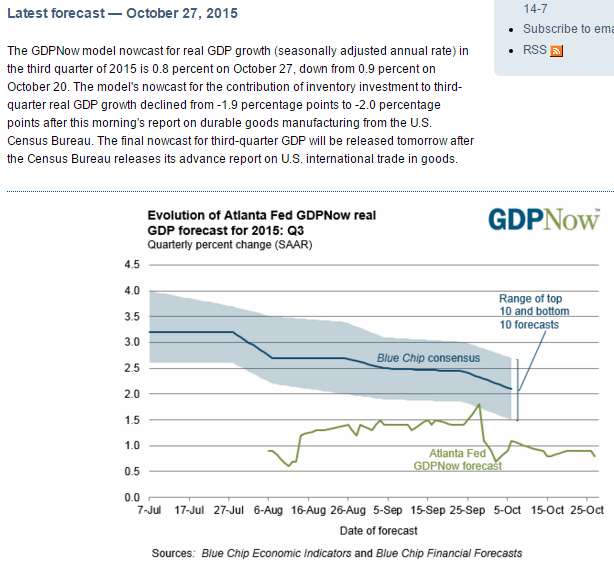

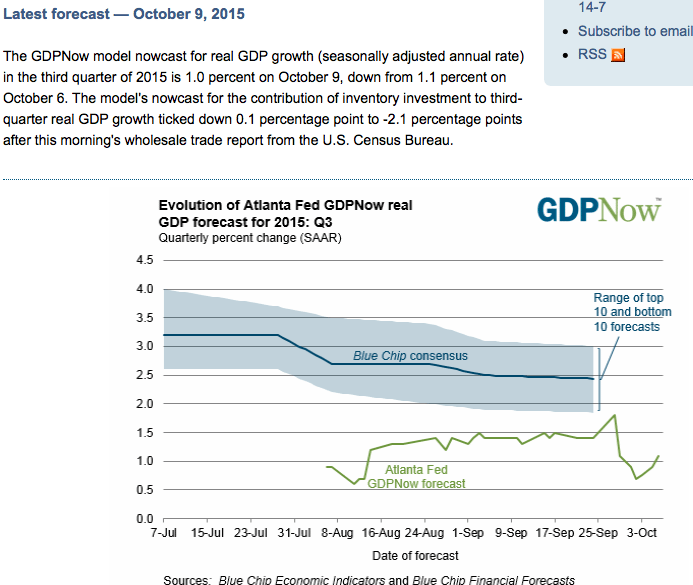

Gives the Fed another dovish data point:

PPI-FD

Highlights

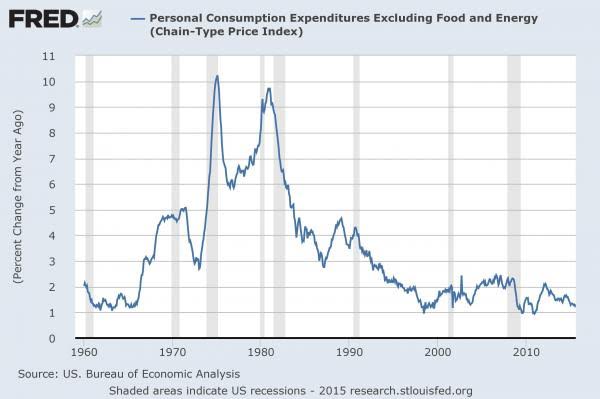

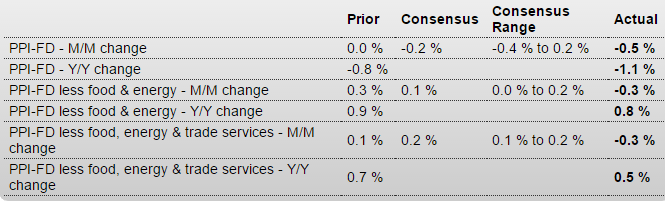

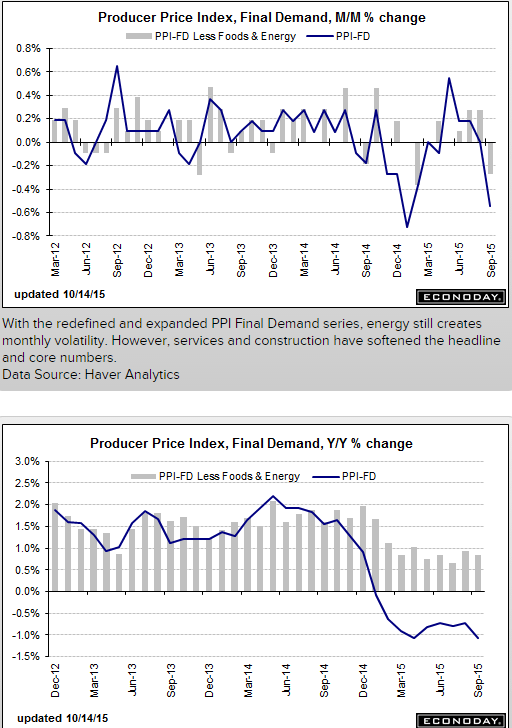

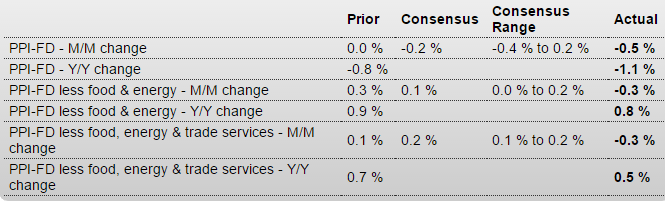

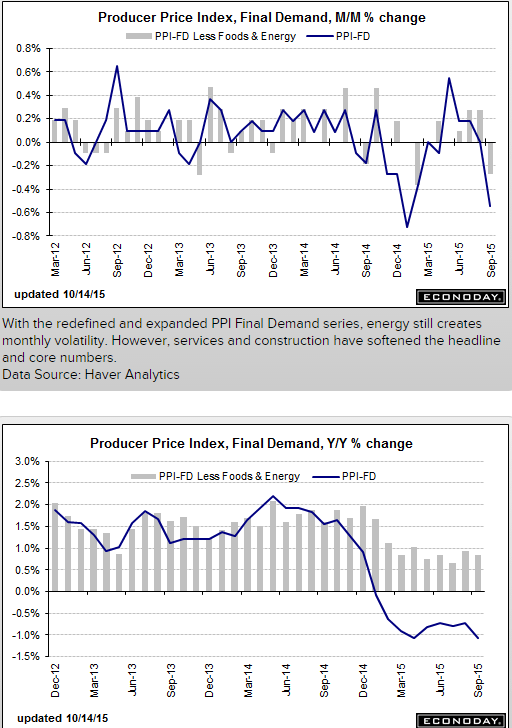

Producer prices show wide weakness and may raise talk that deflationary pressures are building, not easing. The PPI-FD fell 0.5 percent in September which is just below Econoday’s low estimate for minus 0.4. Year-on-year, producer prices are falling deeper into the negative column at minus 1.1 percent. And it’s not all due to energy excluding which and also excluding food, prices fell 0.3 percent though the year-on-year rate is still in the plus column, at plus 0.8 percent but down 1 tenth from August. Excluding food, energy and services, where the latter had been showing price traction, prices still fell 0.3 percent with the year-on-year rate at only plus 0.5 percent.

The services weakness, down 0.4 percent in the month, follows two prior gains of 0.4 percent that had been cited as evidence of resilience in domestic demand. Exports remain very weak at minus 0.8 percent in the month following August’s 0.4 percent decline. September energy prices fell 5.9 percent and are down 23.7 percent year-on-year. Gasoline fell a monthly 16.6 percent for a 42.8 percent year-on-year decline.

Other readings include a 1.3 percent decline for finished goods where the year-on-year rate, following a long string of monthly declines, is down 4.1 percent. This is an important reading that points to pass through of low raw material prices.

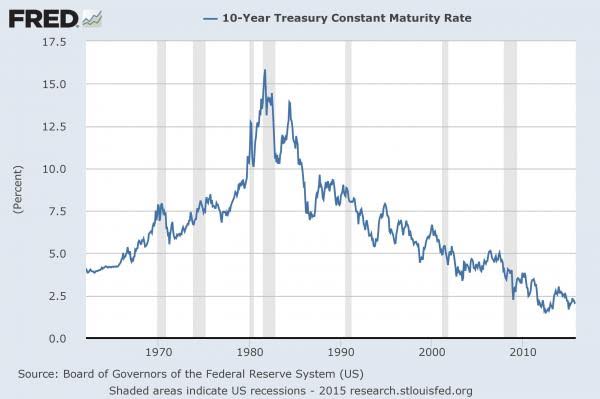

Hawks at the Fed are saying that the negative price effects from oil and low import prices will prove temporary. That may be, but the depth of ongoing price weakness continues to sink. Watch for the consumer price report on tomorrow’s calendar.

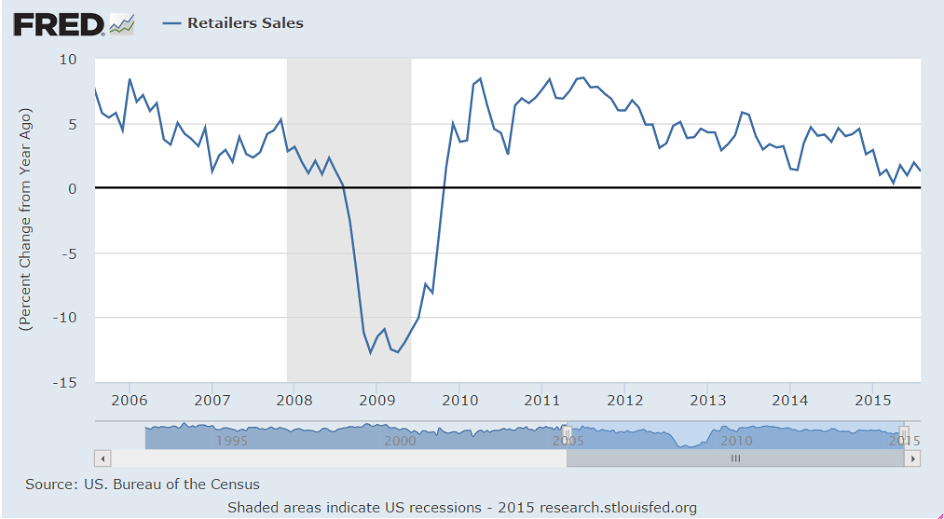

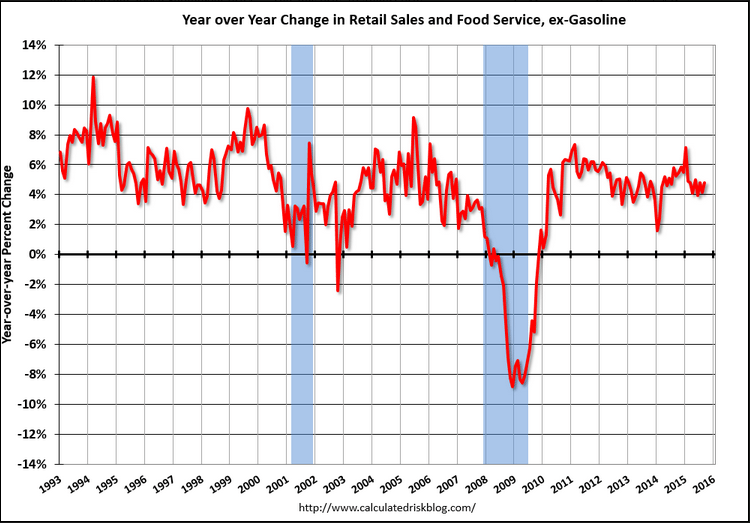

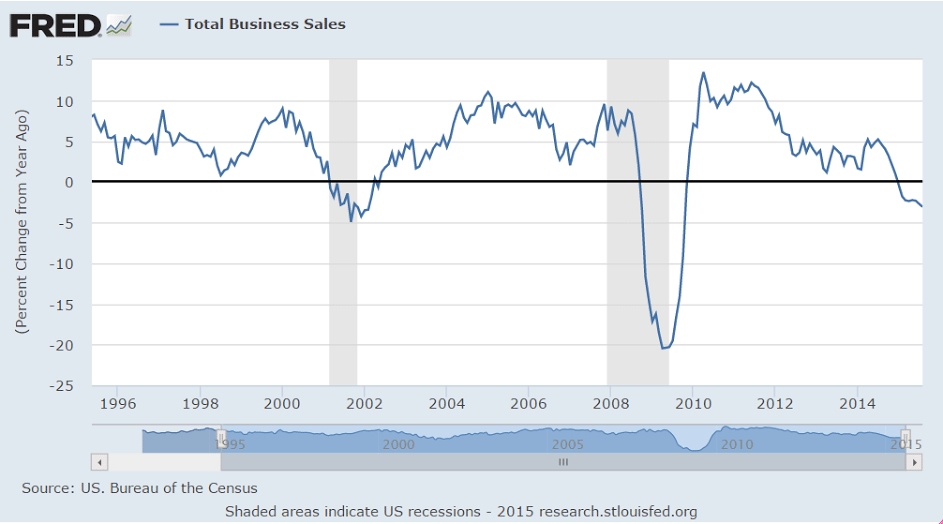

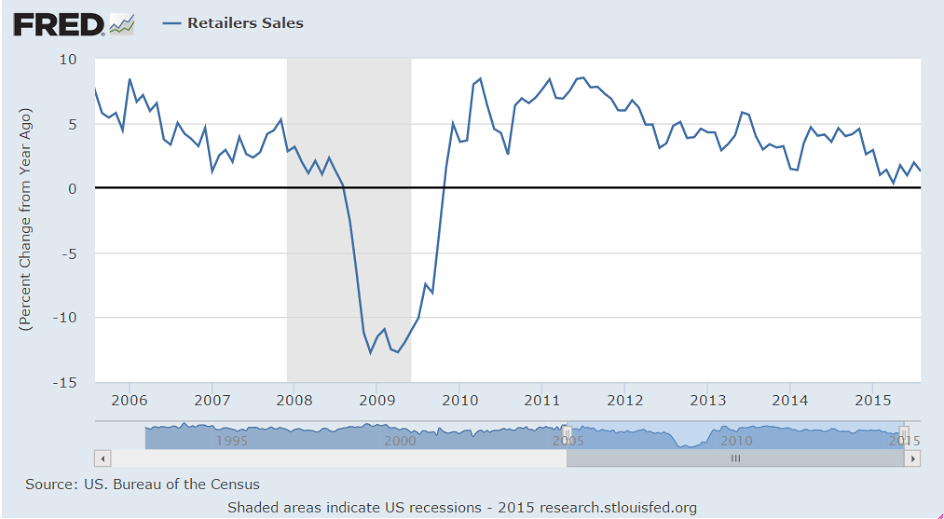

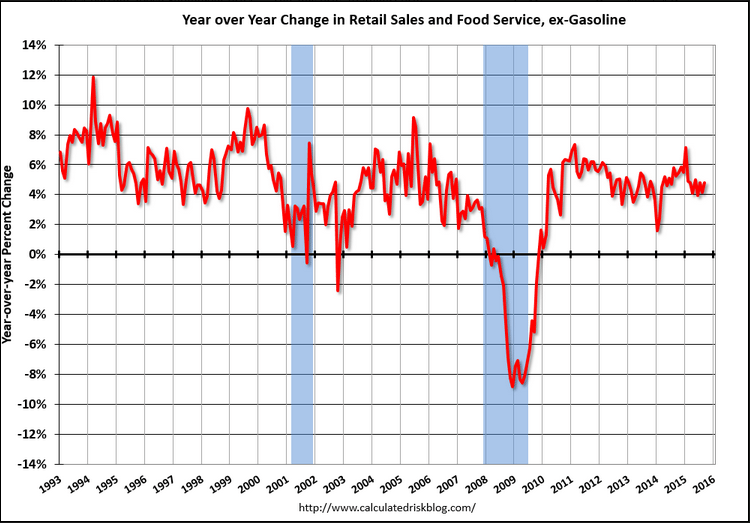

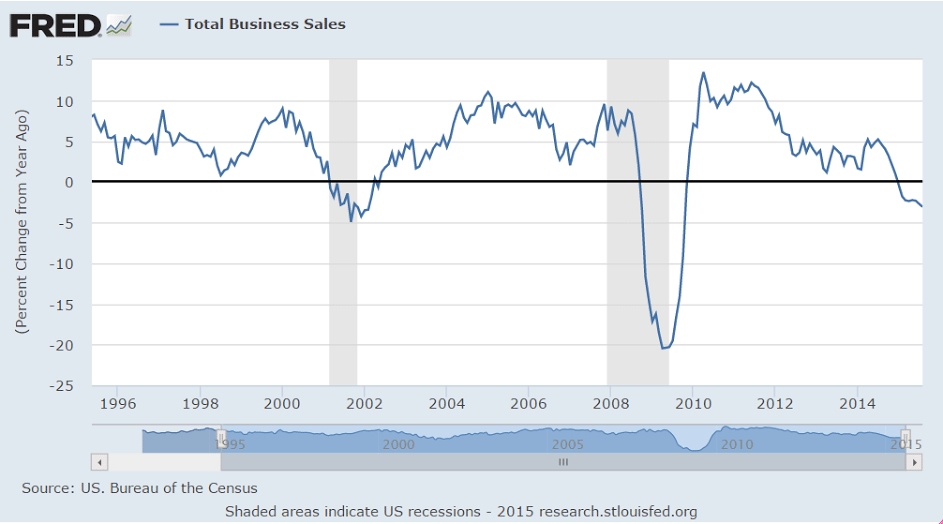

This continues to disappoint, no matter how they try to spin it. And total sales do count, as they are also the total income for the sellers, so that’s been slowing as well:

Retail Sales

Highlights

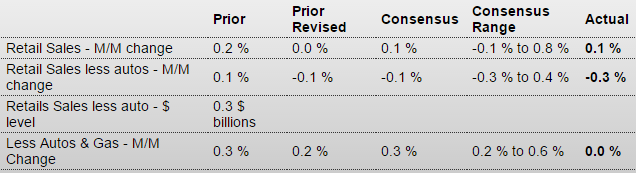

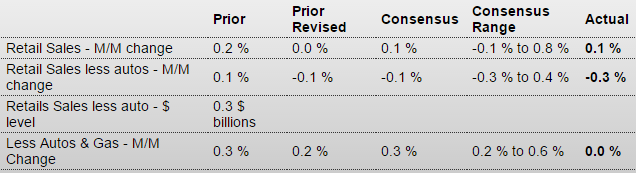

Weakness at gasoline stations, where low prices are depressing sales totals, continues to exaggerate weakness in retail sales where the headline inched only 0.1 percent higher in September. Gasoline sales fell 3.2 percent in the month, excluding which the headline looks far more respectable at plus 0.4 percent.

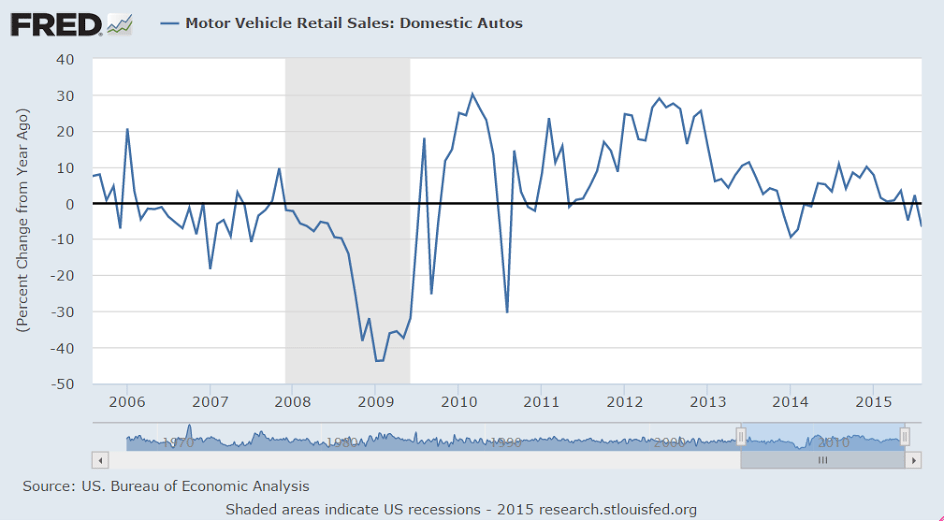

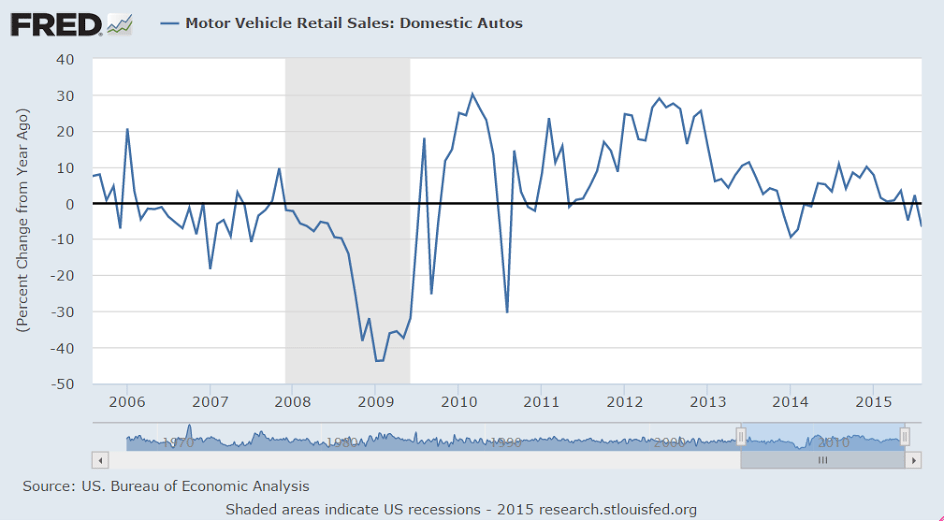

And there are plenty of tangible positives in the data including a third straight solid gain for motor vehicles, at plus 1.7 percent in September, and a second straight outsized gain of 0.9 percent for restaurants. Both of these are discretionary categories and point to underlying consumer strength. Clothing stores are also posting strong gains, up 0.9 percent despite negative price effects from lower import prices.

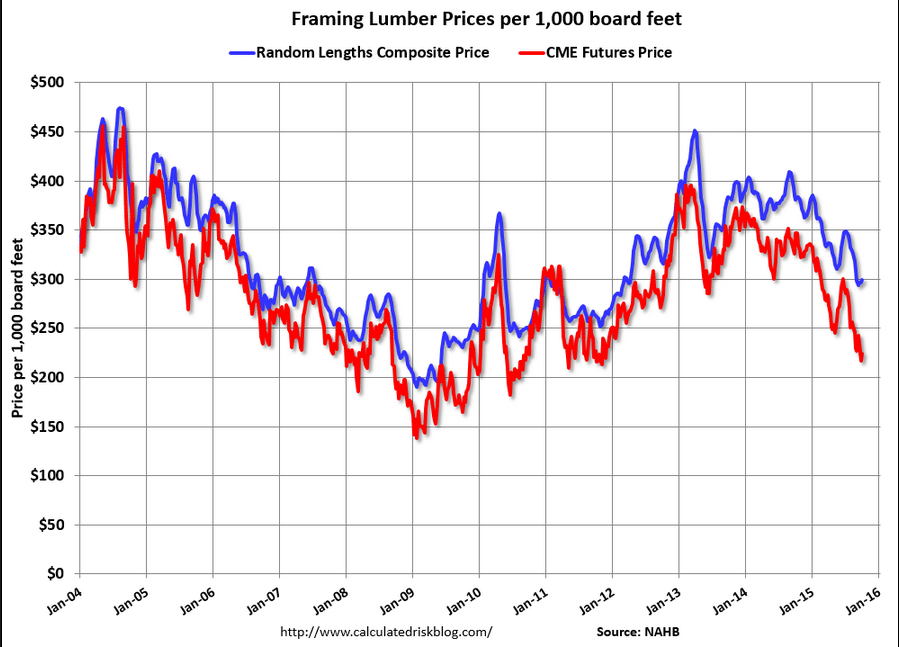

Price weakness is not only pulling down gasoline sales but also sales at food & beverage stores which fell 0.3 percent. But there are signs of consumer retracement in the September report with the general merchandise category, which is very large, down 0.1 percent, and with health & personal care stores unchanged. Building materials fell 0.3 percent with electronics & appliance stores down 0.2 percent.

Looking at adjusted year-on-year rates helps clarify the trends. Excluding gasoline stations, retail sales are up a very respectable 4.9 percent which is well above the less impressive 2.4 percent gain for total sales. Sales at gasoline stations are down a year-on-year 19.7 percent. Leading the positive side are motor vehicles, up 8.8 percent, and restaurants, up 7.9 percent — both robust gains. Core sales, that is ex-auto ex-gas, the year-on-year rate is a moderate plus 3.8 percent for a 1 tenth decline from August.

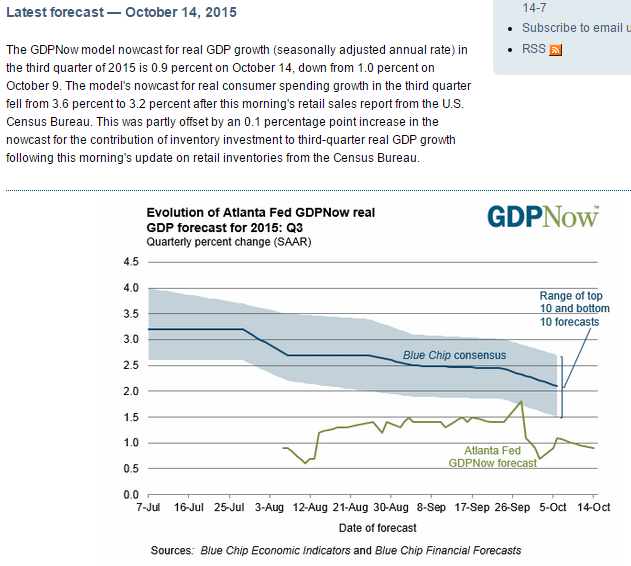

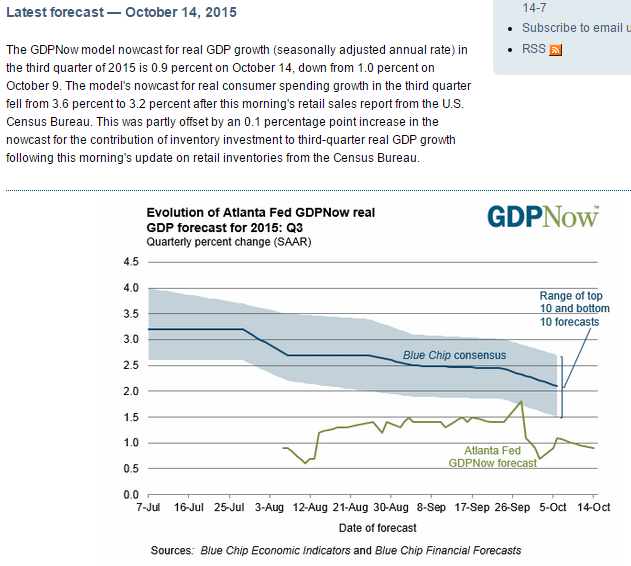

One of the very biggest positives for the consumer right now, aside from strength in labor demand, is the weakness in pump prices, which however in this report, where dollar totals are tracked and not sales volumes, turns into a negative. Still, the headline is weak and will likely lower third-quarter GDP estimates — but for Fed policy, because the weakness is skewed due to gas prices, the results are harder to assess and may prove neutral.

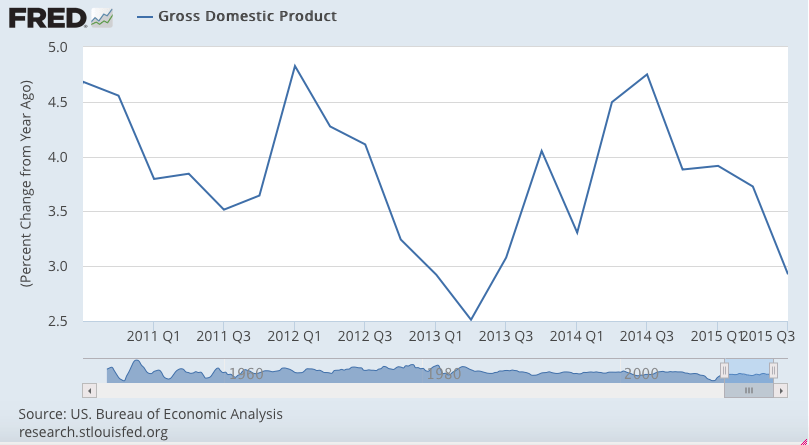

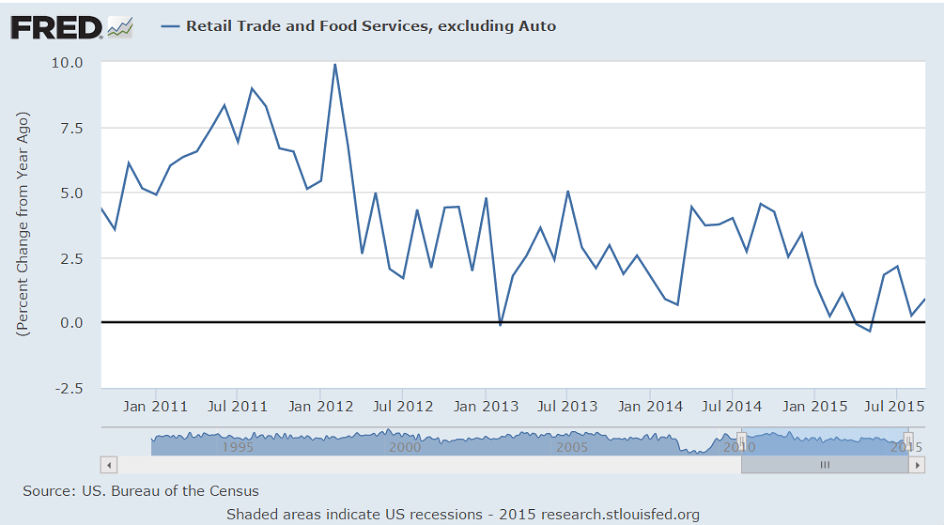

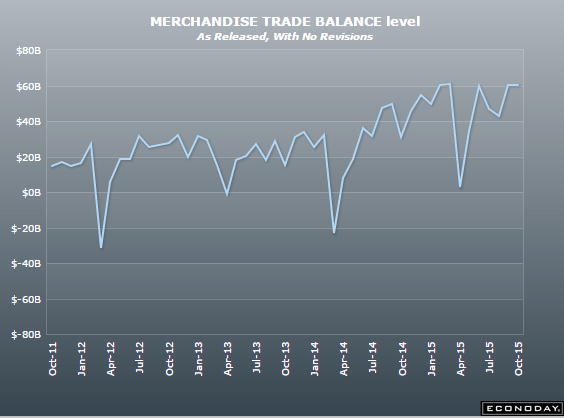

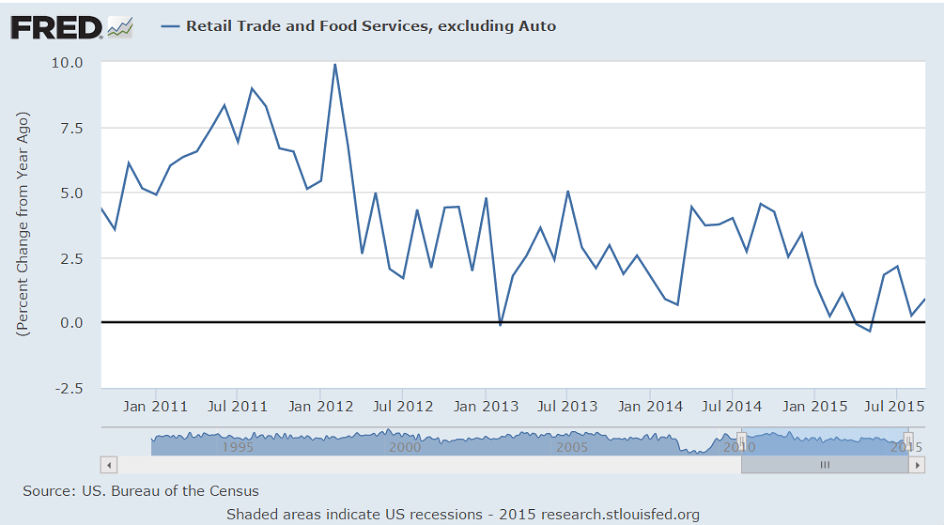

Imports have a much lesser effect on the economy:

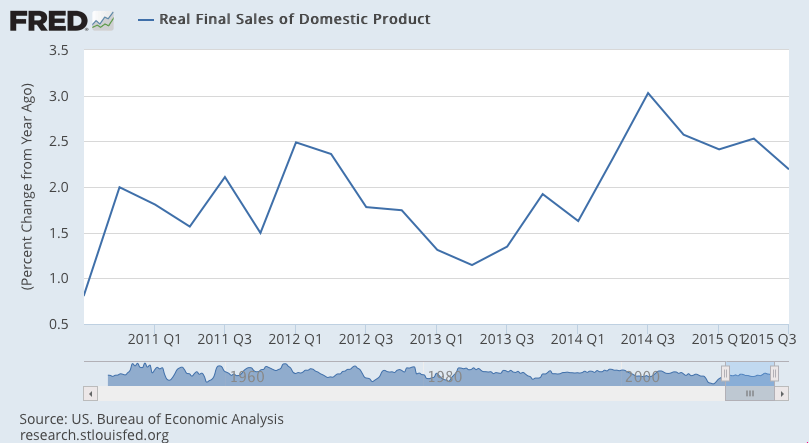

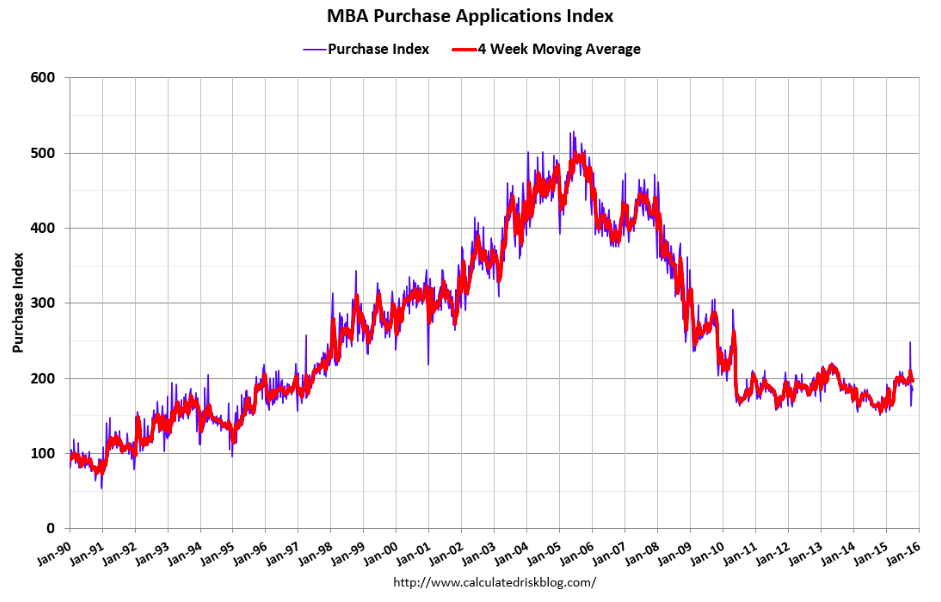

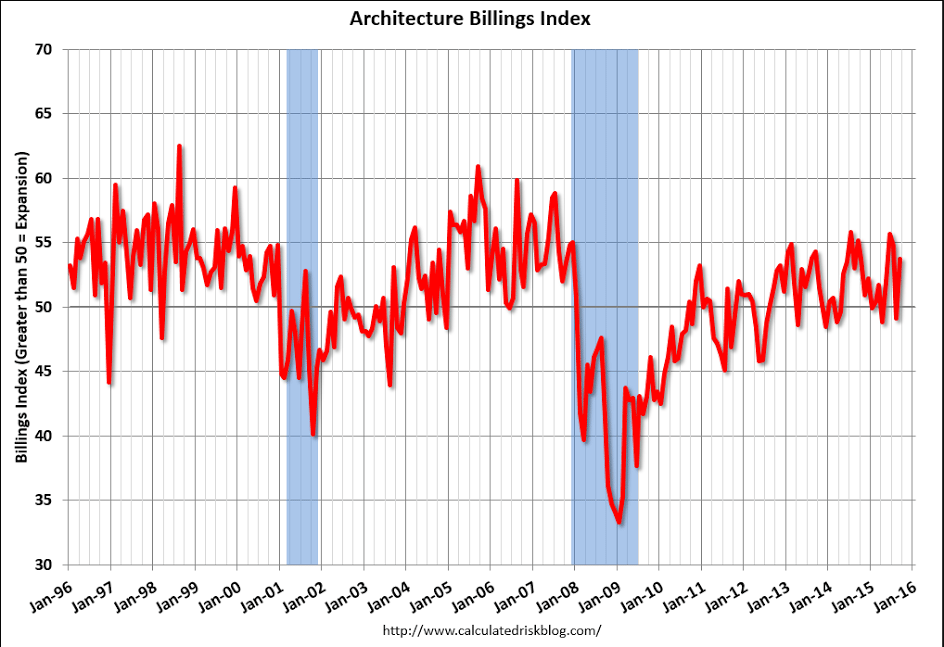

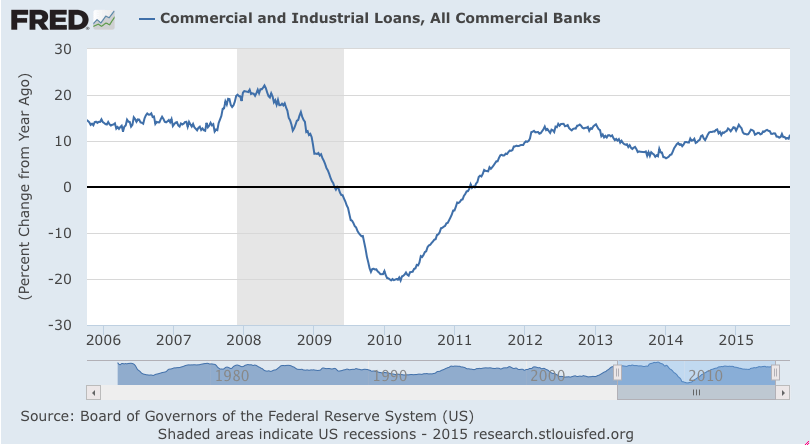

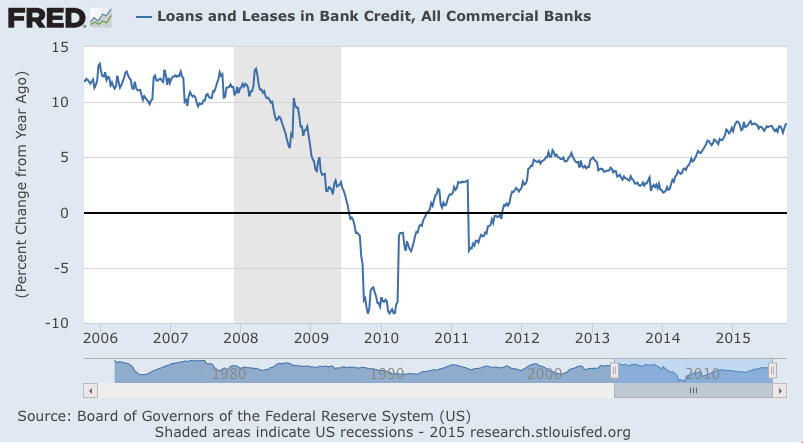

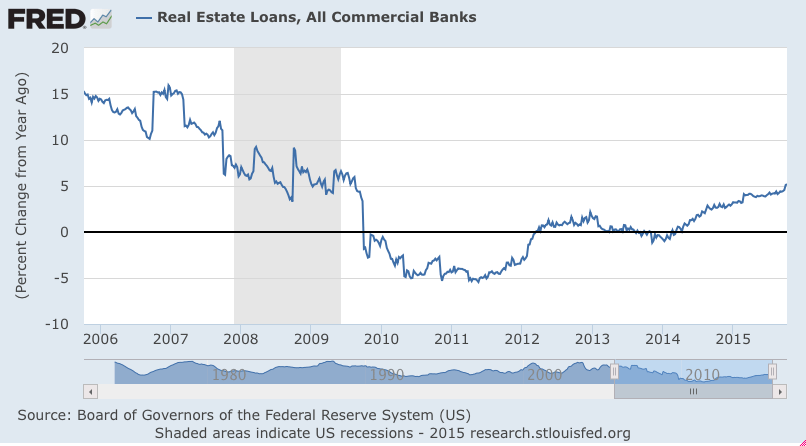

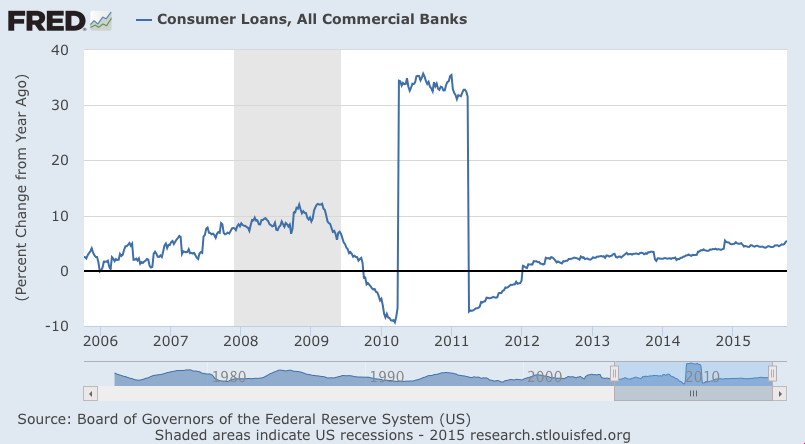

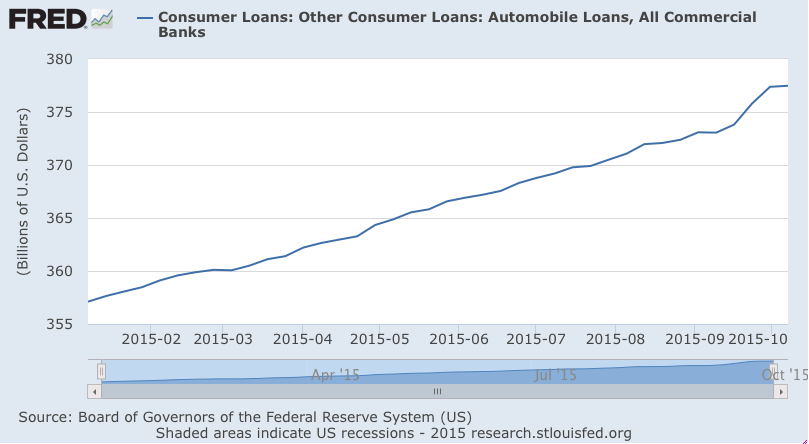

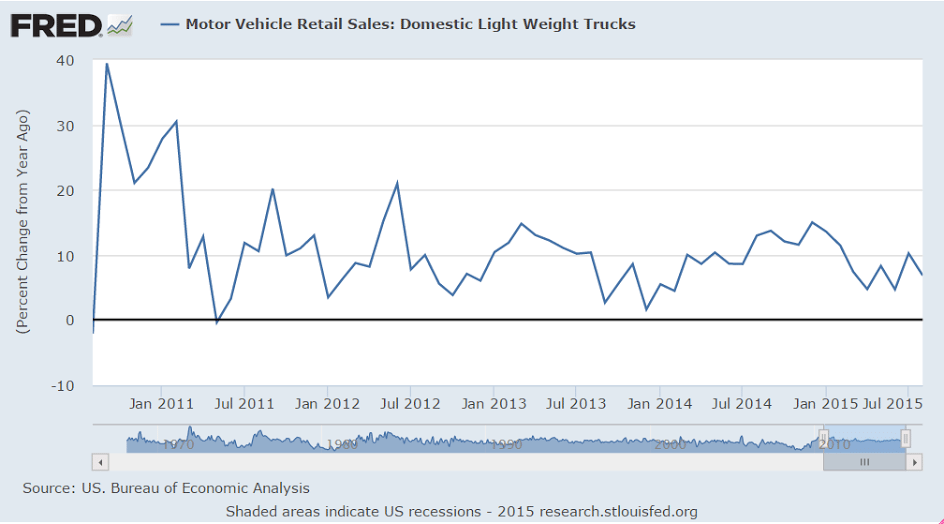

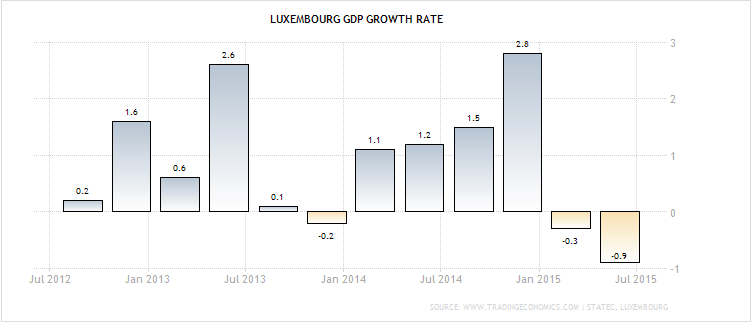

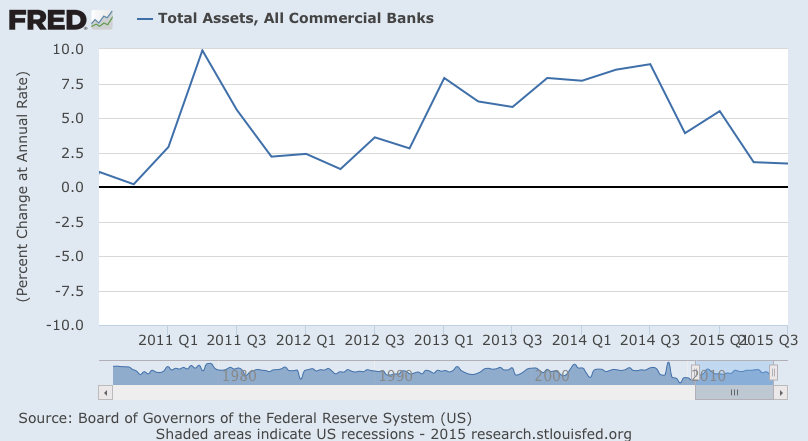

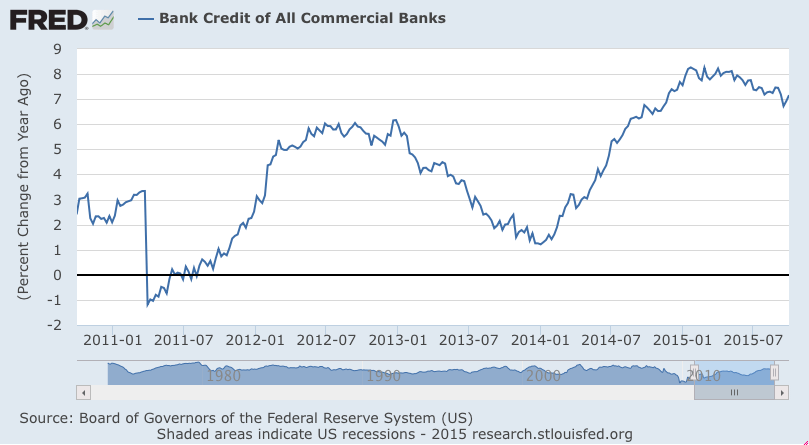

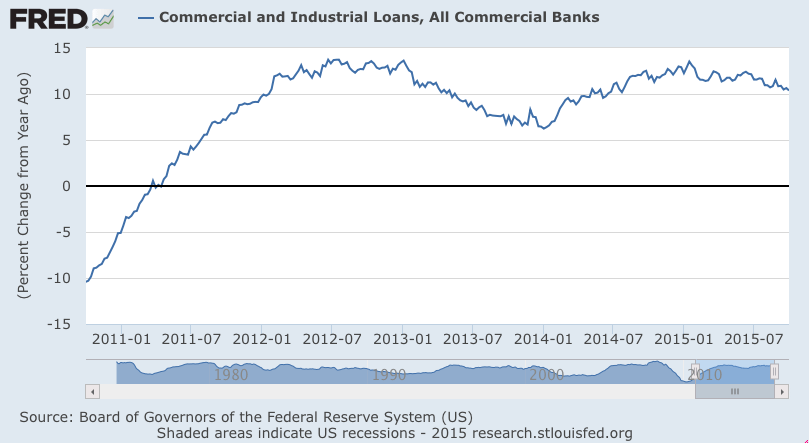

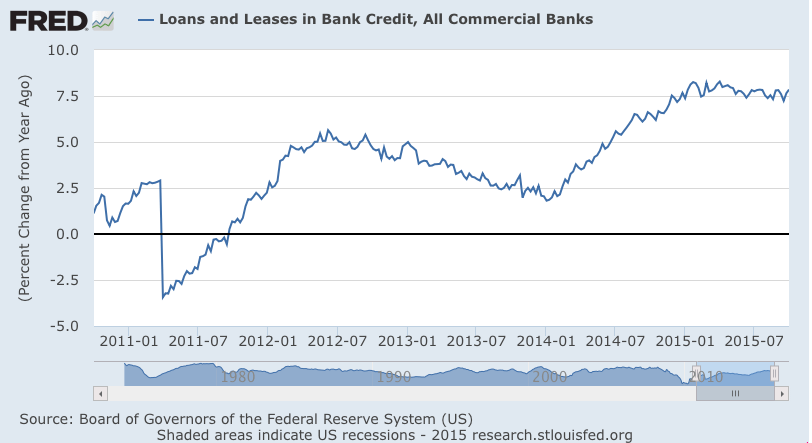

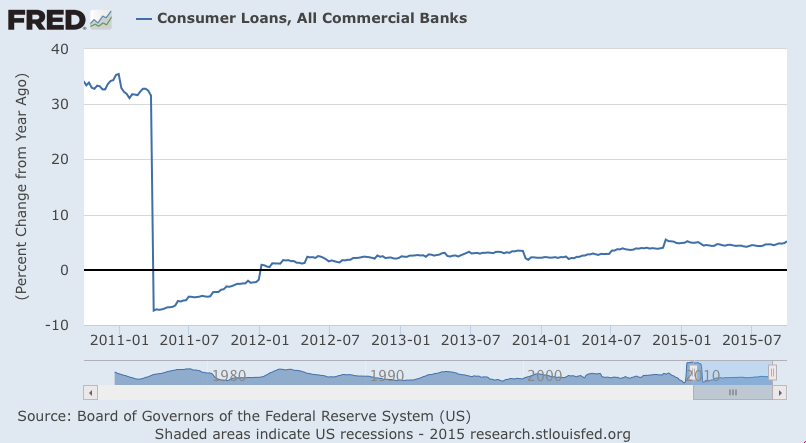

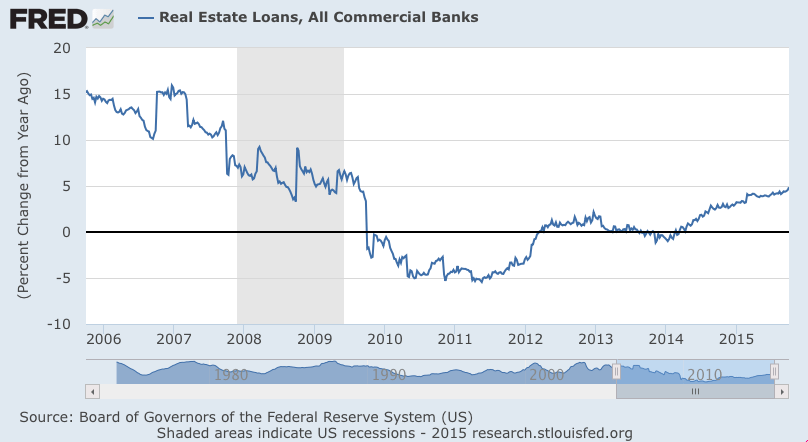

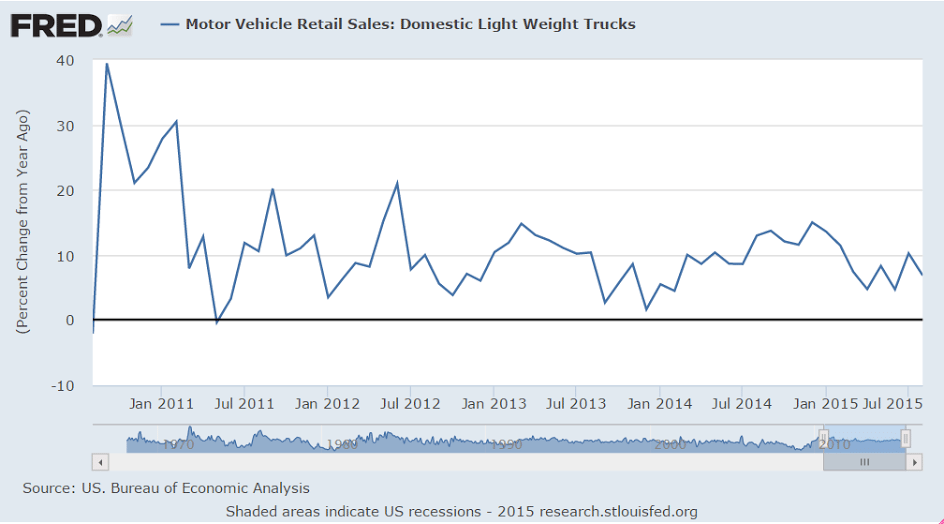

This is where the domestic growth has been, which has been about the same growth rate for the last few years:

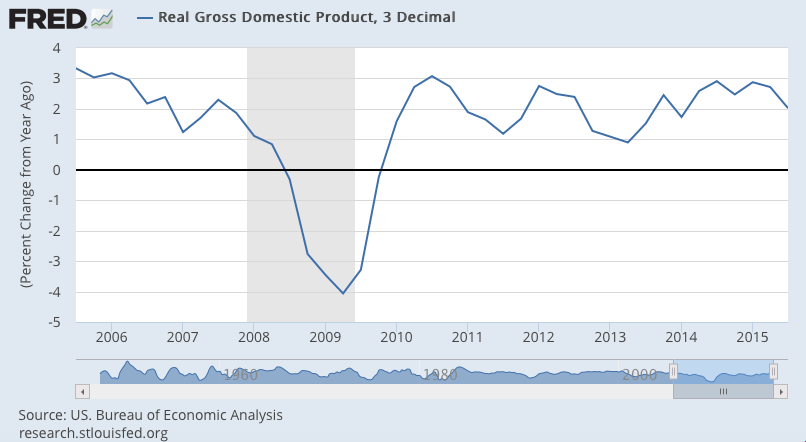

And even this is low vs prior cycles:

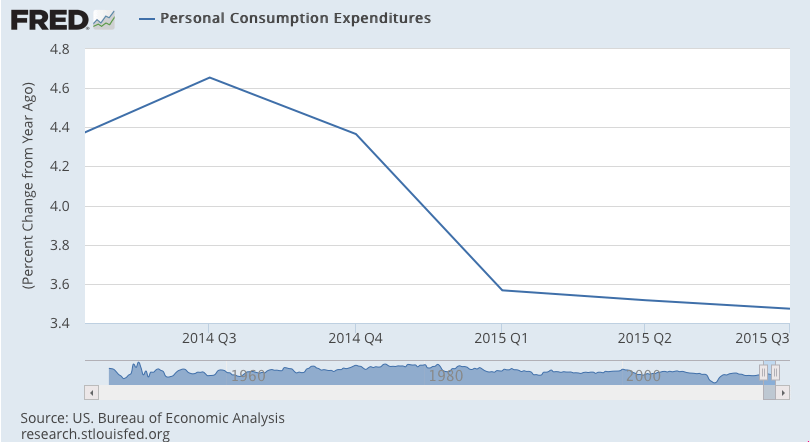

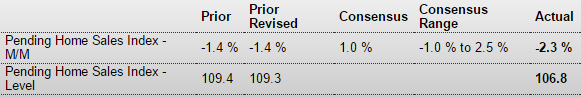

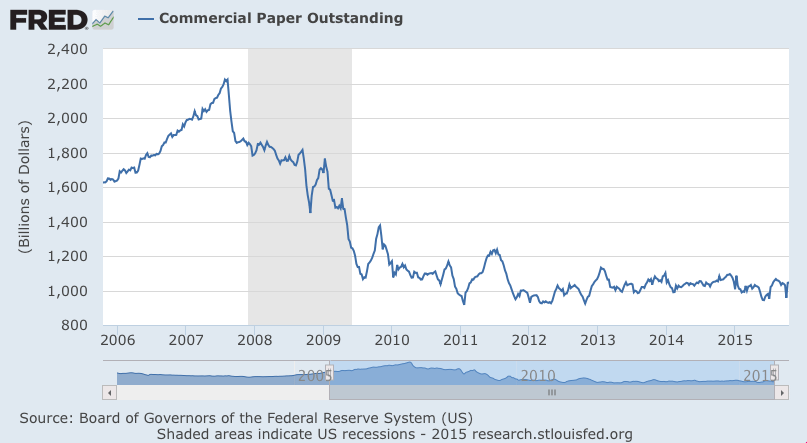

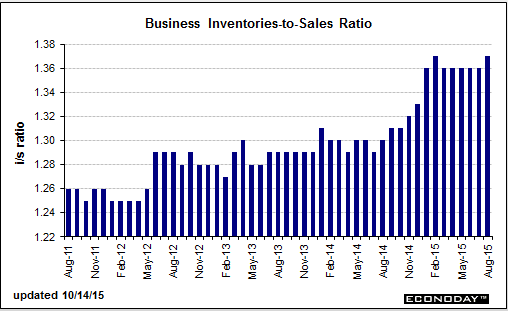

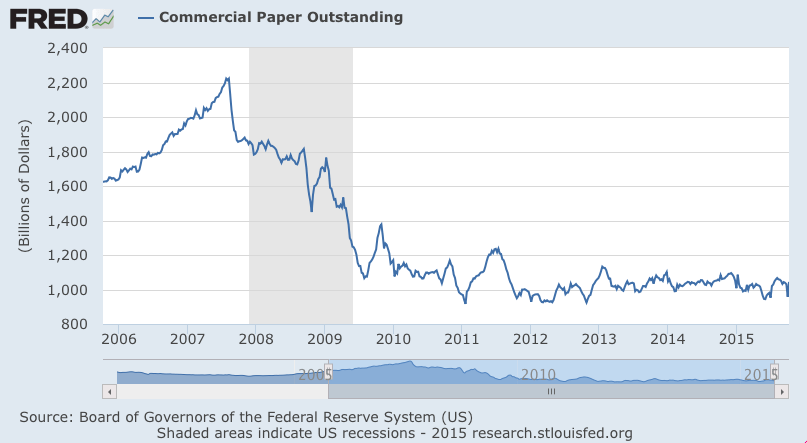

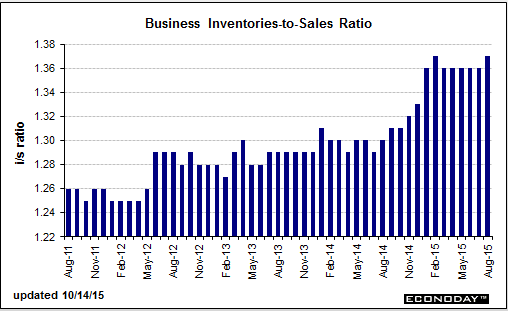

Yet another big negative here. Again, it’s the same unspent income story. If agents spent less than their incomes others must have spent more than their incomes or inventory went unsold, which is exactly what’s been happening. And unsold inventory = cuts in output and employment = less income = less spending etc. until some agent starts spending that much more than his income. Most often that’s govt, spending more than its income (deficit spending) on rising unemployment benefits, and experiencing reduced tax revenues in the slow down:

Business Inventories

Highlights

There’s evidence of economic weakness coming from inventory data where inventories are being kept down but are still building relative to sales. Business inventories were unchanged for a second month in August while sales fell a sizable 0.6 percent, driving up the inventory-to-sales ratio to 1.37 from 1.36.

Inventory downscaling is underway in manufacturing which is being hurt by weak exports. Manufacturing inventories fell 0.3 percent in both August and July against a major sales decline of 0.7 percent in August and a 0.2 percent dip in July. There’s less inventory downscaling, at least right now, among wholesalers where inventories rose 0.1 percent but sales at wholesalers are even weaker, down 1.0 percent in the month. Retail, the third component, is not immune with sales down 0.1 percent but inventories up 0.3 percent.

Inventories are looking heavy which could limit production and employment growth and could emerge as a new concern for the doves at the Fed.

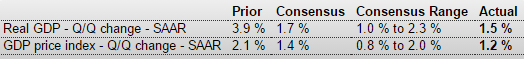

Revised down again:

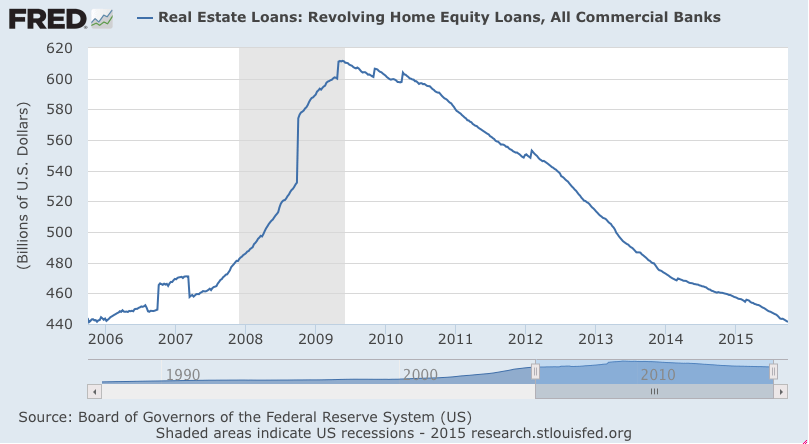

Applying leverage here is, functionally, subversive:

By Rob Garver

Oct 13 (Fiscal Times) — In case anyone thought things couldn’t get more chaotic on Capitol Hill, Senate Majority Mitch McConnell appears ready to set them straight. McConnell, according to a report first published by CNN, plans to make several major demands of the White House, including changes to Medicare, Social Security, and EPA regulations as his price for raising the nation’s debt limit.