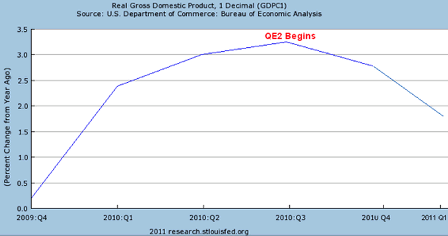

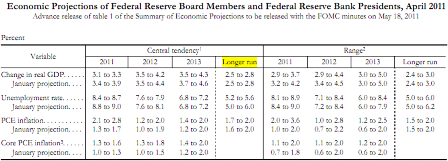

This is disturbing, along with still weak housing price indicators, and the ongoing downward revisions to GDP forecasts, as aggregate demand remains under international attack on all fronts.

On the govt side, China is cutting demand to fight inflation, with India and Brazil presumed to be doing same. Austerity measures continue to bite in the UK and the euro zone, and are looming in the US.

On the private credit expansion side, regulatory over reach continues to restrict lending by the US banking system, and particularly with the small banks. This limits both bank and non bank lending, as the non bank lending is most often at least indirectly dependent on bank lending.

Additionally, the rising costs of food and fuel are taking purchasing power from those with the higher propensities to consume and shifting it to those with far lower propensities to consume.

And, of course, ongoing QE continues to remove interest income from the economy, as does the shift of interest income from savers to bank and other lender net interest margins, in a process that has yet to reach the national debate as a point of discussion.

Other commodity prices also continue to rise as hoarding from pension funds and the like via passive commodity strategies continues to expand globally.

This sends price signals that increase supply, which means human beings are being mobilized to produce stockpiles of gold, silver, and other metals and commodities not to ever be used for real consumption, but to forever remain as ‘reserves’ to index financial performance as demanded by current institutional structures. This is a monumental waste of human endeavor as well as the real resources, including energy, that are committed to this process.

So at the macro level we are removing teachers from what have become over crowded classrooms, removing nurses from neglected patients, and removing workers from building, repairing, and maintaining our homes and other infrastructure, to send them to either the unemployment lines or the gold mines.

And because they think at any moment we can suddenly become the next Greece, both sides agree with the necessity and urgency of promoting this policy.

April 27 (Reuters) — Applications for U.S. home mortgages fell last week as higher insurance premiums for government-insured loans sapped demand, an industry group said Wednesday.

The Mortgage Bankers Association said its seasonally adjusted index of mortgage application activity, which includes both refinancing and home purchase demand, fell 5.6 percent in the week ended April 22.

“Purchase applications fell last week, driven primarily by a sharp decrease in government purchase applications as new, higher Federal Housing Administration premiums went into effect,” Michael Fratantoni, MBA’s vice president of research and economics, said in a statement.

The decline reverses a recent increase in government purchase applications, which was likely due to borrowers trying to beat the deadline, Fratantoni said.

The MBA’s seasonally adjusted index of loan requests for home purchases tumbled 13.6 percent, while the gauge of refinancing applications slipped 0.6 percent.

Fixed 30-year mortgage rates averaged 4.80 percent in the week, easing from 4.83 percent the week before.