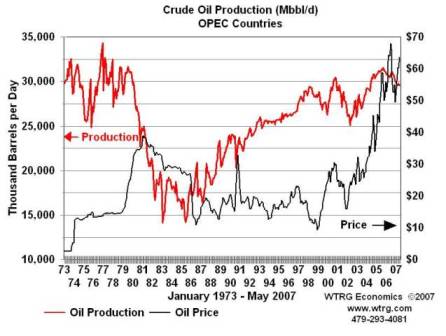

It’s only been a few hours, but seems the first time since August higher oil doesn’t mean lower interest rates, and might even mean higher rates.

Up until now, higher oil prices meant a weaker economy and therefore Fed rate cuts.

I’ve been watching for a shift to higher oil prices meaning higher inflation and therefore Fed rate hikes.

Recent developments- Yellen (the biggest Fed dove) says core inflation is above her comfort zone, and that energy prices are finding their way into core inflation.

Why did she volunteer that when no one was asking? Signalling?

Why not just repeat something like ‘inflation expectations remain well contained but we remain vigilant…’ as before?

Plosser, Fisher, Lasker said much the same, but they are the hawks. It’s not news when they say it.

Maybe they all got an update from the Fed’s economics staff?

Might be revising q2,3, and 4 upwards due to the fiscal package?

They had already expected a second half return to ‘trend’ due to their interest rate cuts.

So let’s guess at what might conservatively be the current mid points of the Fed’s forecast with the new fiscal package-

0% q1, 1% q2, 2.5% q3, 3% q4?

Here’s the problem. The mainstream belief is that inflation is a function of the output gap.

If inflation is too high- above your comfort zone- you bring it down by engineering a sufficient output gap.

That means it takes a weaker economy with higher unemployment to bring down core inflation.

The first step is to try to estimate the GDP ‘speed limit’ which is the max growth rate with inflation staying within Fed comfort zones.

Well, the Q4 data point was .6% gdp growth and inflation above comfort zones. Forward looking Q1 data points are 0 growth with inflation above comfort zones and rising. Q2, Q3 and Q4 now show increasing growth which means at best inflation won’t be projected to fall, and probably continue to deteriorate.

So what is the best guess for the max GDP growth rate consistent with inflation within FOMC member comfort zones?

The hawks said slower growth might not bring down inflation. The dove said she expects slower growth to bring down inflation.

But the forecasts are now for increasing rates of growth, and current conditions are already driving up prices past the Fed’s comfort zones.

Also, the Fed forecasts for 2 years forward always presume about a 2% inflation rate.

That’s because the forecast assumes ‘appropriate monetary policy’ to meet the Fed’s objectives.

The Fed’s interest rate forecast is not released with the rest of the forecast. Built into that model’s forecast is the staff’s calculation of ‘appropriate monetary policy.’

Seems to me that with growth revised up and inflation persisting even with weak q4 and weak q1 growth the model’s ‘appropriate monetary policy’ would be expected to include sufficient rate hikes to be consistent with the 2% inflation rate 2 years down the road.

Recap-

The only way the Fed knows to bring inflation down is to manage the output gap.

You don’t wait for the economy to get strong (achieve a 0 output gap) and then hike rates. That just makes it worse and more costly to keep an appropriate monetary policy/output gap to bring inflation down.

You have to not let the output gap too close to 0.

The Fed has always known this, but since August has feared a deflationary collapse due to supply side issues in the financial sector.

The recent past and the Fed’s forecast shows that instead of the feared deflation, inflation has now climbed above their comfort zones and appears to be persisting. And even looking higher, even with near 0 growth.

And last week’s Fed speeches raised concerns about the possibility that slowing growth has not and may not bring down inflation as anticipated.

And even Yellen volunteered that energy prices are beginning to elevate core inflation measures, and inflation expectations are showing signs of moving up.

Yes, the economy is weak. Yes, there are downside risks. But the economy is strong enough to be relentlessly pushing up prices, including core, and now the forecasts for growth have all been revised up due to the fiscal package.

If the FOMC shifts from fear of a deflationary collapse to fear of a moderate recession with prices holding firm, rate cuts are no longer appropriate monetary policy.

♥