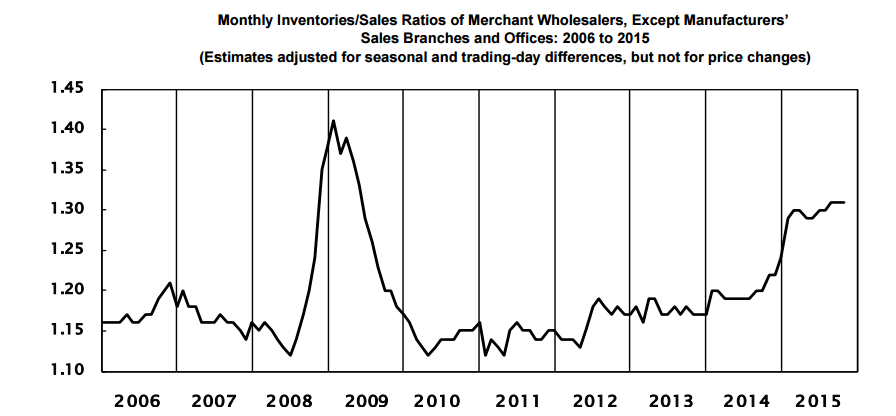

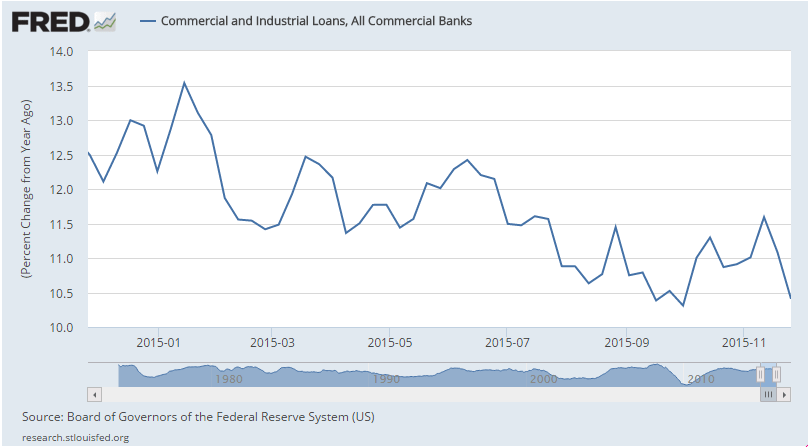

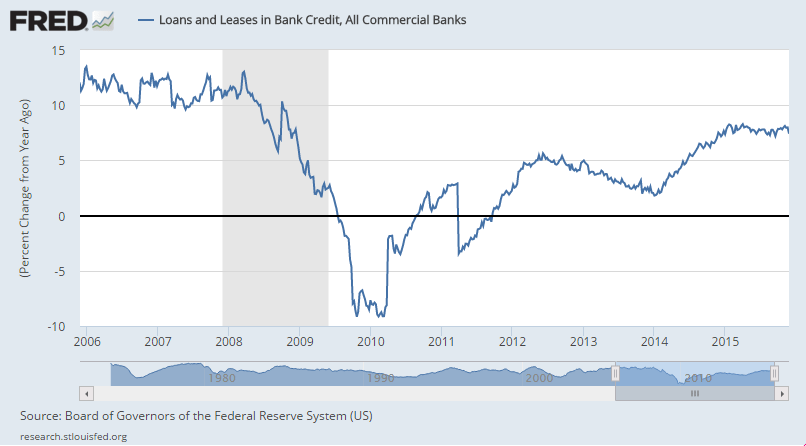

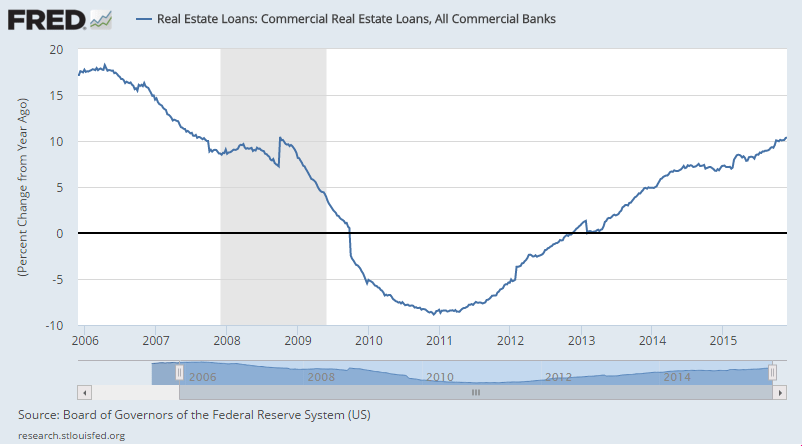

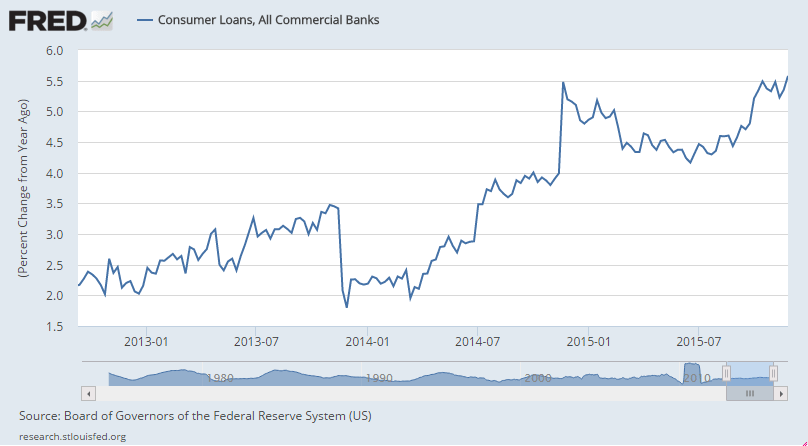

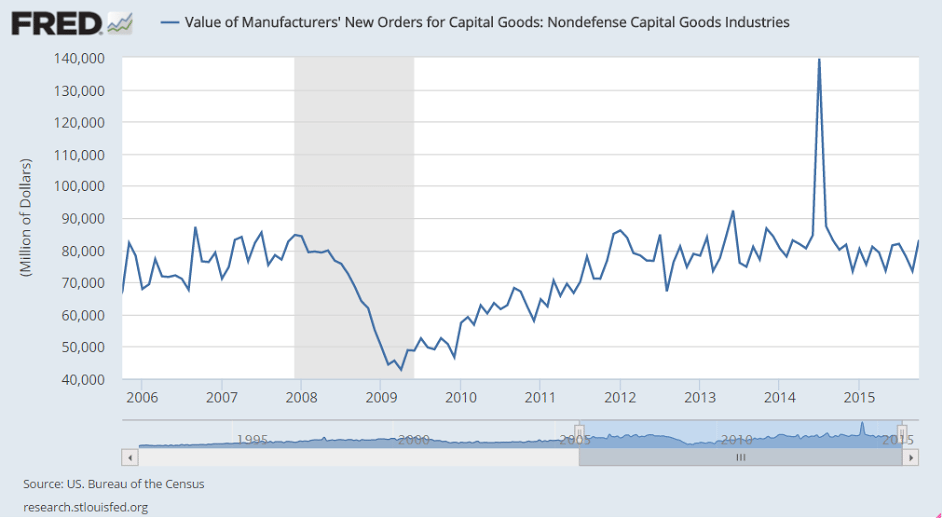

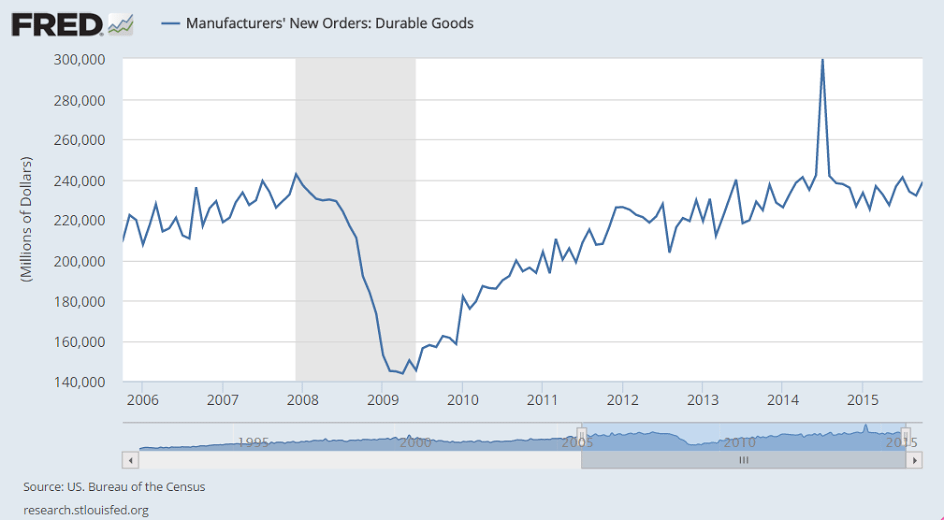

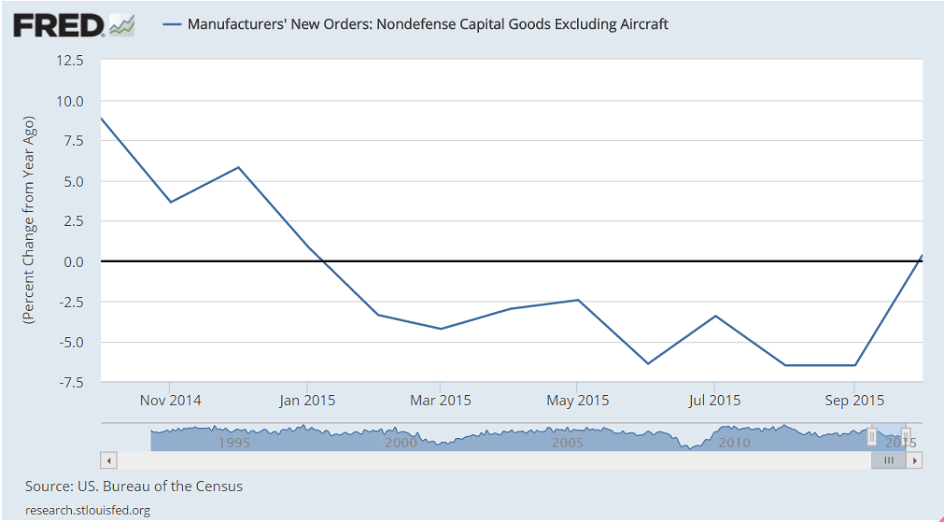

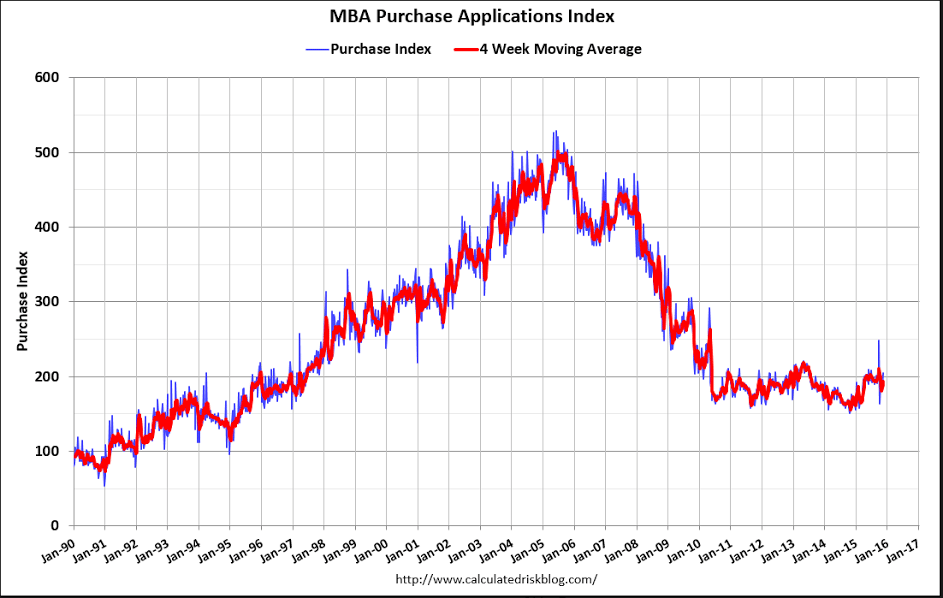

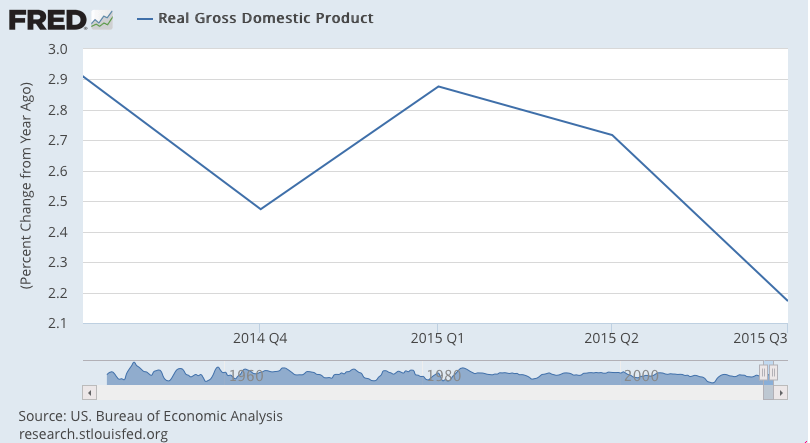

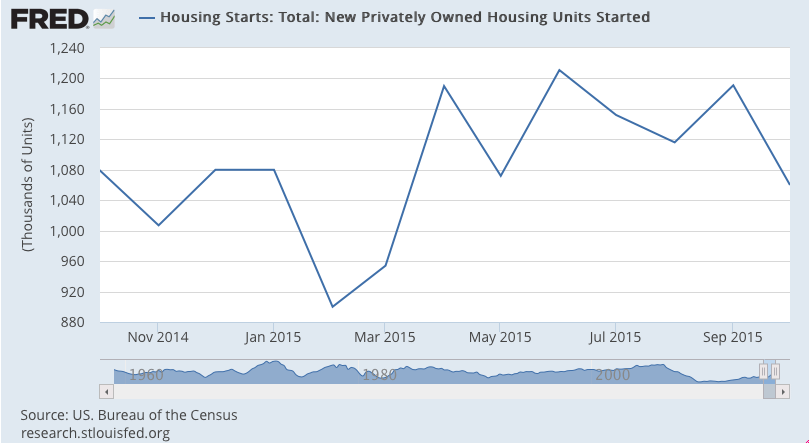

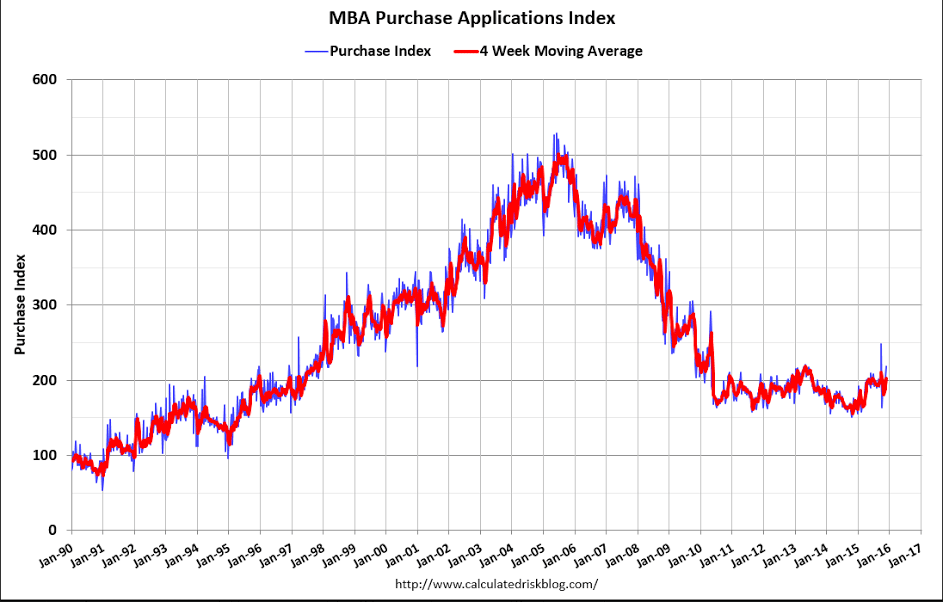

Maybe up from a year ago, but for the last several months flat to down and still at depressed levels:

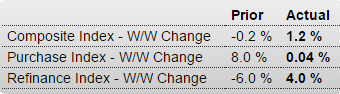

United States : MBA Mortgage Applications

Highlights

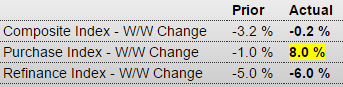

The purchase index was little changed in the December 4 week, up 0.04 percent to an unusual second decimal place as published by the Mortgage Bankers Association. Year-on-year, however, the gain is robust with no decimals offered, at plus 29 percent. The refinance index, measured as usual with one decimal place, rose 4.0 percent in the week. No matter how many decimal places MBA may or may not use, the approaching readings for the purchase index will be interesting to watch as they will cover the reaction, if any, to next week’s pending rate hike by the Fed. The average rate for 30-year fixed mortgages with conforming balances ($417,000 or less) rose 2 basis points in the week to 4.14 percent.

Nothing good here, sales flat and inventories down a very small amount as sales/inventory stays way too high:

United States : Wholesale Trade

Highlights

Wholesale inventories fell 0.1 percent in October against no change for sales, keeping the stock-to-sales ratio for this sector unchanged at 1.31. Wholesale inventories are on the heavy side as this ratio is well up from 1.22 this time last year. Year-on-year, inventories are up 3.6 percent which is well ahead of a 3.7 percent decline for sales.

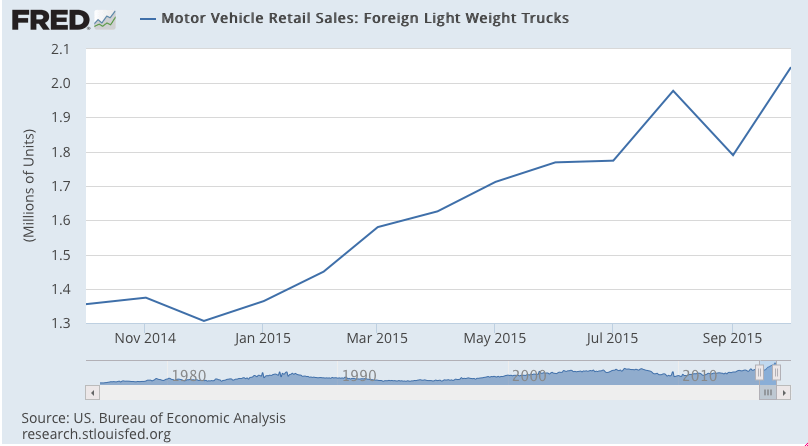

Inventory builds reflecting falling sales include metals and autos, though strong sales of the latter at the retail level point to a bounce back for related wholesale sales. Inventory draws reflecting rising sales include furniture, apparel, and farm products.

Businesses including wholesalers watch their inventory levels carefully, limiting unwanted overhang as much as they can especially when sales are slow. The decline in October inventories, together with a sizable 3-tenth downward revision to September to plus 0.2 percent, may be negatives for third-quarter GDP but are positives for the production and employment outlooks. Watch Friday for the business inventories report which will include data from the retail sector.