“Individuals, corporations, cities, and States can not, of themselves, do anything except play according to the rules of the present money system and make their outgo balance their income, or ultimately “go broke.” Most of them are unable, much as they may desire, to give consideration to helping the general situation except as they may influence the action of the Federal Government, which is in an entirely different category, it being able to make and change therules of the game…A State, of course, is in the same financial category as corporations and individuals in that they do not have the power of issuing money or credit. The Federal Government is entirely in a different category because it controls the money system.” ~ Marriner Eccles (February 13 – 23, 1933 Senate Hearing Committe – prior to becoming Fed Chairman)

Category Archives: Government Spending

Fed’s Williams:Fiscal Policy Actions ‘Badly Needed’

A step in the right direction:

Fed’s Williams:Fiscal Policy Actions ‘Badly Needed’

Fri Nov 18 14:04:45 2011 EST

–The Federal Reserve’s actions have not been enough to deliver a robust recovery

–The recovery has been hurt by the decline in housing and stock prices, tightening of credit and uncertainty in Europe

–Fiscal policy actions to reduce uncertainty and stimulate recovery are ‘badly needed’

By Anusha Shrivastava

NEW YORK-(Dow Jones) — The Federal Reserve’s actions during the past four years have not been enough to deliver a robust recovery so fiscal policy actions are “badly needed”, said a central bank official on Friday.

“What would be especially helpful at this juncture are fiscal policy actions that work in tandem with monetary policy to stimulate the economy,” said John Williams, president of the Federal Reserve Bank of San Francisco, speaking at the Central Bank of Chile in Santiago.

Williams, who expects the U.S. unemployment rate to remain above 7% for three more years, named three “powerful currents” slowing the pace of recovery.

There has been a “massive destruction of wealth” because of the financial crisis, stemming from a housing collapse, he said.

Second, there’s been a severe tightening of credit because of the decline in residential property prices and the wave of foreclosures.

The heightened uncertainty in Europe and overall health of its financial system is another contributory factor diminishing the appetite for risk such that investors are fleeing to safe assets like U.S. Treasurys, he added.

Given the weakness in the economy and the uncertainty impeding recovery, Williams called for fiscal policy actions that work with monetary policy to boost the economy.

One example of such a policy is the recently announced U.S. government initiative to make it easier for homeowners whose houses are now of lower value than when they bought them, to take advantage of very low rates and refinance their mortgages.

“This will trim monthly payments for some households and could reduce foreclosure rates,” Williams said. “It could also eventually provide a modest boost to consumer spending.”

(RNC) Chairman Reince Priebus on the deficit

With the Republicans now willing to hike taxes out of fear of becoming the next Greece, the odds of the super committee going super big are increasing.

“America has crossed an unthinkable threshold: our national debt now exceeds $15 trillion dollars. That’s more than $48,000 per citizen,” Republican National Committee (RNC) Chairman Reince Priebus said. “In 2009, President Obama promised to cut the deficit in half by the end of his first term. Instead, he further accelerated its growth, producing three years of record deficits.”

Republicans, fearing Greece, agreeing to tax hikes

Shows the Republicans truly do fear the US becoming the next Greece,

as they begin to lean towards tax hikes.

Meanwhile, they continue keeping us on the road to Japan.

Or worse.

A lot worse.

Republicans Consider Breaking No-Tax Vow as Deadline Looms

By Brian Faler

November 15 (Bloomberg) — For Senator John Cornyn, it was the situation in Greece.

The Texas Republican said he is willing to back tax increases as part of a major deficit-reduction deal because he fears the European debt crisis could spread to the U.S.

“We’ve never been in this spot before,” said Cornyn, who also leads his party’s effort to elect more Republicans to the Senate. “We’re looking over at Europe and what’s happening in Greece and Italy — we risk having another huge financial crisis in this country, and we’ve got to try to solve the problem.”

He is one of a growing number of Republicans, many with otherwise impeccable anti-tax credentials, who say they are willing to raise taxes to reach a big deficit-reduction deal with Democrats.

That may help insulate them from charges of stubbornness if Congress’s bipartisan supercommittee doesn’t meet its Nov. 23 deadline to find a way to cut $1.5 trillion. For now, it’s helped shift Washington’s debate to how much, rather than whether, to raise taxes.

Senate Budget Committee Chairman Kent Conrad, a North Dakota Democrat, said he is encouraged by the shift even as Democrats scoff at a specific Republican proposal.

“It’s a step in the right direction for them to just rhetorically cross that line,” said Conrad.

‘Real Trouble’

Asked if Republicans were trying to set up a blame game should the supercommittee fail, Conrad said, “I hope not” because “if we aren’t beyond that, we are in real trouble.”

Democrats say the Republican deficit plan relies too heavily on spending cuts and would give the wealthy too much of a tax break. Some question whether its numbers add up.

At issue is a proposal by the supercommittee’s Republicans to trade permanent cuts in income tax rates, with the top rate dropping to as little as 28 percent, for new limits on deductions, exclusions and other tax breaks. They estimate that it would produce $300 billion to reduce the deficit.

The plan’s principal author is Senator Pat Toomey, a Pennsylvania Republican who previously led the Club for Growth, a Washington anti-tax group. House Speaker John Boehner, an Ohio Republican, today endorsed the proposal, calling it a “fair offer.”

Some conservative organizations are accusing Republicans of trying to hide tax increases through the Toomey plan.

Norquist Reaction

“Closing tax loopholes is all well and good,” said Americans for Tax Reform president Grover Norquist in an opinion article in Politico. “But doing so to raise revenues is just as much a tax hike as raising tax rates.” He added, “Any congressman who wants to keep his promise to voters to oppose tax increases” must oppose the plan.

Many Republican lawmakers are also unhappy with the proposal. “We don’t have a tax problem — we have a spending problem,” said Senator Jim DeMint, a South Carolina Republican. “For us to get lulled into ‘how much to raise taxes’ in this thing is foolish.”

Senator Orrin Hatch, the top Republican on the tax-writing Finance Committee, said, “Some of these loopholes really aren’t loopholes.” He called them “important policy provisions, like the home interest mortgage deduction.”

Republican supporters of the plan say they are trying to lock in lower income-tax rates that will otherwise jump if, as is currently scheduled, the tax cuts enacted in President George W. Bush’s administration expire at the end of next year. President Barack Obama opposes extending the Bush-era cuts for those earning more than $250,000, and Republicans are unlikely in the 2012 elections to win the Senate votes they would need to keep the tax cuts in effect.

‘Biggest Tax Increase’

“What we’re trying to do is avoid the biggest tax increase in the history of the country,” Senator Charles Grassley, an Iowa Republican, said of Toomey’s plan.

Toomey declined to comment other than to point to a Nov. 10 Wall Street Journal editorial quoting him as calling his proposal a “bitter pill” that is “justified to prevent the tax increase that’s coming.”

A number of Republicans are playing down anti-tax pledges they signed with Norquist’s group. “We take an oath to uphold the Constitution” and “that trumps any and every consideration,” said Cornyn.

“I didn’t know I was signing a marriage vow,” said Representative Mike Simpson of Idaho, one of 40 House Republicans who recently signed a letter signaling willingness to raise taxes as part of a major deficit-cutting deal.

Shifting Opinion

Senator Lamar Alexander of Tennessee, the chamber’s third- ranking Republican, said he saw a sign of shifting opinion when three of the supercommittee Republican members — Toomey, Rob Portman of Ohio and Arizona’s Jon Kyl — briefed Senate colleagues on their plan and no one complained.

“For Pat Toomey and Portman and Kyl to come in and tell a whole roomful of Republicans that ‘we’ve put $250 billion of tax increases on the table’ and not get a murmur of dissent is remarkable,” said Alexander.

Senator Saxby Chambliss, a Georgia Republican, said his party’s lawmakers should consider bigger tax increases if it would lead to a larger debt-reduction deal, because the political price they would pay will essentially be the same.

“You’re going to be criticized by the same people irrespective of what the number is,” said Chambliss.

Retail Sales/Empire/PPI/Evans- GDP remains firm

As previously discussed, GDP looks to be growing sequentially, and should do fine next year if fiscal policy doesn’t tighten.

But still not so good for people working for a living, pretty good for corporate earnings.

And risks remain- Europe, China, Super Committee, etc. etc.

And look for a relief rally if Europe all agrees the ECB writes the check,

followed by a sell off due to the austerity that accompanies it.

Karim writes:

Data confirms Q4 GDP growth tracking 3.25%.; slight boost to Q1 estimate; more like 2.75% vs 2.5% previously.

RETAIL SALES

- Up 0.5% headline and 0.6% control group

- Iphone 4s definitely helped as electronics sales rise 3.7% for the month, largest gain since 11/09

EMPIRE

- Rises to 6mth high of 0.6 from -8.48 in October; but 0.6 still weak historically.

- Also, new orders and employment component both soften in the month.

PPI

- Pipeline pressures receding as -0.3% headline, -0.4% on consumer goods, -1.1% intermediate stage, and -2.5% crude stage

EVANS AND BULLARD

- Evans advocating 3% inflation target and linking policy guidance to unemployment/inflation objective

- Also acknowledges he is ‘sufficiently outside’ consensus at the Fed

- Bullard rejects linking policy to numerical objectives and states would need to see evidence of deterioration in U.S. economy to support additional easing

The deficit isn’t large enough

MMT joined OWS

MMT proposals for the 99%

1. A full FICA suspension to end that highly regressive, punishing tax and restore sales, output, and jobs.

2. $150 billion in federal revenue sharing for the state goverments on a per capita basis to sustain essential services.

3. An $8/hr federally funded transition job for anyone willing and able to work to facilitate the transition from unemployment to private sector employment.

4. See my universal health care proposals on this website (Health Care Proposal).

5. See my proposals for narrow banking, the Fed, the Treasury and the FDIC on this website (Banking Proposal).

6. See my proposal’s to take away the financial sector’s ‘food supply’ by banning pension funds from buying equities, banning the Tsy from issuing anything longer than 3 month bills, and many others.

7. Universal Social Security at age 62 at a minimum level of support that makes us proud to be Americans.

8. Fill the Medicare ‘donut hole’ and other inequities.

9. Enact my housing proposals on this website (Housing proposal).

10. Don’t vote for anyone who wants to balance the federal budget!!!!

Bill Mitchell on Thomas Sargent and the Nobel Prize

Rewarding those who are culpable

By Bill Mitchell

October 14 — I didn’t comment earlier this week on the recent decision to award the (not)Nobel Prize in Economics to Thomas Sargent. My thoughts were otherwise occupied but it is worth recording that Sargent has been at the centre of the mainstream macroeconomics literature which has been used to justify the claims that government fiscal interventions are ultimately futile and only generate accelerating inflation. His ideas helped my profession to claim authority in its campaign to pressure governments in deregulation, privatisation, inflation targetting and abandoning full employment as a primary policy target. The upshot has been three decades of policy development which really laid the foundations of the current crisis. If Sargent and his cohort had not been so influential the world economy might not have been in the mess that it finds itself in. And … millions might still have their life savings and be gainfully employed. The so-called Nobel Prize in Economics continues to reward those who are culpable.

I covered the event last year – Nobel prize – hardly noble – and noted that the award had nothing to do with Alfred Nobel’s will which wanted prestige to be bestowed on “shall have conferred the greatest benefit on mankind”. Instead, the economic prize was established in 1968 by the ultra-conservative Swedish central bank and the prize is awarded by the Royal Swedish Academy of Sciences.

There is a good critique of Sargent’s selection by John Cassidy in his New Yorker article (October 12, 2011) – A Nobel for Freshwater Economics. He said:

This week’s announcement of the Nobel Prize in Economics got me thinking about the state of the subject, and my thoughts weren’t very positive. Three years after the great financial crisis of 2008 discredited the ruling orthodoxy in macroeconomics and finance, the Royal Swedish Academy of Sciences has chosen to honor one of the leading creators of that orthodoxy: Tom Sargent, of New York University. And judging from the reactions to the Nobel announcement, most academic economists heartily approved of it.

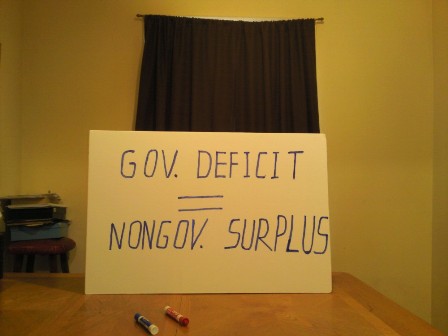

Sign for OWS

“WE DEMAND

AGGREGATE DEMAND!”