Not to mention taking $500 billion out of the medicare budget to give to the insurance companies and then declaring victory on healthcare. And the early statement about needing to first fix the financial sector before the real sector can recover.

And, of course, it would be nice if Professor Krugman would reverse his errant and highly counterproductive contention that the federal deficit presents a long term economic or financial problem per se.

This Republican Economy

By Paul Krugman

June 3 (NYT) — What should be done about the economy? Republicans claim to have the answer: slash spending and cut taxes. What they hope voters won’t notice is that that’s precisely the policy we’ve been following the past couple of years. Never mind the Democrat in the White House; for all practical purposes, this is already the economic policy of Republican dreams.

So the Republican electoral strategy is, in effect, a gigantic con game: it depends on convincing voters that the bad economy is the result of big-spending policies that President Obama hasn’t followed (in large part because the G.O.P. wouldn’t let him), and that our woes can be cured by pursuing more of the same policies that have already failed.

For some reason, however, neither the press nor Mr. Obama’s political team has done a very good job of exposing the con.

What do I mean by saying that this is already a Republican economy? Look first at total government spending — federal, state and local. Adjusted for population growth and inflation, such spending has recently been falling at a rate not seen since the demobilization that followed the Korean War.

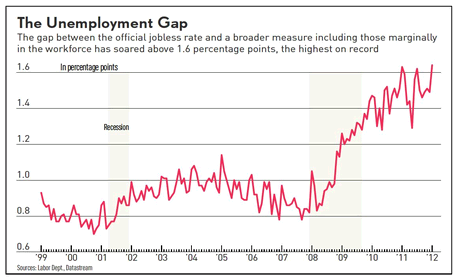

How is that possible? Isn’t Mr. Obama a big spender? Actually, no; there was a brief burst of spending in late 2009 and early 2010 as the stimulus kicked in, but that boost is long behind us. Since then it has been all downhill. Cash-strapped state and local governments have laid off teachers, firefighters and police officers; meanwhile, unemployment benefits have been trailing off even though unemployment remains extremely high.

Over all, the picture for America in 2012 bears a stunning resemblance to the great mistake of 1937, when F.D.R. prematurely slashed spending, sending the U.S. economy — which had actually been recovering fairly fast until that point — into the second leg of the Great Depression. In F.D.R.’s case, however, this was an unforced error, since he had a solidly Democratic Congress. In President Obama’s case, much though not all of the responsibility for the policy wrong turn lies with a completely obstructionist Republican majority in the House.

That same obstructionist House majority effectively blackmailed the president into continuing all the Bush tax cuts for the wealthy, so that federal taxes as a share of G.D.P. are near historic lows — much lower, in particular, than at any point during Ronald Reagan’s presidency.

As I said, for all practical purposes this is already a Republican economy.

As an aside, I think it’s worth pointing out that although the economy’s performance has been disappointing, to say the least, none of the disasters Republicans predicted have come to pass. Remember all those assertions that budget deficits would lead to soaring interest rates? Well, U.S. borrowing costs have just hit a record low. And remember those dire warnings about inflation and the “debasement” of the dollar? Well, inflation remains low, and the dollar has been stronger than it was in the Bush years.

Put it this way: Republicans have been warning that we were about to turn into Greece because President Obama was doing too much to boost the economy; Keynesian economists like myself warned that we were, on the contrary, at risk of turning into Japan because he was doing too little. And Japanification it is, except with a level of misery the Japanese never had to endure.

So why don’t voters know any of this?

Part of the answer is that far too much economic reporting is still of the he-said, she-said variety, with dueling quotes from hired guns on either side. But it’s also true that the Obama team has consistently failed to highlight Republican obstruction, perhaps out of a fear of seeming weak. Instead, the president’s advisers keep turning to happy talk, seizing on a few months’ good economic news as proof that their policies are working — and then ending up looking foolish when the numbers turn down again. Remarkably, they’ve made this mistake three times in a row: in 2010, 2011 and now once again.

At this point, however, Mr. Obama and his political team don’t seem to have much choice. They can point with pride to some big economic achievements, above all the successful rescue of the auto industry, which is responsible for a large part of whatever job growth we are managing to get. But they’re not going to be able to sell a narrative of overall economic success. Their best bet, surely, is to do a Harry Truman, to run against the “do-nothing” Republican Congress that has, in reality, blocked proposals — for tax cuts as well as more spending — that would have made 2012 a much better year than it’s turning out to be.

For that, in the end, is the best argument against Republicans’ claims that they can fix the economy. The fact is that we have already seen the Republican economic future — and it doesn’t work.