recession and high unemployment.

For September, revolving credit, the category that includes credit cards, fell for a record 25th consecutive month, dropping by an annual rate of $8.3 billion, or 12.1 percent.

The category that includes student loans and auto loans, rose by $10.4 billion, or an annual rate of 7.9 percent.

The $2.1 billion rise in overall borrowing pushed consumer debt to a seasonally adjusted $2.4 trillion in September, down 2.9 percent from where consumer credit stood a year ago.

Analysts said that consumer credit is continuing to be constrained by all the problems facing households, including high unemployment and tighter lending standards on the part of banks struggling with high loan losses.

Households are borrowing less and saving more and that has acted as a drag on the overall economy by lowering consumer spending, which accounts for 70 percent of total economic activity.

The economy, as measured by the gross domestic product, grew at a lackluster annual rate of 2 percent in the July-September quarter, up only slightly from 1.7 percent GDP growth in the April-June period.