STAFF ANALYSIS OF THE CONGRESSIONAL BUDGET OFFICE’S BUDGET AND ECONOMIC OUTLOOK, 2015–2025 “Political differences shouldn’t prevent us from taking bold, decisive action to address America’s dire financial outlook.

Yes, there is an acute shortage of available desired savings as indicated by the slack in the labor market.

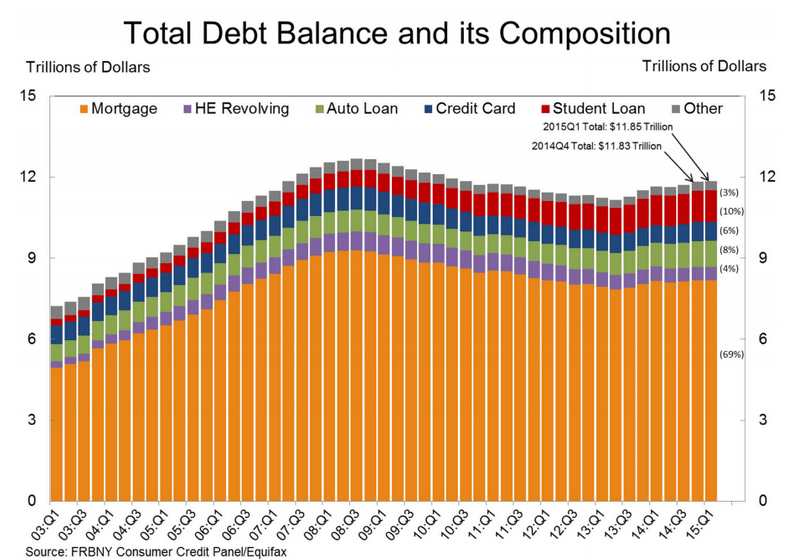

Republicans and Democrats agree that being $18 trillion in debt today and facing the prospect of spending more than $800 billion a year on interest payments alone does not lend itself to a prosperous future for our country.

We don’t agree. A prosperous future is not a function of said forecast interest payments.

CBO’s numbers only reinforce this notion.

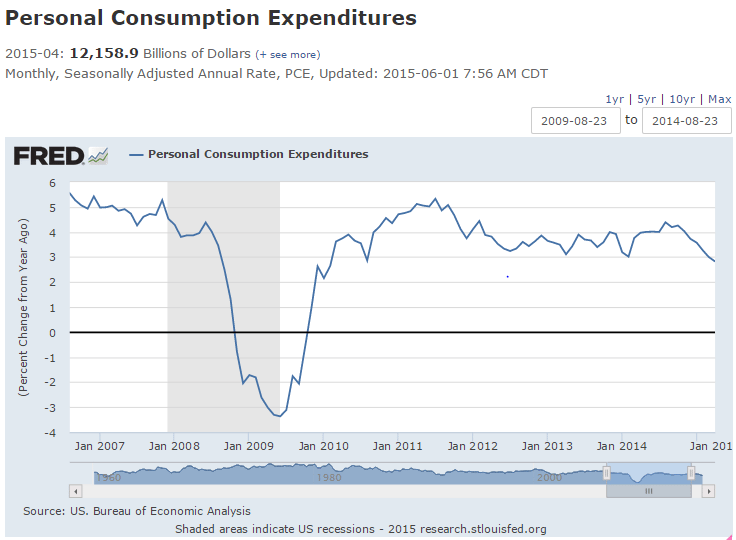

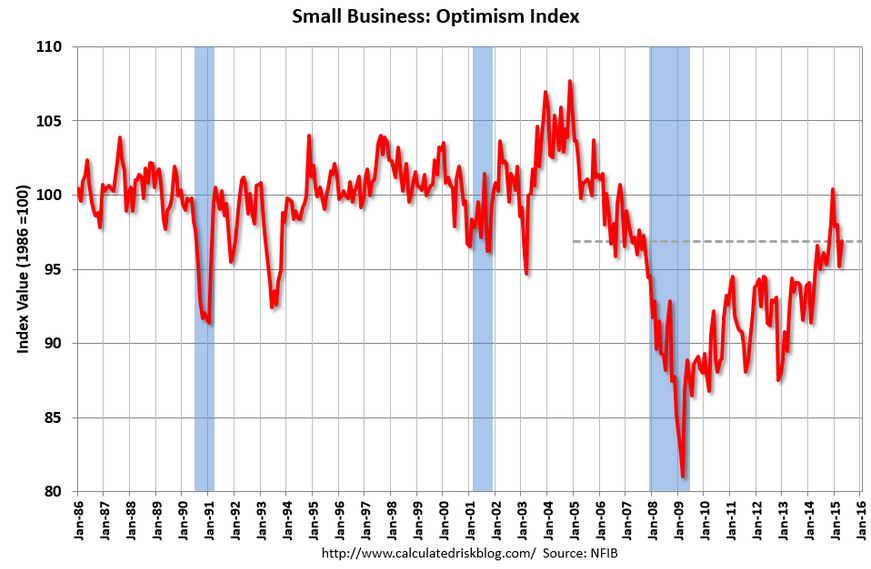

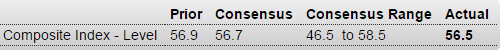

To the contrary, the inflation forecast and growth forecast together indicate the deficit forecast is far too low-given current institutional structure- to accommodate the nations savings desires, and as a consequence aggregate demand falls short of full employment levels.

The longer we postpone reforms and put off making tough decisions, the deeper the hole we have to climb out of. Let’s not miss the opportunity before us to start down a new path and address our problems head on.”

I agree, the problem of inadequate aggregate demand should be addressed head on, immediately, and decisively with an immediate fiscal expansion- tax cuts and/or spending increases. There is no time to waste as we are sacrificing yet another generation of young Americans on the alter of failed austerity.

– Chairman Mike Enzi “America remains on a financially unsustainable path that threatens the future stability, security, and prosperity of our economy.

The idea of financial sustainability with a non convertible currency, floating exchange rate policy is entirely inapplicable.

What is threatening the future is a deficit that’s far too small to accommodate our savings desires, as evidenced by the low inflation forecast and the low participation rates.

Interest on the debt alone will consume $5.6 trillion of federal spending over the next decade.

This interest is paid routinely by the Fed by simply crediting the appropriate member bank’s reserve account at the Fed.

There are no grandchildren or taxpayers in sight when this routine accounting entry take place.

We have a duty to prevent a clear and present danger, and that means we must take steps now to balance the budget.” – Sen. Jeff Sessions “The new projections released by the CBO should serve as a stark reminder that our country is on an unsustainable economic path. The longer we wait to act, the more difficult it will become to put in place real reforms to control spending and reduce our over $18 trillion national debt.

It is a fact, not theory, that those $18 trillion of net financial assets held by the global economy as ‘savings’ is far less than the desired net savings as evidenced by the unemployment rates and labor participation rates, and an immediate fiscal expansion- lower taxes and/or higher spending- is in order.

This dangerous level of debt remains a drag on the economy and job growth and will only worsen over time if Washington continues to irresponsibly add to the credit card.” – Sen. Mike Crapo “This latest CBO report indicates that we’re headed down an unsustainable path that will put a damper on economic growth and hurt American workers.

Nothing could be further from the truth. When govt cuts taxes and/or increases spending every professional economic forecaster paid to be right increases his GDP estimate and lowers his unemployment forecast.

When a nonpartisan organization like the CBO says that Americans will pay more taxes yet our deficits will rise, something needs to be done.

Yes, we need an immediate tax cut and/or spending increase.

It’s crucial that we get our spending and deficits under control so we can grow our economy and give job creators the certainty they need to expand and hire more workers.” – Sen. Rob Portman “With $18 trillion in debt and the growth of entitlement programs skyrocketing, it is clear the federal government’s current fiscal path is unsustainable. A sluggish economy makes the problem even worse. CBO has warned that this situation could persist if no action is taken.

True! Without an immediate tax cut and/or spending increase the economy will continue to under employ and under pay the American people.

Controlling debt requires making smart choices on spending as well as enacting policies that encourage stronger economic growth.” – Sen. Roger Wicker “I didn’t come to Washington to sit idly by as lawmakers in both parties pretend the deficit is shrinking and that our national debt is not a concern.

True, he came to Washington with no clue as to the functioning of today’s monetary system.

We have a genuine fiscal crisis on our hands. We’re already handing our kids and grandkids a national debt of over $18 trillion and tens of trillions of dollars of unfunded liabilities for entitlement programs. The latest CBO report shows that the deck is stacked to get even worse.

No, in fact their 2% long term inflation forecast is evidence that the built in spending is insufficient to keep the US running at anywhere near full capacity.

We need a sense of urgency to seriously tackle our national debt because of the threat it poses to our economy and national security. As a member of the Budget Committee, I look forward to working with Senate Budget Chairman Mike Enzi and House Budget Chairman Tom Price in the pursuit of a budget that reflects the tough decisions necessary to eliminate wasteful spending, prioritize our resources, and grow the economy.” – Sen. David PerdueSummary CBO projects that the government will collect $3.2 trillion in revenue and spend $3.7 trillion this year, resulting in a deficit of $468 billion in FY 2015 ($15 billion less than recorded in the prior year). Based on current law, CBO projects that the country’s fiscal situation will remain relatively stable for the next few years. After FY 2019, however, CBO projects steadily increasing levels of deficits, debt, and interest payments. By the last year of the budget window, FY 2025, deficits will again surpass the $1 trillion mark, debt held by the public will reach $21.6 trillion, and a single year’s interest payments will total $827 billion.

And the inflation and employment forecasts show that isn’t nearly enough to be adding to savings to support our economy at full employment levels.

According to CBO, federal outlays will total $3.7 trillion in FY 2015, or 20.3 percent of GDP— slightly higher than the 20.1 percent 50-year historical average. Federal outlays are expected to grow to reach $6.1 trillion, or 22.3 percent of GDP by FY 2025, while revenues are expected to remain steady at about 18 percent of GDP. Spending is projected to increase by 2 percentage points of GDP over the budget window. Mandatory spending (primarily Social Security and health care spending) will account for 1.7 percentage points of the increase; net interest costs will contribute another 1.7 percentage points; and discretionary spending will account for a reduction of 1.4 percentage points. CBO projects federal revenues will total $3.2 trillion in FY 2015, or 17.7 percent of GDP—slightly above the 50-year historical average of 17.4 percent. Under current law, total revenues will rise significantly in 2016 to $3.5 billion (18.4 percent of GDP) due mainly to the expiration of business tax provisions that were allowed to lapse at the end of calendar year 2014. After FY 2016, revenue collections will remain steady at approximately 18.1 percent of GDP throughout the duration of the forecast period. In total, over the 10-year budget horizon (FY 2016–2025), CBO expects the federal government will collect $41.7 trillion in revenue. Deficits Over the period FY 2016–2025, annual spending will outpace tax collections by a cumulative total of $7.6 trillion.For the budget year (FY 2016), CBO projects a deficit of $467 billion. Spending will total $3.9 trillion, while revenues total $3.5 trillion. Deficits will begin to climb after FY 2016, reaching $1.1 trillion by FY 2025. Deficits will remain relatively flat at around 2.5 percent of GDP from FY 2015 through FY 2018 (slightly below the 50-year average of 2.7 percent of GDP), then rise steadily to 4 percent of GDP by FY 2025. Debt And Interest CBO projects that debt held by the public will follow a similar path as deficits, remaining relatively stable at about 74 percent of GDP in the near term and then rapidly growing to nearly 79 percent of GDP by FY 2025. In dollar terms, debt held by the public would increase from $13.4 trillion in FY 2015 to $21.6 trillion in FY 2025, a nearly 62 percent increase. CBO notes that while the federal debt increase over the projected window seems modest, it is already high by historical standards—with debt remaining greater relative to GDP than at any other time since the years immediately following World War II.Gross debt, which includes Treasury securities held by federal trust funds, will also continue to rise according to CBO. By the end of FY 2015, CBO projects a gross debt of $18.5 trillion. This number will grow to $27.3 trillion by the end of FY 2025, an increase of 47.7 percent. Gross debt grows less rapidly than public debt because Social Security begins redeeming bonds at a rapid rate toward the end of the projection period.

Yes, and the 2% inflation forecast indicates all of this fall short of providing the savings needed for our economy to sustain full employment.

According to CBO, carrying these high levels of debt has negative consequences for the federal budget and the U.S. economy, including increased government borrowing crowding out private borrowing and leading to increased costs of borrowing for businesses,

That applies only to fixed exchange rate regimes. It is entirely inapplicable to the US with our floating exchange rate policy, as history has clearly demonstrated.

limits to the ability of the government to respond to crises with tax and spending policies,

Any such limit is by political decision, and not an operational constraint with todays floating exchange rate policy.

and increased interest payments.

Yes, which are simply a credit to a member bank account by the Fed.

The federal government is expected to spend $227 billion on interest payments in FY 2015, or about 1.3 percent of GDP. These interest payments will increase to $827 billion (3 percent of GDP) by FY 2025, an increase of 264 percent. These interest costs, a product of continuing to carry such a high debt burden, will put a strain on federal resources and begin to crowd out other priorities.

Interest payments are a matter of the Fed crediting a member bank account. The notion of a strain on federal resources’ is entirely inapplicable. And, in fact, even with those interest payments inflation is forecast at only 2% indicating there is no forecast of excess spending per se.

Enough???