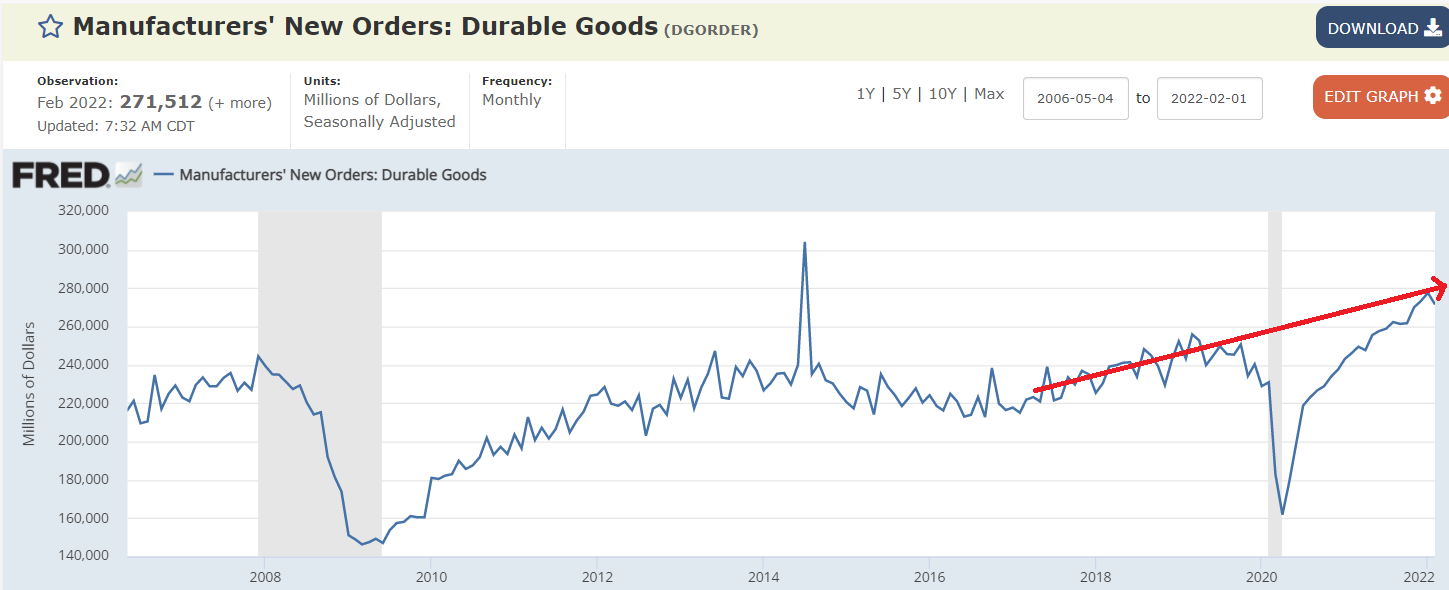

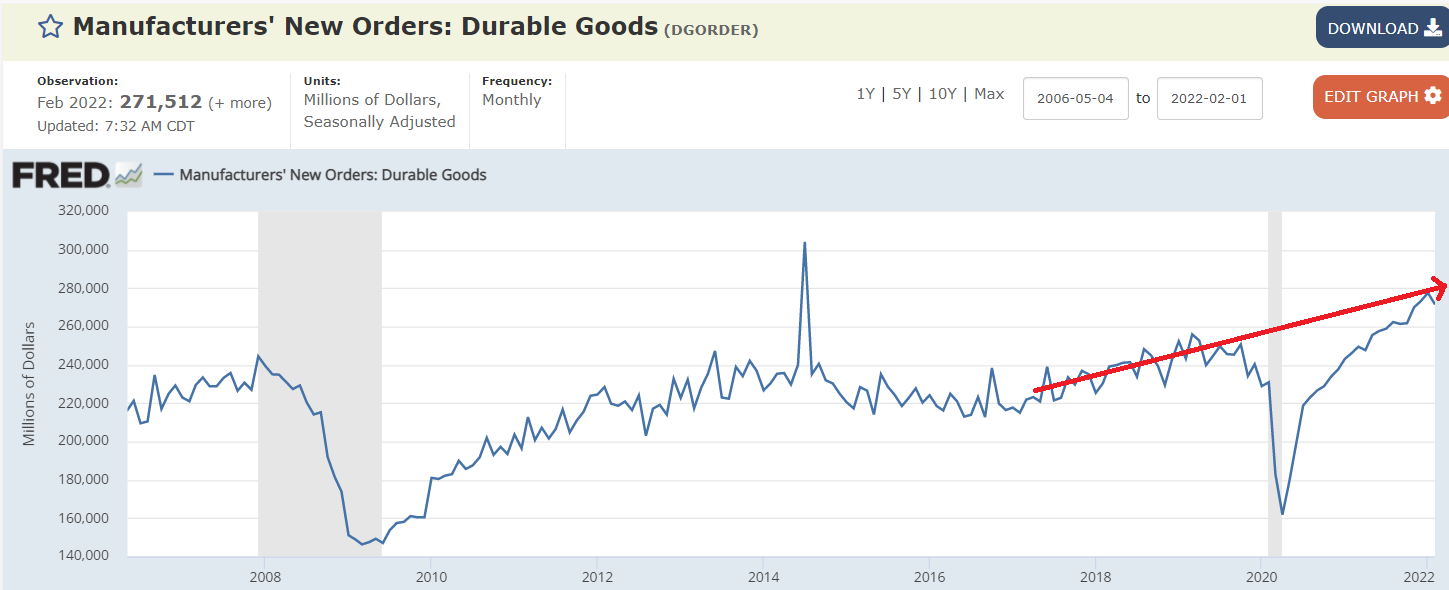

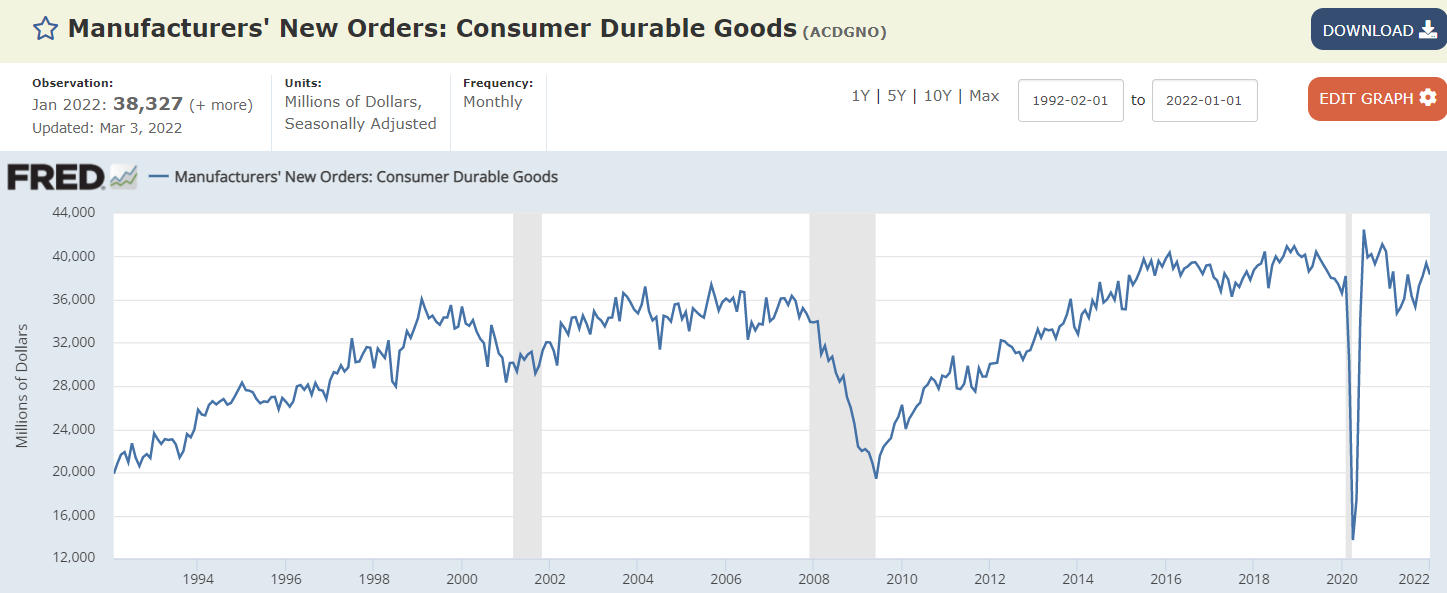

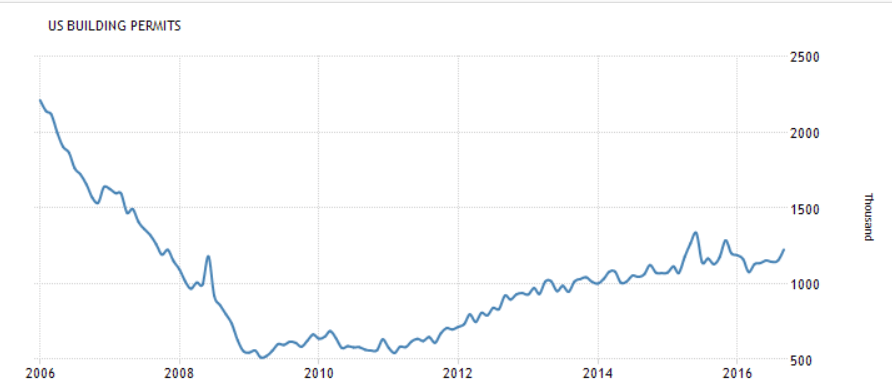

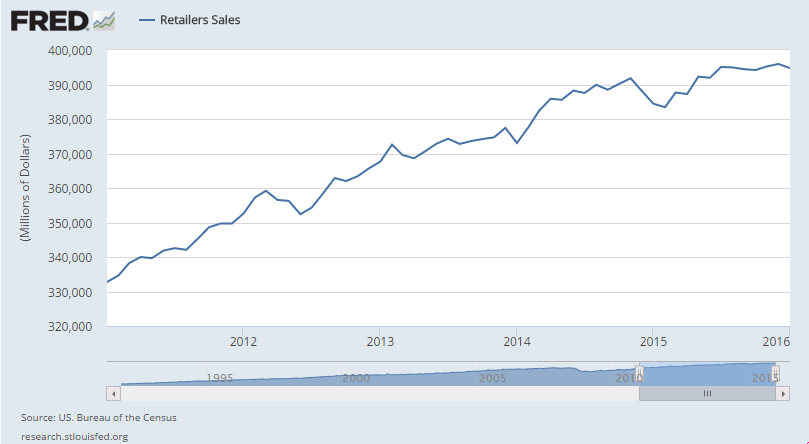

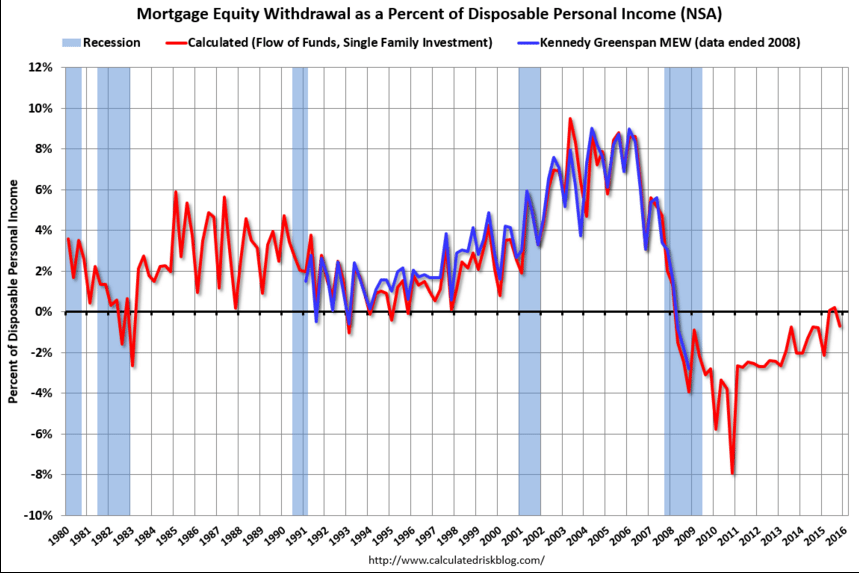

Recovered to trend but only because this chart isn’t adjusted for inflation:

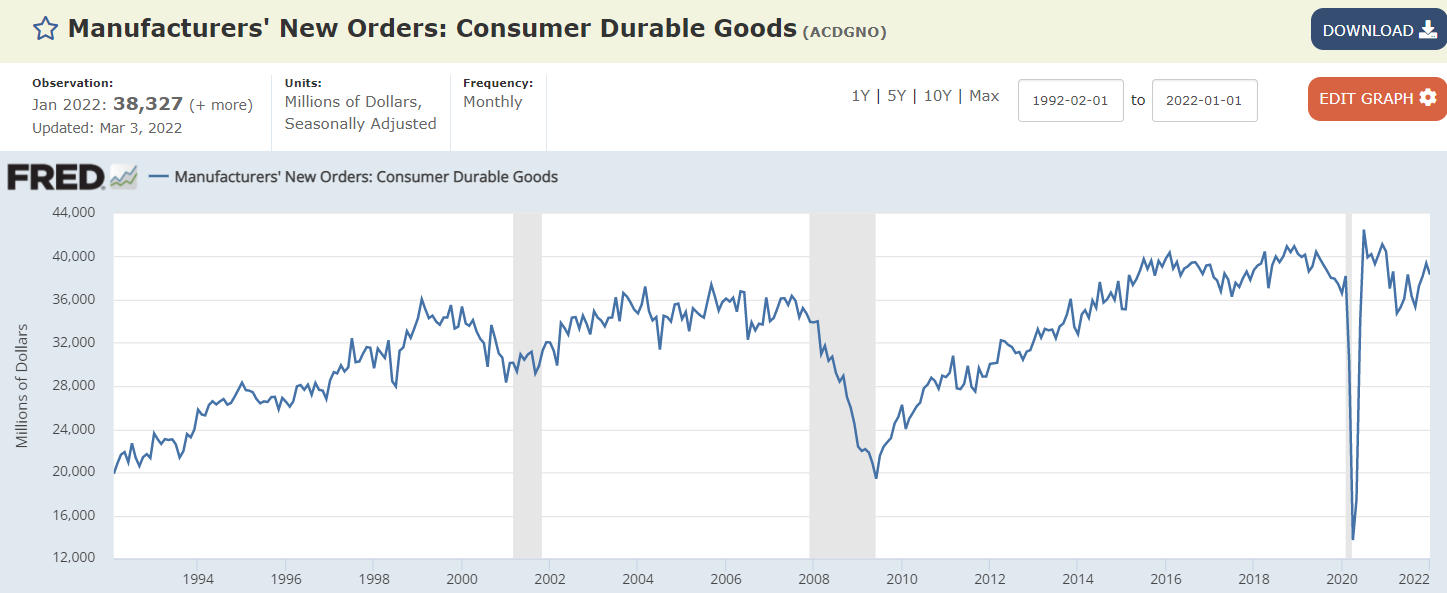

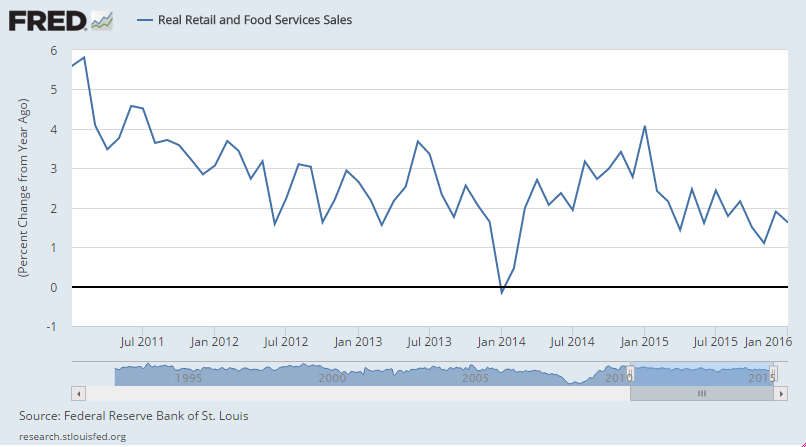

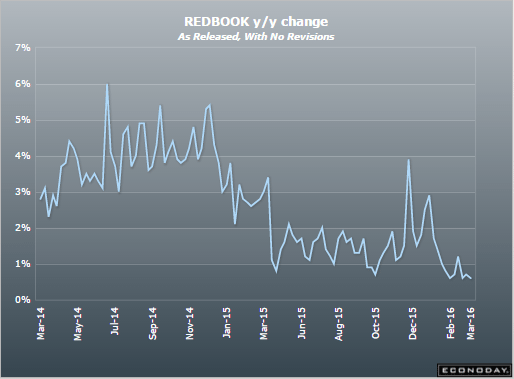

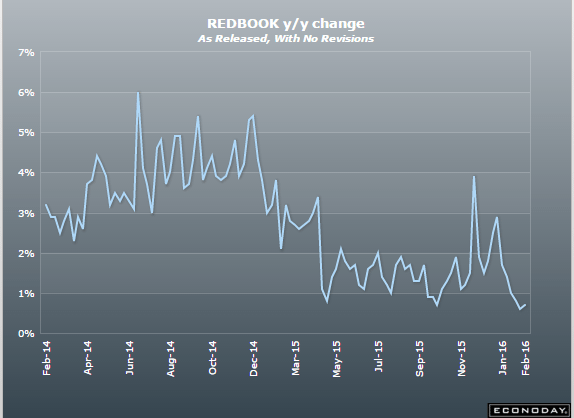

Nor does the narrative that consumers have gone crazy buying goods seem to be holding up:

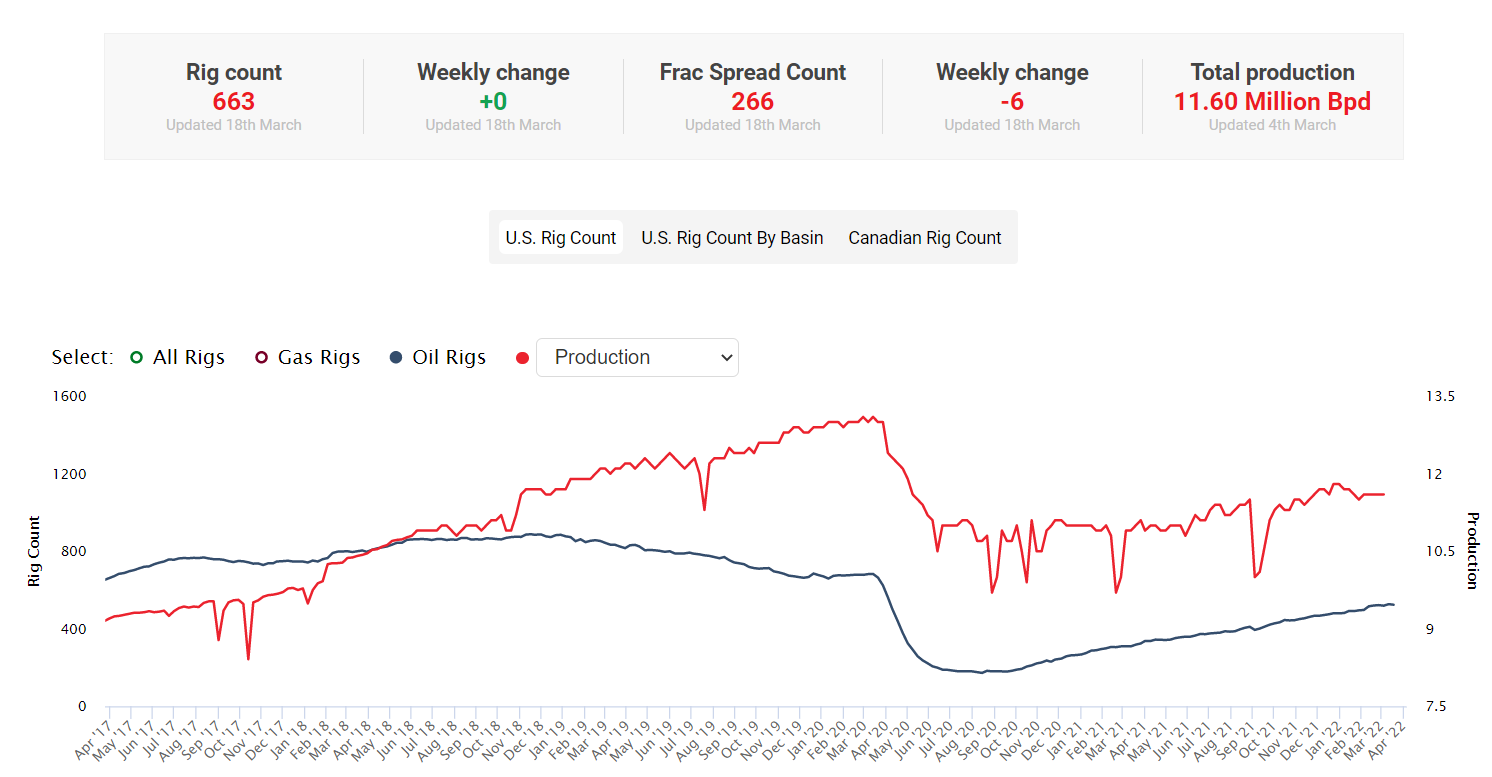

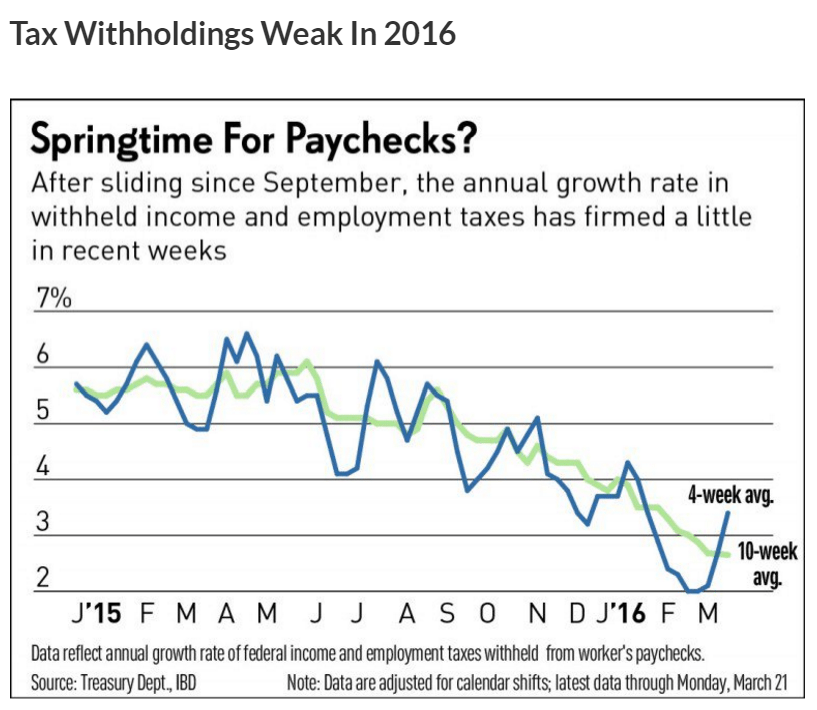

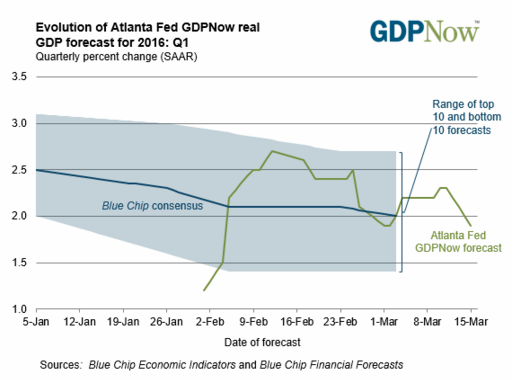

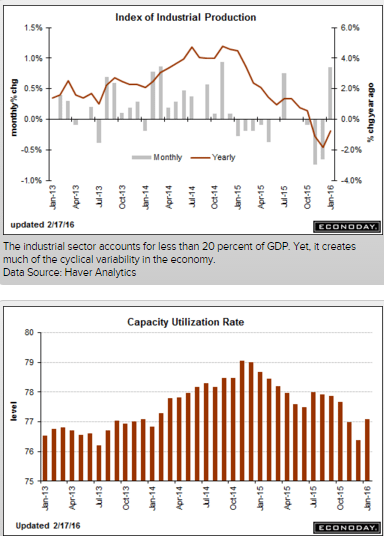

Not a lot of growth here:

Recovered to trend but only because this chart isn’t adjusted for inflation:

Nor does the narrative that consumers have gone crazy buying goods seem to be holding up:

Not a lot of growth here:

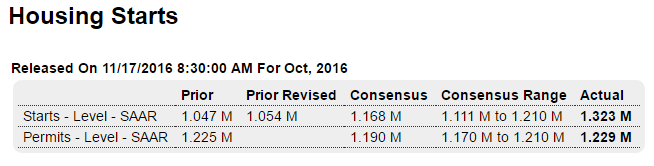

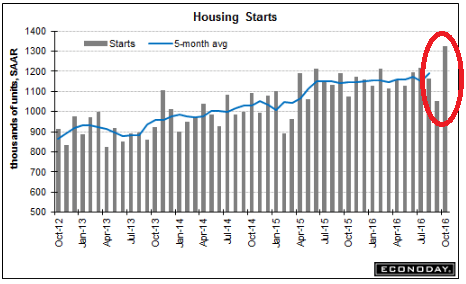

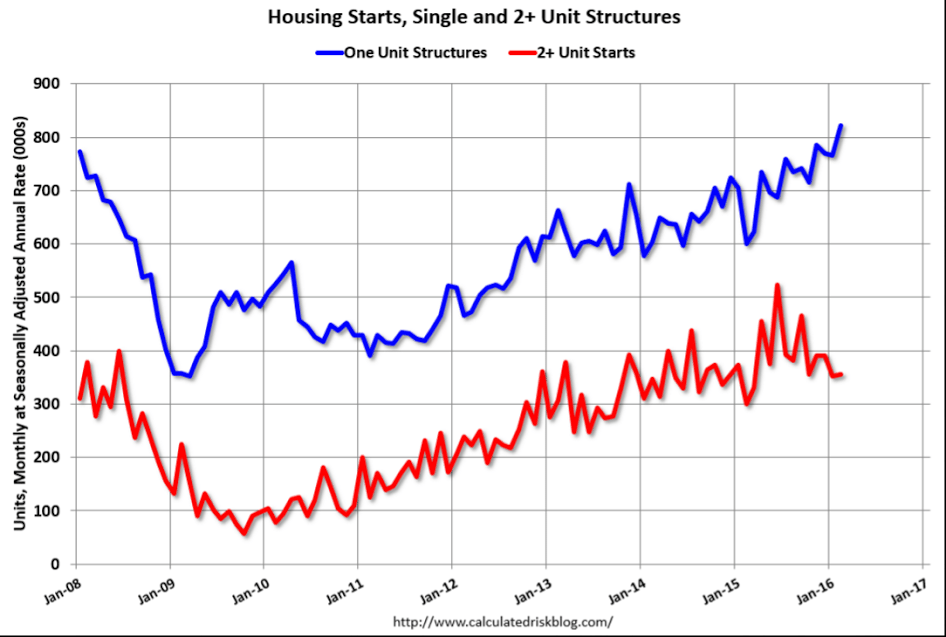

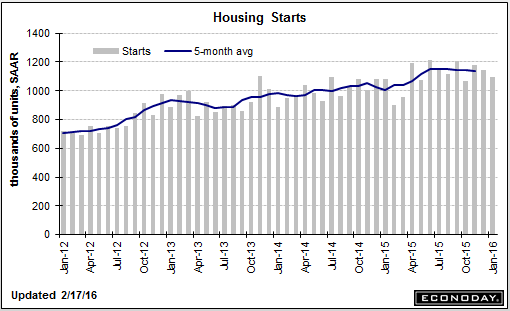

Nice move up after a large move down. Note that the average of the last two months is about where this series has been. And, again, it’s the permits that count, and they are about the same as last month. And not to forget mortgage applications to buy homes fell a full 6% last week after rates went up in response to the election.

Highlights

In data that will lift estimates for fourth-quarter GDP, housing starts surged 25.5 percent in October to a 1.323 million annualized rate. This is the best rate of the cycle, since August 2007 with the monthly percentage gain the strongest since 1982. The jump reflects a 10.7 percent rise to an 869,000 rate for the report’s key component, single-family homes, that follows an 8.4 percent surge in September. And multi-family homes snapped back from September’s odd 39 percent decline, rising 69 percent in October to a 454,000 rate.

But there’s less strength in permits which, however, did rise 0.3 percent to a 1.229 million rate. Importantly, single-family permits are up 2.7 percent in the data to offset a 3.3 percent dip for multi-family homes.

There’s plenty of strength in this report but it’s centered in the near-term, less so in the coming months. Other data include a 5.5 percent gain for completions to a 1.055 million rate led here by a 9.7 percent gain for the multi-family component with single-family homes up a very solid 3.9 percent. Regionally the West, which is key region for builders, is showing the most strength in this report followed by the Midwest. The South is mixed and the Northeast is mostly soft.

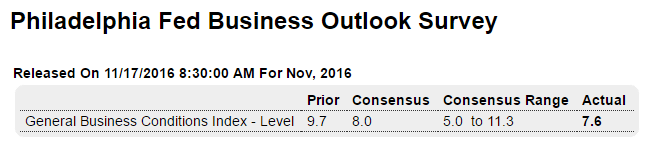

Highlights

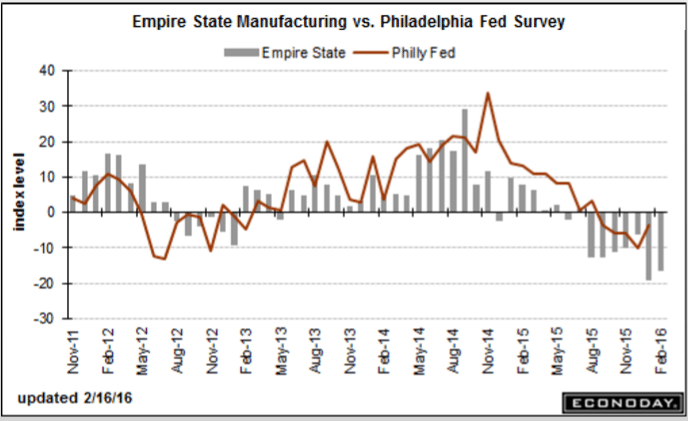

The Philly Fed continues to pick up signs of strength in the long dormant factory sector. The November headline looks tame at plus 7.6 but most of the details are very strong. New orders are up for a third month in a row and at very sharp multi-year high of 18.6. And unfilled orders make a rare appearance in the plus column at 4.1.

Shipments are at 19.5 and inventories, which are usually negative, are also in the plus column and strongly so at 13.4. Underscoring all the strength is solid and sudden life in prices with input costs surging nearly 20 points to 27.5 and selling prices also surging nearly 20 points to 16.0. The weakness in the report is in employment which continues to run in the negative column, at minus 2.6. However, if the strength in orders is repeated in the coming months, new hiring in the Mid-Atlantic factory sector is bound to begin.

Today’s report adds to a mix of indications, including the details of yesterday’s industrial production report, that the factory sector appears to be accelerating into the 2016 close.

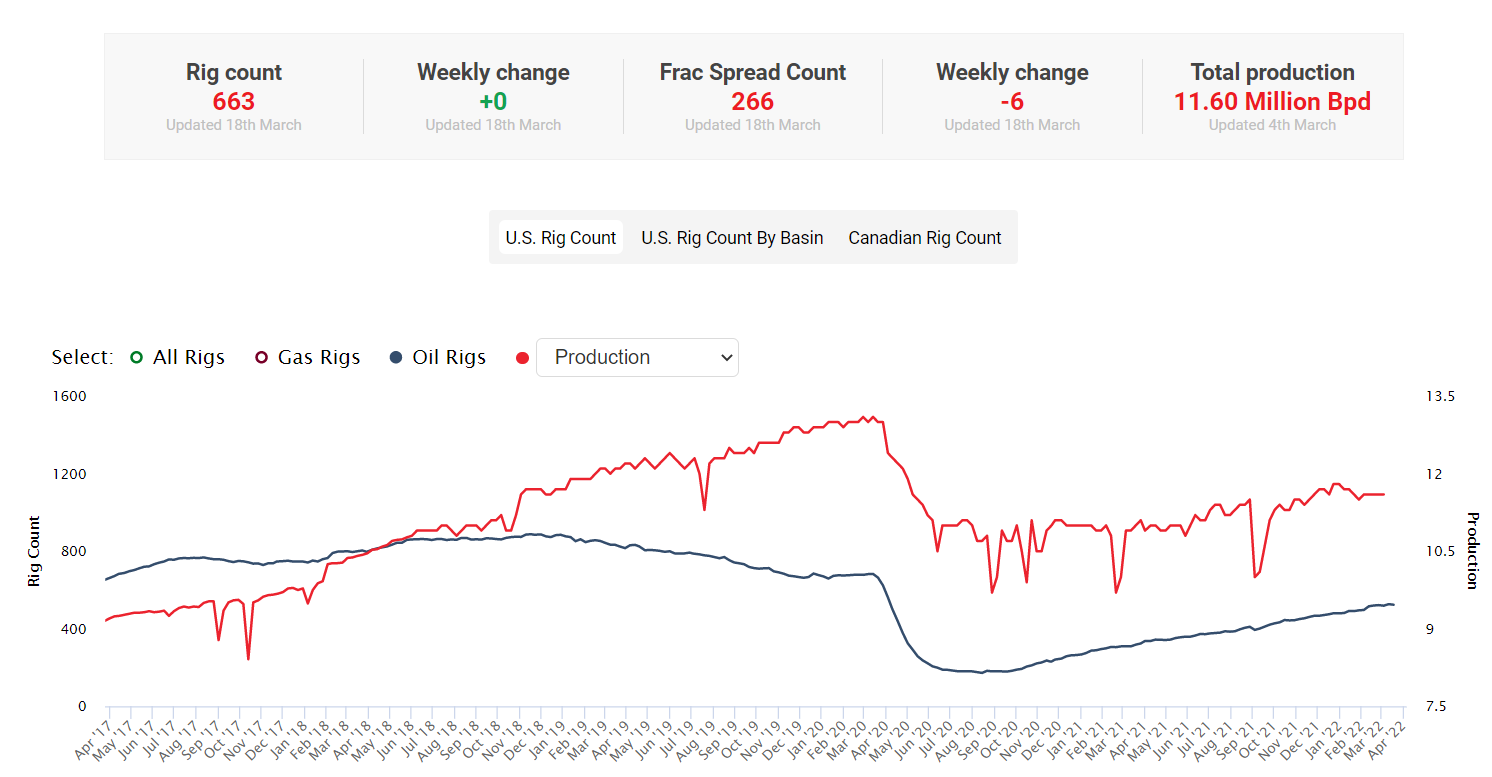

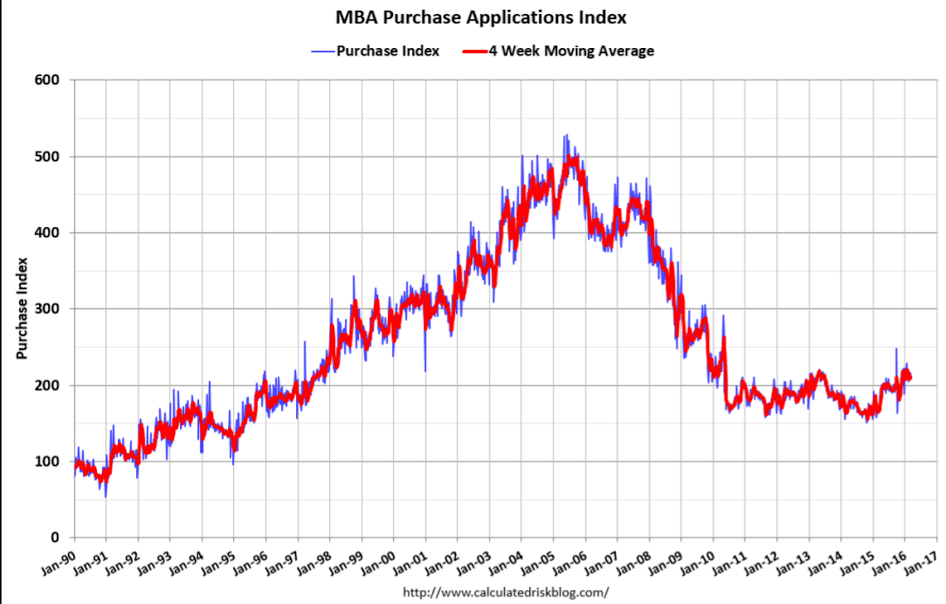

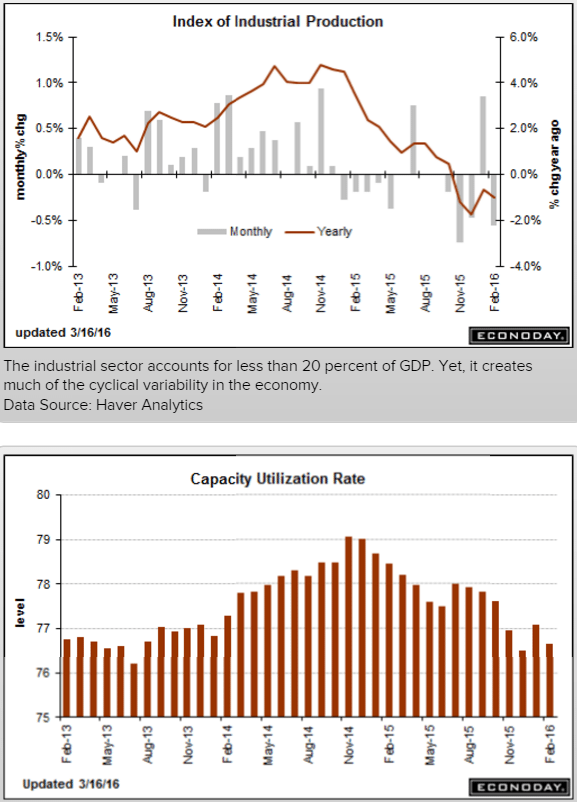

Down some, still depressed and going nowhere:

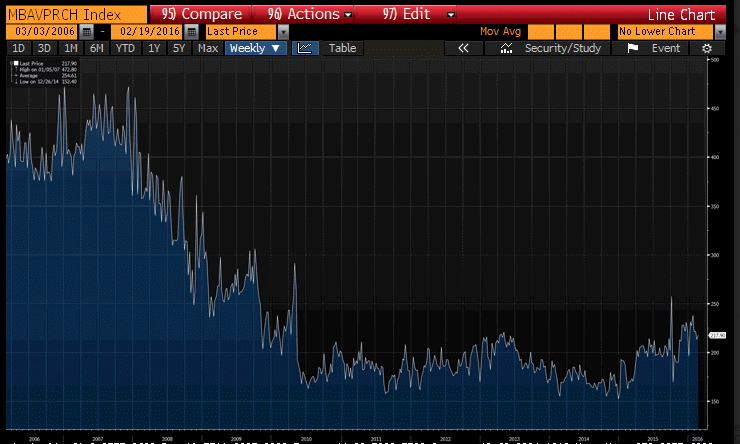

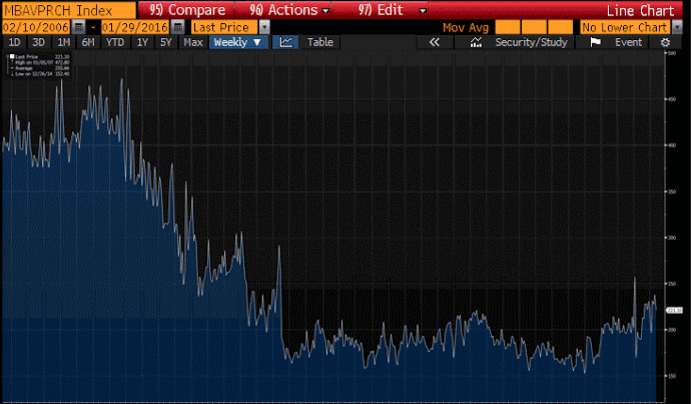

MBA Mortgage Applications

Highlights

Purchase applications for home mortgages fell back by 1 percent in the March 18 week, bringing down the year-on-year increase to a still very strong 25 percent, though some loss of momentum in this component is evident. Refinancing applications continued in the decline of recent weeks, dropping 5 percent in the latest week despite a 1 basis point slip to 3.93 percent in the average rate for 30-year conforming loans ($417,000 or less).

Been moving sideways for quite a while:

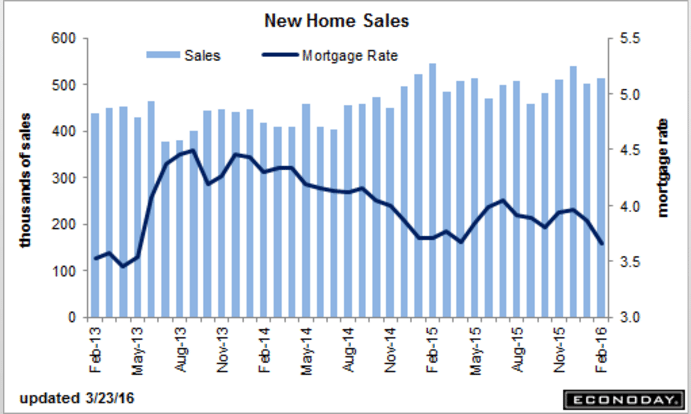

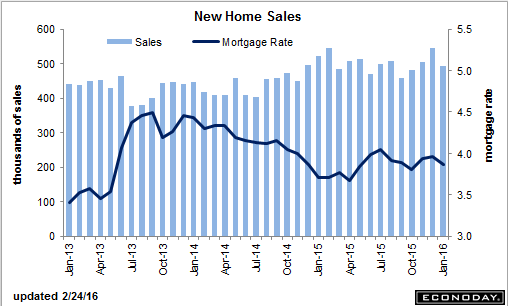

New Home Sales

Highlights

A burst of strength in the West supported a roughly as expected 2.0 percent rise in February new home sales to an annualized rate of 512,000. Sales in the West, which is a key region for the new home market, jumped 39 percent to reverse January’s 33 percent flop. The swings in this region are a reminder that new home sales, because of small samples, are subject to extreme month-to-month volatility.

February’s gain for sales didn’t come at the expense of discounting, based on the median price which jumped a monthly 6.2 percent to $301,400 but short of September’s record of $307,600. And the median price compared to sales does look high, up a very modest but possibly unsustainable 2.6 percent year-on-year vs a sharp decline of 6.1 percent for sales.

Lack of supply has been a problem for both existing home sales and also new home sales, with supply in the latter having been held down by a topping out in permits and also by supply constraints in the construction sector including for labor. Supply did edge 4,000 higher to a 7-year high of 240,000 units but supply relative to sales is unchanged at 5.6 months.

Looking at year-on-year sales rates for regions, the West, after its big showing in February, is back in front at plus 10.2 percent. The Midwest is up only 1.9 percent and the Northeast and South are both down, at 3.8 percent and 14.3 percent respectively. These declines, especially for the South which is a very large region, are a reminder of how soft new home sales have been.

Yet today’s report, which includes the gain for prices, is a plus for housing, a sector that has opened the year on a soft note.

Working their way a bit higher but still seriously depressed:

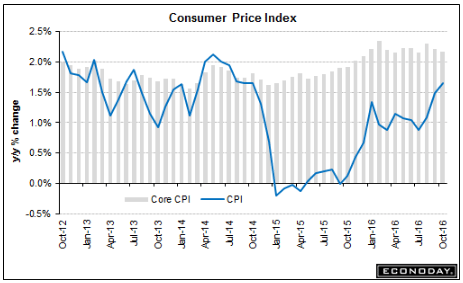

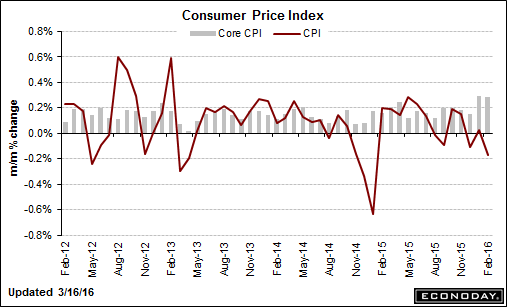

With the year over year CPI increase now only 1% the Fed can only wait and see if headline will catch up to core and ‘justify’ their tightening bias.

Consumer Price Index

Highlights

The CPI core is showing pressure for a second month, up a higher-than-expected 0.3 percent in February with the year-on-year rate up 1 tenth to plus 2.3 percent and further above the Federal Reserve’s 2 percent line.

Gains are once again led by health care with medical care up 0.5 percent for a second straight month which includes a 0.9 percent gain for prescription drugs. Shelter also shows pressure, up 0.3 percent as does apparel which is up 1.6 percent for a second straight sharp gain. Food rose percent 0.2 percent with the year-on-year rate at plus 0.9 percent.

Energy prices, which may be on the climb this month, fell a sharp 6.0 percent in February and pulled down the total CPI which came in at minus 0.2 percent with the year-on-year rate at plus 1.0 percent.

But it’s not the total that Fed officials will be watching but the core which — for a second straight month — is signaling what policy makers want, that is upward pressure. This report isn’t dramatic enough to revive much chance for a rate hike at today’s FOMC but it will offer strong arguing point for the hawks.

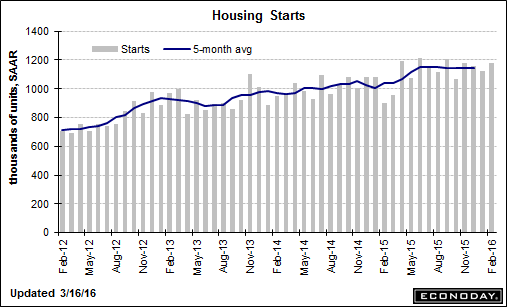

There are no starts without permits, and permits are down:

Housing Starts

Highlights

Housing starts & permits are mixed with starts way up but permits, which are the more important of the two, way down. Starts rose 5.2 percent to a 1.178 million annualized rate while permits, which were expected to show no change, dropped 3.1 percent to 1.167 million.

The gain for starts is split between a 7.2 percent surge for single-family homes and a 0.8 percent gain for the multi-family component while the drop for permits is centered in multi-family, down 8.4 percent to a 436,000 rate. But permits for single-family homes, and this is the silver lining in this report, are up 0.4 percent to 731,000. The multi-family component, driven by investment demand, is often very volatile which makes single-family homes the more telling of the two.

Year-on-year, single-family permits are up a very strong 16.8 percent offsetting a 7.6 percent dip on the multi-family side. Regional data for permits show the Northeast out in front with a nearly 36 percent gain and the South in the rear at minus 1.8 percent. The West, which is a key region for new housing, is up 6.5 percent.

The gain for starts will boost ongoing estimates for construction spending while the small gain for single-family permits may help ease concern that housing is losing momentum.

And more confirmation that multifamily peaked last June when the NY tax credits expired:

And more bad:

Industrial Production

Highlights

Industrial production fell 0.5 percent in February but includes a respectable and higher-than-expected 0.2 percent gain for manufacturing production which pulls this report to the positive column for the economic outlook. The utility component, down 4.0 percent in February after rising 4.2 percent in January, is very volatile reflecting month-to-month swings this time of year in heating demand. The mining component, down again at minus 1.4 percent, has been weak for the last year reflecting the price collapse for commodities.

But the manufacturing component is the telling component with strength belying broad weakness in regional surveys and pointing perhaps to better-than-expected output for the first quarter. Vehicles have been a center of strength for manufacturing, though production here did slip 0.1 percent in the month, while business equipment is suddenly showing life, up 0.6 percent for a second straight month. The gain for this component hints at a revival for business investment.

Capacity utilization overall is down 0.4 percentage points to 76.7 percent though manufacturing capacity, again the reading to focus on, is unchanged at 76.1 percent. The factory sector has been getting pulled back by weak exports and weak demand for energy equipment though this report, together with positive indications in yesterday’s Empire State report, do suggest, or at least offer the hint, that the worst may over.

Note that the traditional non-NAICS numbers for industrial production may differ marginally from the NAICS basis figures.

Just plain bad. Including last month’s downward revision.

And, again, sales = income, and lower income means less to spend in the next period:

Retail Sales

Highlights

Consumer spending did not get off to a good start after all in 2016 as big downward revisions to January retail sales badly upstage respectable strength in February. January retail sales are now at minus 0.4 percent vs an initial gain of 0.2 percent. The two major sub-readings also show major downward revisions with ex-auto sales now down 0.4 percent vs an initial gain of 0.1 percent and ex-auto ex-gas sales now at minus 0.1 percent from plus 0.4 percent. The latest for this latter core rate is really the main positive in today’s report, up a solid 0.3 percent in February. Total sales for February are weak at minus 0.1 percent as is the ex-auto reading, also at minus 0.1 percent.

But even in the core readings, details are not great with strength so far this year mixed across nearly all categories. Still, year-on-year strength is evident in two key discretionary components which are vehicles, up 6.8 percent, and restaurants which are up 6.4 percent. Non-store retailers, benefiting from growth in ecommerce, are up 6.3 percent. Sporting goods, a smaller discretionary category, are up 6.7 percent. And building materials & garden equipment, in a sign of strength for residential investment, are up 12.2 percent. The downside includes electronics & appliances which are at minus 3.2 percent and department stores down 2.2 percent. The weakest of all of course are gasoline stations, down 15.6 percent on the year as low fuel prices depress dollar sales.

Given the skewing effect of gasoline, the ex-gas total is important to look at it and it’s up 0.2 percent in the month for very respectable yearly growth of 4.8 percent. This reading underscores the silver lining in the report, that retail sales, despite all the negatives, are moving in the right direction. January and February are the lowest sales months of the year, a fact that magnifies adjustment effects and can cause volatility in the readings. But that aside, consumer spending, despite high employment, is struggling to break out of a flat run that included a very soft holiday season.

This is year over year change, adjusted for inflation:

While U.S. retail sales fell less than expected in February, the sharp downward revision to January’s sales could be “devastating” for investors, CNBC’s Jim Cramer said Tuesday.

“I’m just kind of flummoxed. A number comes out that makes us feel great, and then that number is taken away,” Cramer said on “Squawk on the Street.”

;)

Another bad one:

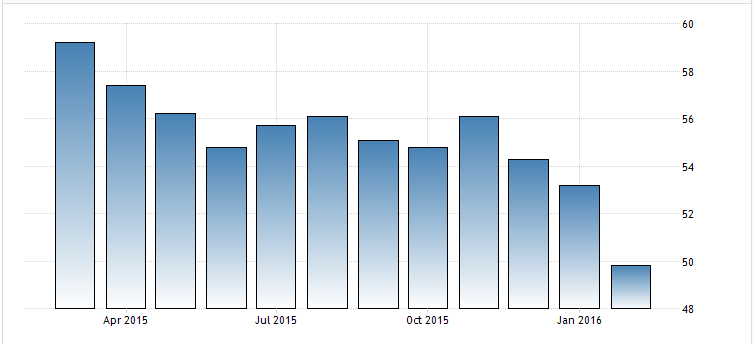

Housing Market Index

Highlights

Demand for new homes is solid but lack of available lots and shortages in construction labor are holding back growth. The housing market index came in unchanged in March at a 58 level which however remains well above breakeven 50. Present sales, unchanged at a strong 65, lead the March report followed by future sales which are down 3 points to 61. A plus, however, is a 4 point gain to 43 for buyer traffic which has been weak this whole cycle.

The gain in traffic hints at the drawing power of low mortgage rates and speaks to the strength of the labor market. But there hasn’t been much acceleration in housing nor is any expected in tomorrow’s permits data. The housing sector, which was billed as a strength for 2016, has yet to build any momentum this year.

Also bad:

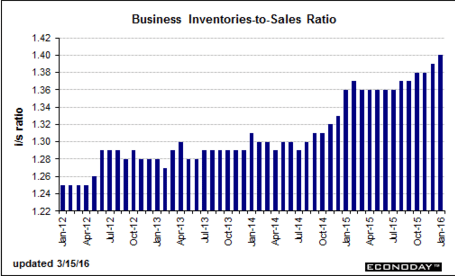

Business Inventories

Highlights

It’s been a weak morning for U.S. economic data and business inventories are no exception. Inventories rose an unwanted 0.1 percent in December against a 0.4 percent decline for sales in a mismatch that drives the stock-to-sales ratio from 1.39 to 1.40 for the fattest reading of the whole cycle, since May 2009. Inventories fell for factories but rose for wholesalers and also for retailers. Sales, however, fell for both retailers and especially for wholesalers. Heavy inventories are a negative for future production and future employment and today’s report points to slowing for both during the first quarter.

Better than expected but still weak:

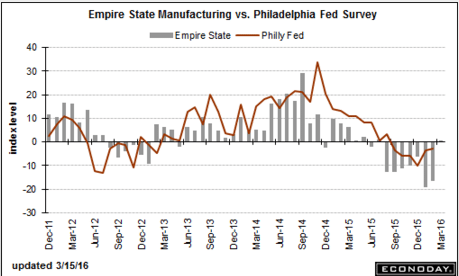

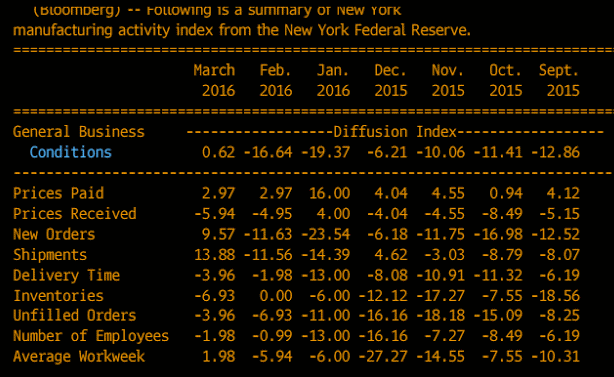

Empire State Mfg Survey

Highlights

After seven straight months of contraction, the general conditions index of the Empire State report is back in the plus column, though just barely at 0.62 in a reading that signals fractional strength for factory activity during March. New orders are the report’s most convincing headline, at plus 9.57 to end nine straight months of contraction. Unfilled orders, however, remain in contraction, but only slightly at minus 3.96, as does employment at minus 1.98. Inventories are in contraction as are selling prices. Yet still, the 6-month outlook is picking up, to plus 25.53 for a more than 10 point gain. Shipments are also positive, at 13.88 in what points to strength for the manufacturing component of the March industrial production report, the February edition of which will be posted tomorrow and is expected to be flat. Flat is really the theme of this report which, compared to the deep contraction of prior reports, is relatively good news for a factory sector that has been getting hit by weakness in exports and energy equipment.

No sign of credit expansion here:

As previously suspected, last month’s higher print was just a bit of volatility on the way down, as per the chart:

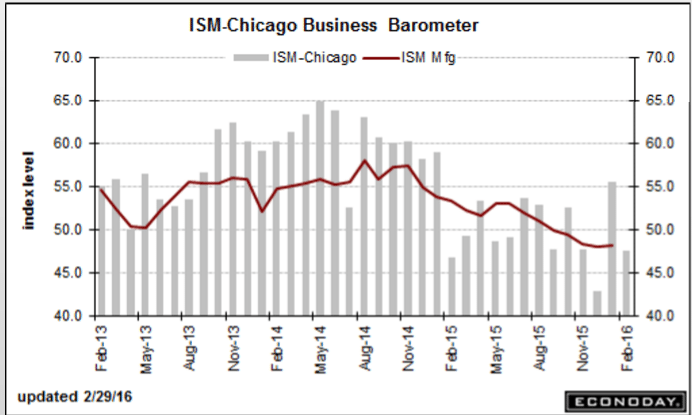

Chicago PMI

Highlights

Another month and another month of wild volatility for the Chicago PMI which lurched from solid expansion in January to noticeable contraction in February. At a headline 47.6, Chicago’s PMI has fallen outside Econoday’s consensus range for a third month in a row! Still, this report is closely watched and confirms other early indications of February softness, not only for manufacturing but for services as well since this report tracks both sectors. The good news in the report is that new orders have held over breakeven 50 which hints at better readings in next month’s report. Now the bad news. Production is down sharply, backlogs are in a 13th month of straight contraction, employment is down and in a fifth month of contraction, and prices paid are contracting at the fastest pace since 2009. The resilience in new orders limits the signal of damage from this report, but production and other activity look to have slowed in February following respectable strength in January.

Another bad one, as the weakness that began with oil capex continues to dampen the rest:

Pending Home Sales Index

Highlights

Pending sales of existing homes slowed in January, down an unexpected 2.5 percent to an index level of 106.0 in a decline offset but only in part by an 8-tenths upward revision to December to plus 0.9 percent. Econoday forecasters were expecting a much better reading, at a consensus plus 0.5 percent for January sales. Sales in the month fell in three of the four regions with only the South in the plus column. Year-on-year, pending sales are up only 1.4 percent. Today’s report is yet another disappointment for a sector that, despite high employment and low mortgage rates, is getting off to a flat start for 2016.

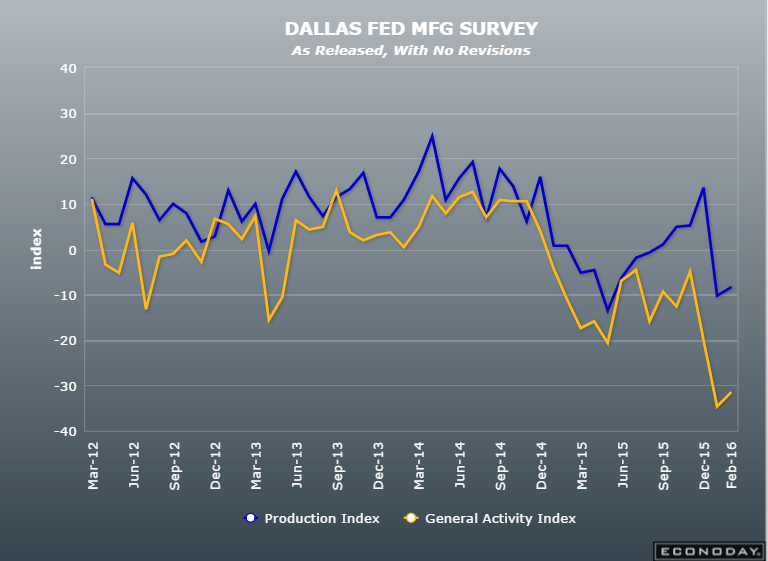

The oil patch is where the recession started and it keeps getting worse which means the rest of the economy will continue to deteriorate as well:

Dallas Fed Mfg Survey

Highlights

Dallas, together with Kansas City, are two Fed districts that are being hit hardest by the collapse in oil prices. The Dallas Fed’s general activity index came in at a deeply minus 31.8 in February vs minus 34.6 in January. New orders contracted a further 8.4 points in the month to minus 17.6 for their lowest reading since 2009 in what is a very ominous signal for the months ahead. Unfilled orders are also in contraction as are production and shipments. Price contraction deepened for both raw materials and selling prices. Inventories are down as is employment. In fact, in a rare sweep of weakness, all 17 current components are in contraction! The company outlook index is at minus 17.4 with a quarter of the sample saying their outlook has worsened during February. The latter is a telling reading and suggests very strongly, in line with all other anecdotal readings this month, that the factory sector, hit by weak exports and a weak energy sector, fell back in February.

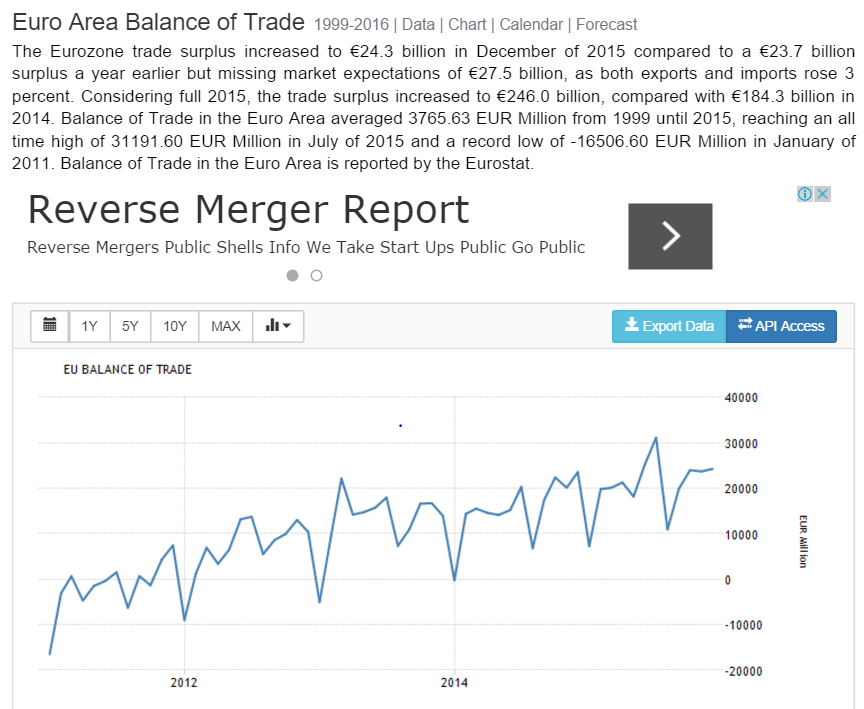

Fundamentally high inflation = weaker currency as higher prices means the same amount of currency buys less,etc. and deflation = a fundamentally stronger currency. However, the euro has been falling on news of deflation, as portfolio mangers, traders, etc. sell what euro they still have (or get outright short), their logic/fears being that deflation will trigger more inflationary policy from the ECB, which has yet to ‘trigger’ inflation. Meanwhile, the lower euro, driven down by selling and not ‘fundamentals’, continues to support the large and growing trade surplus that removes net euro financial assets from global markets. This has been going on for maybe a couple of years now leaving the euro more and more ‘undervalued’ and in ever shorter supply:

Euro-Area Prices Decline Most in Year as ECB Mulls Easing

By Alessandro Speciale

Feb 29 (Bloomberg) — The inflation rate in the 19-nation bloc declined to minus 0.2 from a positive reading of 0.3 percent in January,. Core inflation, which strips out volatile elements such as food and energy, was at 0.7 percent, down from 1 percent in the prior month. In Germany, the European Union- harmonized inflation rate dropped to minus 0.2 percent from 0.4 percent. The rate in France fell to minus 0.1 percent, while Spanish prices slid 0.9 percent. The ECB has already cut its deposit rate to minus 0.3 percent and is pumping 60 billion euros ($66 billion) a month into the economy via asset purchases.

Nothing good here:

The world’s top economies are set to declare on Saturday that they need to look beyond ultra-low interest rates and printing money if the global economy is to shake off its torpor, while promising a new focus on structural reform to spark activity.

A draft of the communique to be issued by the Group of 20 (G-20) finance ministers and central bankers at the end of a two-day meeting in Shanghai reflected myriad concerns and policy frictions that have been exacerbated by economic uncertainty and market turbulence in recent months.

“The global recovery continues, but it remains uneven and falls short of our ambition for strong, sustainable and balanced growth,” the leaders said in a draft seen by Reuters.

“Monetary policies will continue to support economic activity and ensure price stability … but monetary policy alone cannot lead to balanced growth.”

Geopolitics figured prominently, with the draft noting risks and vulnerabilities had risen against a backdrop that includes the shock of a potential British exit from the European Union, which will be decided in a June 23 referendum, rising numbers of refugees and migrants, and downgraded global growth prospects.

But there was no sign of coordinated stimulus spending to spark activity, as some investors had been hoping after the market turmoil that began 2016.

Germany had made it clear it was not keen on new stimulus, with Finance Minister Wolfgang Schaeuble saying on Friday the debt-financed growth model had reached its limits.

“It is even causing new problems, raising debt, causing bubbles and excessive risk taking, zombifying the economy,” he said.

This is from a story about Virginia’s claims for unemployment which are down even as the economy has weakened:

Colonna said the dip to 1974 levels in new unemployment claims is baffling since economic growth has been so sluggish in Virginia recently.

The state’s economy didn’t grow at all last year, U.S. Bureau of Economic Analysis data show.

And for the 12 months ended in July, the number of Virginians working rose by just 12,200, or 0.3 percent, the Virginia Employment Commission reports. The number who were unemployed declined by 33,000 – a figure that’s larger because it includes people who have stopped looking.

Part-time workers can’t always qualify for benefits when they are laid off, since to receive the minimum $60 a week unemployment benefit in Virginia, a person must have earned at least $3,000 during two of the previous five quarters.

And if income from any part-time job exceeds a laid-off person’s unemployment benefit, the state won’t pay the unemployment benefit. The maximum unemployment benefit in Virginia is $378, and the maximum time it is paid is 26 weeks. You can’t get the benefit if you are fired or quit your job.

Challenging to put a good spin on this one, but they gave it their best shot, as the wheels are coming off at every turn:

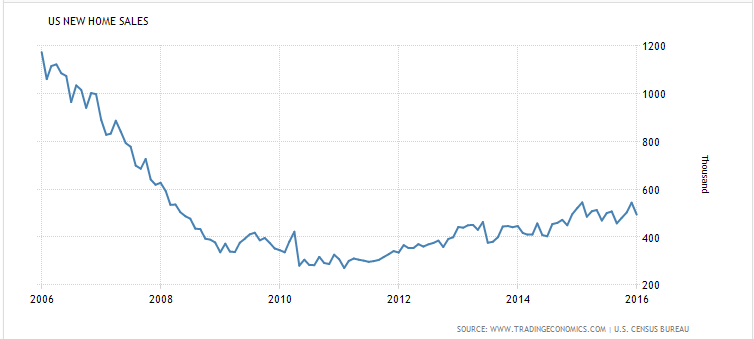

New Home Sales

Highlights

A downturn out West helped pull new homes sales down a steep 9.2 percent in January to a lower-than-expected annualized rate of 494,000. The level, however, is still respectable given that there is no revision to December which stands at a very solid 544,000. Sales in the West, which is a key region for the new home market, fell 32 percent in the month which pulls down the region’s year-on-year rate to minus 24 percent. The South and Midwest show only marginal year-on-year contraction with the Northeast, the smallest new home region however, up sharply.

Price discounting seems to be at play as it was in yesterday’s existing home sales report. The median price fell 5.7 percent in the month to $278,000 for a year-on-year decline of 4.5 percent. Sales had been ahead of prices before this report but not anymore, with a nearly double-digit year-on-year pace now falling into contraction at minus 5.2 percent.

Supply has been very slow to enter the market, the result largely of constraints in the construction sector. But more new homes did enter the market in the month, up 2.1 percent to 238,000 and supply relative to sales, given the slowdown in sales, is up sharply, to 5.8 months vs 5.1 months.

The slope for the housing sector has been volatile but is trending upward. Price discounts will help boost sales but will also pull down home-price appreciation which has been a central area of strength for household wealth.

This is from the not so reliable survey organization that tends to overstate things. And it now has the service sector in contraction and the spin is bad as well:

PMI Services Flash

Highlights

In what could be a chilling indication of trouble ahead, the February flash for the service PMI slipped below breakeven 50 to 49.8 for the weakest reading since the government shutdown of October 2013.

New orders are still growing but at the slowest pace in nearly six years with contraction in backlog orders the most severe since early 2014. The 12-month outlook, though still positive, is the least positive in 5-1/2 years. Employment in the sample is still growing but for how long is a question. Price data are not favorable, with inputs down and growth in selling prices at a 5-month low.

The breakdown in the service sector, a breakdown however still isolated to this report, would leave the economy without a central point of strength. The declines here do suggest that domestic demand could be on the downswing and falling in line with sinking demand overseas.

These are up a bit this week but still depressed historically and the comps vs a year ago will soon get a lot tougher:

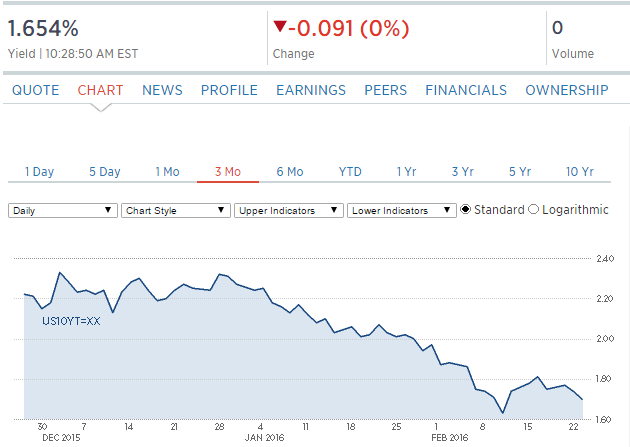

From the way the yield has been falling on the 10 year tsy seems market participants don’t see the same economic strength the Fed sees:

Purchase apps down again:

MBA Mortgage Applications

Highlights

Falling mortgage rates continue to drive refinancing applications sharply higher, up 16 percent for a second straight week. Purchase applications, up 30 percent year-on-year, are also being driven higher though they declined 4 percent in the latest week. The average rate for 30-year conforming loans ($417,000 or less) fell 8 basis points in the week to 3.83 percent.

Again, so much for what’s been forecast to be the ‘driver’ of the 2016 economy.

Note how the chart shows starts have been working their way lower for a substantial period of time:

Housing Starts

Highlights

Housing starts and permits proved softer-than-expected in January, down 3.8 percent to an annual rate of 1.099 million for starts with permits down 0.2 percent to 1.202 million. Starts show roughly equal weakness between single-family homes, down 3.9 percent to a 731,000 rate, and multi-family homes, down 3.7 percent to 368,000. Permits for single-family homes fell 1.6 percent to 720,000 while multi-family permits, in the strongest reading of the report, rose 2.1 percent to 482,000.

Multi-family homes remain the center of strength for the housing sector with year-on-year permits up 19.9 percent, surpassing a very solid 9.6 percent gain for single-family homes. Starts are lagging far behind, at a year-on-year plus 1.8 percent overall and reflecting supply constraints in the construction sector, including for labor, as well as January’s heavy weather that hit the East Coast at mid-month.

The housing sector isn’t on fire but trends in permits do point to strength. Watch for existing home sales on Tuesday next week followed by new home sales on Wednesday.

Not good, year over year negative, and the blip up in auto production will likely reverse as auto sales have declined:

Industrial Production

Highlights

A sharp gain in motor vehicle production underpins a very strong industrial production report where the headline surged 0.9 percent in January which is far above Econoday’s plus 0.4 percent consensus and 0.6 percent high-end estimate. The gain lifts capacity utilization to 77.1 percent for a strong 7 tenths gain from a downward revised December.

Vehicle production surged 2.8 percent in the month and drove the manufacturing component up by 0.5 percent, a gain that compares with a plus 0.2 percent consensus and a high-end estimate of 0.4 percent. But manufacturing was also supported by capital goods, an area that has been weak but which did gain 0.3 percent in the month.

The utilities component, up a monthly 5.4 percent and reflecting a temperature swing from a warm December to a more seasonably cold January, is the major factor behind the headline gain. Mining, hit by low energy and commodity prices, continues to lag, coming in unchanged in the month for a year-on-year decline of 9.8 percent.

Total year-on-year industrial production also remains in the negative column, at minus 0.7 percent, a disappointment but a contrast to manufacturing where the year-on-year rate is modest but accelerating, at plus 1.2 percent.

A negative in the report is a downward revision to December, to minus 0.7 percent from minus 0.4 percent. But the revision doesn’t take much away from the January surprise where strength, based in manufacturing and underscoring January’s rise in retail auto sales, should help ease concern over the economy’s first-quarter performance.

Deceleration here as well:

E-Commerce Retail Sales

Highlights

Strength in non-store retail sales and reports of strength for holiday online shopping are only modestly confirmed by the e-commerce report where sales rose only 2.1 percent in the fourth quarter vs a downward revised plus 3.8 percent in the third quarter. Still, compared to the no-change quarterly reading for total fourth-quarter retail sales, the gain does point to relative strength. And year-on-year, e-commerce sales were up 14.7 percent which is far above the 1.3 percent year-on-year rate for total sales. E-commerce as a percentage of total retail sales edged 1 tenth higher in the quarter to 7.5 percent.

A lot worse than expected and still deep in contraction:

Empire State Mfg Survey

Highlights

For the seventh straight month, the Empire State report is signaling significant contraction for the manufacturing sector. The general business conditions index for February came in below low-end expectations, at minus 16.64 vs even deeper contraction of minus 19.37 in January. New orders, at minus 11.63, are in contraction for a ninth month in a row while employment, though improving to minus 0.99 from minus 13.00, is in contraction for an eighth month in a row.

Shipments are in contraction at minus 11.56 with unfilled orders at minus 6.93. The workweek is at minus 5.94. One reading in the plus column is the six-month outlook, up nearly 5 points to 14.48 which, however, is unusually low for this reading which usually tracks in the 30s and 40s. Price data show marginal improvement for inputs but contraction for finished goods.

This report is showing its weakest run by far of the recovery and, unfortunately, points to extended weakness for the nation’s factory which is getting hit by weak exports and weak energy markets at home.

This is going the wrong way for what’s been promoted as the ‘driver’ of the economy for the year:

Housing Market Index

Highlights

Optimism among home builders is cooling noticeably, based on the housing market index for February which is down 3 points to 58 for the lowest reading since May last year. But 58 is still well over breakeven 50 with the future sales component actually rising 1 point to 65. The current sales component, however, is down 3 points to 65 which points to expected slowing for tomorrow’s starts & permits data. The traffic component has been holding down this report throughout the whole recovery and continues to do so, down a steep 5 points to 39 and the lowest reading since also May last year. Weakness here reflects lack of first-time buyers and also perhaps the major snowstorm that hit the East Coast at mid-month.

Details show step backwards for all four regions with the West, a key region for the new home sector, down 5 points to a still standout composite score of 68. The South and Midwest are both at 57 with the Northeast continuing to trail far behind, down 2 points to 45.

Builders are citing scarcity of both labor and available lots as negatives right now. Momentum in the housing sector was bumpy last year and, based on this report, looks to remain so, at least through the early part of this year.

As previously discussed, not good for bank, either:

High risk of bankruptcy for one-third of oil firms: Deloitte

Feb 16 (Reuters) — Roughly a third of oil producers are at high risk of slipping into bankruptcy this year as low commodity prices crimp their access to cash and ability to cut debt, according to a study by Deloitte. The report is based on a review of more than 500 publicly traded oil and natural gas exploration and production companies across the globe. The roughly 175 companies at risk of bankruptcy have more than $150 billion in debt, with the slipping value of secondary stock offerings and asset sales further hindering their ability to generate cash, Deloitte said in the report.

Pro active currency depreciation tends to have these kinds of consequences:

Japan’s household spending falls 2.7% in 2015

Feb 16 (Kyodo) — Japan’s average monthly household spending in 2015 fell 2.7 percent in price-adjusted real terms from the previous year to 247,126 yen for the second straight year of decrease. The drop followed a demand surge in the January to March period in 2014 before the consumption tax increase in April as well as weak sales of clothing due to an unusually warm winter, according to an official of the Internal Affairs and Communications Ministry. The decline compares with a 3.2 percent drop in 2014. Household spending figures are a key indicator of private spending, which accounts for around 60 percent of the nation’s gross domestic product.

Two things. First, weak exports tend to reflect weak global demand. Second, reduced imports tend to reflect weak domestic demand.

And the ‘solid’ -;)- trade surplus is a fundamental force that works to support the currency:

China Trade Surplus Hits Fresh Record High in January

China trade surplus stood at USD63.29 billion in January of 2016, widening from USD60.03 billion reported a year earlier and beating market consensus. It is the largest trade surplus on record, as exports and imports fell far worse than expected. In January, exports plunged by 11.2 percent year-on-year to USD177.48 billion, following a 1.4 percent fall in December 2015.Imports tumbled by 18.8 percent year-on-year to USD114.19 billion, following a 7.6 percent decline in the preceding month, the 14th straight month of contraction, as a result of declining commodity prices and weak demand.

Same for the euro:

Up last week now back down as this sector remains in prolonged depression:

MBA Mortgage Applications

Highlights

The purchase index has been posting outsized gains this year but not in the January 29 week, falling 7.0 percent. The refinance index, however, did post a gain in the week, up 0.3 percent. Low interest rates have triggered strong demand for mortgage applications. The average 30-year fixed loan for conforming mortgages ($417,000 or less) fell 5 basis points and is back under 4.00 percent for the first time since October, at 3.97 percent.

Winter Weather Dings U.S. Auto Sales

Feb 2 (WSJ) — Overall, auto sales were flat for the month, declining less than 1% to 1.15 million vehicles, according to researcher Autodata Corp. January’s selling pace was an annualized 17.58 million compared with 17.34 million in December. Incentive spending jumped 13% last month to $2,932 a vehicle, according to TrueCar Inc.WardsAuto, which the U.S. government uses for economic analysis, said the annualized rate was 17.46 million and that monthly sales fell 0.4 percent from a year ago. WardsAuto said U.S. sales hit a record 17.39 million vehicles in 2015.

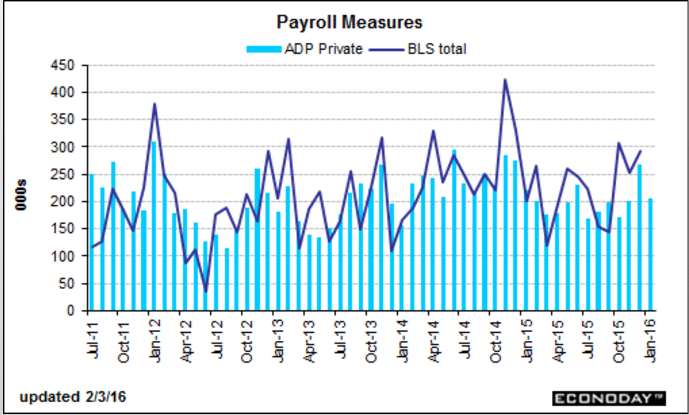

This is a forecast for Friday’s payroll number:

ADP Employment Report

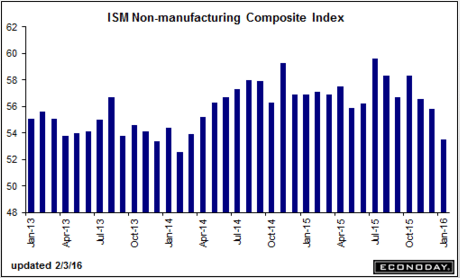

So with manufacturing having gone negative, which is about 15% of the economy, stands to reason some of those people are probably customers of the service sector? Skip to the charts which clearly indicate the direction it’s all going.

ISM Non-Mfg Index

Highlights

Monthly growth is slowing noticeably in ISM’s non-manufacturing sample. The composite index for January fell a sharp 2.3 points to 53.5 from December’s revised 55.8 which is 2 points below the Econoday consensus. Slowing is most apparent in output (as measured by the business activity component) with employment growth also slowing sharply, to 52.1 for a 4.2 point dip. However new orders, at 56.5, remain solidly above breakeven 50 though here to there is slowing, from December’s 58.9. Supplier deliveries, the fourth component of the composite, slowed in the month in a sign of congestion in the supply chain in what is an offsetting positive for the month.

Other readings include a solid 52.0 for backlog orders which are extending a long string of monthly expansion that contrasts sharply with a long string of contraction in the rival PMI services report. Inventories in ISM’s sample continue to rise but at only a marginal pace. Weakness is signaled by both contraction in import orders, which points to business caution among U.S. businesses, and also for export orders, the result of weak foreign markets and the negative effects of the strong dollar. Input prices, which have been subdued, fell in the month.

A negative in the report is narrow breadth among industries with 10 reporting composite growth in the month vs 8 reporting contraction, with the latter led by continued weakness for mining. Strength is led by both finance and real estate and includes construction.

Through much of last year, this report was among the most resilient, consistently pointing to steady strength that for the most part proved correct. Today’s declines, along with the dip in the PMI services report released earlier this morning, unfortunately hint at soft growth for the first quarter while this report’s employment index, hitting its lowest point since January last year, points to modest disappointment for Friday’s employment report.

Still looks to me like it’s been falling back ever since the July spike:

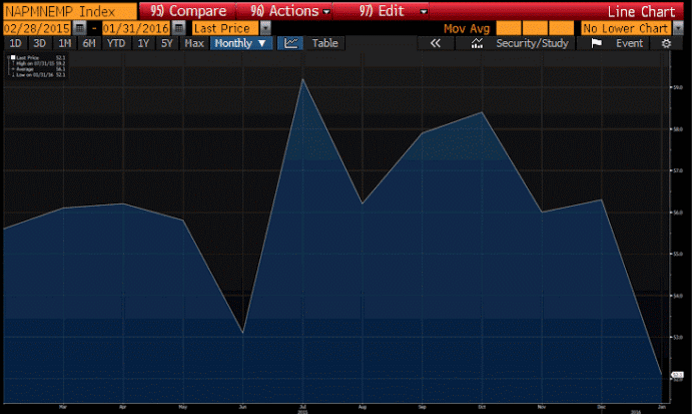

This is the ISM non manufacturing employment index for the last year:

Exxon slashes spending after smallest profit in years

Feb 2 (Reuters) — Exxon said it will cut 2016 spending by one-quarter and suspend share repurchases. Exxon forecast capital spending at around $23.2 billion this year, a 25 percent drop from 2015. Exxon suspended its share buyback plan meant to return cash to investors in the first quarter. Exxon reported that fourth-quarter profit tumbled to $2.78 billion, or 67 cents per share, from $6.57 billion, or $1.56 per share, in the same period a year earlier. Exxon said its oil and gas output rose 4.8 percent in the fourth quarter as it pumped more crude oil.

To again quote the carpenter with his piece of wood- “no matter how much I cut off it’s still too short”:

BOJ Kuroda says ready to use more policy options to boost inflation

Feb 2 (Reuters) — “If we judge that existing measures in the toolkit are not enough to achieve (our) goal, what we have to do is to devise new tools,” BOJ Governor Haruhiko Kuroda said in a speech. “I am convinced that there is no limit to measures for monetary easing,” he said. Kuroda countered criticism that the BOJ was running out of ammunition to accelerate inflation, saying negative rates won’t hamper the bank’s efforts to gobble up government bonds. “If judged necessary, it is possible to further cut the interest rate from the current level of minus 0.1 percent,” he said.