the BIG stupid…

Conservative lawmakers weigh bid to call for constitutional convention

Consumer Credit

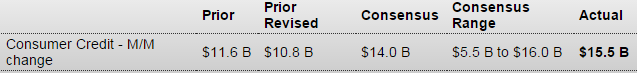

Highlights

Consumer credit rose a solid looking $15.5 billion in February but a closer look shows an unwanted $3.7 billion decline in revolving credit. This is the 4th decline in 5 months for the revolving component which reflects consumer reluctance to finance purchases with credit-card debt. This reluctance may be a plus for consumer wealth, given the extremely high rates of interest credit-card companies often charge, but it is a definite negative for consumer spending which has been very soft in recent months.In contrast to revolving credit, non-revolving credit rose $19.2 billion which is the strongest gain since July 2011. The gain does reflect financing for autos but also an item not associated with consumer spending, and that’s the government’s ongoing and heavy acquisition of student loans.

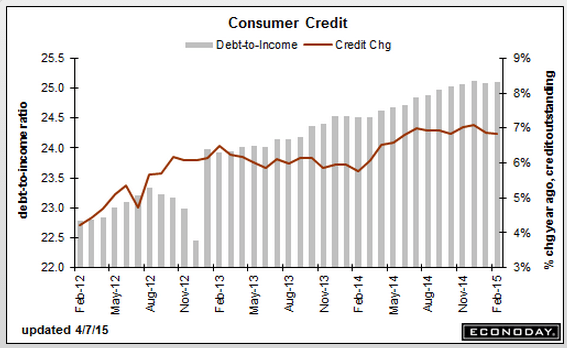

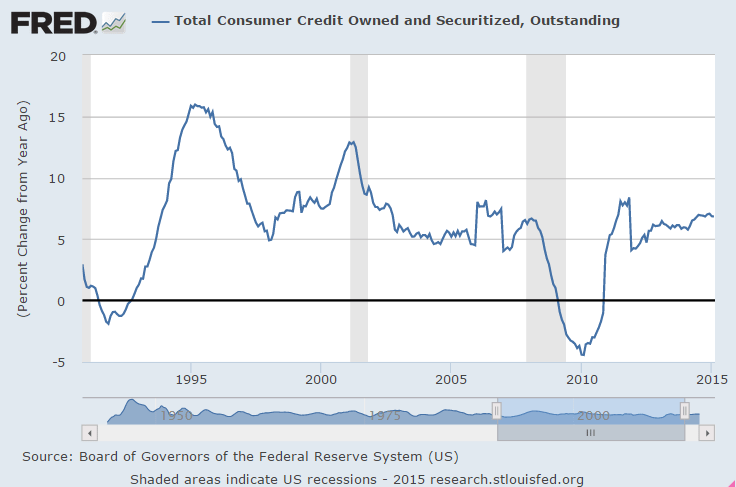

Year over year showing a (modest) decline in growth:

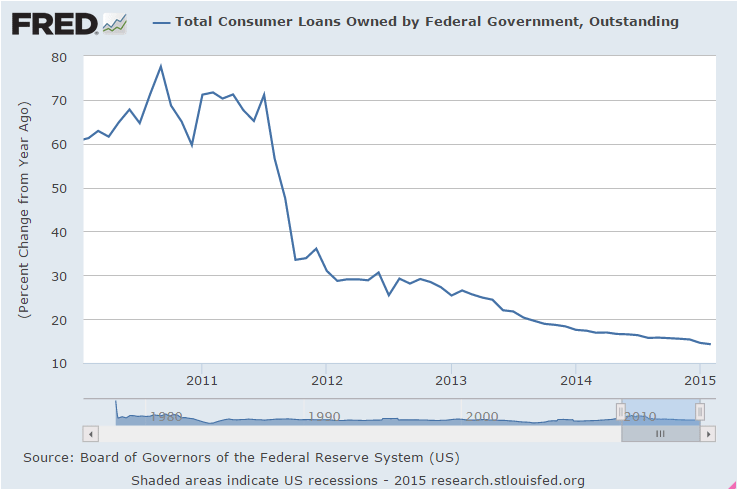

This is mainly student loans and the growth rate continues to decline:

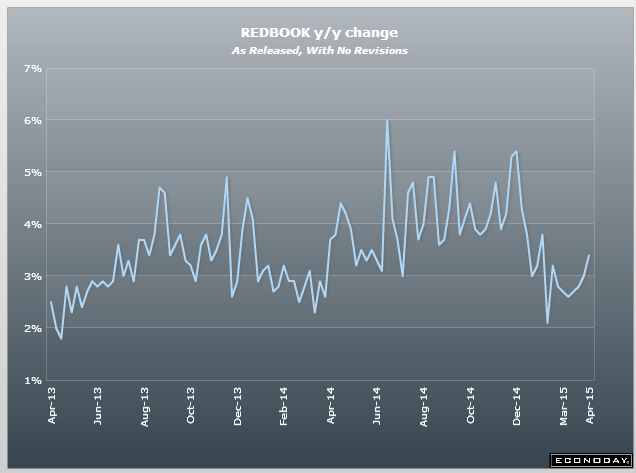

Not much of an Easter boost in retail showing in this chart:

This was for Feb and inline with Feb payrolls: