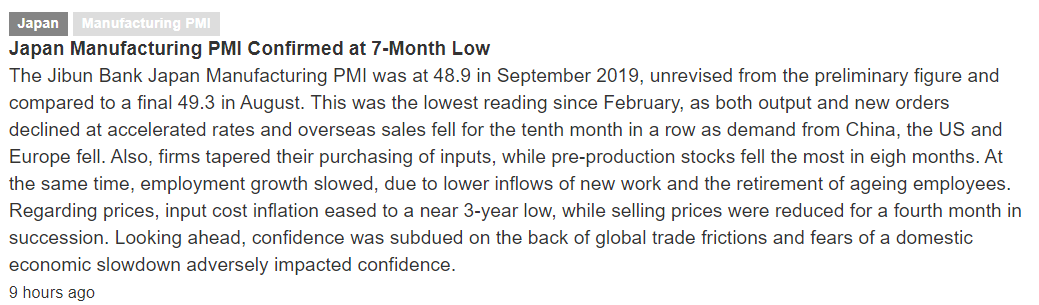

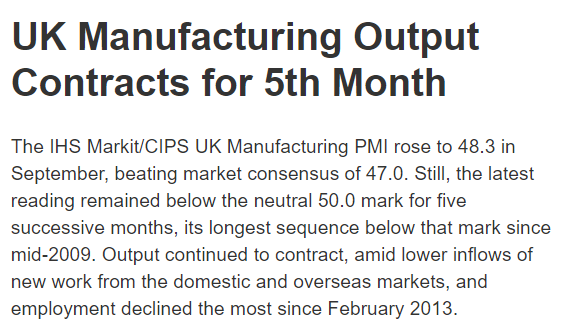

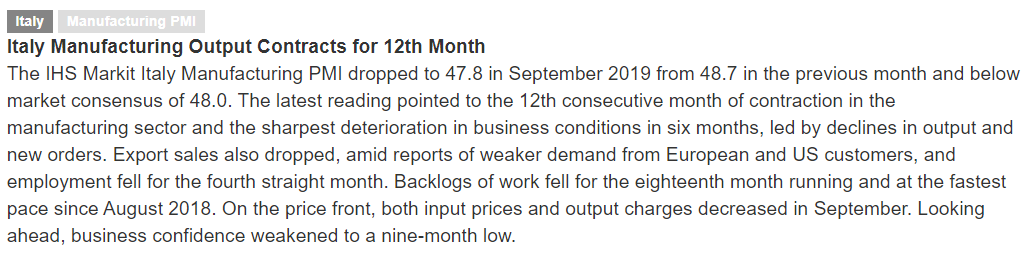

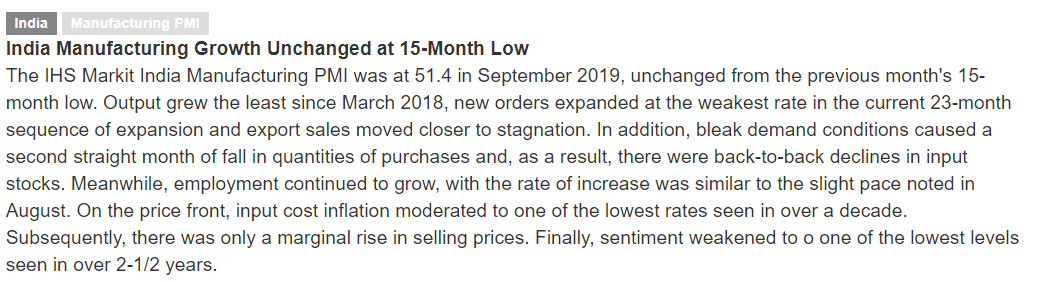

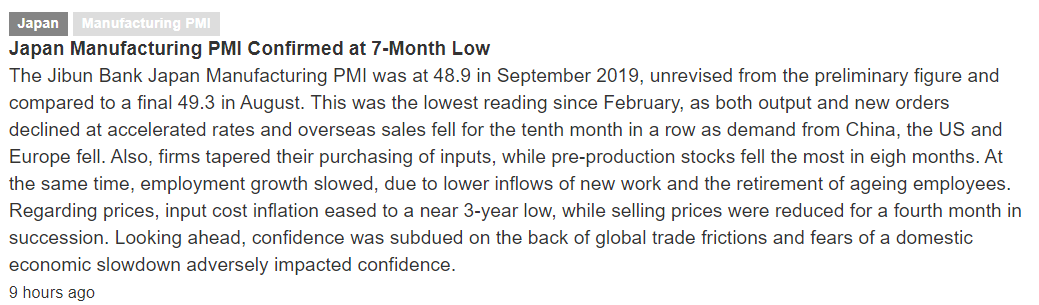

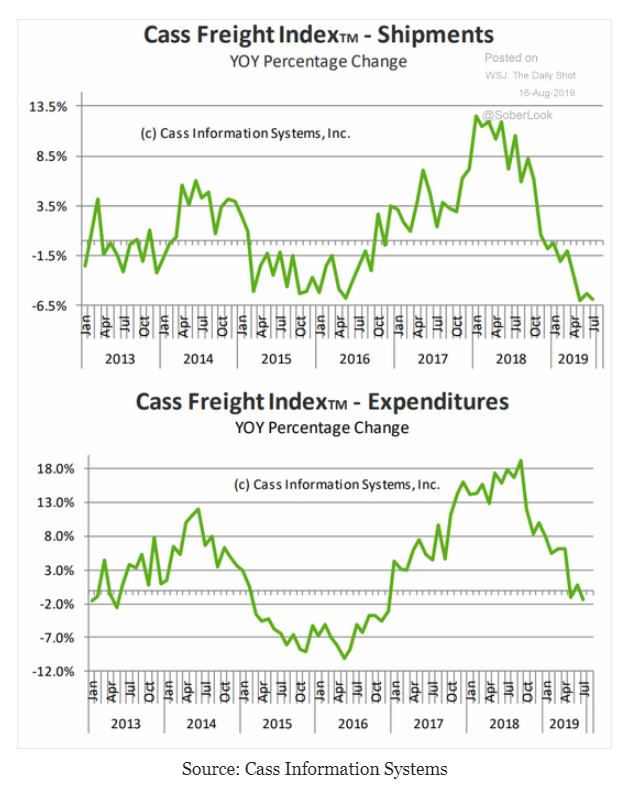

Just a partial recap of today’s releases as the tariff induced global trade collapse continues:

Just a partial recap of today’s releases as the tariff induced global trade collapse continues:

Someone else agrees with me about the tariffs and the global trade collapse:

CNBC: The trade war is weighing ‘like a big, dark cloud’ on the global economy, says Christine Lagarde.

And this would function like a tax increase:

Bloomberg: President Trump Doubles Down on Call for Negative Interest Rates.

Today’s tariff induced bad news:

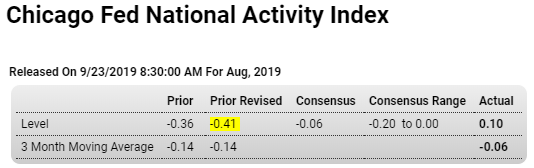

Highlights

A snapback for manufacturing production led a jump into the positive column for the national activity index which at 0.10 marks the second positive score in three months. Yet the 3-month average, at minus 0.06, remains in the negative column for the seventh straight month.

Manufacturing has been the center of weakness for this indicator but posted a strong gain in August’s industrial production report. Offsetting this strength was a drop below 50 to 49.1 for the ISM manufacturing report. And speaking to broad weakness, the other three components of the index (employment, sales/orders/inventories, consumption & housing) all posted marginal declines on the month of minus 0.2 percent.

This report has been running well below GDP, offering an alternative and not very upbeat assessment of the 2019 economy. Of the 85 separate indicators that make up this report, 51 were available for August’s results.

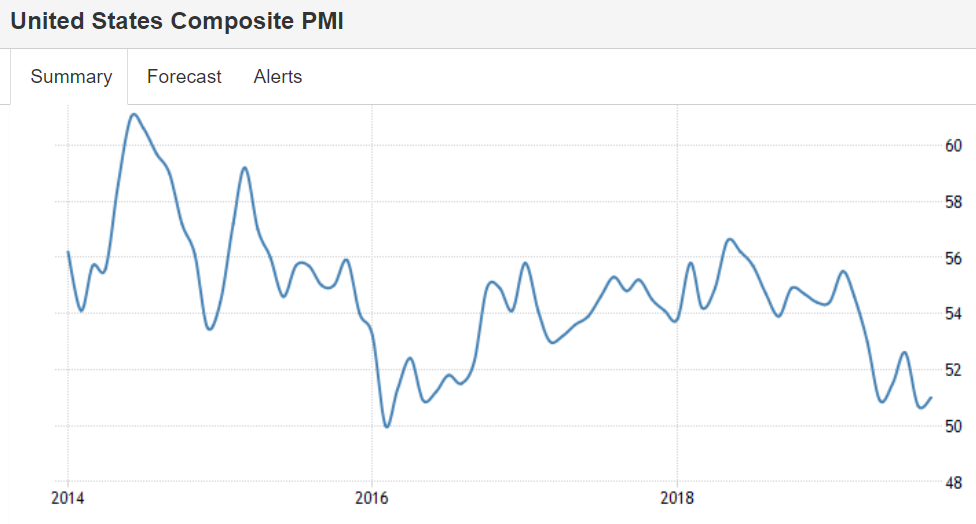

This is a composite of manufacturing and services and doesn’t look good:

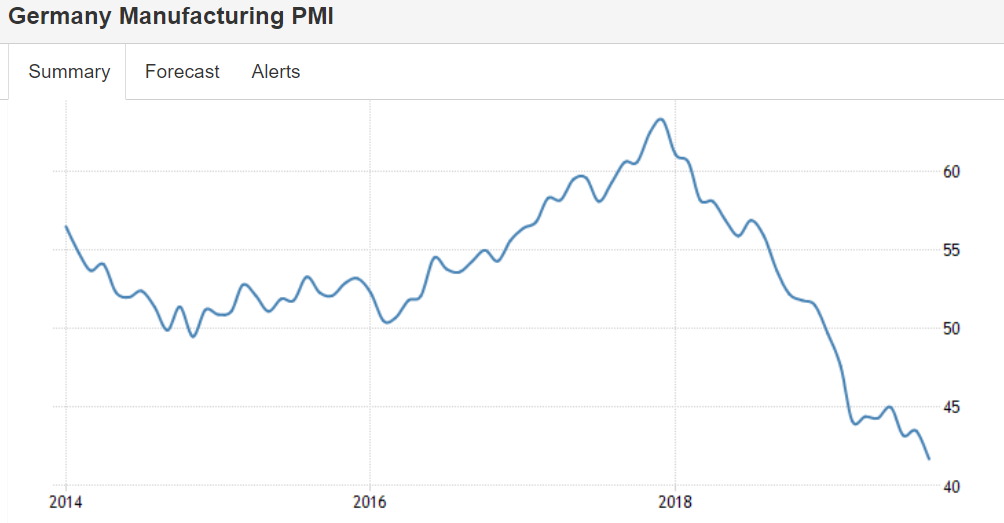

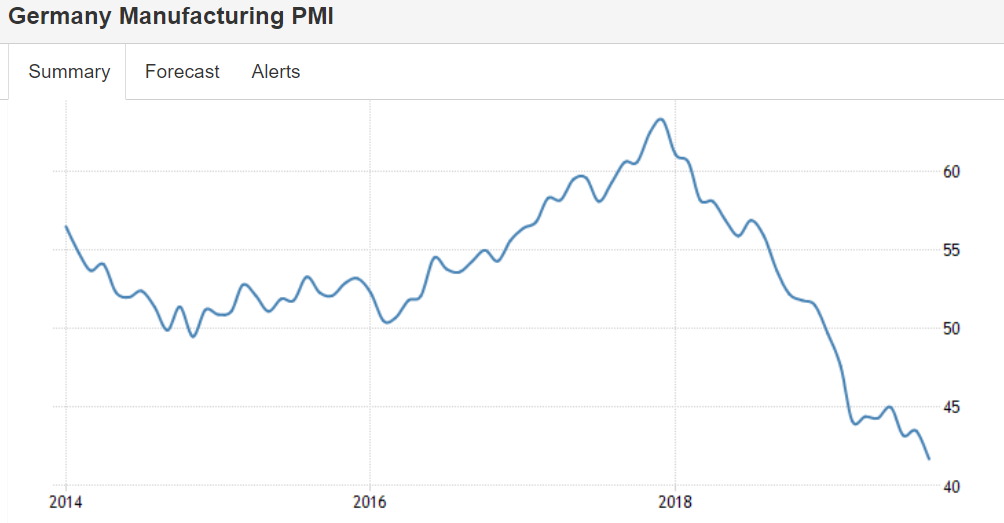

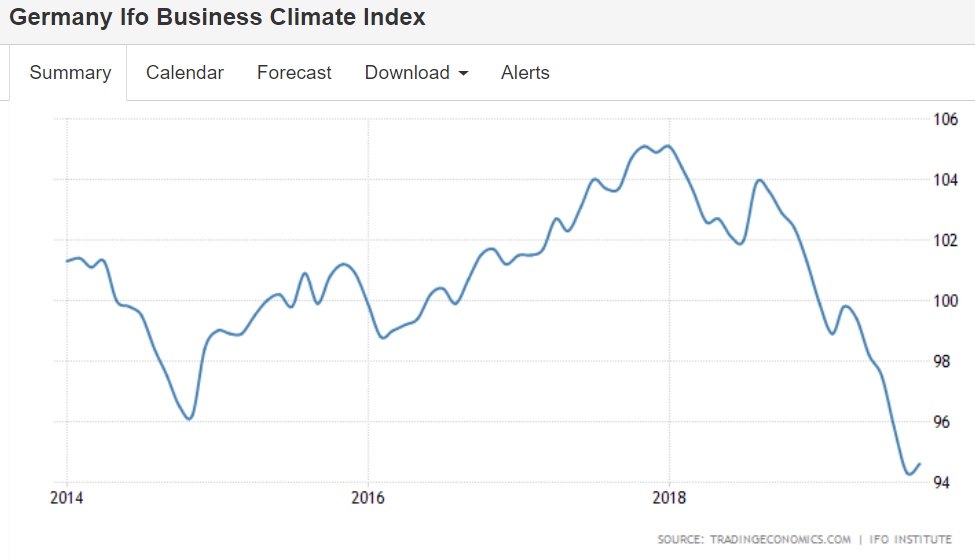

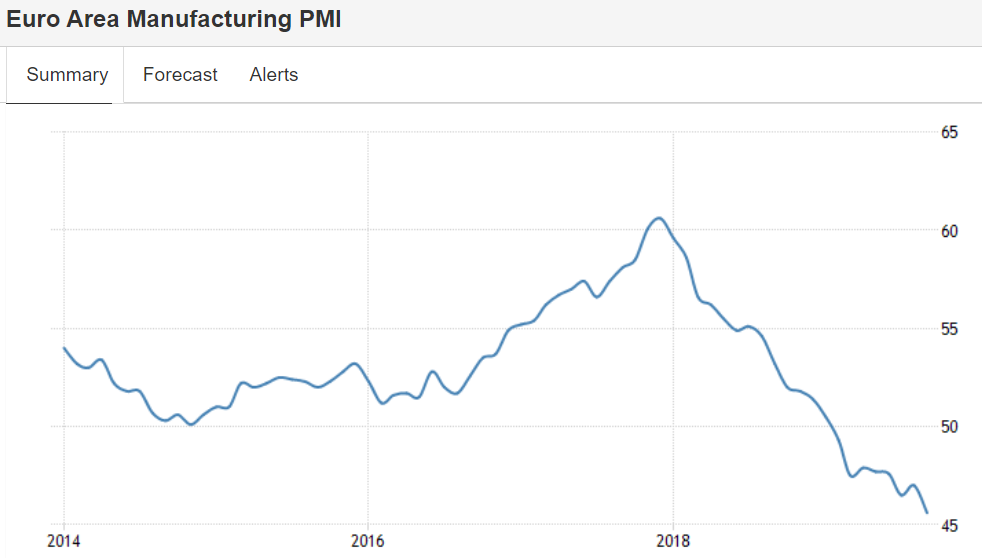

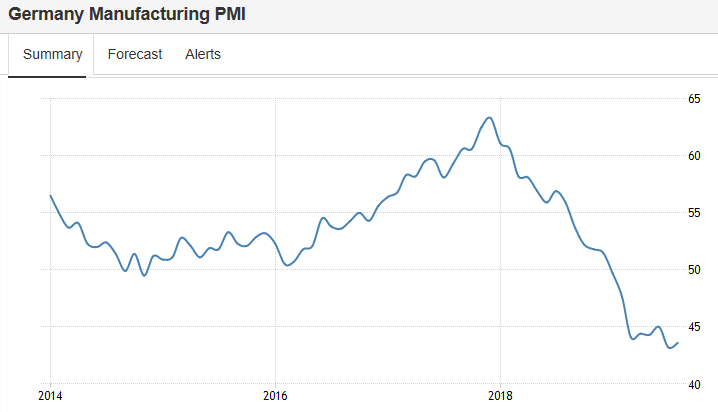

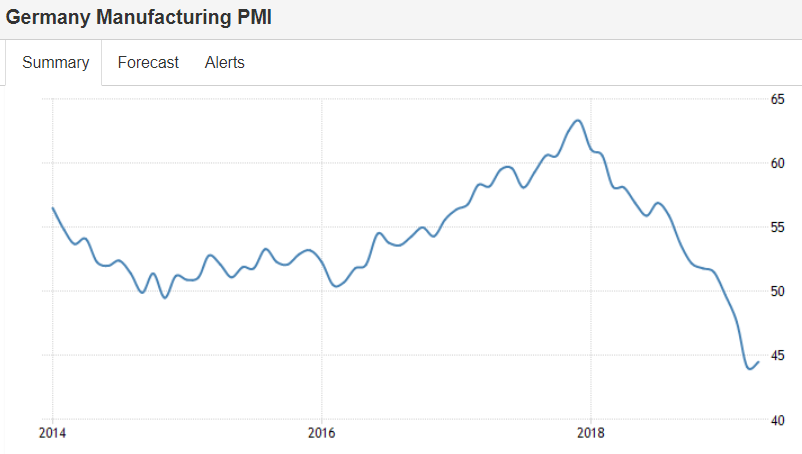

Looking like full blown recession in progress:

German Manufacturing PMI at Over 10-Year Low

The IHS Markit Germany Manufacturing PMI fell to 41.4 in September, missing market expectations of 44 and pointing to the steepest contraction in factory activity since the global financial crisis in mid-2009. Output shrank at the sharpest pace since July 2012 and new business dropped the most in more than a decade. Also, the job shedding rate accelerated to the fastest since January 2010.

Employment growth has been revised substantially lower. Note that one of the inputs used for estimating monthly employment is data from the weekly jobless claims report, which I had suggested would be misleading due to claims being made substantially harder to get over the last several years.

Employment: Preliminary annual benchmark revision shows downward adjustment of 501,000 jobs

The BLS released the preliminary annual benchmark revision showing 501,000 fewer payroll jobs as of March 2019. The final revision will be published when the January 2019 employment report is released in February 2020. Usually the preliminary estimate is pretty close to the final benchmark estimate.

Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to comprehensive counts of employment for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. For national CES employment series, the annual benchmark revisions over the last 10 years have averaged plus or minus two-tenths of one percent of total nonfarm employment. The preliminary estimate of the benchmark revision indicates a downward adjustment to March 2019 total nonfarm employment of -501,000 (-0.3 percent).

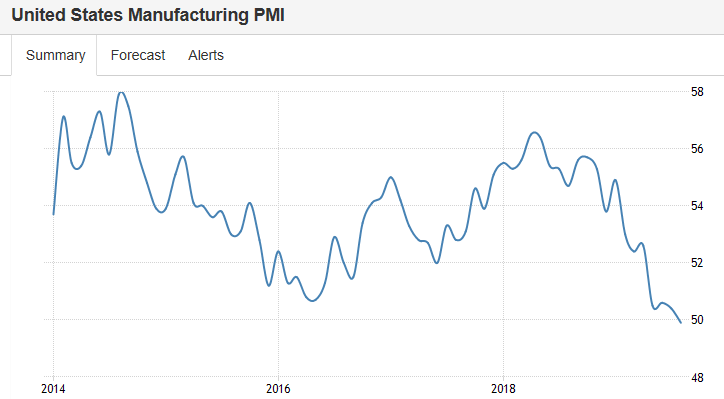

US Factory Activity Contracts for 1st Time in a Decade

The IHS Markit US Manufacturing PMI dropped to 49.9 in August from 50.4 in July and below market expectations of 50.5, a preliminary estimate showed. The latest reading pointed to the first month of contraction in manufacturing since September 2009, as new orders fell the most in 10 years led by the largest decline in exports since August 2009.

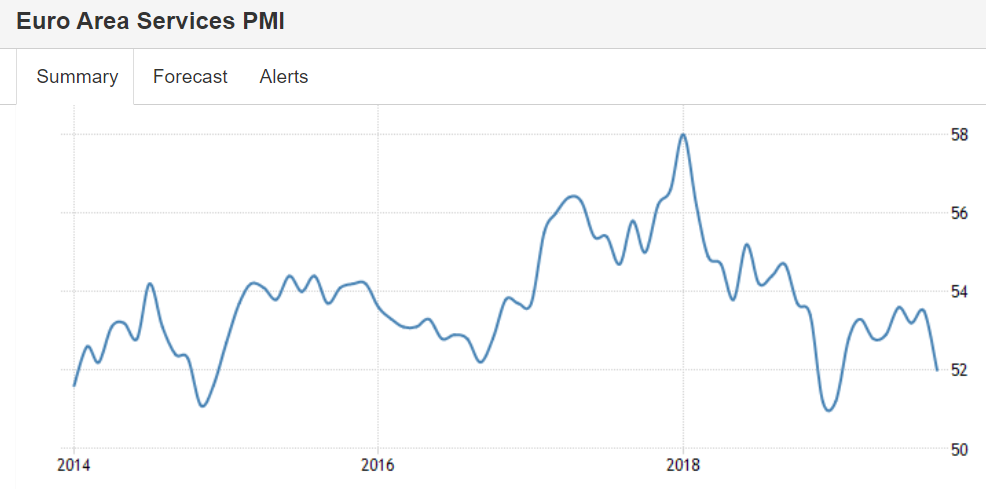

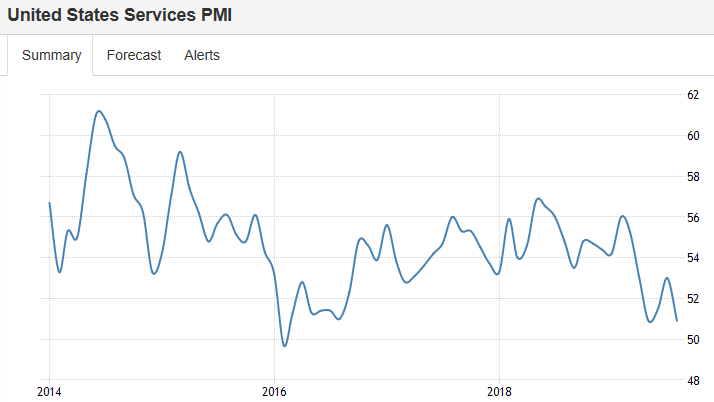

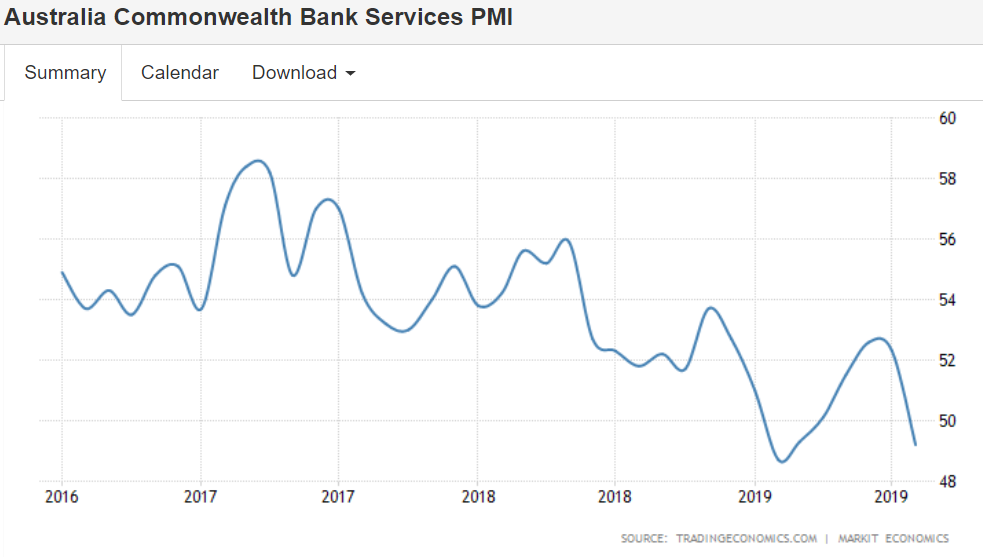

Services decelerating and near contraction:

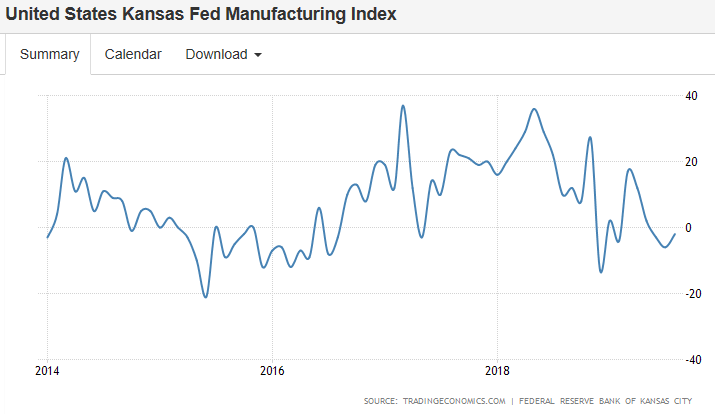

In contraction:

Continued weakness:

German Manufacturing Contracts for 8th Month

The IHS Markit Germany Manufacturing PMI rose to 43.6 in August 2019 from a seven-year low of 43.2 in the previous month and above market expectations of 43, a preliminary estimate showed. Still, the latest reading pointed to the eight month of contraction in the manufacturing sector, as new orders fell the most since April on the back of weak external demand. In addition, employment contracted the most since July 2012 and outstanding business continued to decline. On the price front, goods producers recorded a further sharp drop in input costs and a subsequent reduction in factory gate charges. Looking ahead, business confidence was the weakest since that series began in mid-2012.

Services in contraction:

Continuous flip flopping as dementia sets in:

President Donald Trump says he’s not currently looking at a payroll tax cut or indexing capital gains to inflation.

The comments follow several days of mixed messaging from his administration about whether or how it will respond to growing recession fears.

Trump says the U.S. does not “need” tax cuts, because of a “strong economy.”

?????

Trump attacks Ford Motor for not backing fuel economy rollback

Highlights

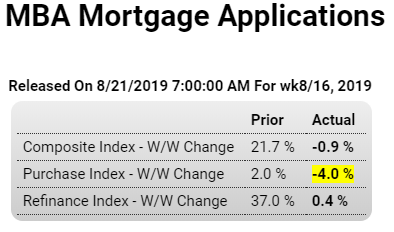

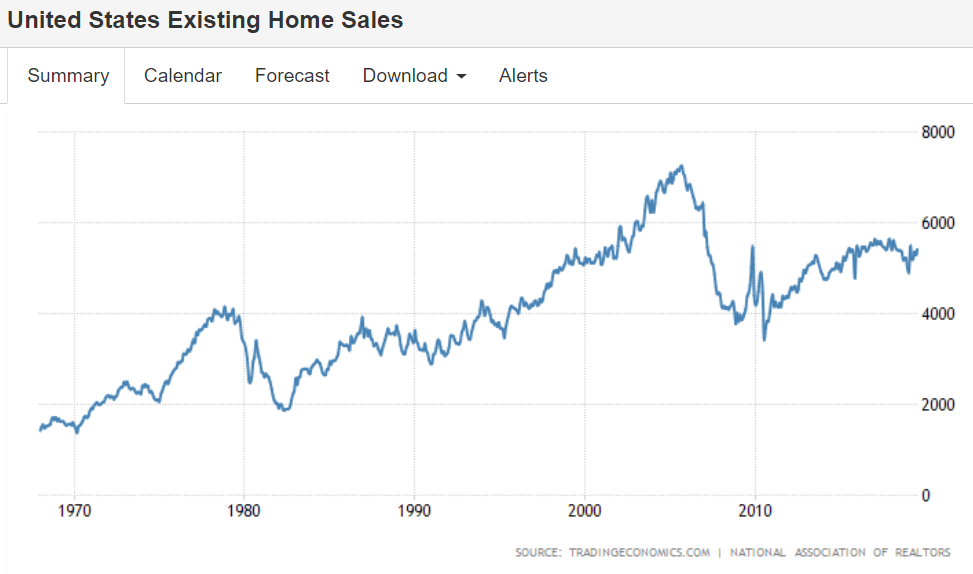

The surge in refinancing is easing as the related index, after spiking 37.0 and 12.0 percent in the two prior weeks, rose only 0.4 percent in the August 16 week. Yet rates did move lower in the week, down another 3 basis points to 3.90 percent for conventional 30-year loans and down nearly 20 basis points over the past month. Mortgage-related gains for the purchase index have been much more subdued with this index up 0.4 percent in the latest week and the year-on-year increase slowing sharply to 5.0 percent. The slowing in the purchase index will not be lifting expectations for home sales which have been struggling to move higher this year.

Maybe try to buy Denmark?

U.S. President Donald Trump said he was postponing a scheduled meeting with Denmark’s Prime Minister Mette Frederiksen because of her lack of interest in discussing a possible purchase of Greenland.

Powell’s best move is to resign:

Trump says the Fed is the ‘only problem’ with the economy, calls Powell ‘a golfer who can’t putt’

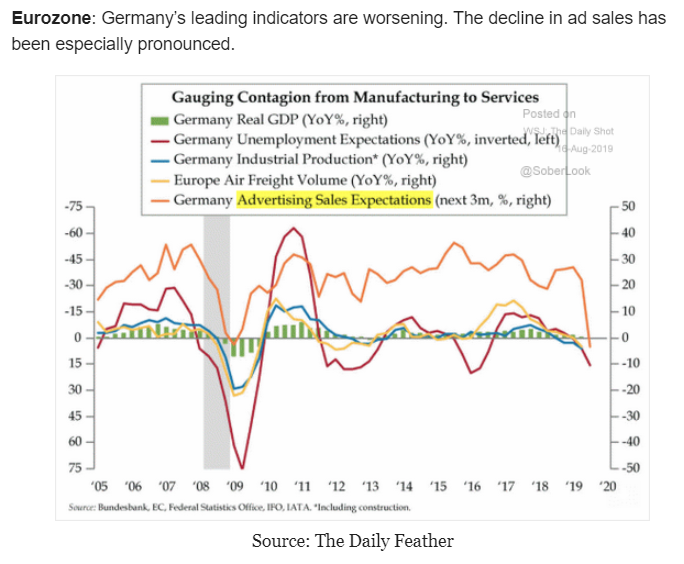

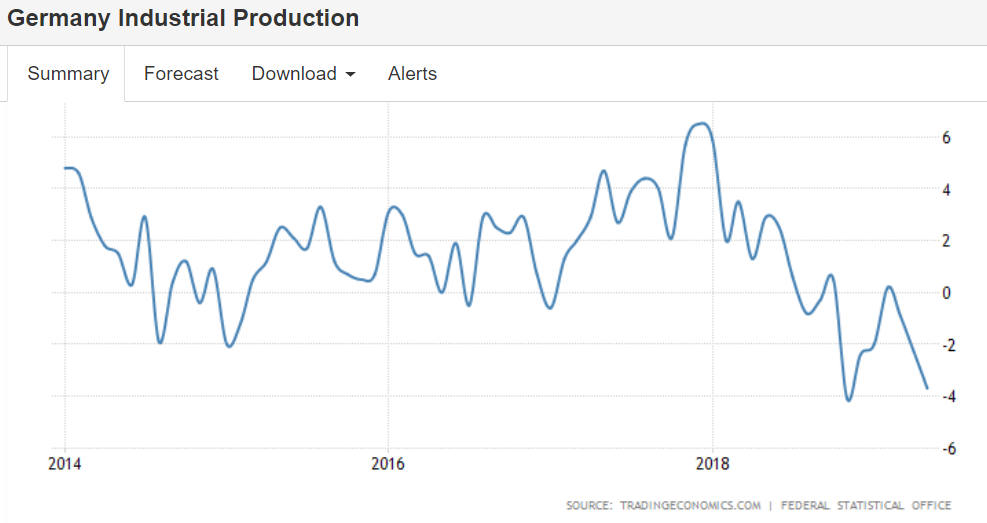

German Economy Contracts in Q2 as Exports Fall

Germany’s gross domestic product contracted by a seasonally-adjusted 0.1 percent on quarter in the three months to June 2019, following a 0.4 percent expansion in the previous period and matching market expectations, a preliminary estimate showed. Net external demand contributed negatively to the GDP, mainly due to a slump in exports, while fixed capital formation in construction also declined.

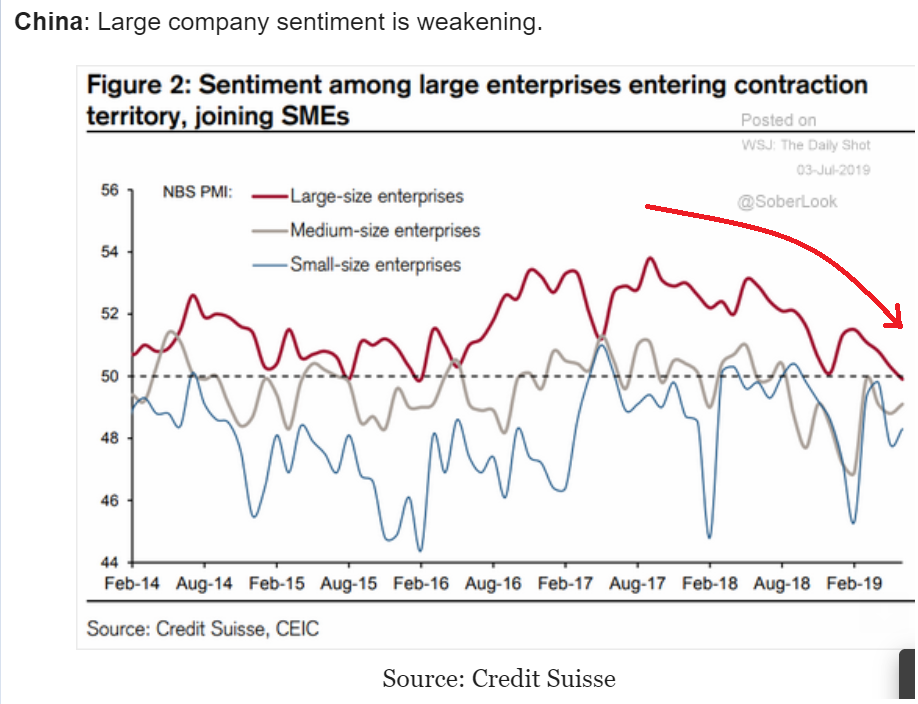

China Industrial Output: Growth at Over 17-Year Low

China’s industrial production increased 4.8 percent year-on-year in July 2019, the weakest annual gain since February 2002 and below market consensus of 5.8 percent, on the back of

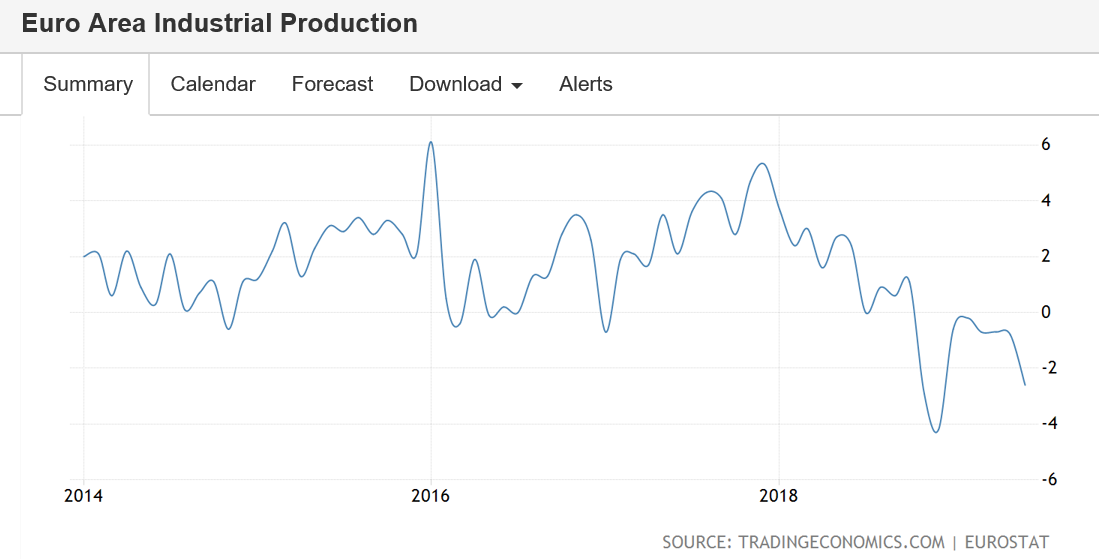

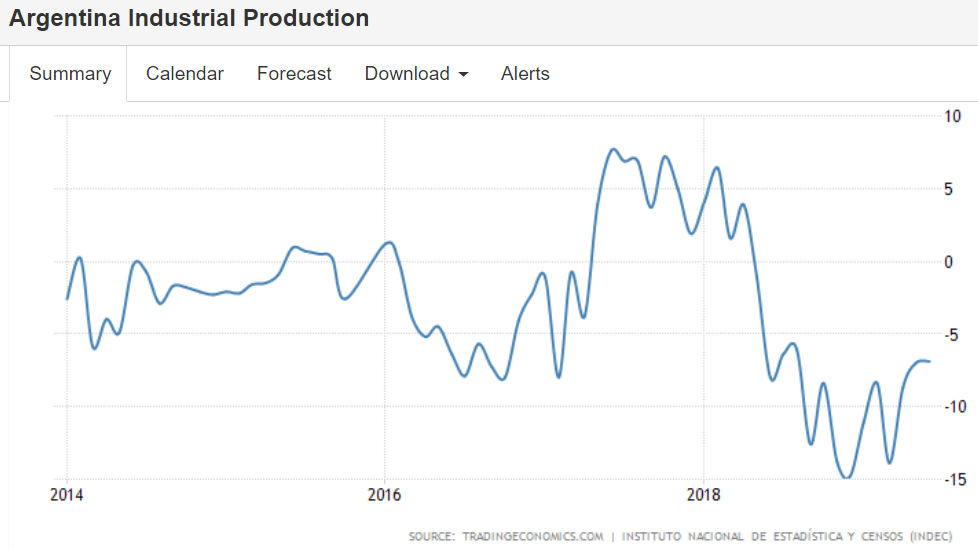

Deep into global industrial contraction:

Not that rate cuts are expansionary, of course, but that they think they are. As the barber quipped, ‘no matter how much I cut off, it’s still too short’ :

Central Banks Across Asia Cut Interest Rates

The Reserve Bank of India cut its benchmark repo rate for a fourth straight meeting by a deeper-than-expected 35bps to 5.4%; the Reserve Bank of New Zealand slashed its official cash rate/OCR by a larger-than-expected 50bps to a fresh record low of 1%; and the Bank of Thailand unexpectedly lowered its policy rate by 25bps to 1.5%.

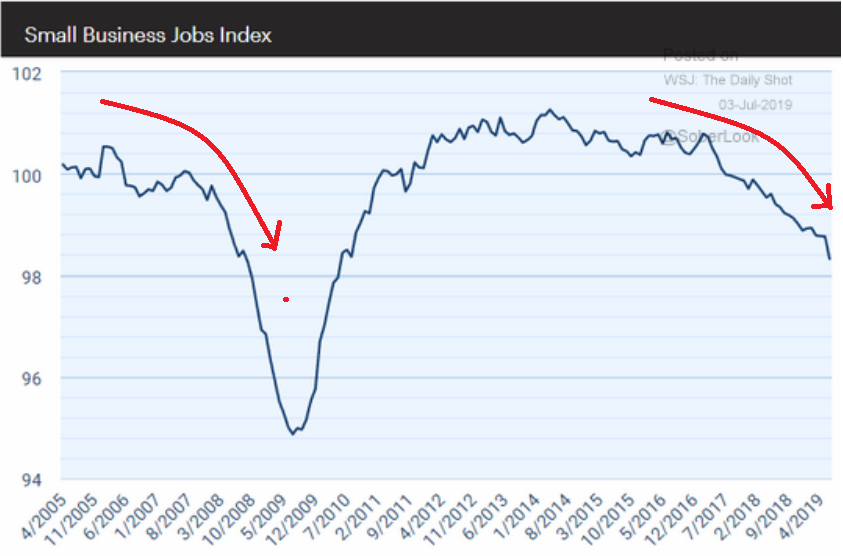

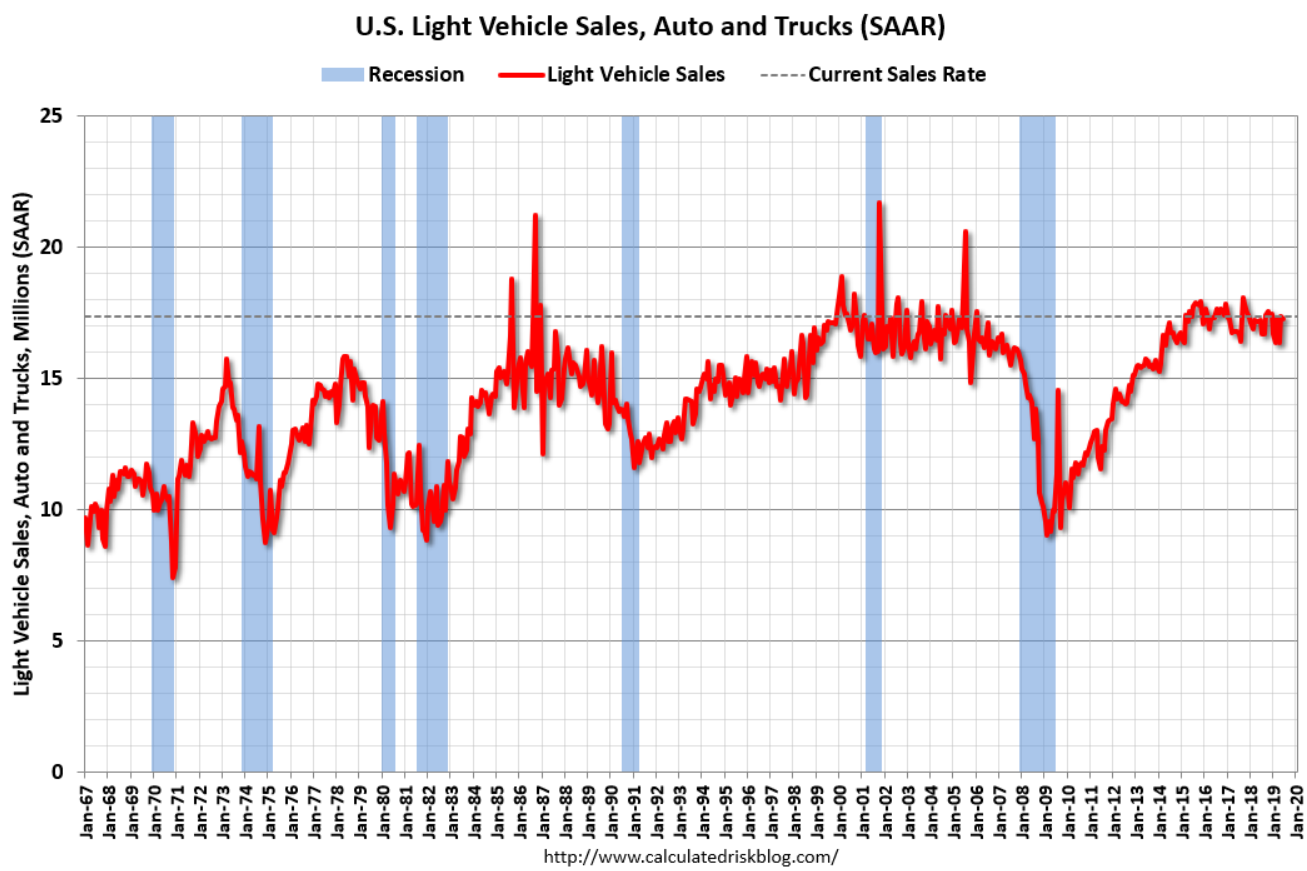

Light vehicle sales peaked a while back:

Been helping to support the $US:

Eurozone Retail Sales Fall Unexpectedly

Retail trade in the Euro Area fell 0.3% in May, following a 0.1% drop in April and missing expectations of a 0.3% growth, as sales declined for all main categories. Among the bloc’s largest economies, Germany’s retail trade decreased for the second month, while gains were recorded in France and Spain. Year-on-year, retail sales rose 1.3%, also missing forecasts of 1.6%.

Not looking good:

German Factory Activity Continues to Contract in April

The IHS Markit Germany Manufacturing PMI rose to 44.5 in April 2019 from the previous month’s near seven-year low of 44.1, but below market expectations of 45, a preliminary estimate showed. Still, the latest reading pointed to a sharp contraction in the manufacturing sector, as inflows of new business fell for a fourth straight month led by a further steep decline in new export orders, which dropped at the second-fastest rate in the past ten years. Firms highlighted weak demand across the automotive sector in particular, whilst also suggesting some hesitancy among UK based clients. In addition, work-in-hand at manufacturers declined the most for almost a decade while employment levels were unchanged. Looking ahead, business confidence towards the year-ahead outlook was the weakest since November 2012.

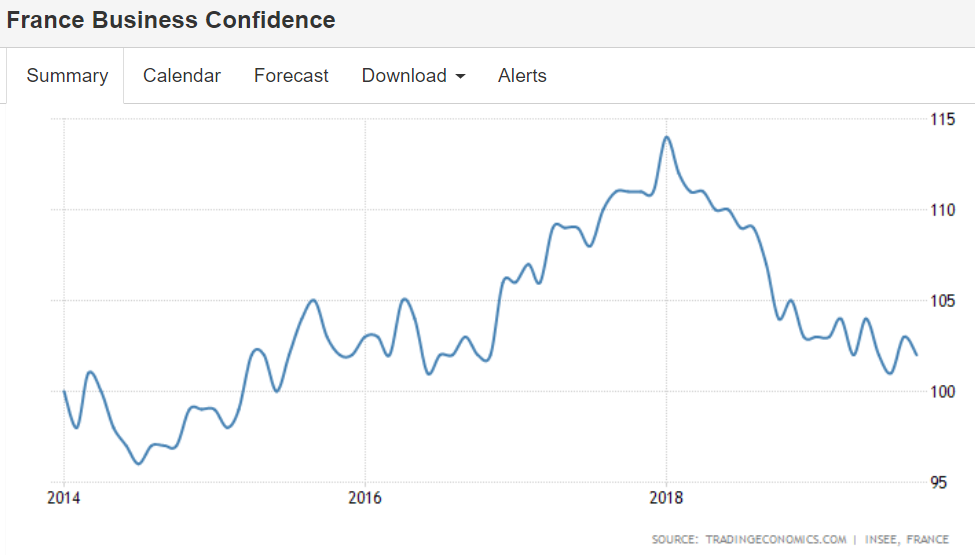

French Factory Activity Contracts the Most in 2-1/2 Years

The IHS Markit France Manufacturing PMI edged down to 49.6 in April 2019 from 49.7 in the previous month, missing market expectations of 50, a preliminary estimate showed. The latest reading pointed to the steepest contraction in the manufacturing sector since August 2016, as output fell the most in four years. On the other hand, new orders and export sales both declined at a softer pace while employment growth accelerated.

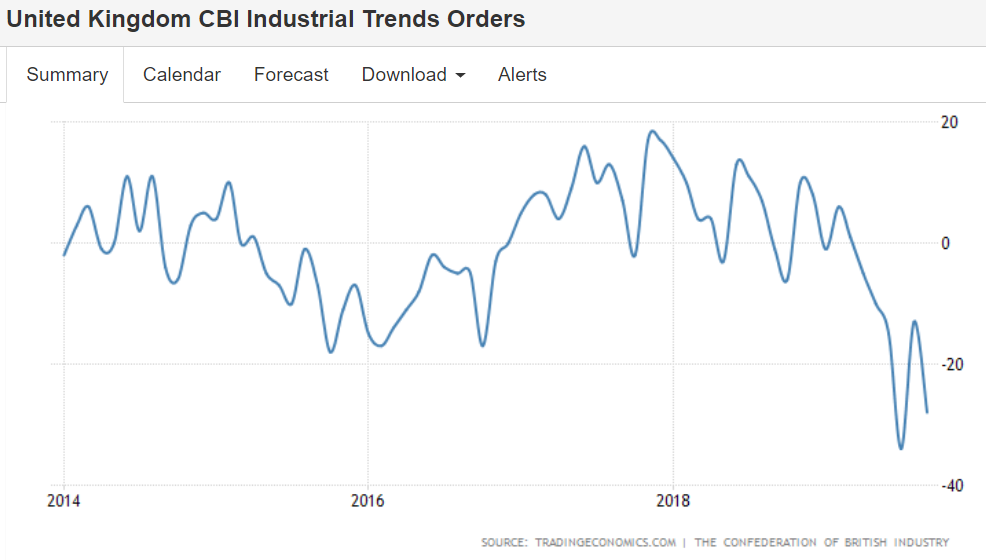

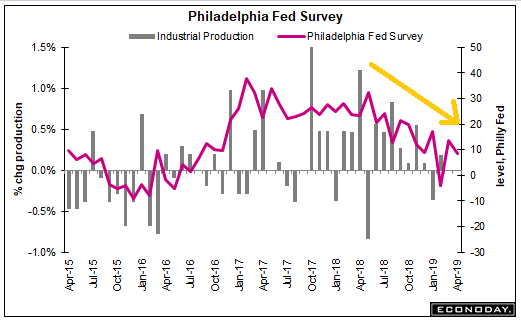

Back in negative territory:

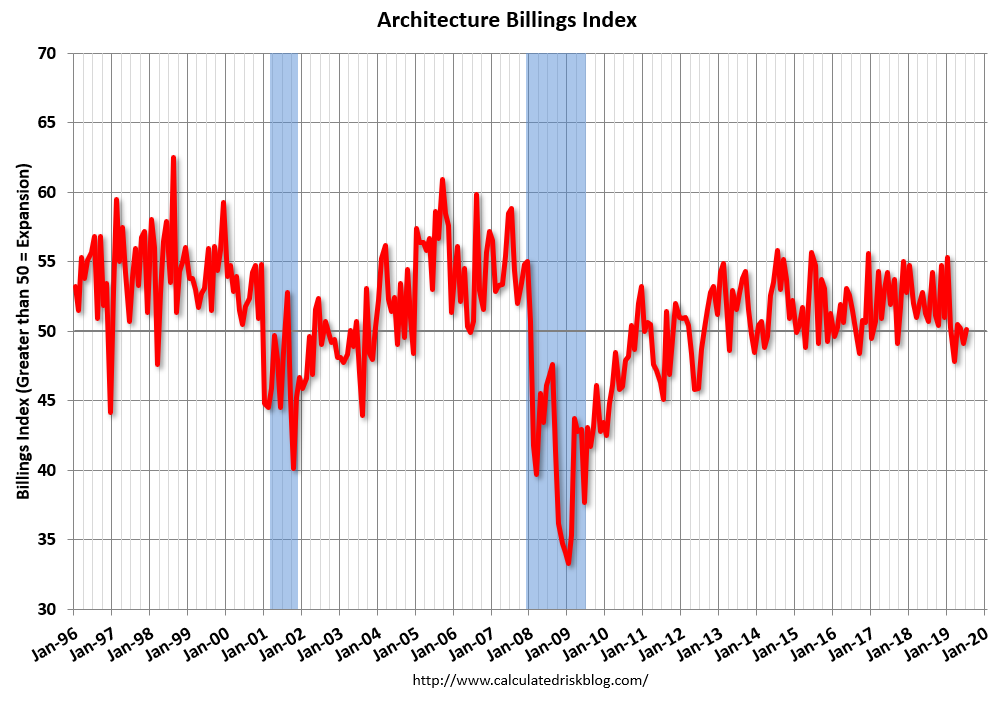

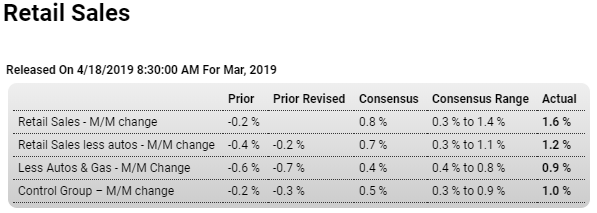

In contrast, this is an upbeat report (subject to revision) for March, though the chart doesn’t look so good:

Highlights

The optimists weren’t quite optimistic enough as March retail sales, across all major readings, came in just above Econoday’s high estimates. Still, the trend is uneven and not pointing with certainty to acceleration ahead for consumer spending.

Total retail sales jumped 1.6 percent in March which exactly matches the decline in the much more important month of December. February sales are unrevised at the headline level at minus 0.2 percent with January sales revised 1 tenth higher to a gain of 0.8 percent.

Ex-auto sales show a bit less strength over this period, rising 1.2 percent in March but falling 2.1 percent in December with February revised to a 0.2 percent decline and January holding at an increase of 1.4 percent. Other core readings are similar, showing strength in March following bumpy results previously with ex-autos ex-gas rising 0.9 percent in the latest month and control group sales, which are inputs into GPD, up a helpful 1.0 percent.

Vehicle sales stand out sharply in March, up 3.3 percent following declines in the two prior months. Sales at gasoline stations also stand out, up 3.5 percent for a second straight month but boosted by price effects for fuel.

Convincing strength is evident once again for non-store retailers which, after falling 4.5 percent in December, have posted three straight strong gains including 1.2 percent in both March and February. Restaurants are also convincing, up 0.8 percent in the latest month for a third straight gain in what speaks directly to discretionary strength. Furniture & home furnishing stores are also doing well with three straight gains including a 1.7 percent March jump.

Lagging are department stores, unchanged following three straight declines which may reflect a shift underway in consumer habits away from traditional malls than weakness in consumer demand. General merchandise, which is the broader category that includes department stores, rose 0.7 percent in March but failed to make up for recent weakness.

Yet this report is not about weakness but about strength, and the results are certain, like yesterday’s trade data for February, to give a lift to first-quarter GDP estimates. The economy’s soft patch so far this year isn’t as soft as it once looked, but questions remain.

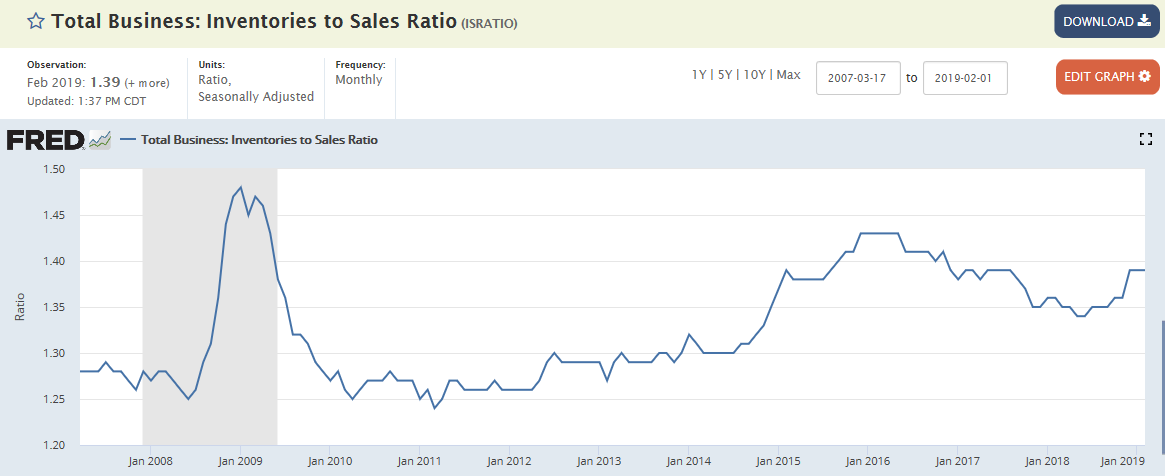

Elevated inventories are not a good sign:

(Reuters) The U.S. central bank’s “Beige Book” report found economic activity grew at a slight-to-moderate pace in March and early April. Prices have risen modestly since the last Beige Book, with tariffs, freight costs and rising wages often cited as key factors, the Fed said. It added that consumer spending was mixed but suggested sluggish sales for both general retailers and auto dealers. Wages grew moderately in most districts for both skilled and unskilled workers. In terms of the manufacturing sector, the Fed said contacts in many districts reported that trade-related uncertainty was weighing on activity.