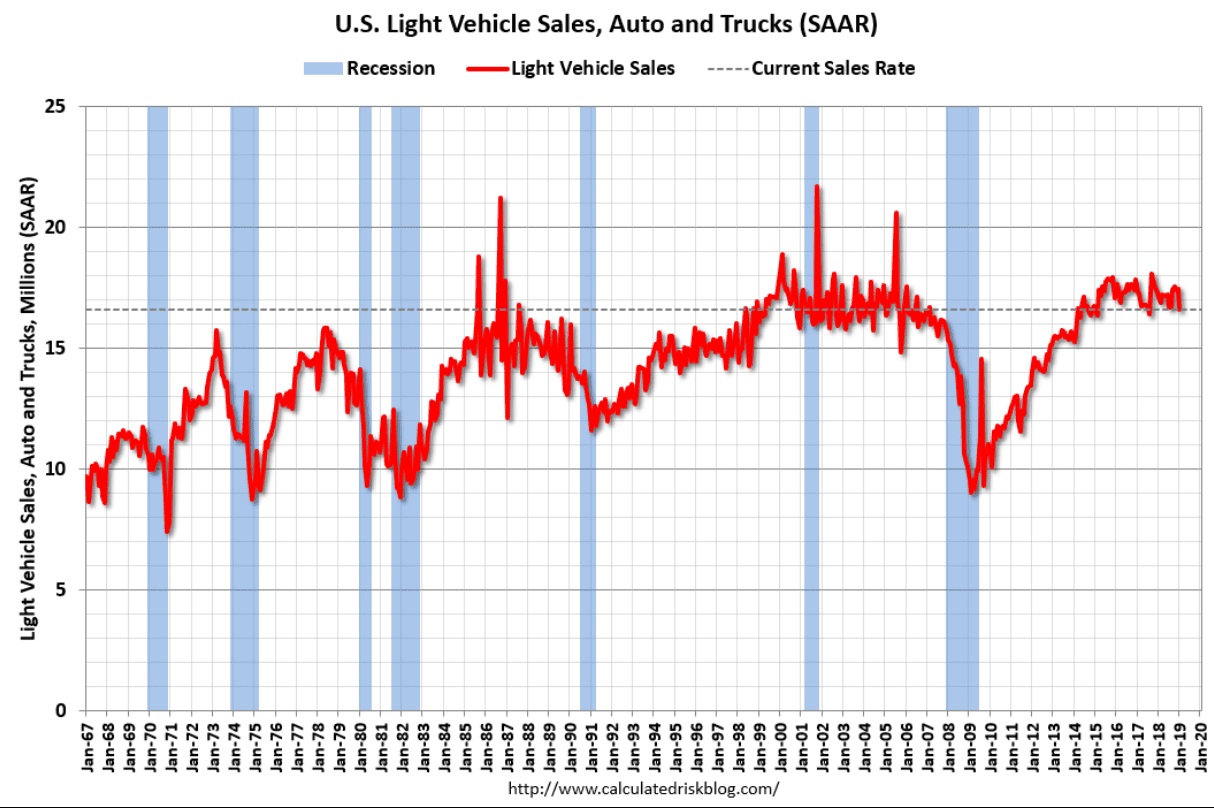

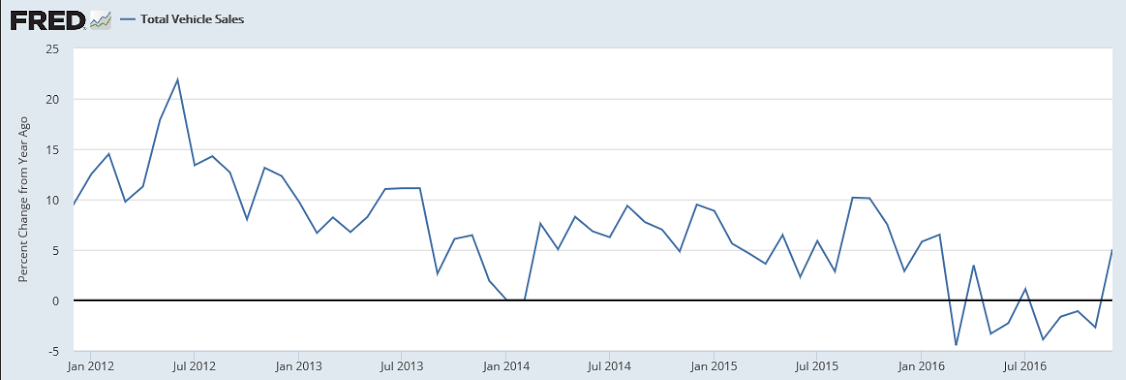

Blaming interest rates for a decline that started about two years ago:

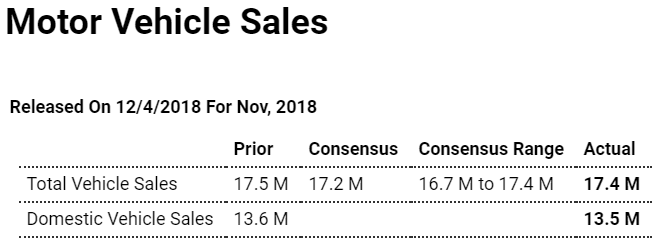

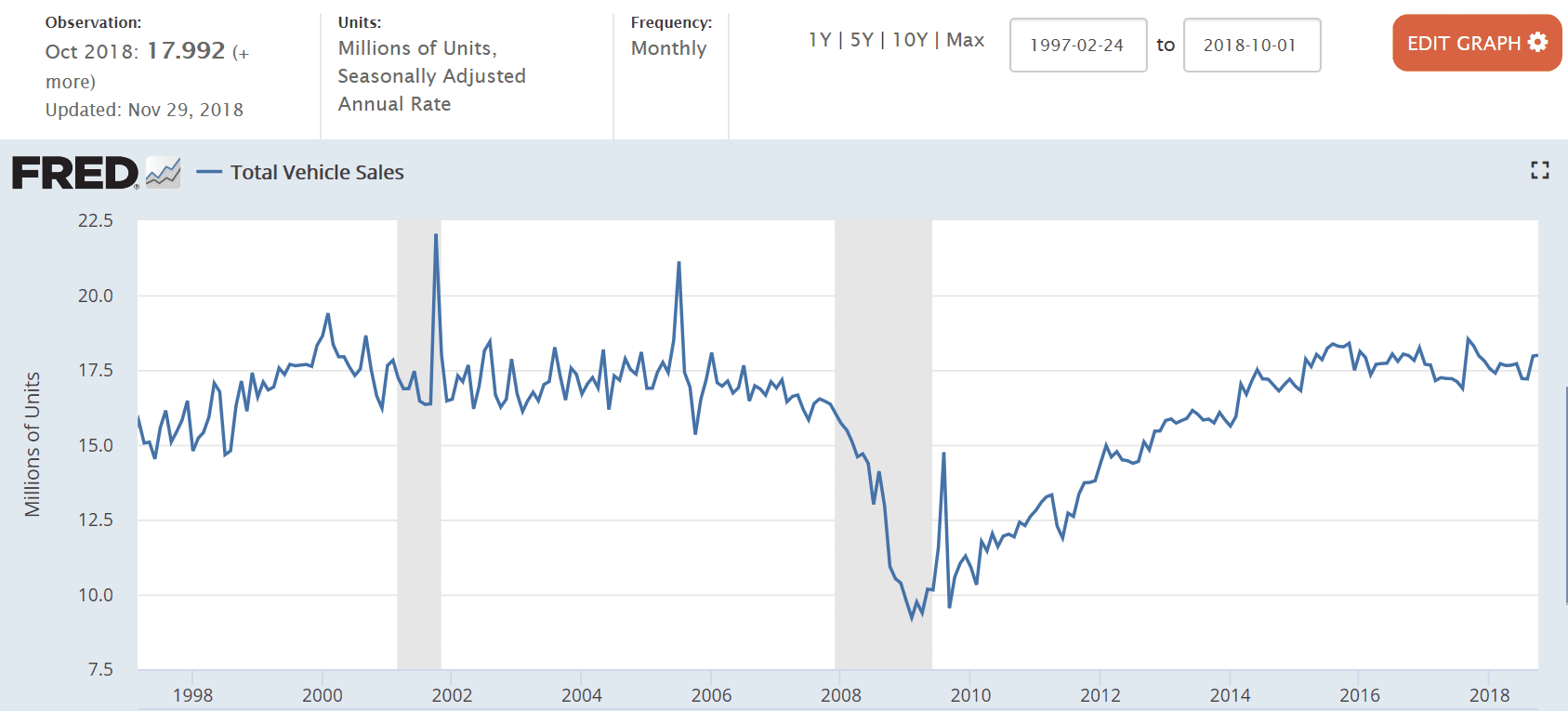

Overall U.S. vehicle sales dropped 2.4% in February, to 1.3 million, according to Autodata Corp. J.D. Power estimates incentive spending in February—averaging $3,850 per vehicle—was down slightly from the same month in 2017. The seasonally adjusted sales pace for the market slipped to 17.1 million on an annualized basis, from 17.5 million a year earlier, according to Autodata. Average monthly payments now exceed $525 a month, according to Edmunds.com, with the online-shopping company estimating that interest rates on new-vehicle loans hit an eight-year high in February.

What best serves public purpose when this is a concern is to require defense needs be sourced domestically while the rest of the economy continues unrestricted:

“The premise for the decision, known as Section 232, was on national security grounds. The White House claimed that relying on foreign steel could threaten the U.S. defense industry.”

I wrote this a year or so ago and just modified to keep it current:

Shop to Win!

The President no doubt knows that when you go shopping, buying at the lowest price is the mark of a winner, while paying too much is the mark of a loser. Yet when it comes to buying lumber from Canada, cars from Germany, and now steel and aluminum, the President has viciously attacked and is now retaliating against other nations for not charging us enough for their products!

And while everyone knows that buying at the lowest price is a good thing, there is no serious push back from Democrats, the ‘free trade’ Republicans, the media or any of the headline mainstream analysts. There is clearly something very wrong with their underlying mainstream logic that leads to this type of costly Presidential blunder.

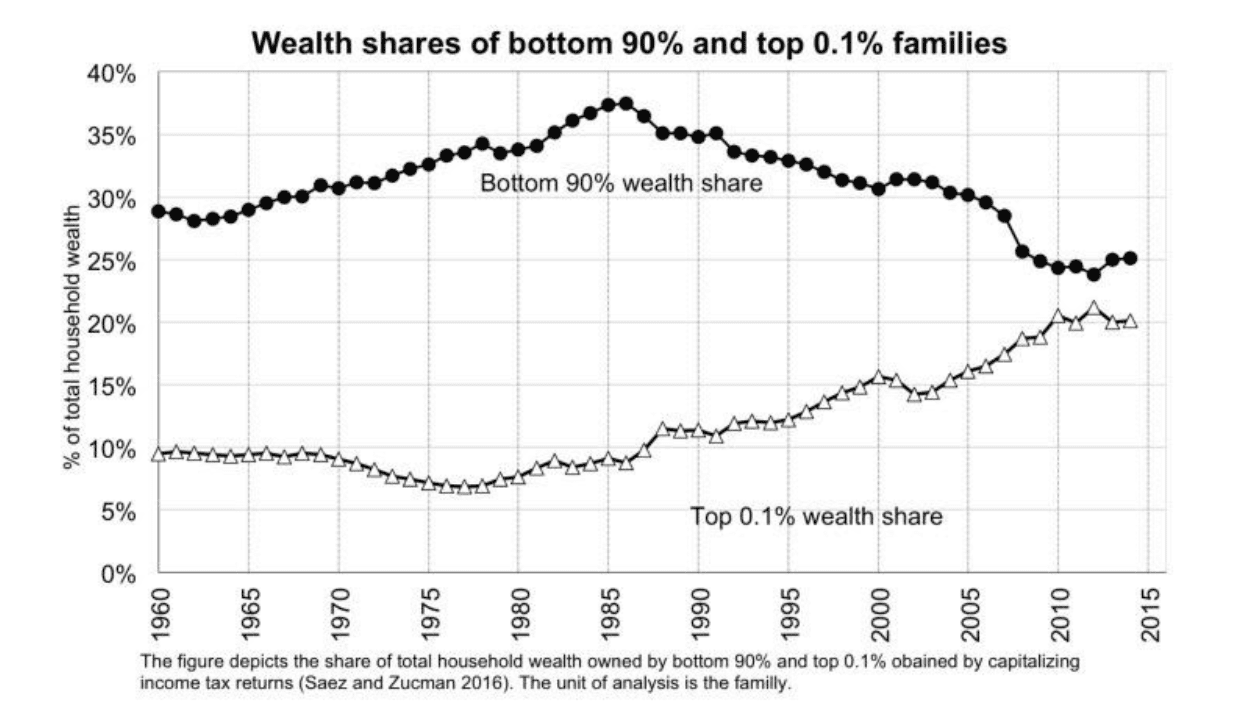

Yes, when we buy imports jobs are lost, just as when we replace workers with machines, including lawn mowers, vacuum cleaners, and power washers, jobs are lost. And yet somehow we’ve survived all that. We went from needing 99% of the people working to grow our food to less than 1%, and manufacturing jobs are down to only 7% of the labor force. And yet the remaining 90% of us are not all unemployed, as jobs have proliferated in the service sector, where most of those jobs are now considered to be better jobs than the lost agricultural and manufacturing jobs. Nor has a trade deficit necessarily resulted in higher unemployment or lower pay. In 1999, for example, we had record imports with unemployment under 4% and inflation under 2%, and students were getting recruited for good paying jobs well before graduation.

The answer to sustaining high levels of employment and pay is fiscal policy. If for any reason, including more imports, weak demand at home is keeping unemployment too high or wages too low, the appropriate policy response is fiscal relaxation- either a tax cut or spending increase, even if that increases the public debt- and not to tax or otherwise drive up the cost of imports. Unfortunately however, the policy that allows all of us to pay the lowest prices for imports and have good paying jobs to replace those lost because of imports has been taken entirely off the table by both Republicans and Democrats. Consequently a very good thing for America- lower prices of imports- has been turned into a very bad thing- unemployment, and all because of the fake news about the public debt that is supported by Republicans and Democrats.

The US public debt is nothing more than the dollars spent by the federal government that have not yet been used to pay taxes. Those dollars spent and not yet taxed sit in bank accounts at the Federal Reserve Bank that are called ‘reserve accounts’ and ‘securities accounts’, along with the actual cash in circulation. Treasury securities (bonds, notes, and bills) are nothing more than dollars in securities accounts at the Federal Reserve Bank, functionally the same as dollars in savings accounts or CD’s at commercial banks.

Think of it this way- when the government spends a dollar, that dollar either is used to pay taxes and is lost to the economy, or it’s not used to pay taxes and remains in the economy. Deficit spending adds to those dollars that were spent but not yet taxed, which is called the public debt. And what’s called ‘paying off the debt’ (as happens to 10’s of billions of Treasury securities every month) is just a matter of the Fed shifting dollars from securities accounts to reserve accounts- a simple debit and a credit- all on its own books. (No tax payers or grand children required…) The ‘ability to pay’ is always there- it’s just a debit and a credit to accounts on the books of the Federal Reserve Bank. The fear mongering about the US running out of money or constraints by foreigners is simply not applicable to today’s monetary system.

And if you are worried about inflation, our proposal works to lower prices for all of us, while the Presidents direct policy is to raise the prices we all pay.

And if the concern is national security, the policy response that best serves public interest is to order the defense department to require domestic sourcing of what they consider strategically important,

and let the rest of us continue to shop for the lowest possible prices.

Point is, once it’s understood that 1) the public debt is nothing more than what can be called the net money supply 2) there is no risk of default 3) there is no dependence on foreign or any other lenders 4)there is no burden being put on future generations the President will be free to make us all winners by being our shopper in chief who works to get us the lowest possible prices.